Cancer Tumor Profiling Market Size

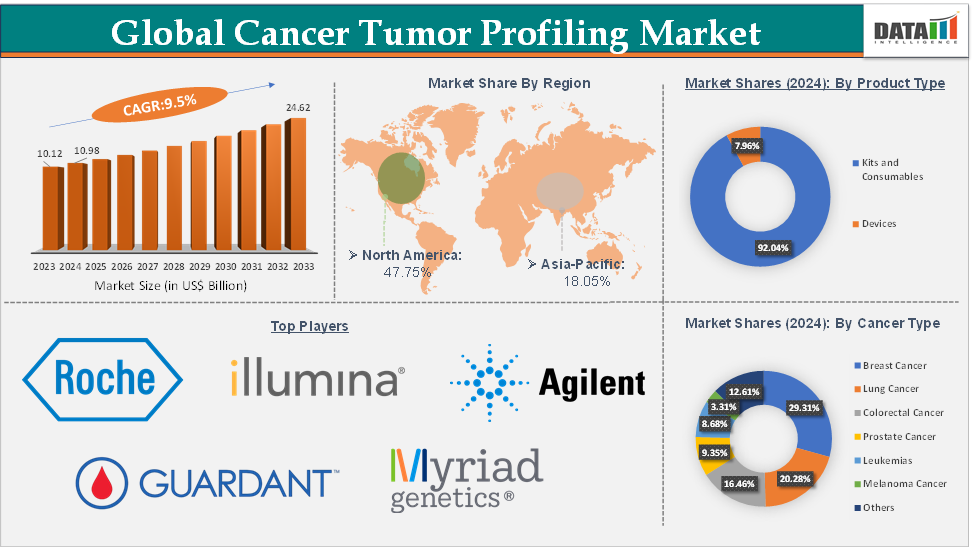

The global cancer tumor profiling market size reached US$ 10.98 Billion in 2024 from US$ 10.12 Billion in 2023 and is expected to reach US$ 24.62 Billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025-2033.

Cancer Tumor Profiling Market Overview

The cancer tumor profiling market is experiencing significant growth due to advancements in precision medicine, increasing cancer prevalence and the rising demand for personalized treatment approaches. Cancer tumor profiling has revolutionized cancer care by improving diagnosis, treatment efficacy, monitoring and helping to predict patient outcomes.

The market is characterized by strong demand in developed regions, such as North America and Europe, driven by higher healthcare expenditure, advanced healthcare infrastructure and greater adoption of precision medicine. Meanwhile, emerging regions such as Asia-Pacific and Latin America are experiencing increasing adoption of cancer tumor profiling, spurred by growing healthcare investments, increasing cancer rates and expanding awareness about personalized treatment options.

Cancer Tumor Profiling Market Executive Summary

Cancer Tumor Profiling Market Dynamics

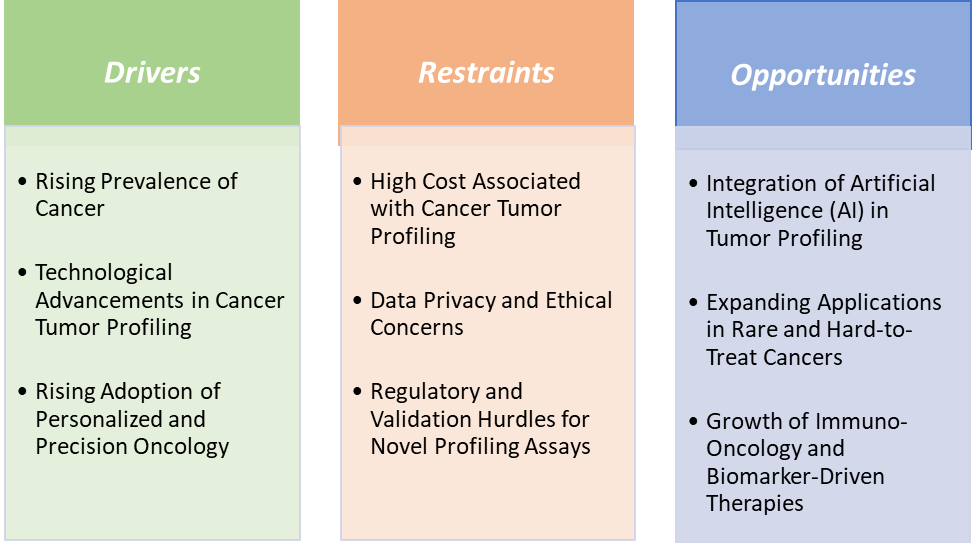

Drivers:

