CMO/CDMO Biotechnology Market Size& Industry Outlook

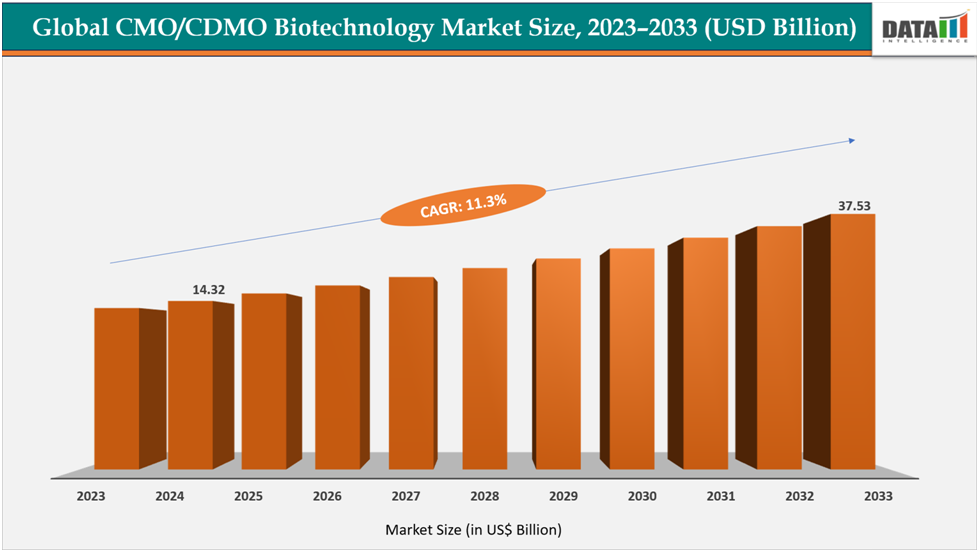

The global CMO/CDMO Biotechnology Market size reached US$14.32Billion in 2024 from US$12.74Billionin 2023 and is expected to reach US$ 37.53Billion by 2033, growing at a CAGR of 11.3%during the forecast period 2025-2033.

The market is expanding rapidly, driven by rising demand for novel biologics & biosimilars, advancements in bioprocessing technologies, increasing biologics approvals & biosimilar launches, and capacity expansion & integrated service models.

Biologics, including monoclonal antibodies, recombinant proteins, gene therapies, and biosimilars, exemplify the innovation propelling the CMO/CDMO biotechnology market. Leveraging advanced expression systems and single-use bioreactors, these therapeutics can be manufactured more efficiently and cost-effectively, enabling faster scale-up and commercialization. The market’s growth is further supported by increasing approvals of biologics and biosimilars in the U.S. and Europe, rising outsourcing by emerging biotech firms, and strategic investments in integrated development-to-manufacturing services. Collectively, these factors position CMO/CDMOs as indispensable partners in accelerating next-generation biologic drug development and expanding global patient access.

Key Market Highlights

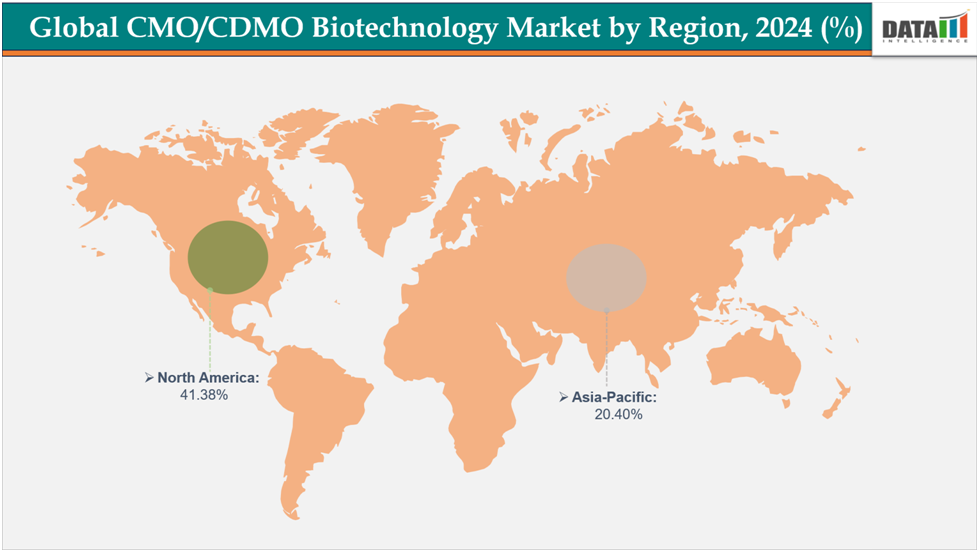

- North America dominates the CMO/CDMO Biotechnology Market with the largest revenue share of 41.38% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of12.7% over the forecast period.

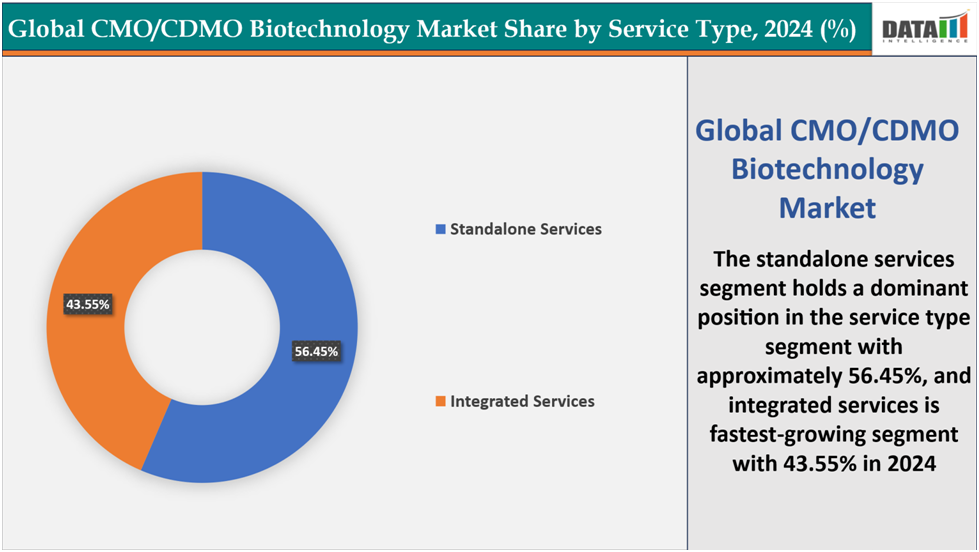

- Based on the service type, the standalone services segment led the market with the largest revenue share of 56.45% in 2024.

- The major market players in the CMO/CDMO Biotechnology Market are Catalent, Samsung Biologics Co., Ltd, Lonza, Boehringer Ingelheim, AGC Biologics, Inc., Patheon N.V., WuXi Biologics, AbbVie Inc, Avid Bio services, Inc., Fujifilm Diosynth Biotechnologies, among others

Market Dynamics

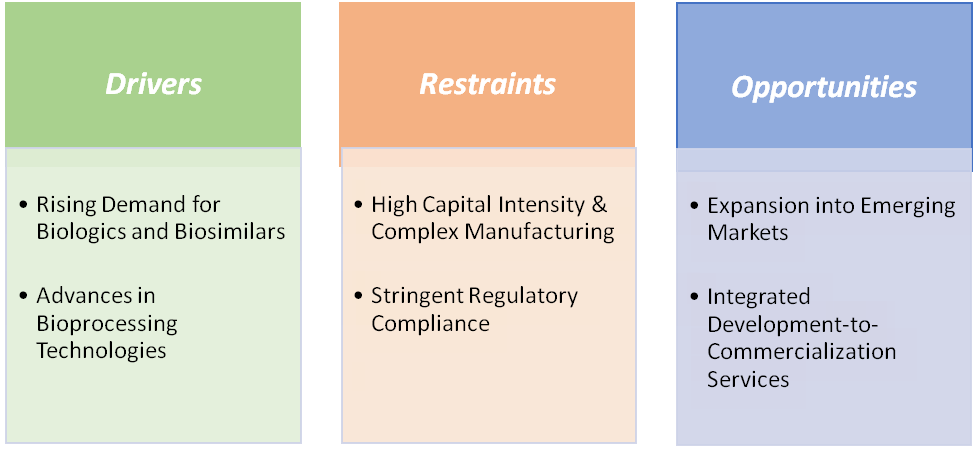

Drivers:

Rising demand for biologics and biosimilars is significantly driving the CMO/CDMO Biotechnology Market growth

The rising demand for biologics and biosimilars is a major driving force behind the CMO/CDMO biotechnology market. According to Mabion’s Science Hub, 2025 is expected to bring a significant wave of innovative biologic approvals, including first-in-class antibody-drug conjugates (ADCs), gene therapies, interfering RNAs, fusion proteins, and novel monoclonal antibodies. In 2024, the FDA approved 50 new drugs, including 16 biologics. This surge in approvals and anticipated launches is straining global manufacturing capacity, prompting both large pharma and emerging biotech firms to increasingly rely on CMO/CDMOs. By offering scalability, regulatory expertise, and cost-efficient production, CDMOs are becoming indispensable partners in accelerating commercialization and expanding global patient access to next-generation biologic therapies.

