Global Clinical Nutrition Market – Industry Trends & Outlook

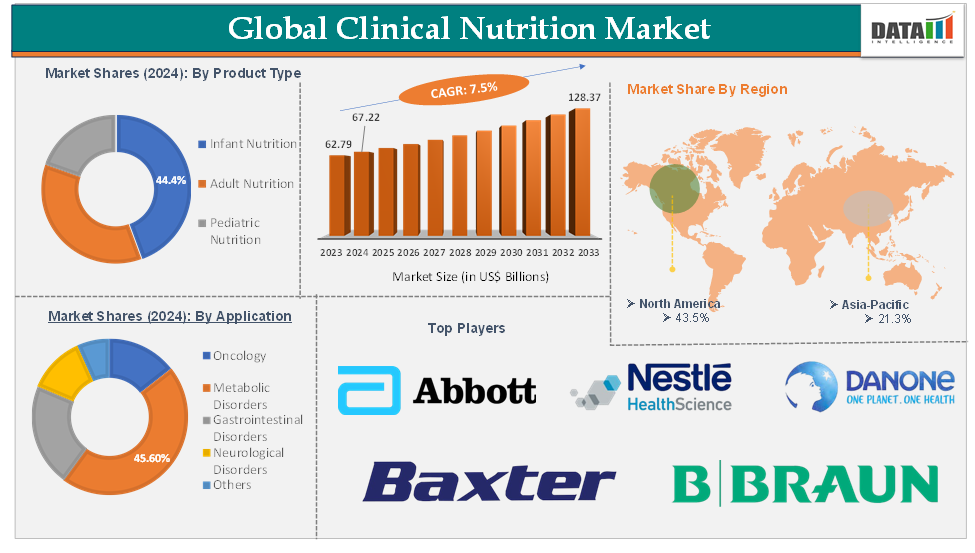

The global clinical nutrition market was valued at US$ 62.79 Billion in 2023. The market size reached US$ 67.22 Billion in 2024 and is expected to reach US$ 128.37 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

The rising prevalence of chronic diseases primarily drives the global clinical nutrition market, the expanding geriatric population, and increasing awareness of the importance of nutrition in healthcare. As more people suffer from conditions such as diabetes, cancer, and metabolic disorders, the demand for specialized nutritional therapies is accelerating.

Key trends shaping the market include the adoption of personalized nutrition, advances in nutrigenomics, and the integration of digital health and telehealth platforms for nutrition management. There is also a growing preference for functional foods, probiotics, prebiotics, and plant-based or sustainable clinical nutrition products, reflecting changing dietary patterns and consumer interest in holistic and preventive health approaches.

There is also significant potential in developing condition-specific and allergen-free nutritional solutions, as well as expanding home healthcare and long-term care applications. As healthcare systems worldwide seek to improve patient outcomes and manage costs, clinical nutrition is poised to play a central role in disease management and recovery, creating new avenues for growth and innovation.

Global Clinical Nutrition Market – Executive Summary

Global Clinical Nutrition Market Dynamics: Drivers

Rise in the prevalence of metabolic disorders

The rise in the prevalence of metabolic disorders such as diabetes, obesity, and metabolic syndrome is a major driver for the global clinical nutrition market. Metabolic disorders are characterized by disruptions in normal metabolic processes, often involving abnormal energy metabolism, hormone regulation, or nutrient utilization. These conditions are increasingly common worldwide due to factors such as sedentary lifestyles, poor dietary habits, and an aging population. As more individuals are diagnosed with these disorders, there is a growing demand for specialized clinical nutrition products that help manage and mitigate their effects.

Clinical nutrition plays a crucial role in the management of metabolic disorders by providing tailored dietary interventions that optimize nutrient intake, control blood glucose levels, manage body weight, and reduce cardiovascular risk factors. For example, nutrition therapy for diabetes often emphasizes balanced macronutrient intake, portion control, carbohydrate counting, and glycemic index management to achieve better glycemic control and improve patient outcomes. Similarly, in obesity and related metabolic conditions, clinical nutrition solutions are designed to support weight management and address nutrient deficiencies that may arise from restrictive diets or malabsorption.

For instance, according to the International Diabetes Federation, a total of 60 data sources from 39 countries were used to generate diabetes estimates among adults in the region. According to the Diabetes Med data in 2025, the diabetes prevalence (9.2%) and number of people with diabetes (61 million) in the European region will increase by 13 % by 2045. The Europe region has the highest number of children and adolescents with type 1 diabetes (295,000) as well as the highest incidence annually, with 31,000 new cases per year. Hence, the rise in the number of metabolic disorders and other chronic diseases will increase the demand for clinical nutrition directly, which will help the market to grow during the forecast period.

Global Clinical Nutrition Market Dynamics: Restraints

Lack of awareness for clinical nutrition

Lack of awareness for clinical nutrition acts as a significant restraint in the growth and effectiveness of the global clinical nutrition market. This challenge is multifaceted, stemming from both healthcare professionals (HCPs) and the broader health system. Many HCPs receive insufficient nutrition education during their undergraduate and postgraduate training, leaving them ill-equipped to identify malnutrition, provide dietary counseling, or integrate nutrition into patient care plans.

The absence of clear roles and responsibilities for nutritional care within healthcare teams further exacerbates the issue, leading to poor collaboration and communication among staff and ultimately resulting in underdiagnosed and undertreated malnutrition.

Additionally, health systems often lack resources such as up-to-date guidelines, educational materials, and dedicated nutrition support personnel, making it even harder to deliver effective clinical nutrition interventions. This systemic lack of awareness and prioritization not only limits patient access to appropriate nutritional support but also hampers the adoption of innovative clinical nutrition products and services, restraining market growth and reducing the overall impact of nutrition on patient outcomes.

Global Clinical Nutrition Market Dynamics: Opportunities

Personalized and digital nutrition

Personalized and digital nutrition presents a major opportunity for the global clinical nutrition market by leveraging advanced technologies and individualized health data to deliver tailored nutritional solutions. This approach uses genetic, biomarker, lifestyle, and behavioral information to create customized diet plans, supplements, and interventions that address each person’s unique health needs and goals.

The rapid adoption of digital tools such as wearable devices, health tracking apps, and AI-driven nutrition advisors enables real-time monitoring and adjustment of nutritional strategies, making personalized nutrition more accessible and effective for both patients and healthcare providers.

The market is experiencing strong growth, with increasing consumer demand for health customization, advancements in genomics and digital health, and the integration of personalized nutrition into wellness programs and clinical care. As awareness of the benefits of tailored nutrition grows and digital health technologies become more widespread, the personalized and digital nutrition segment is poised to transform clinical nutrition by improving patient outcomes, increasing adherence to dietary recommendations, and opening new avenues for product development and market expansion.

For more details on this report, Request for Sample

Global Clinical Nutrition Market - Segment Analysis

The global clinical nutrition market is segmented based on product type, age group, route of administration, application, distribution channel, and region.

Product Type:

The infant nutrition product type segment in the clinical nutrition market was valued at US$ 29.85 Billion in 2024

This segment includes various product types such as infant milk formula (designed to closely mimic breast milk’s nutritional profile), follow-on milk (for older infants transitioning to solid foods), specialty baby milk (for infants with specific health or dietary needs), prepared baby food (ready-to-eat meals and purees), and dried baby food (powdered or dehydrated foods for easy preparation). These products are tailored for different infant age groups and nutritional requirements, with formulations that may include proteins, fats, carbohydrates, vitamins, minerals, and sometimes probiotics or prebiotics.

The infant nutrition product type segment plays a crucial role in supporting healthy growth and development, particularly when breastfeeding is not possible or insufficient. These products are designed to provide essential nutrients required during the critical early stages of life, address specific health needs such as allergies or lactose intolerance through specialty formulas, and offer convenient feeding options for parents, especially working mothers or those with limited time, by providing ready-to-use or easy-to-prepare foods.

The growth of this market segment is driven by several factors, including the rising number of working mothers and changing family structures, which increase the demand for convenient and nutritious alternatives to breastfeeding. There is also growing awareness of infant health and nutrition, prompting parents to seek products that support optimal development and immunity. Product innovation, such as the introduction of organic, hypoallergenic, and fortified formulas, along with improvements in packaging for greater convenience and shelf life, further fuels market expansion.

