Infant Nutrition Market Size

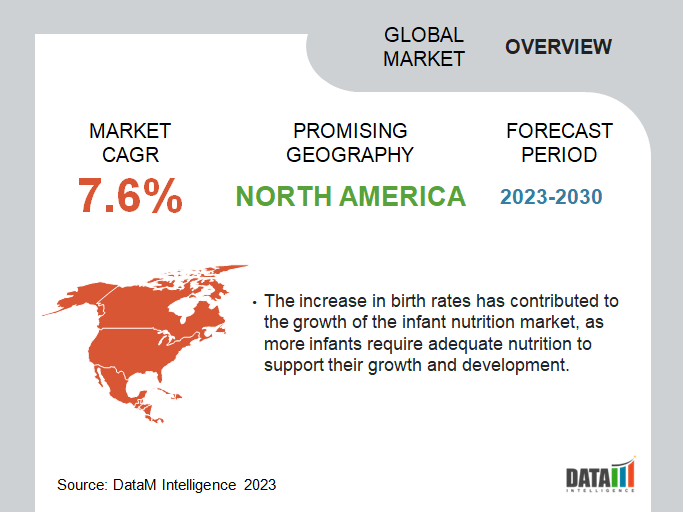

Global Infant Nutrition Market was valued at USD 44,436 million in 2022 and is projected to witness lucrative growth by reaching up to USD 79,843 million by 2031. The market is growing at a CAGR of 7.6% during the forecast period 2025-2032

Infant nutrition products are widely used by parents and caregivers as an alternative to or supplement to breast milk. While breast milk is generally considered the optimal source of nutrition for infants, not all parents can breastfeed, and there may be situations where infant formula or other products are needed to support the nutritional needs of the infant.

The benefits of infant nutrition products include supporting healthy growth and development, providing essential nutrients, and promoting immune function. Infant formula products are designed to mimic the nutritional composition of breast milk and are often fortified with additional vitamins, minerals, and other nutrients to support infant health. The infant nutrition market is a large and growing industry, driven by increasing birth rates, changing dietary habits, and a growing awareness of the importance of early childhood nutrition.

Infant Nutrition Market Scope

| Metrics | Details |

| CAGR | 7.6% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Product Type, Form, Distribution Channel, and Region |

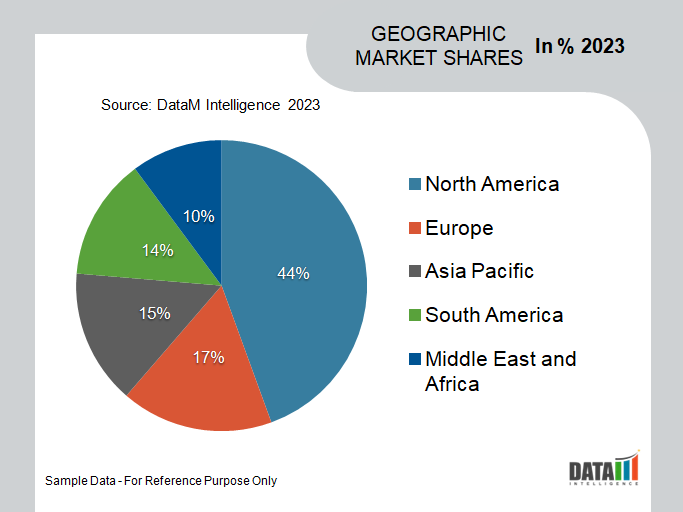

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Fastest Growing Region | Asia Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights Download Sample

Infant Nutrition Market Dynamics

The Increasing Birth Rates Globally Are Driving The Growth Of The Infant Nutrition Market

According to data from the United Nations, the global birth rate has been steadily increasing over the past few decades. In 2020, the estimated global birth rate was 18.4 births per 1,000 population, up from 17.6 births per 1,000 population in 2000. This represents an increase of 4.5% over the past two decades.

Negative Perceptions About The Product Are Holding Back The Infant Nutrition Market Growth

Negative perceptions about infant nutrition products can be a significant restraint on the growth of the market. One example is the 2008 melamine contamination scandal in China, where infant formula was found to be contaminated with the industrial chemical melamine. This led to widespread consumer mistrust of infant formula brands, and many parents turned to alternative sources of infant nutrition or imported infant formula from other countries. This led to widespread consumer mistrust of infant formula brands, and many parents turned to alternative sources of infant nutrition or imported infant formula from other countries.

Infant Nutrition Market Segment Analysis

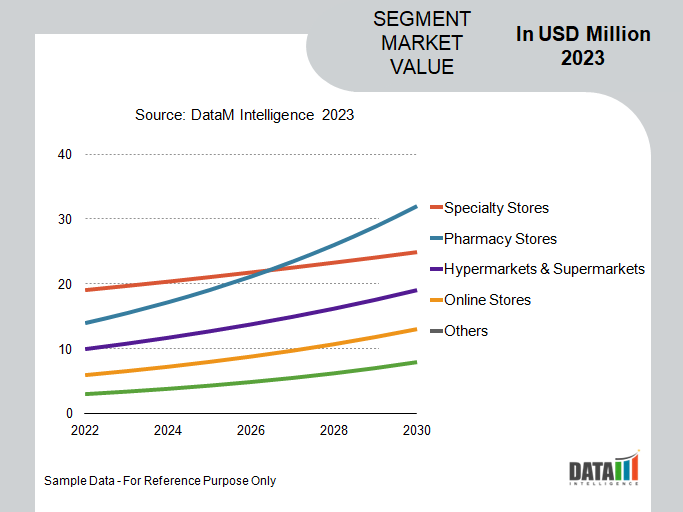

The global infant nutrition market is segmented based on product type, form, distribution channel, and region.

The First Infant Formula Segment Holds The Largest Market Share Of The Infant Nutrition Market

The first infant formula is widely recognized and also known as cow's milk-based formula holds the largest market share in the infant nutrition market. One of the major reasons is that cow's milk-based formula is nutritionally complete and provides a balance of essential nutrients required for infant growth and development. This formula is designed to mimic the nutritional composition of breast milk, and it is often recommended by healthcare professionals as a suitable alternative for infants who are not breastfed.

Infant Nutrition Market Geographical Share

North America is Expected To Dominate The Global Infant Nutrition Market During The Forecast Period

North America holds the largest market share in the infant nutrition market due to several factors, including the high demand for infant nutrition products, a strong healthcare system, and high disposable income levels. According to the Centers for Disease Control and Prevention (CDC), approximately 83% of infants born in the United States were breastfed at some point in 2018. However, the CDC also notes that many infants are supplemented with infant formula, particularly in the first few months of life. This high demand for infant nutrition products in the United States and other North American countries, such as Canada, has contributed to the region's dominant market share.

Infant Nutrition Companies

The major global players include Abbott Laboratories, Baby Gourmet Foods, Inc., Bellamy's Australia Limited, Danone S.A., Royal FrieslandCampina NV, Reckitt Benckiser (Mead Johnson), Nestlé S.A., Perrigo Company Plc, Parent's Choice Infant Formula, and The Kraft Heinz Company.

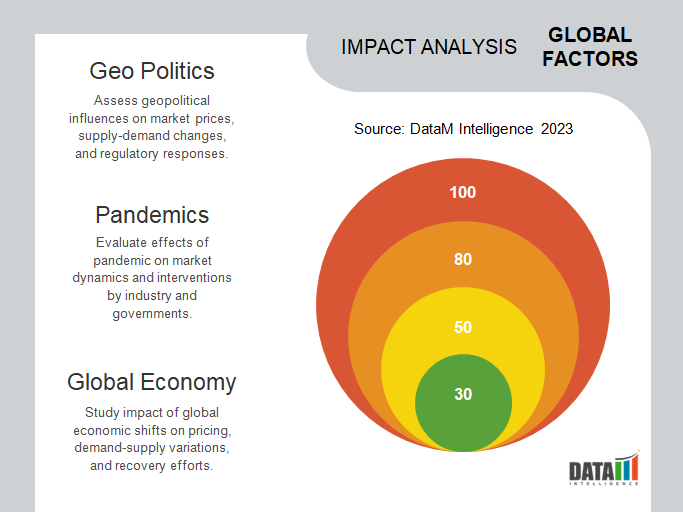

COVID-19 Impact on Market

The COVID-19 pandemic has had a significant impact on the infant nutrition market, both in terms of supply and demand. One of the primary impacts of the pandemic on the infant nutrition market has been disruptions to the supply chain. Manufacturers of infant formula and related products have faced challenges sourcing raw materials, shipping products, and meeting demand due to pandemic-related disruptions. This has led to temporary shortages and price increases in some markets.

AI Impact

Artificial intelligence (AI) is beginning to have an impact on the infant nutrition market, although the extent of this impact is still relatively limited. One of the primary ways in which AI is being used in the infant nutrition market is through the development of predictive analytics and quality control systems. These systems use machine learning algorithms to analyze data on the production and quality of infant nutrition products and can help manufacturers identify potential issues and improve the safety and quality of their products.

Russia-Ukraine War Impact

The ongoing conflict between Russia and Ukraine has had a limited direct impact on the infant nutrition market, as most infant nutrition products are produced and consumed outside of the conflict zone. However, there have been some indirect effects of the conflict that have affected the market. One of the primary indirect effects of the conflict has been economic sanctions, which have affected trade and investment between Russia and Ukraine, as well as between Russia and other countries.

Key Developments

- In October 2022, Else Nutrition Holdings Inc. opened its flagship Chinese store on Tmall Global. The company is currently selling Else Nutrition infant cereal and toddler formula to Chinese customers directly through the store. The third market Else has entered since beginning its global expansion is China.

- In September 2022, Nestlé discovered myelin, which is a nutrient-rich combination of elements found in breast milk. The company first introduced Nutrilearn Connect, an infant formula with a unique ingredient, in Hong Kong before spreading to other regions.

- In March 2022, ByHeart, the next-generation baby nutrition company, announced the launch of its groundbreaking infant formula to become the one and only new infant formula brand to rewrite the recipe from scratch.

Why Purchase the Report?

- To visualize the global infant nutrition market segmentation based on product type, form, and distribution channel and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous infant nutrition market-level data points all for segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global infant nutrition market report would provide approximately 61 tables, 57 figures, and 102 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies