Closed-Loop Insulin Delivery Systems Market – Market Insights

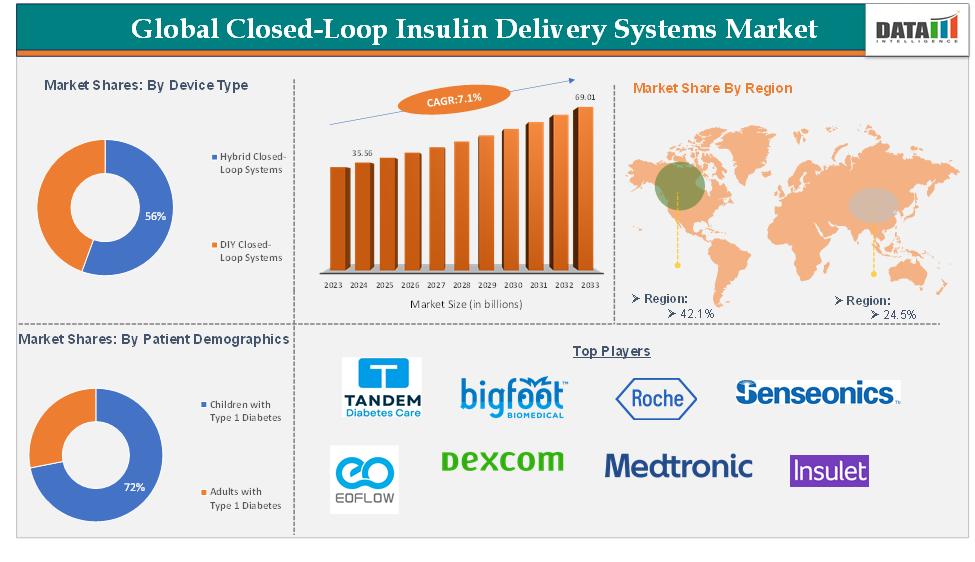

Closed-Loop Insulin Delivery Systems Market reached US$ 35.56 billion in 2024 and is expected to reach US$ 69.01 billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

The global closed-loop insulin delivery systems market is driven by various factors like, technological advancements in diabetes management, rising prevalence in diabetes and others, whereas also the market has significant challenges like, limited patient awareness and adoption, technical issues which hinders the market during the forecast period.

Executive Summary

For more details on this report, Request for Sample

Closed-Loop Insulin Delivery Systems Market Dynamics - Drivers & Restraints

Technological Advancements in Diabetes Management are Driving the Market Growth

The global closed-loop insulin delivery systems market observed growth as technological advances in the field of diabetes management relations. Continuous glucose monitoring sensors and insulin pumps improved hybrid closed-loop systems in terms of accuracy, reliability, and user-friendliness. These systems locally and automatically adjust the insulin delivery to the blood glucose levels detected and so minimize human interference. The better the system works, the more it appeals to the patient and the healthcare provider, depending on its newly integrated features, such as smartphone compatibility and Bluetooth connectivity, the device adoption rate of which is fast in the developed regions.

For instance, in March 2025, Tandem Diabetes Care, Inc., an insulin delivery and diabetes technology company, announced the launch of Control-IQ+ technology in the United States, which is the next generation of the company's technologically advanced hybrid closed-loop algorithm. Control-IQ+, which operates with both t: slim X2 insulin pump and Tandem Mobi System, will now be provided to people with type 1 diabetes 2 years and older, as well as adults affected with type 2 diabetes. These new pumps come pre-loaded with the software and are already shipping out to new customers, whereas all eligible Tandem customers with an in-warranty system will gain access to the new features via a free remote software update.

Limited Patient Awareness and Adoption Restraining the Market Growth

The global market for closed-loop systems for insulin delivery faces limited patient awareness and adoption as major challenges. Especially in areas endowed with lower levels of healthcare literacy, patients may never have learned the full benefit of these systems.

The realization that these systems were very technically complicated, or are at least perceived as such, along with doubts about their reliability and the need to oversee their operation constantly, may have generated doubt in their minds regarding whether to accept new technologies into their lives. There is also the potential that patients' worries relating to the learning curve of these modern systems may have been a deterrent in their switching from old-school traditional treatment methods, thus slowing down their adoption rate at large.

Closed-Loop Insulin Delivery Systems Market - Segment Analysis

The global closed-loop insulin delivery systems market is segmented based on device type, patient demographics, control mechanisms, end-user, and region.