The rising prevalence of cancer is significantly driving the cancer tumor profiling market growth

As cancer rates rise globally, there is a growing emphasis on early detection and personalized medicine. Tumor profiling helps identify specific genetic mutations and alterations in tumors, which enables more accurate diagnoses and the development of personalized treatment plans. This helps in providing targeted therapies that are more effective and less toxic than traditional treatments.

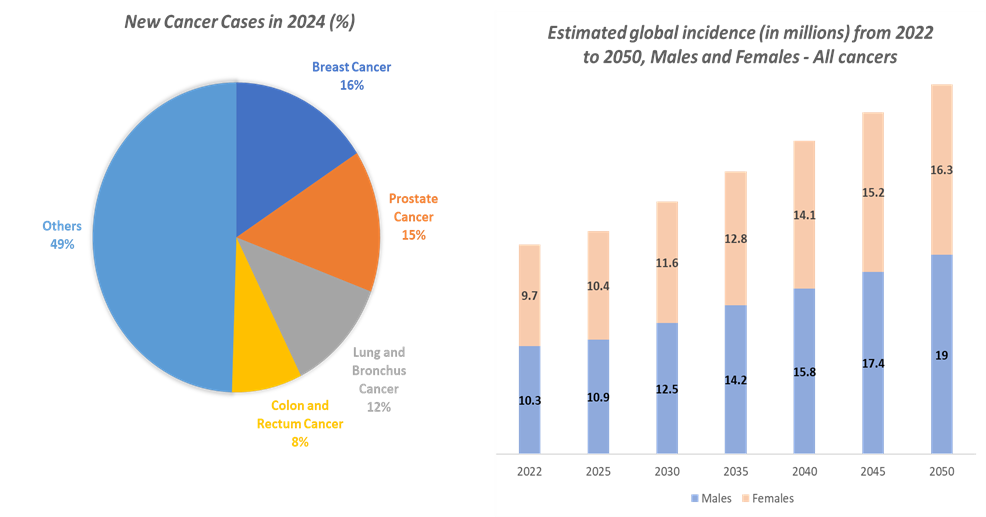

For instance, according to the National Institutes of Health, cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. By 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million. Additionally, according to the International Agency for Research on Cancer, in 2025, cancer incidence cases are projected to reach 21.3 million, and in 2030, the cases are estimated to reach 24.1 million.

Breast cancer is becoming the most burdensome cancer in the world, with an alarming rise in incidence and prevalence rate. There have been many innovations in the early detection and diagnosis of breast cancer, for which advanced tumor profiling technologies are paving the way. For instance, according to the International Agency for Research on Cancer projections, nearly 2.7 million breast cancer incidence cases are expected to be reported in 2030, rising from 2.3 million in 2022.

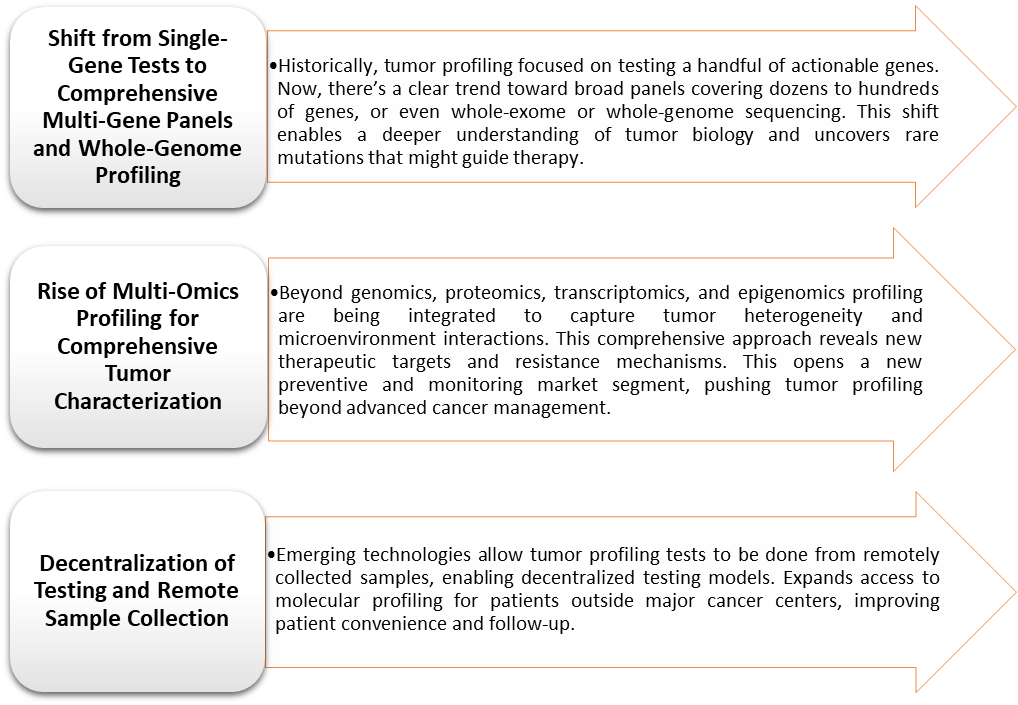

As the prevalence of cancer increases, major market players focus on the advancements in next-generation sequencing (NGS) and liquid biopsy technologies that are providing better and more efficient tumor profiling. These advanced technologies, along with artificial intelligence (AI), enable high-throughput testing of genetic mutations in cancer cells, leading to more precise treatment selection.

For instance, in April 2025, Guardant Health, Inc. launched Guardant360 Tissue, the first molecular profiling test for tumor tissue that incorporates comprehensive multiomics analysis, including DNA, RNA, AI-powered PD-L1 and genome-wide methylation data, to provide researchers and cancer care teams with a more comprehensive view of cancer. Guardant360 Tissue is built on the smart liquid biopsy platform, which requires 92% less tissue surface area for analysis than the industry norm. The Guardant360 Tissue test allows biopharmaceutical researchers and healthcare providers to successfully analyze tissue samples with 40% fewer slides and thus test more patients using less precious tissue.

Restraints:

The high cost associated with cancer tumor profiling is hampering the growth of the market

High costs make tumor profiling tests inaccessible to a large portion of the population, particularly in low-income regions or among uninsured patients. This limits the potential market for these tests and delays early detection or personalized treatment, which is crucial for improving cancer outcomes.

For instance, according to the National Institutes of Health, turnaround time ranges from 4 days for Oncomine Dx, a 23-gene panel of lung-cancer-related genes, to 21 to 28 days for Ambry Genetics TumorNext, which examines hereditary and somatic mutations in ovarian cancer patients. Costs for testing are in the $3000 to $6000 range. This price point can be prohibitive for many patients, especially those without adequate insurance coverage.

Laboratories that perform tumor profiling using advanced technologies like NGS face high operational costs due to the expensive equipment, consumables and the need for highly skilled personnel. These costs are passed on to healthcare systems and patients, making tumor profiling tests less affordable. For instance, the cost of sequencing equipment for NGS, which includes instruments like the Illumina NovaSeq X Plus, can exceed $1 million. Additionally, reagents and consumables for each test add significant costs to the overall process.

Opportunities:

Integration of artificial intelligence (AI) in tumor profiling creates a market opportunity for the cancer tumor profiling market

Integration of AI in tumor profiling is expected to create a market opportunity for the cancer tumor profiling market, driving advancements in diagnostic accuracy, speed and personalized treatment strategies. AI technologies, including machine learning (ML), deep learning and natural language processing, are transforming the way cancer tumor profiling is conducted by enabling more efficient and precise analyses of large datasets, such as genomic information and medical imaging. Thus, major and emerging market players are focusing on the AI-tumor profiling, gaining market momentum.

For instance, in January 2025, Tempus AI, Inc. launched the company’s FDA-approved, NGS-based in vitro diagnostic device, xT CDx. xT CDx is a 648-gene next-generation sequencing test for solid tumor profiling, which includes microsatellite instability status and companion diagnostic claims for colorectal cancer patients.

AI algorithms can process vast amounts of genomic, histopathological and imaging data in a fraction of the time it would take human analysts, reducing errors and ensuring higher diagnostic accuracy. This can significantly improve the effectiveness of tumor profiling, enabling more accurate predictions of cancer behavior and treatment responses.

For instance, New York-based medtech startup Ataraxis AI has emerged from stealth mode, announced $4 million in seed funding. The company has a focus on developing artificial intelligence (AI) driven cancer diagnostics that can help clinicians to pick the best therapy for their patients and predict their progress.

AI-driven platforms can serve as a clinical decision support system, assisting oncologists in interpreting complex tumor profiling results, such as genetic mutations and tumor characteristics. This can lead to more informed clinical decisions and help in identifying optimal treatment paths based on real-time data integration, including genetic profiling, clinical outcomes and patient demographics.

Cancer Tumor Profiling Market Trends

For more details on this report – Request for Sample

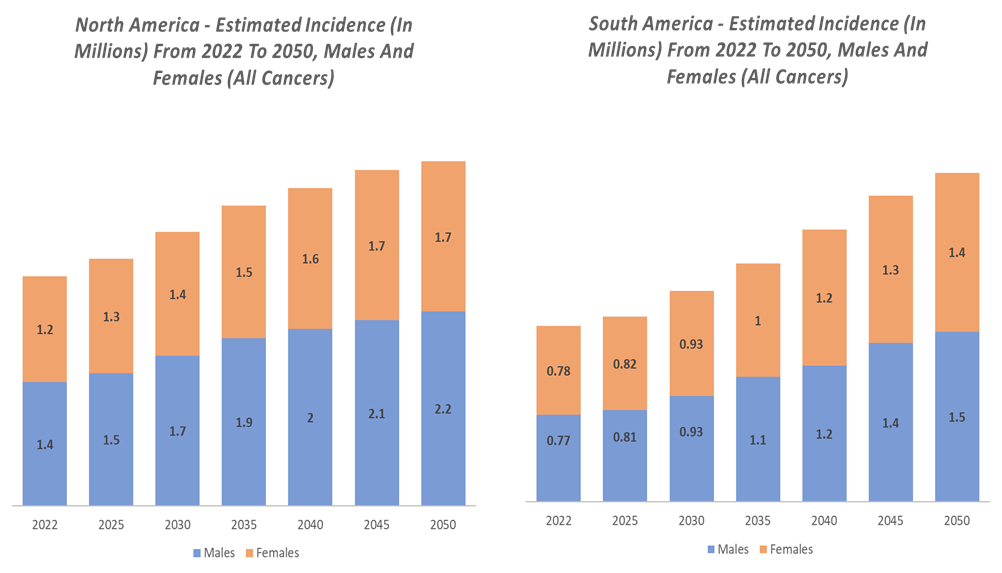

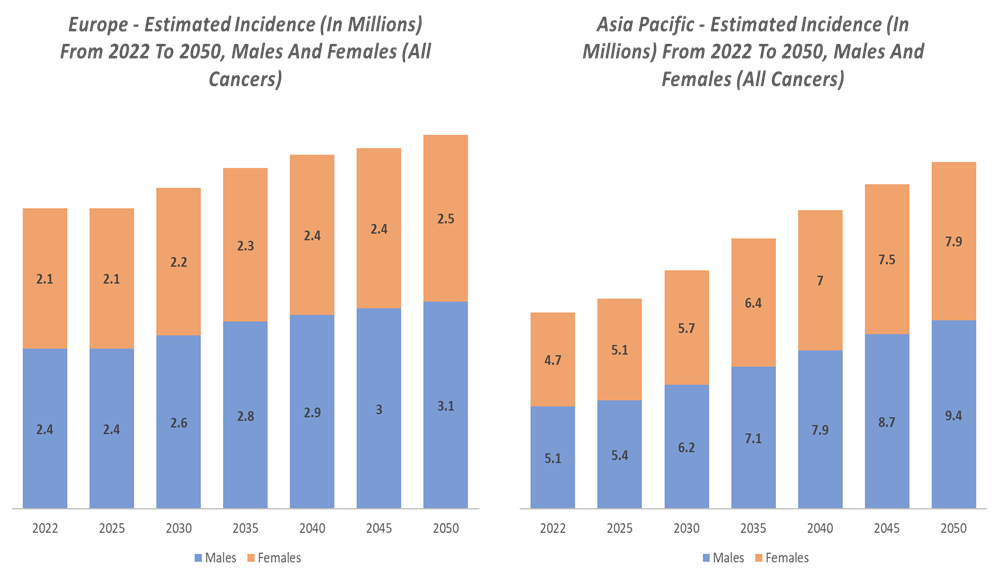

Cancer Tumor Profiling Market, Epidemiology Analysis for All Cancers (Region Wise)

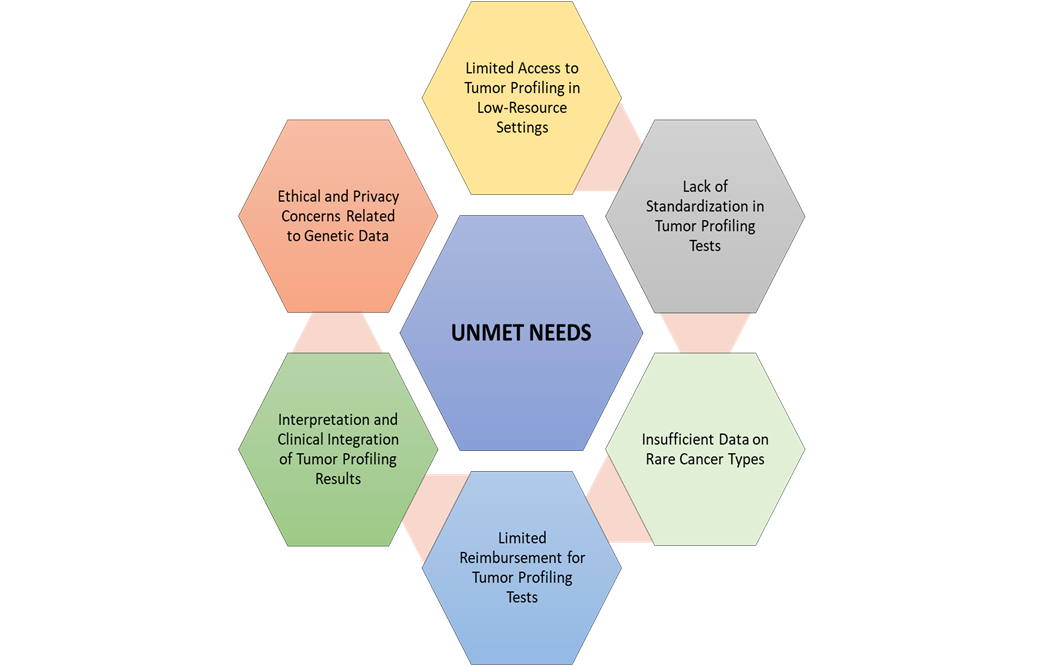

Cancer Tumor Profiling Market, Unmet Needs

Cancer Tumor Profiling Market, Segment Analysis

The global cancer tumor profiling market is segmented based on product type, cancer type, technology type, biomarker type, application, end-user, and region.

The kits and consumables segment from the product type reached US$ 10.11 Billion in 2024 in the cancer tumor profiling market

Kits and consumables include laboratory materials necessary for the execution of tests related to cancer profiling, which could be assay kits, probes, primers, and reagents. These products are necessary for the preparation, processing, and analysis of different tumor samples, whether genomic, proteomic, or metabolomic studies. As the kits are more important products in tumor profiling, market players are launching various kits, which is driving the segment growth.

For instance, in May 2025, Illumina, Inc. received approval from the Ministry of Health, Labour and Welfare (MHLW) for TruSightTM Oncology (TSO) Comprehensive for Class III/IV Medical Device (Specially Controlled Medical Device) in Japan. TSO Comprehensive is the first FDA-approved distributable comprehensive genomic profiling IVD kit with pan-cancer CDx claims in the US. This single test includes analysis of DNA and RNA variants and interrogates over 500 genes to profile a patient’s solid tumor, helping to increase the likelihood of identifying clinically actionable biomarkers that enable targeted therapy selection or clinical trial enrolment.

Similarly, in October 2024, OncoDNA, a genomic and theranostic company, launched the OncoDEEP Kit, a comprehensive workflow solution for laboratories with NGS capabilities to perform comprehensive biomarker testing, provide powerful data analysis, and support oncologists in personalized treatments for cancer patients.

Cancer Tumor Profiling Market, Geographical Analysis

North America is expected to dominate the global cancer tumor profiling market with a US$ 5.24 Billion in 2024

According to the American Cancer Society, in 2025, 2,041,910 new cancer cases are projected to occur in the United States. The rising cancer cases in North America, especially in the United States, drive demand for personalized treatment strategies, pushing the adoption of tumor profiling to tailor therapies and improve outcomes.

Additionally, although the market is dominant, several market players are actively involved in innovating advanced tumor profiling platforms and launching their products in the region. This will contribute to the further growth of the cancer tumor profiling market in the North American region. For instance, in August 2024, the U.S. Food and Drug Administration (FDA) approved Illumina, Inc.’s in vitro diagnostic (IVD) TruSight Oncology (TSO) Comprehensive test and its first two companion diagnostic indications. This test enables fast matching of patients to targeted therapies.

Asia-Pacific is growing at the fastest pace in the cancer tumor profiling market, holding 18.05% of the market share

APAC is experiencing a rapid increase in cancer cases due to aging populations, urbanization, lifestyle changes, and environmental factors. According to the World Health Organization (WHO), Asia accounts for more than half of global cancer cases, with an expected 10.5 million cases in 2025, with countries like China and India seeing significant year-on-year increases. This escalating cancer burden creates an urgent need for precise diagnostic and therapeutic tools such as tumor profiling.

In addition, market players are introducing novel tests and kits to provide a deep glance for the researchers, which further accelerates the market growth in the region. For instance, in 2024, Strand Life Sciences launched its Somatic Advantage 74 Liquid Biopsy (SA74 LB) Test. This test detects circulating tumor DNA in blood samples of cancer patients to provide a comprehensive analysis of 74 clinically relevant genes, providing invaluable insights for cancer treatment.

The market players in the region are expanding their strategic collaborations and partnerships with the existing market players to expand their businesses and make available the kits with the growing demand. For instance, in October 2024, MGI and OncoDNA collaborated to provide laboratories with a streamlined NGS workflow for implementing the Comprehensive Genomic Profiling (CGP) OncoDEEP Kit in clinical practice.

Cancer Tumor Profiling Market Competitive Landscape

Top companies in the cancer tumor profiling market include F. Hoffmann-La Roche Ltd., Illumina, Inc., Myriad Genetics, Inc, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Caris Life Sciences., Guardant Health, NanoString Technologies (a Bruker Company), Foundation Medicine, Inc., and Paragon Genomics, Inc., among others.

Cancer Tumor Profiling Market Scope

Metrics | Details | |

CAGR | 9.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Kits and Consumables and Devices |

Cancer Type | Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Leukemias, Melanoma Cancer and Others | |

Technology Type | Immunoassay, Next-Generation Sequencing, Liquid Biopsy, Polymerase Chain Reaction, In-Situ Hybridization, Microarray and Others | |

Biomarker Type | Genomic Biomarkers, Protein Biomarkers and Others | |

Application | Clinical Applications and Research Applications | |

End-User | Hospitals, Diagnostic Centers, Pharmaceutical and Biotechnology Companies, Research and Educational Institutions and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights on Cancer Tumor Profiling Market

According to DMI analysis, the global cancer tumor profiling market size reached US$ 10.98 Billion in 2024 and is expected to reach US$ 24.62 Billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025-2033.

The cancer tumor profiling market is experiencing robust growth globally, driven primarily by the increasing demand for personalized cancer therapies, advances in molecular diagnostics, and expanding applications of next-generation sequencing (NGS) and multi-omics technologies. Tumor profiling, which involves comprehensive molecular characterization of cancer tissue or blood samples, is revolutionizing oncology by enabling tailored treatment plans based on specific genetic, proteomic, and epigenetic alterations.

The market is highly competitive, with key players like Foundation Medicine, Guardant Health, Caris Life Sciences, F. Hoffmann-La Roche Ltd., Illumina, Inc., and others investing heavily in R&D, partnerships, and market expansion. The integration of AI, liquid biopsies, and multi-omics approaches will further enhance the precision and utility of profiling, potentially transforming cancer care globally.

However, overcoming challenges related to cost, data complexity, regulatory harmonization, and equitable access will be critical to unlocking the full potential of tumor profiling. Efforts toward standardization, clinician education, and innovative business models (e.g., tumor profiling as a service) are likely to accelerate market penetration.

The global cancer tumor profiling market report delivers a detailed analysis with 86 key tables, more than 90 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here