This surge is largely driven by the rising prevalence of chronic diseases and the expanding therapeutic applications of biologics. The growing acceptance of RNA-based therapies, highlighted by the success of mRNA COVID-19 vaccines, further reinforces this trend. Meanwhile, the expiration of patents for major biologics is accelerating the adoption of biosimilars, providing cost-effective alternatives and broadening patient access. These developments are placing significant pressure on manufacturing capacities, prompting both large pharmaceutical companies and emerging biotechnology companies to increasingly rely on CMO/CDMOs for scalable, compliant, and cost-efficient production solutions, which is expected to accelerate, driving the market growth.

Restraints:

High capital intensity &complex manufacturing are hampering the growth of the market

The biotechnology manufacturing sector faces significant barriers due to the high capital intensity and technical complexity inherent in biologics production. Establishing and maintaining Good Manufacturing Practice (GMP)-compliant facilities necessitates substantial investments, often ranging from tens to hundreds of millions of dollars. For instance, the Government of Canada invested $126 million to build the Biologics Manufacturing Centre, with annual operating costs of approximately $20 million. This financial commitment is coupled with the need for specialized equipment, skilled personnel, and rigorous validation processes. Such requirements create substantial entry barriers and capacity constraints, particularly for small and mid-sized companies. Consequently, many companies opt to outsource manufacturing to Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) to mitigate these challenges and focus on core competencies. These challenges limit in-house production, particularly for small and mid-sized companies, thereby restraining market expansion despite the growing demand for biologics and biosimilars.

For more details on this report – Request for Sample

Segmentation Analysis

The global CMO/CDMO Biotechnology Market is segmented based onservice, product, company size, scale of operation, expression system, and region.

Service Type:

The standalone services segment is dominating the CMO/CDMO Biotechnology Market with a 56.45% share in 2024

The standalone services segment is dominating the CMO/CDMO biotechnology market, capturing a 56.45% share in 2024. This dominance is primarily attributed to the increasing complexity and specialization required in the development and manufacturing of biologics and biosimilars. Standalone services encompass a range of critical functions, including analytical testing, formulation development, and regulatory support, which are essential for ensuring the quality, safety, and efficacy of biologic products. As pharmaceutical and biotechnology companies face growing pressure to accelerate time-to-market while maintaining compliance with stringent regulatory standards, outsourcing these specialized services to experienced CMOs and CDMOs allows them to focus on their core competencies and mitigate operational risks. This trend is particularly evident in the biologics sector, where the demand for specialized services is escalating due to the intricate nature of biologic drug development and manufacturing processes.

The integrated services segment is the fastest-growing in the CMO/CDMO Biotechnology Market with a43.55% share in 2024

The integrated services segment is the fastest-growing area of the CMO/CDMO biotechnology market, driven by rising demand for end-to-end solutions that streamline biologics development and manufacturing. These services combine drug development, analytical testing, process optimization, and commercial-scale manufacturing under one roof, enabling faster timelines and reduced operational risk. For example, Lonza and Catalent provide integrated solutions for monoclonal antibodies, gene therapies, and cell therapies, supporting companies from cell line development to commercial production while ensuring regulatory compliance. Similarly, Samsung Biologics and WuXi AppTec offer turnkey services that help small and mid-sized biotech firms accelerate time-to-market without heavy capital investment. The increasing complexity of biologics and biosimilars, alongside stringent regulatory requirements, has made integrated services highly attractive for companies seeking scalable, compliant, and cost-efficient solutions. Collectively, these factors position integrated services as the fastest-growing segment in the CMO/CDMO market, drawing strong interest across global pharma and biotech pipelines.

Geographical Analysis

North America is expected to dominate the global CMO/CDMO Biotechnology Market with a 41.38% in 2024

North America stands as the dominant region in the CMO/CDMO biotechnology market, driven by the presence of major market players, advanced manufacturing infrastructure, and a strong regulatory framework that supports biologics and biosimilars development. The region benefits from a large number of pharmaceutical and biotech companies outsourcing development and manufacturing to CMOs and CDMOs, combined with significant investments in state-of-the-art facilities, single-use technologies, and automated bioprocessing systems. Coupled with rising demand for complex biologics, gene therapies, and next-generation therapeutics, North America continues to set the benchmark for innovation, regulatory compliance, and capacity expansion in the global CMO/CDMO market, making it the clear leader in revenue generation and adoption of integrated and standalone services.

US CMO/CDMO Biotechnology Market Trends

The United States continues to lead the global CMO/CDMO biotechnology market, driven by advanced regulatory frameworks, a strong industry presence, and high demand for biologics and biosimilars. The U.S. FDA’s proactive role in streamlining approvals for innovative biologics and cell & gene therapies ensures faster market access and encourages outsourcing to CMOs and CDMOs. Companies such as Lonza, Catalent, and Samsung Biologics have established both integrated and standalone service facilities in the U.S., supporting the development and large-scale manufacturing of monoclonal antibodies, CAR-T therapies, and viral vector-based products.

The region’s focus on accelerating commercialization is further reinforced by the growing complexity of therapeutics, the increasing number of biologic approvals each year, and the adoption of next-generation manufacturing technologies, including single-use bioreactors, automated analytics, and high-throughput process development. Strong investments in research, a robust biotech and pharma ecosystem, and a culture of innovation position the U.S. as the hub for outsourced biologics manufacturing and development, solidifying its leadership in market adoption, service innovation, and revenue generation.

The Asia Pacific region is the fastest-growing region in the global CMO/CDMO Biotechnology Market, with a CAGR of 12.7% in 2024

The Asia Pacific region is the fastest-growing market for CMO/CDMO Biotechnology, driven by a large population base, rising prevalence of chronic diseases, and significant investments in healthcare infrastructure. Demand for biologics and biosimilars is particularly strong, with countries such as China and India leading the adoption of advanced therapies. Key biologics fueling this growth include monoclonal antibodies like Sintilimab (a PD-1 inhibitor for cancer, developed in China), gene therapies such as Zynteglo (for beta-thalassemia, entering India), and biosimilars like Reditux (rituximab biosimilar widely used in India and China). In addition, the presence of regional leaders such as Samsung Biologics (South Korea), along with strategic partnerships between global and emerging players, is improving accessibility and affordability. Together, these factors establish the Asia Pacific region as a pivotal hub in the global CMO/CDMO biotechnology market, offering significant opportunities for growth, innovation, and collaboration.

Europe CMO/CDMO Biotechnology Market Trends

In Europe, the CMO/CDMO biotechnology market is witnessing steady growth, supported by a robust regulatory framework, government initiatives promoting advanced therapies, and increasing adoption of outsourced biologics manufacturing. The European Medicines Agency (EMA) and national regulatory bodies have strengthened their focus on biologics and biosimilars approval, ensuring high standards for safety, quality, and efficacy, which encourages pharmaceutical companies to partner with CMOs and CDMOs. Countries like Germany, Switzerland, and the UK are home to leading service providers such as Lonza (Switzerland) and CMC Biologics (Denmark), which offer integrated development-to-manufacturing solutions for monoclonal antibodies, gene therapies, and viral vectors.

The region’s aging population and rising prevalence of chronic diseases are driving demand for advanced biologic therapies, while Europe’s emphasis on innovation and sustainability is fostering collaborations between biotech startups, pharma companies, and CDMOs. Collectively, these factors, combined with Europe’s strong research infrastructure and skilled workforce, make it a key hub for outsourced biologics development and manufacturing in the global CMO/CDMO market.

Competitive Landscape

Top companies in the CMO/CDMO Biotechnology market include Catalent, Samsung Biologics Co., Ltd, Lonza, Boehringer Ingelheim, AGC Biologics, Inc., Patheon N.V., WuXi Biologics, AbbVie Inc, Avid Bio services, Inc., Fujifilm Diosynth Biotechnologies, among others.

Market Scope

| Metrics | Details | |

| CAGR | 11.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | Small Molecules and Large Molecules |

| Service | Standalone Services and Integrated Services | |

| Company Size | Small, Mid-sized, and Large | |

| Scale of Operation | Preclinical, Clinical, Commercial | |

| Expression System | Mammalian and Microbial | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global CMO/CDMO Biotechnology Market report delivers a detailed analysis with 62 key tables, more than 56visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here