Device Type:

The hybrid closed-loop systems segment is expected to hold 56.1% of the closed-loop insulin delivery systems market

Hybrid closed-loop systems (HCL systems) represent the most advanced insulin-delivery technology to date in that they provide an automation for insulin dosing when coupled with continuous glucose monitoring (CGM). Since insulin delivery is compensated for measured blood glucose levels, patients can add additional doses manually. This mode of delivery gives the most exact control of a patient's blood sugar with the least amount of input from the patient, and hence improves the quality of life for the diabetic patient.

Hybrid closed-loop systems, in general, are considered suitable for children and adults who have type 1 diabetes, though this will greatly depend on the licensing restrictions placed on each system. For those having insulin-dependent type 2 diabetes, systems are not available yet under the NHS, but we've financed research in this sector with the aim that such support shall bridge the existing gap. Our support undoubtedly extends to the entire area of artificial pancreas research.

Hybrids are mainly in looming since the skyrocketing population of Type 1 diabetes cases in developed regions leads to an ever-increasing demand for effective tools assisting in diabetes management. These types of systems have so many pros versus conventional insulin delivery methods: better glycemic control, less burden on the patient. Advances in technologies of CGMs and insulin pumps are making these systems more dependable and easier to access. Public awareness of such devices and reimbursement options is also accelerating the widespread acceptance. Convenience and treatment that is truly customized are increasing favorably for market growth for hybrid closed-loop systems.

For instance, in 2023, ViCentra B.V., the company behind Kaleido, brought forth the Hybrid Closed Loop system for automated insulin delivery. This delivery is granted by the DBLG1 algorithm, which takes input from the Dexcom G6 Continuous Glucose Monitoring (CGM) sensor.

Closed-Loop Insulin Delivery Systems Market - Geographical Share

North America is expected to 42.1% in the closed-loop insulin delivery systems market

The North America closed-loop insulin delivery systems market is growing on account of the presence of an advanced healthcare infrastructure, a high incidence of Type 1 diabetes, the reimbursement framework, increasing awareness, and patient-education programs for diabetes self-care, plus preference for home-based healthcare, especially after the pandemic. Such a reimbursement framework in the region encourages patients to buy closed-loop systems offered at exorbitant prices, whereas the presence of prominent market players wondrously enhances technological advancement and product availability. Regulatory support, patient educational programs, and preference for home-based healthcare set the path for growth in the market.

For instance, in April 2025, Insulet Corporation announced that sales of Omnipod 5 have begun in Canada. Omnipod 5 is the first tubeless, waterproof Automated Insulin Delivery (AID) System approved in Canada for use by individuals two years of age and older with type 1 diabetes.

Asia-Pacific is expected to 24.5% in the closed-loop insulin delivery systems market

The Asia-Pacific region's closed-loop insulin delivery systems market is experiencing substantial development, which is primarily due to the increasing prevalence of diabetes, particularly in countries like China, India, and Japan. The significant increase in the number of diabetics has resulted in a compelling need for advanced and efficient insulin management solutions. Government initiatives and supportive healthcare policies, such as subsidized access to insulin devices in countries such as Australia, are further driving the adoption of these systems.

Additionally, the deployment and accessibility of these inventive diabetes management tools throughout the region are being facilitated by the ongoing development of healthcare infrastructure in emerging economies.

For instance, according to the International Diabetes Federation, Japan, among the 20 IDF Western Pacific region countries, is facing a significant increase in diabetes prevalence, with an estimated 260 million people affected by the disease by 2045.

Closed-Loop Insulin Delivery Systems Market – Major Manufacturers

The major global players in the closed-loop insulin delivery systems market include Medtronic, Tandem Diabetes Care, Insulet Corporation, Dexcom, Bigfoot Biomedical, Roche Diabetes Care, MicroTech Medical, Medtrum Technologies, Senseonics, and EOFlow, among others.

Closed-Loop Insulin Delivery Systems Market - Industry Trends

- In October 2024, Luna Diabetes announced the beginning of the pivotal trial for the Luna System. Luna represents the first automated insulin delivery solution for the >90% of insulin-requiring-patients-out-there-who-insulin-pen-it, very commonly referred to as multiple daily injections (MDI). Being the first of its kind, the study will be the first ever pivotal study evaluating closed-loop technology in persons on MDI.

Market Scope

| Metrics | Details | |

| CAGR | 7.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Device Type | Hybrid Closed-Loop Systems, DIY Closed-Loop Systems |

| Patient Demographics | Children with Type 1 Diabetes, Adults with Type 1 Diabetes | |

| Control Mechanism | Bluetooth-enabled Devices, Smartphone-integrated Systems | |

| End-User | Hospitals, Homecare Settings, Specialty Diabetes Clinics | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, Device Type pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Device Type Performance & Market Positioning: Analyzes Device Type performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into Device Type development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Device Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance Device Type safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global closed-loop insulin delivery systems market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 200 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- End-User & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.