For instance, in February 2024, Bobbie, the mom-founded pediatric nutrition company, announced its first move beyond infant formula with two organic infant supplements: Vitamin D and Probiotic Drops. The move marks the company’s first foray into non-formula products, a natural extension of its existing high-quality, simple formula lineup.

Also, in January 2024, Danone India launched AptaGrow, a toddler nutrition range that aims to provide health benefits to as many children as possible. It contains 37 essential nutrients, including prebiotics that help absorb vital nutrients. According to Danone, this blend of nutrients is specifically designed to support the growth, brain development, and immunity of children aged between 3 and 6 years.

Application:

The metabolic disorders application segment in the clinical nutrition market was valued at US$ 30.65 Billion in 2024

Metabolic disorders are medical conditions that disrupt normal metabolic processes in the body, such as diabetes, obesity, metabolic syndrome, hyperlipidemia, and inherited metabolic diseases. These disorders often require tailored dietary management to control symptoms, prevent complications, and support overall health.

Clinical nutrition products in this segment are used to help manage blood glucose levels in diabetes, promote healthy weight loss or maintenance in obesity, and address specific nutrient deficiencies or imbalances associated with various metabolic conditions. They may include low-glycemic formulas, protein-rich supplements, calorie-controlled meal replacements, and products fortified with specific vitamins and minerals.

The growth of the metabolic disorders application segment is driven by the increasing global prevalence of metabolic diseases, largely due to sedentary lifestyles, unhealthy diets, and rising rates of obesity and diabetes. Greater awareness among healthcare providers and patients about the importance of nutrition in disease management, along with advances in personalized nutrition and product innovation, is further fueling demand. Additionally, the expansion of healthcare infrastructure, rising healthcare expenditures, and supportive government initiatives for chronic disease management are contributing to the robust growth of this segment.

Global Clinical Nutrition Market – Geographical Analysis

The North America clinical nutrition market was valued at US$ 29.24 Billion in 2024

The North America clinical nutrition market is driven by several key factors. A major driver is the high and rising prevalence of chronic and non-communicable diseases such as diabetes, cardiovascular conditions, obesity, and cancer, which increases the need for specialized nutritional support in both hospital and home care settings. The region’s large and aging population further fuels demand, as older adults often require clinical nutrition due to poor nutrient absorption and increased risk of disease-related malnutrition.

The US clinical nutrition market was valued at US$ 24.33 Billion in 2024

For instance, according to the data published by the National Diabetes Statistics Report 2022, the US population has 38.4 million people with diabetes, with 29.7 million diagnosed, including 29.4 million adults. Undiagnosed is 8.7 million, with 22.8% of adults undiagnosed. 97.6 million adults aged 18 or older have prediabetes, with 48.8% of those aged 65 or older having it. Hence, the patients suffering from the diseases need proper nutrition, which indeed helps the market to grow during the forecast period.

Strong healthcare infrastructure and significant investment in research and development by leading global companies also support market growth, enabling rapid innovation and broad product availability. Additionally, there is a growing emphasis on personalized and preventive nutrition, with advances in digital health, nutrigenomics, and tailored dietary solutions gaining traction among both healthcare providers and patients. Awareness initiatives and government support for nutritional care, especially for vulnerable groups such as cancer patients and the elderly, further stimulate the adoption of clinical nutrition products.

For instance, in January 2024, Hologram Sciences, a leader in health technology and personalized nutrition, collaborated with the Mayo Clinic for the development of the 'Precision Nutrition Platform'. This initiative employs advanced machine learning and adaptive technologies, drawing on the clinical insights of Mayo Clinic through a know-how agreement to address the widespread challenges of malnutrition in surgical recovery and enhance patient care across multiple disciplines.

The Asia-Pacific clinical nutrition market was valued at US$ 14.32 Billion in 2024

The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is a primary driver, as these illnesses require specialized nutritional support for effective management and recovery. The region also has the largest and fastest-growing elderly population in the world, leading to increased demand for clinical nutrition products that address age-related health challenges like malnutrition and sarcopenia.

The Japan clinical nutrition market was valued at US$ 2.76 Billion in 2024

High birth rates, a growing number of premature births, and widespread malnutrition further fuel the need for infant and pediatric clinical nutrition solutions. Expanding healthcare expenditures, improved infrastructure, and rising nutritional awareness supported by government initiatives and public health campaigns are making clinical nutrition more accessible across both urban and rural populations.

Medical tourism, robust local manufacturing, and the entry of competitive local players are also contributing to the market’s dynamism, making products more affordable and widely available. Finally, ongoing product innovation, regulatory alignment, and the growing adoption of disease-specific and customized nutrition solutions are expected to further accelerate market growth and differentiation in the Asia-Pacific region.

For instance, in January 2025, ENOSOLID Semi Solid for Enteral Use is a newly launched medical nutrition product developed by Otsuka Pharmaceutical Factory, Inc., a leading Japanese company specializing in clinical nutrition. This product is designed for enteral feeding, which means it is intended to be administered directly into the gastrointestinal tract (usually via a feeding tube) for patients who cannot consume food orally but have a functioning digestive system.

Also, in September 2024, Dutch Medical Food B.V. (a Netherlands-based company specializing in medical nutrition) and Pristine Pearl Pharma Pvt. Ltd. (an Indian pharmaceutical company) have joined forces to introduce advanced medical nutrition products in India.

Global Clinical Nutrition Market – Competitive Landscape

The major global players in the clinical nutrition market include Abbott Laboratories (Abbott Nutrition), Nestle Health Science, Baxter International Inc., B. Braun Melsungen AG, Danone (Nutricia), BASF SE, Perrigo Company PLC, Royal DSM, AYMES International Ltd, and Hexagon Nutrition Ltd, among others.

Global Clinical Nutrition Market – Key Developments

In May 2024, Danone acquired Functional Formularies, a U.S.-based provider of whole food tube feeding solutions from Swander Pace Capital. This move is part of Danone's Renew Strategy and aims to strengthen its Medical Nutrition business in the U.S. by expanding its range of enteral tube feeding products.

In March 2024, SIRIO Pharma, a leading global nutraceutical contract development and manufacturing organization (CDMO), launched a comprehensive women’s health platform at Vitafoods Europe. This new portfolio consists of 25 ready-to-launch formulations specifically tailored to address women’s health needs across all life stages, from puberty through post-menopause.

In January 2024, Abbott launched PROTALITY, a new brand focused on supporting adults who are aiming to lose weight while preserving muscle mass and maintaining good nutrition. The first product under this brand is a high-protein nutrition shake designed specifically for people who may struggle to get enough protein and essential nutrients during weight loss, especially those using weight loss medications, following calorie-restricted diets, or undergoing weight-loss surgery.

Global Clinical Nutrition Market – Scope

Metrics | Details | |

CAGR | 7.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Infant Nutrition, Adult Nutrition, Pediatric Nutrition |

Age Group | Adult, Pediatric | |

Route of Administration | Oral, Enteral, Parenteral | |

Application | Oncology, Metabolic Disorders, Gastrointestinal Disorders, Neurological Disorders, Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

According to DMI analysis, the clinical nutrition industry as a crucial pillar of modern healthcare, with high momentum (CAGR 7.5%) due to increased chronic disease prevalence, aging demographics, and a trend toward preventative and individualized care. Companies should target condition-specific and digitally enabled nutrition products, particularly in the metabolic diseases and pediatric segments, where growth is highest. The convergence of AI, nutrigenomics, and telehealth platforms opens up new avenues for innovation, allowing for real-time monitoring and personalized intervention. Product innovation in areas such as plant-based, hypoallergenic, and enteral nutrition will be crucial for meeting changing dietary patterns. To gain a long-term competitive edge in this changing global market, strategic investments should prioritize clinical trial-backed product differentiation, home healthcare compatibility, and cross-sector collaborations (for example, tech-healthcare alliances).

The global clinical nutrition market report delivers a detailed analysis with 78 key tables, more than 73 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here