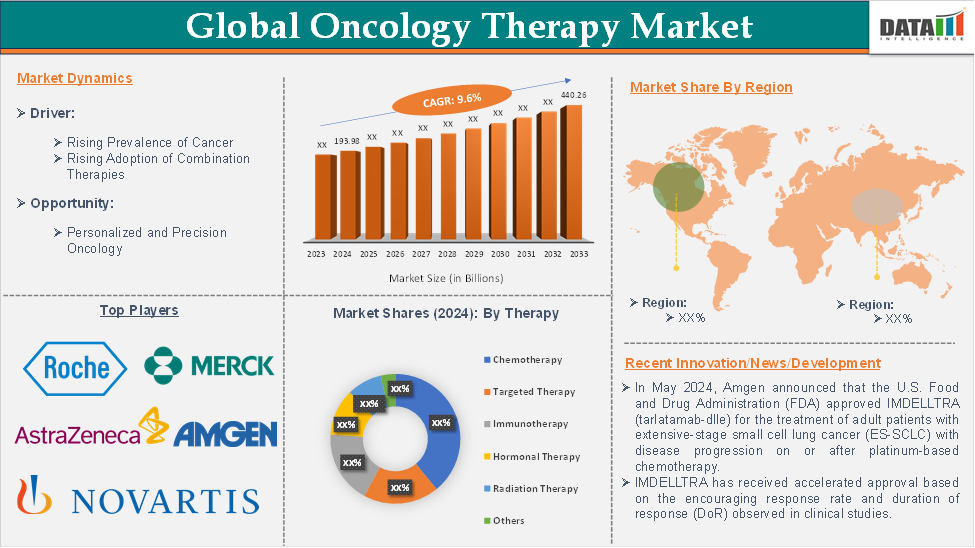

Oncology Therapy Market Size

The Global Oncology Therapy Market size reached US$ 193.98 billion in 2024 and is expected to reach US$ 440.26 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.6% during the forecast period of 2025-2033.

In 2022, the Global Oncology Therapy Market was at US$ 167.09 Billion, and by 2023, it had reached US$ 178.78 Billion, marking a significant growth in market value.

Oncology therapy refers to the medical treatments and interventions designed to manage and treat cancer. It encompasses a wide range of therapeutic strategies aimed at eliminating or controlling cancer cells, alleviating symptoms, enhancing the patient's quality of life, and ultimately achieving remission or a cure, where possible. Oncology therapy is multi-disciplinary and often requires a combination of treatments, personalized approaches, and ongoing monitoring.

Oncology therapy is a broad and evolving field that aims to treat cancer through various approaches, including chemotherapy, immunotherapy, targeted therapy, surgery, and radiation. These therapies can be used in combination or alone, depending on the type and stage of cancer. With advances in personalized medicine, the future of oncology therapy lies in more precise and tailored treatments that offer higher effectiveness with fewer side effects.

Executive Summary

For more details on this report, Request for Sample

Oncology Therapy Market Dynamics: Drivers & Restraints

The rising prevalence of cancer is significantly driving the oncology therapy market growth

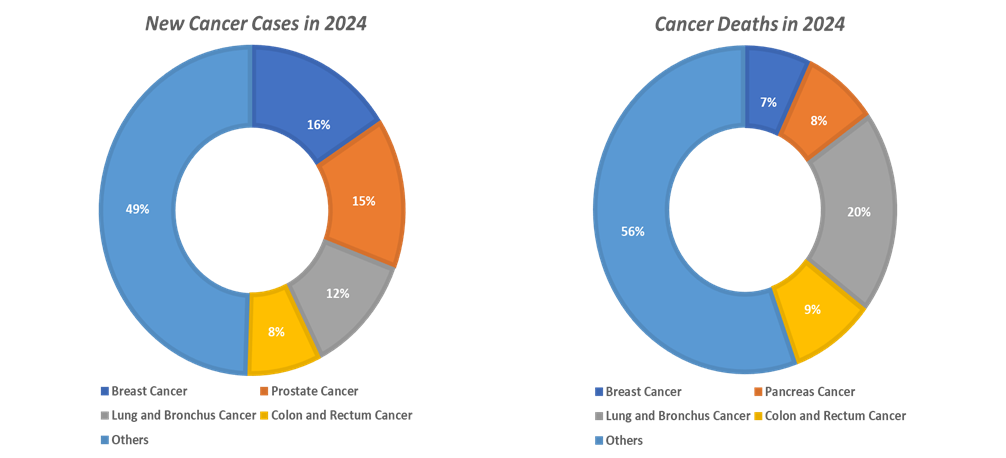

Cancer is becoming more common globally, and its increasing incidence is creating a heightened demand for effective treatments and therapies. As cancer cases rise, there is a growing need for various oncology therapies, such as chemotherapy, immunotherapy, targeted therapy, and radiation. More people are being diagnosed with cancer, increasing the patient pool requiring treatment, leading to greater demand for both established and novel cancer therapies.

For instance, according to the National Institutes of Health, cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. By 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million. According to the International Agency for Research on Cancer, in 2025, cancer incidence cases are projected to reach 21.3 million, and in 2030, the cases are estimated to reach 24.1 million.

Breast cancer is becoming the most burdensome cancer in the world, with an alarming rise in incidence and prevalence rate. For instance, according to the International Agency for Research on Cancer projections, nearly 2.7 million breast cancer incidence cases are expected to be reported in 2030, rising from 2.3 million in 2022. With more people being diagnosed, the demand for effective cancer treatments, ranging from chemotherapy to advanced immunotherapies, is intensifying, ensuring continued expansion in the market.

Adverse effects associated with various oncology therapies hamper market growth

While oncology therapies are essential for cancer treatment, adverse effects associated with these therapies can hamper their widespread adoption and market growth. The side effects, which range from mild to severe, often affect patients' quality of life and can lead to treatment discontinuation or modification. The presence of these adverse effects poses challenges for healthcare providers, pharmaceutical companies, and patients, influencing treatment decisions and limiting the market's potential growth.

Chemotherapy is one of the most common cancer treatments, but it is associated with a wide range of toxic side effects due to its non-selective action on rapidly dividing cells. It not only targets cancer cells but also affects normal, healthy cells, leading to significant side effects. These side effects can lead to treatment delays or dose reductions, which can impact the overall efficacy of the therapy and patient compliance. As a result, patients may seek alternative therapies or choose not to complete the prescribed chemotherapy regimen, hindering overall market growth.

Immunotherapy, though revolutionary in treating cancers like melanoma and lung cancer, comes with a unique set of immune-related adverse events. These adverse effects arise from the immune system's overreaction to cancer treatments, which can lead to inflammation in normal tissues and organs. Targeted therapies, while more precise than traditional chemotherapy, still have specific side effects related to the targeted molecules they affect. These therapies can be highly effective for cancers driven by specific genetic mutations, but side effects related to the inhibition of these molecular targets can limit their use.

Oncology Therapy Market Segment Analysis

The global oncology therapy market is segmented based on therapy, application, end-user, and region.

Application:

The breast cancer segment is expected to dominate the oncology therapy market with the highest market share

Breast cancer is the most common cancer in women worldwide. The global burden of breast cancer is substantial, and its increasing prevalence drives the demand for effective oncology therapies. For instance, according to the World Health Organization (WHO), in 2022, there were 2.3 million women diagnosed with breast cancer and 670,000 deaths globally, making it the most common cancer across both developed and developing countries.

The advancements in breast cancer treatments are a major driver of the segment's dominance. Over the last few decades, innovations such as targeted therapies, hormonal therapies, and immunotherapies have dramatically improved survival rates and quality of life for breast cancer patients. For instance, targeted therapies like Trastuzumab (Herceptin) have transformed the treatment of HER2-positive breast cancer, leading to improvements in survival for patients.

Novel product launches by major market players in the field of breast cancer are boosting the segment. For instance, in January 2024, AstraZeneca India Pharma Ltd., a science-led biopharmaceutical company, officially launched Trastuzumab deruxtecan, a therapy tailored for the treatment of adult patients with unresectable or metastatic HER2-positive breast cancer for those who have previously received an anti-HER2 regimen. Developed in collaboration with Daiichi Sankyo, Trastuzumab deruxtecan is a specifically engineered HER2-directed antibody drug conjugate (ADC).

Oncology Therapy Market Geographical Analysis

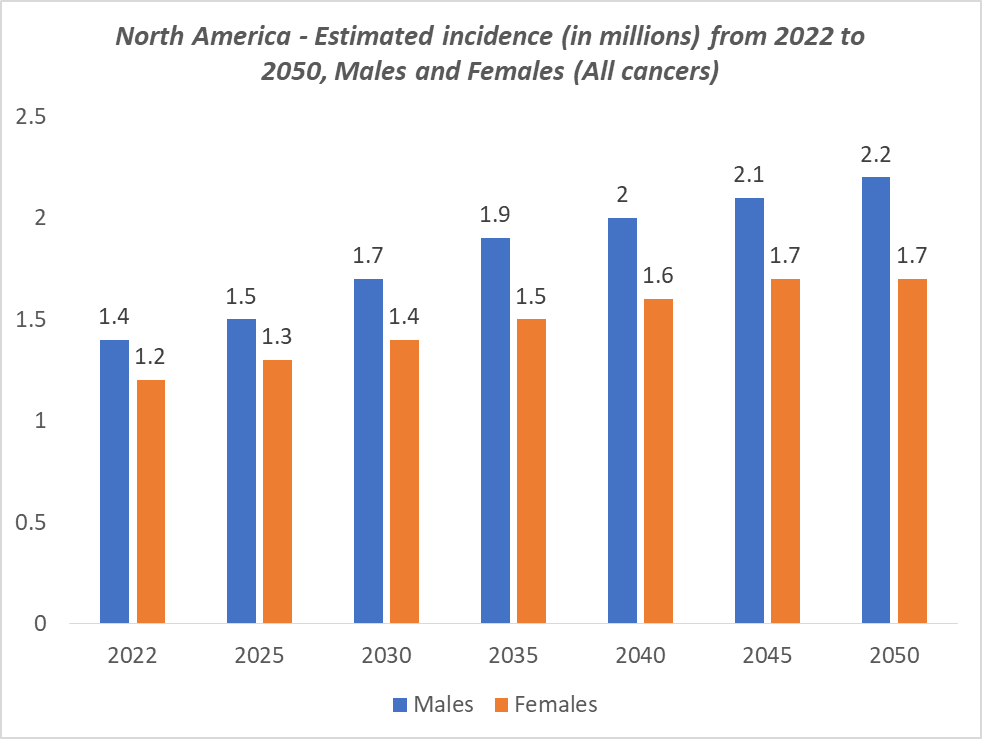

North America is expected to hold a significant position in the global oncology therapy market with the highest market share

North America led the Global Oncology Therapy Market in 2022 with a market size of US$ 70.70 billion and expanded further to US$ 75.64 billion in 2023.

The oncology therapy market in the North America region is expected to grow owing to the strong presence of major market players, the rising prevalence of cancers, increasing research activities, rising awareness about cancer, rising clinical studies, and well-established healthcare infrastructure. The prevalence of cancer in the United States is continuously rising, which further increases the demand for various oncology therapies. Factors such as aging populations, lifestyle changes, and the prevalence of risk factors like obesity and smoking are driving the demand for improved treatments.

Moreover, the presence of major market players in the region launching various oncology therapies, along with FDA approvals, further accelerates the market growth in the region. For instance, in April 2024, Johnson & Johnson cleared the U.S. Food and Drug Administration (FDA) approval for CARVYKTI (ciltacabtagene autoleucel; cilta-cel) for the treatment of adult patients with relapsed or refractory multiple myeloma who have received at least one prior line of therapy, including a proteasome inhibitor and an immunomodulatory agent, and are refractory to lenalidomide. With this approval, CARVYKTI becomes the first and only B-cell maturation antigen (BCMA)-targeted therapy approved for the treatment of patients with multiple myeloma as early as first relapse.

Additionally, in May 2024, Amgen announced that the U.S. Food and Drug Administration (FDA) approved IMDELLTRA (tarlatamab-dlle) for the treatment of adult patients with extensive-stage small cell lung cancer (ES-SCLC) with disease progression on or after platinum-based chemotherapy. IMDELLTRA has received accelerated approval based on the encouraging response rate and duration of response (DoR) observed in clinical studies. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial(s).

Oncology Therapy Market Top Companies

Top companies in the oncology therapy market include Amgen Inc., AstraZeneca, Bayer AG, Merck & Co., Inc., Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd, Novartis AG, GSK plc, Eli Lilly and Company, Rigel Pharmaceuticals, Inc., and others.

Scope

| Metrics | Details | |

| CAGR | 9.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Therapy | Chemotherapy, Targeted Therapy, Immunotherapy, Hormonal Therapy, Radiation Therapy, and Others |

| Application | Breast Cancer, Lung Cancer, Blood Cancer, Prostate Cancer, Colorectal Cancer, Stomach Cancer, Liver Cancer, Esophageal Cancer, Cervical Cancer, Ovarian Cancer, Bladder Cancer, Head and Neck Cancer, Skin Cancer (Melanoma), Pancreatic Cancer, Kidney Cancer, and Others | |

| End-User | Hospitals, Cancer Research Centers, Specialty Clinics, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |