Oncology Nutrition Market Size

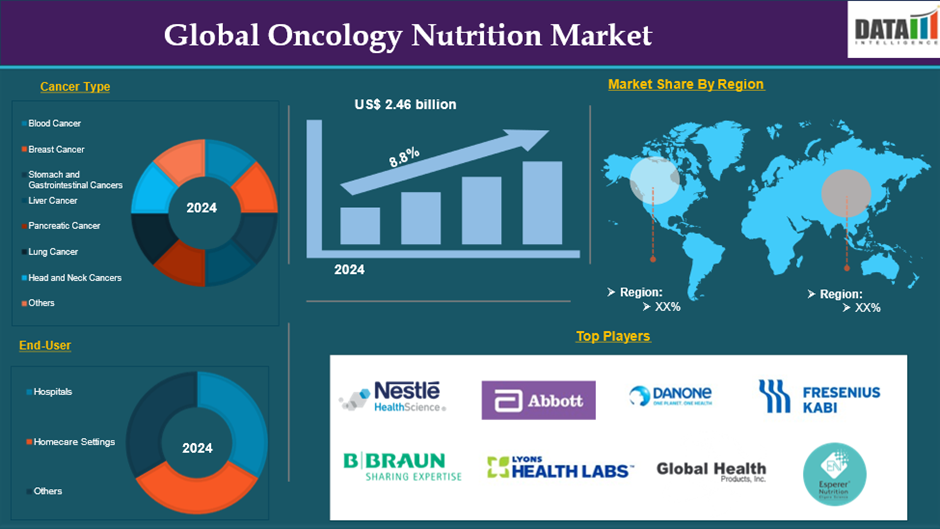

The Global Oncology Nutrition Market reached US$ 2.46 billion in 2024 and is expected to reach US$ 5.33 billion by 2033, growing at a CAGR of 8.8 % during the forecast period 2025-2033.

The global oncology nutrition market refers to the industry dedicated to providing specialized nutritional products and services designed to support cancer patients throughout their treatment journey. This market encompasses a variety of offerings, including dietary supplements, enteral nutrition products, and therapeutic foods, all aimed at addressing the unique nutritional needs of individuals undergoing chemotherapy, radiotherapy, or other cancer treatments.

Cancer treatments often lead to complications such as malnutrition, weight loss, and appetite changes. The oncology nutrition market focuses on developing products that help manage these issues, ensuring that patients receive adequate nutrition to support their overall health and treatment outcomes. The global oncology nutrition market plays a crucial role in supporting cancer patients by providing specialized dietary solutions aimed at improving their quality of life and treatment outcomes. As awareness grows regarding the significance of nutrition in cancer care, this market is poised for continued growth and innovation. These factors have driven the global oncology nutrition market expansion.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Innovations in Oncology Nutritional Products

The innovations in oncology nutritional products is significantly driving the growth of the global oncology nutrition market and is expected to drive throughout the market forecast period. The oncology nutrition market is expected to continue expanding due to ongoing research into personalized nutrition plans that cater to individual patient needs. Innovations in product development are likely to focus on enhancing the effectiveness of nutritional support during cancer treatment.

Innovations in oncology nutritional products are a crucial driving force in the global oncology nutrition market, focusing on advancements that enhance dietary support for cancer patients. These innovations aim to tackle the specific nutritional challenges faced by individuals undergoing cancer treatment, ultimately improving their quality of life and treatment outcomes.

There is an increasing emphasis on developing personalized nutrition products tailored to the unique needs of cancer patients. For instance, products like Tality utilize a concept known as Targeted Nutrients Deprivation (TND), which deprives cancer cells of non-essential amino acids while supplying essential nutrients to healthy cells. This approach is grounded in extensive research into cell metabolism and aims to enhance treatment efficacy and improve patient outcomes.

The integration of cutting-edge technologies, such as 3D printing, is revolutionizing the development of nutritional products for cancer patients. This technology allows for the creation of customized meals that accommodate specific dietary restrictions, such as dysphagia (difficulty swallowing), ensuring that patients receive adequate nutrition in a form they can easily consume.

Furthermore, key players strategies such as partnerships and collaborations that would drive this global oncology nutrition market growth. For instance, in June 2024, the Department of Atomic Energy (DAE) unveiled an innovative nutraceutical called AKTOCYTE, developed in collaboration with IDRS Labs Pvt. Ltd. This innovative food supplement is specifically formulated to enhance the quality of life for cancer patients undergoing radiotherapy. All these factors demand the global oncology nutrition market.

Moreover, the rising demand for the growth of development of personalized nutrition plans contributes to the global oncology nutrition market expansion.

Limited Awareness among Individuals

Limited awareness among individuals presents a significant restraint in the global oncology nutrition market, affecting both patients and the general public regarding the critical role of nutrition in cancer care. This lack of awareness can lead to several challenges that hinder effective nutritional support for cancer patients:

Many cancer patients may not fully understand the vital role that nutrition plays in their treatment and recovery processes. Consequently, they might overlook necessary dietary changes or fail to seek specialized nutritional products that could help manage treatment side effects, maintain strength, and enhance overall health. This underutilization can impede their recovery and negatively impact treatment outcomes.

Patients often lack clarity about their specific nutritional requirements during cancer treatment. For instance, they may not realize how certain foods or supplements can alleviate symptoms such as nausea or fatigue. This misunderstanding can result in poor dietary choices that exacerbate their condition and hinder recovery. Thus, the above factors could be limiting the global oncology nutrition market's potential growth.

Market Segment Analysis

The global oncology nutrition market is segmented based on cancer type, end-user, and region.

Cancer Type:

The Head and Neck Cancers segment is expected to dominate the global oncology nutrition market share

The head and neck cancers segment holds a major portion of the global oncology nutrition market share and is expected to continue to hold a significant portion of the global oncology nutrition market share during the forecast period. The global oncology nutrition market is crucial due to the specific nutritional challenges faced by patients diagnosed with these types of cancers. This segment focuses on providing specialized nutritional support tailored to the unique needs of individuals with head and neck cancers, which encompass cancers of the oral cavity, pharynx, larynx, and salivary glands.

Patients with head and neck cancers often experience significant nutritional difficulties as a result of treatment side effects. These challenges include difficulty swallowing can make it painful or impossible for patients to consume solid foods, necessitating a shift to softer diets or enteral nutrition. Treatments such as chemotherapy and radiation can alter taste perception, leading to decreased appetite and food intake.

Inflammation of the mucous membranes can cause pain and discomfort while eating, complicating nutritional intake further. Proper nutrition is essential for maintaining strength, supporting immune function, and improving overall quality of life during cancer treatment. Nutritional interventions can help mitigate treatment side effects, prevent malnutrition, and enhance recovery.

Furthermore, key players in the industry focus on the research activities that would drive this segment growth in the global oncology nutrition market. For instance, according to the S. Karger AG, Bas research data in July 2024, zinc supplementation has emerged as a promising approach to alleviate complications arising from chemotherapy and radiotherapy in patients with head and neck cancer. This interest in zinc is due to its essential role as a trace element that supports various cellular functions, including immune response and tissue repair.

Research indicates that zinc may provide protective benefits to normal tissues, particularly the salivary glands, during radiation therapy. This is important because radiotherapy often leads to side effects such as xerostomia (dry mouth) and mucositis (inflammation of the mucous membranes), which can significantly impact a patient's quality of life. These factors have solidified the segment's position in the global oncology nutrition market.

Market Geographical Share

North America is expected to hold a significant position in the global oncology nutrition market share

North America holds a substantial position in the global oncology nutrition market and is expected to hold most of the market share. The incidence of cancer in North America is on the rise, with estimates suggesting approximately 1.9 million new cancer cases diagnosed in the United States in 2022. This growing patient population creates a heightened demand for nutritional support tailored to the specific needs of cancer patients, as proper nutrition is essential for managing treatment side effects and improving overall health outcomes.

North America benefits from a well-established healthcare system that includes advanced medical facilities, access to specialized care, and a strong emphasis on patient-centered approaches. This infrastructure facilitates the integration of oncology nutrition into comprehensive cancer care, making it easier for patients to access nutritional products and services. There is a growing recognition among healthcare professionals and patients regarding the importance of nutrition in cancer treatment and recovery. Educational initiatives, such as symposiums and certification programs offered by organizations like the Oncology Nutrition Institute, are helping to raise awareness about effective nutritional strategies, further driving demand for oncology nutrition products.

Various government programs aim to enhance cancer care and support research into oncology nutrition. These initiatives often promote awareness campaigns and provide funding for nutritional research, which can lead to the development of innovative products tailored to meet cancer patients' needs. Furthermore, a major number of key players presence, and investments that would drive this global oncology nutrition market growth.

For instance, in June 2022, Faeth Therapeutics, a company specializing in cancer metabolism, successfully completed a $47 million Series A funding round led by S2G Ventures. This financing brings the total funding raised by the company to $67 million. The funds will be utilized to progress Faeth's clinical trials, which focus on integrating nutrient control, therapeutic strategies, and digital tools to inhibit cancer metabolism. Thus, the above factors are consolidating the region's position as a dominant force in the global oncology nutrition market.

Asia Pacific is growing at the fastest pace in the global oncology nutrition market share

Asia Pacific holds the fastest pace in the global oncology nutrition market and is expected to hold most of the market share.

The Asia-Pacific (APAC) oncology nutrition market is positioned for significant growth, driven by various factors that reflect the region's evolving healthcare landscape and the increasing prevalence of cancer. The APAC region is experiencing a notable rise in cancer cases, with projections suggesting that this trend will continue. The growing patient population creates a heightened demand for specialized nutritional support tailored to the unique needs of cancer patients. Proper nutrition is essential for managing treatment side effects and improving overall health outcomes, leading to increased utilization of oncology nutrition products.

Many countries in the APAC region are investing in their healthcare infrastructure, resulting in better access to medical facilities and specialized care. Enhanced healthcare systems facilitate the integration of oncology nutrition into comprehensive cancer care, ensuring that patients can easily access necessary nutritional products and services. There is a growing recognition among healthcare professionals and patients regarding the importance of nutrition in cancer treatment and recovery. Educational initiatives, including workshops and training programs, are helping to raise awareness about effective nutritional strategies, thereby driving demand for oncology nutrition products.

Furthermore, key players in the industry in the industry product launches that would drive this global oncology nutrition market growth. For instance, in July 2022, Nestlé introduced China's first Foods for Special Medical Purpose (FSMP) tailored for patients with tumor-related conditions, completing a comprehensive five-year approval process with Chinese regulatory authorities. This innovative product, named Oral Impact Su Yi Su, stands out as the only FSMP currently authorized for nutritional supplementation within this patient demographic. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global oncology nutrition market.

Major Global Players

The major global players in the oncology nutrition market include Nestlé Health Science, Abbott, Danone, Fresenius Kabi India Pvt., B. Braun SE, Lyons Health Labs., Global Health Products, Inc., and Esperer Nutrition., among others.

Key Developments

- In June 2024, AEACaP (Asociación Española de Afectados de Cáncer de Pulmón) launched an initiative called "Pills About Nutrition," which consists of a series of educational videos aimed at providing crucial nutritional guidance for lung cancer patients, their families, and caregivers. This program underscores AEACaP's dedication to enhancing the quality of life for individuals impacted by lung cancer through informed dietary choices.

| Metrics | Details | |

| CAGR | 8.8% | |

| Market Size Available for Years | 2023-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Cancer Type | Blood Cancer, Breast Cancer, Stomach and Gastrointestinal Cancers, Liver Cancer, Pancreatic Cancer, Lung Cancer, Head and Neck Cancers, Others |

| End-User | Hospitals, Homecare Settings, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global oncology nutrition market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.