Software-Defined Wide Area Network (SD-WAN) Market Size

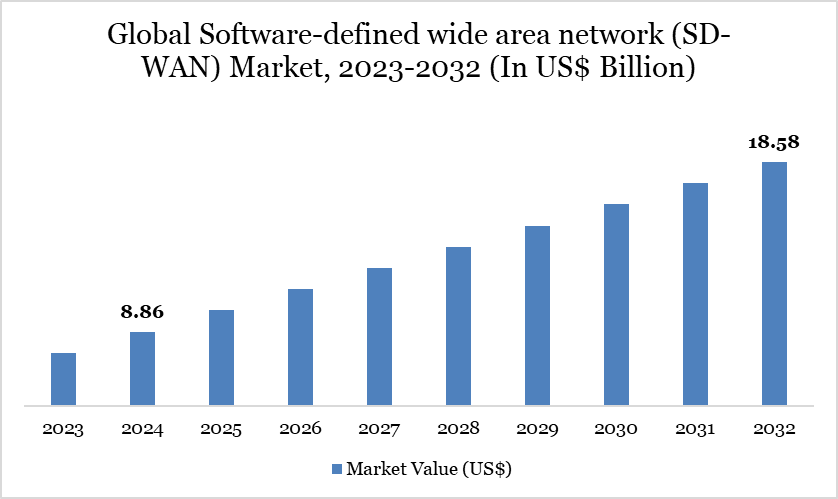

Global Software-defined wide area network (SD-WAN) market reached US$ 8.86 billion in 2024 and is expected to reach US$ 18.58 billion by 2032, growing with a CAGR of 12.2% during the forecast period 2025-2032.

The software-defined wide area network (SD-WAN) market is witnessing steady growth driven by rapid digital transformation, rising adoption of cloud-based applications, and the growing need for secure, high-performance enterprise networking. Organizations worldwide are modernizing their network infrastructure with SD-WAN solutions to improve application performance, reduce dependency on costly MPLS circuits, and enhance branch-to-cloud connectivity.

Growth is further fueled by the increasing demand for scalable and flexible networking architectures that support hybrid workforces, multi-cloud strategies, and real-time data access across geographically dispersed locations. The integration of artificial intelligence, advanced analytics, and built-in cybersecurity features into SD-WAN platforms is enhancing network efficiency, security, and agility, enabling enterprises to achieve operational superiority in a highly dynamic digital landscape.

Software-defined wide area network (SD-WAN) Market Trend

One of the most prominent trends in the Software-Defined WAN Market is the increasing integration of security functions such as Secure Access Service Edge (SASE) and Zero Trust Network Access (ZTNA) within SD-WAN platforms. This convergence of networking and security is helping enterprises simplify IT management while ensuring data protection across cloud and remote environments.

Another key trend is the shift toward cloud-native and AI-driven SD-WAN solutions, which enable predictive network analytics, automated traffic routing, and real-time application optimization. These advancements are enhancing performance for latency-sensitive applications such as video conferencing, IoT, and unified communications.

Additionally, the market is witnessing growing adoption of managed SD-WAN services, as enterprises seek to reduce operational complexity and rely on service providers for deployment, monitoring, and lifecycle management. This trend is particularly strong among SMEs that require enterprise-grade connectivity without high upfront investment.

Software-Defined WAN Market Scope:

Metrics | Details |

By Component | Solution, Services |

By Deployment | On-premises, Cloud based |

By Enterprise Size | Large Enterprises, SME’’s |

By Industry | IT & Telecom, Healthcare, BFSI, Retail, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Adoption of Cloud Services and SaaS Applications Driving SD-WAN Market Growth

The increasing shift toward cloud services and SaaS applications is a major driver of the software-defined wide area network (SD-WAN) market, as enterprises worldwide migrate business-critical workloads to platforms such as Microsoft Azure, Amazon Web Services (AWS), and Google Cloud.

For instance, Gartner reported that global spending on public cloud services is expected to reach $679 billion in 2024, a 20.4% increase from 2023, underscoring the growing enterprise reliance on cloud-based solutions.

This surge includes significant adoption of SaaS platforms such as Microsoft 365, Salesforce, and Zoom, which require secure, low-latency, and application-aware networking capabilities that traditional WAN architectures struggle to provide.

Similarly, IDC forecasts that over 70% of enterprises will operate using a “cloud-first” strategy by 2025, further amplifying the demand for SD-WAN solutions. These developments highlight how the widespread embrace of cloud and SaaS ecosystems is creating a sustained need for SD-WAN to ensure scalability, reliability, and optimized performance across global enterprise networks.

Integration Complexity and Legacy Infrastructure

The adoption of software-defined wide area network (SD-WAN) is often slowed by integration challenges and dependence on legacy infrastructure. Many enterprises still rely on traditional MPLS networks and outdated hardware, making migration to SD-WAN costly and time-consuming. This creates delays, higher expenses, and resistance to adoption.

On the other hand, growing reliance on managed SD-WAN and Secure Access Service Edge (SASE) services is helping enterprises overcome these barriers. As highlighted by Futuriom, IT and cybersecurity teams are increasingly outsourcing to specialized providers, simplifying deployment and improving performance. This trend is counterbalancing complexity and driving faster adoption of SD-WAN globally.

Segmentation Analysis

The software-defined wide area network (SD-WAN) market is segmented based on component, deployment, enterprise size, industry and region.

Cloud-Based Deployment Driving Growth in the Global SD-WAN Market

The cloud-based segment is a major driver of the global software-defined wide area network (SD-WAN) market, supported by the rapid shift of enterprises toward digital transformation and cloud-first strategies. Organizations are increasingly moving workloads to public and hybrid cloud environments, requiring secure, flexible, and high-performance networking solutions to connect distributed applications and users. This deployment model enhances scalability, cost efficiency, and centralized management, making it especially attractive for businesses with multiple branch offices and remote employees.

For instance, In 2025, Arista Networks, a provider of cloud and artificial intelligence (AI) networking solutions, has introduced a range of new AI-driven enterprise products, including advanced switching, Wi-Fi 6 access points, and enhanced WAN capabilities. Alongside these launches, the company announced the acquisition of the VeloCloud SD-WAN portfolio from Broadcom. This strategic move, combined with Arista’s innovations, is aimed at delivering simplified operations through zero-touch provisioning, proactive monitoring, and automated troubleshooting across the entire client-to-cloud networking ecosystem.

Geographical Penetration

North America Strengthens Its Leadership in the SD-WAN Market

North America remains a dominant region in the software-defined wide area network (SD-WAN) market, supported by rapid digital transformation, widespread cloud adoption, and the growing need for secure, high-performance enterprise networking. The region benefits from the strong presence of leading technology providers such as Cisco, VMware, Fortinet, and Palo Alto Networks, which continue to invest in innovation and strategic partnerships to expand SD-WAN capabilities.

For Instance, Verizon Business has expanded its long-standing strategic partnership with Cisco by introducing three new managed SD-WAN service offerings. This expansion strengthens support for enterprise customers by providing a wider global reach, access to advanced solutions and capabilities, and an improved management and policy framework designed to help businesses achieve their desired outcomes.

The region’s enterprises are also driving adoption due to the rise of remote and hybrid work models, requiring scalable, cloud-based solutions to ensure secure access and consistent performance across distributed locations. With strong regulatory support, advanced IT infrastructure, and high digital maturity, North America continues to set the pace for SD-WAN innovation and large-scale enterprise deployment, reinforcing its leadership in the global market.

Technological Analysis

The technological landscape of the software-defined wide area network (SD-WAN) market is rapidly evolving, driven by advancements in artificial intelligence (AI), machine learning (ML), cloud-native architectures, and automation that enhance performance, interoperability, and adaptability across enterprise networks. Modern software-defined wide area network (SD-WAN) platforms integrate multi-layered security frameworks, centralized orchestration, and dynamic traffic management capable of operating in highly distributed and cloud-centric environments.

Edge and cloud-based technologies, such as secure access service edge (SASE) and zero-trust frameworks, are enabling faster, more secure data transmission and real-time application performance across hybrid and remote work setups. The adoption of 5G integration is improving bandwidth efficiency and reducing latency in WAN applications, while next-generation analytics and AI-driven monitoring tools provide enhanced visibility, proactive troubleshooting, and predictive network optimization across multi-cloud operations.

Competitive Landscape

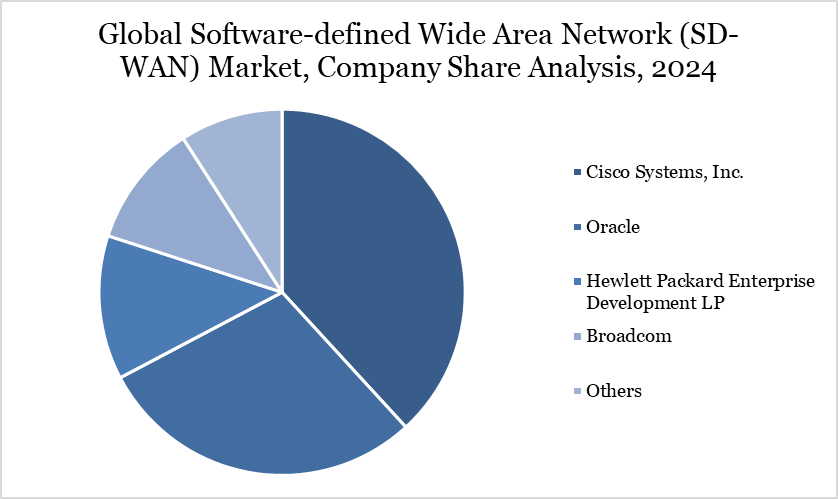

The major global players in the market include Cisco Systems, Inc., Oracle, Hewlett Packard Enterprise Development LP, Broadcom, Forcepoint, Nokia, Huawei Technologies Co., Ltd., Cloud Software Group, Inc., Ciena Corporation., NEC Corporation and among others.

Key Developments

In 2022, Nokia and stc announced the launch of a managed SD-WAN solution, stc SD-WAN, based on the Nuage Networks from Nokia Virtualized Network Services (VNS) platform. The stc SD-WAN solution was introduced as a key element in stc’s cloud portfolio, providing automated, dynamic, programmable, and more efficient network services to its enterprise customers. It enabled rapid ordering and automated configuration of network services, along with greater visibility and control tailored to the individual requirements of enterprises.

In 2025, Arista Networks announced its agreement to acquire VMware’s former VeloCloud Software-Defined Wide Area Network (SD-WAN) technology from Broadcom. This acquisition expands Arista’s portfolio beyond traditional data center and campus networking, strengthening its presence in the WAN and branch markets

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies