Butterfly Needle Sets Market Overview

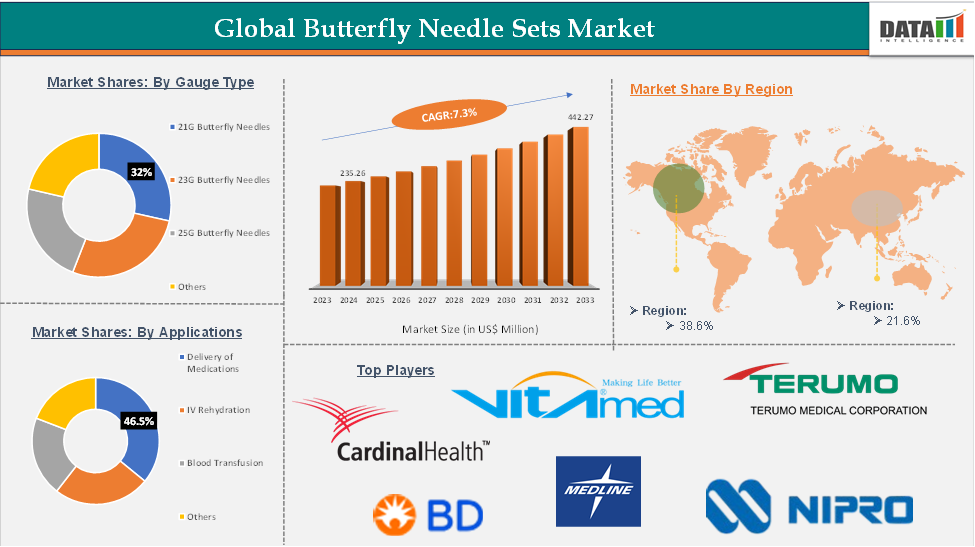

Butterfly Needle Sets Market reached US$ 235.26 Million in 2024 and is expected to reach US$ 442.27 Million by 2033, growing at a CAGR of 7.3% during the forecast period 2025-2033.

A butterfly needle, also known as a scalp vein set or winged infusion set, is a tool used to take blood from a vein or give IV medication through it. It consists of a narrow needle, two flexible wings, a clear flexible tube, and a connector.

The butterfly needle sets market is poised for steady growth, driven by the increasing prevalence of chronic conditions such as cancer, diabetes, and kidney disease, which require frequent blood draws and intravenous access. The demand is further fueled by the rise in blood transfusions, growing adoption of home healthcare, and the need for minimally invasive procedures. Technological advancements are improving user safety and patient comfort, reducing the risk of needlestick injuries.

North America currently dominates the market due to its advanced healthcare infrastructure, while Asia-Pacific is expected to witness the fastest growth owing to rising healthcare investments and a large patient population.

Executive Summary

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

CAGR | 7.3% |

Market Size Available for Years | 2022-2033 |

Estimation Forecast Period | 2025-2033 |

Revenue Units | Value (US$ Mn) |

Segments Covered | Gauge Type, Applications, End-users |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

Largest Region | North America |

Fastest Growing Region | Asia-Pacific |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other Key Insights. |

Butterfly Needle Sets Market Dynamics: Drivers & Restraints

Increase in the prevalence of chronic diseases

The increase in the prevalence of chronic diseases is expected to drive the growth of the butterfly needle sets market during the forecast period. Conditions such as cancer, kidney disease, and diabetes often require regular blood sampling, intravenous medication administration, and transfusions.

For instance, in the United States, approximately 129 million individuals are affected by at least one major chronic disease according to the U.S. Department of Health and Human Services. Notably, five of the top ten causes of death are linked to chronic illnesses that are largely preventable and manageable.

The prevalence of these conditions has been steadily rising over the past two decades and is expected to continue increasing. A significant portion of the population now lives with multiple chronic conditions, with 42% having two or more and 12% managing five or more simultaneously.

As the global burden of these diseases continues to rise, particularly among aging populations, the demand for safe, reliable, and minimally invasive vascular access tools like butterfly needles is expected to grow significantly, supporting overall market expansion.

High cost of the butterfly needles

The high cost of butterfly needle sets is expected to hinder market growth, particularly in low and middle-income regions. Compared to conventional needles, butterfly needles are more expensive due to their specialized design, safety features, and enhanced comfort mechanisms. This cost difference can be a barrier for widespread adoption, especially in resource-constrained healthcare settings where budget limitations prioritize lower-cost alternatives.

Additionally, the recurring need for disposable butterfly needles in chronic disease management adds to long-term expenses for healthcare providers. As a result, the high cost can limit accessibility and slow market penetration, despite the clinical advantages these devices offer.

Butterfly Needle Sets Market Segment Analysis

The global butterfly needle sets market is segmented based on the gauge type, applications, end-users, and region.

The 25G butterfly needle segment is expected to dominate the market share of 32% in 2024

25G butterfly needles are expected to hold the dominant position in the market share due to their advantages and applications over the other types. Compared to lesser gauge needles (e.g., 22G, 21G), 25G needles have a smaller diameter, which makes them thinner and may cause less discomfort during insertion, particularly for youngsters or patients with delicate veins.

Due to their tiny size, they cause less tissue damage at the puncture site, which promotes quicker healing and may lessen swelling or bruises. Patients with thin or frail veins are best served by 25G needles since bigger needles may be difficult to place or may even induce vein collapse. For operations like certain blood draws or injections that need slower blood flow management, a smaller size could be desirable.

Because of the reduced size, there is less chance of unintentional vein injury during operations due to improved control and precision. Thus, the above factors are increasing the demand for 25G butterfly needles and are expected to hold the segment in the dominant position in the forecast period.

Butterfly Needle Sets Market Geographical Analysis

North America is expected to hold a significant position in the butterfly needle sets market share of 38.6% in 2024

North America is expected to hold a dominant position in the market growth. There are several hospitals, clinics, and other medical institutions in the region that are furnished with cutting-edge tools and technology. The market is growing because of this strong infrastructure, which leads to an increase in the use of butterfly needle-based medical operations and treatments.

Chronic diseases like cancer and diabetes are very common in North America, which makes the use of butterfly needles in procedures increasingly common. For instance, according to the American Cancer Society, it is estimated that there will be around 2 million cancer cases in the US in 2024. It is estimated that around 5,500 cancer cases will be diagnosed each day. Thus, the above factors are expected to hold the region in the dominant position in the market share.

Market Segmentation

By Gauge Type

21G Butterfly Needles

23G Butterfly Needles

25G Butterfly Needles

Others

By Applications

Delivery of Medications

IV Rehydration

Blood Transfusion

Others

By End-users

Hospitals

Blood Banks

Pathology Labs

Others

By Region

North America

The U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Rest of Europe

South America

Brazil

Argentina

Rest of South America

Asia-Pacific

China

India

Japan

Australia

Rest of Asia-Pacific

Middle East and Africa

Butterfly Needle Sets Market Major Players

The major global players in the market include Nipro Corporation, Medline Industries, Terumo Corporation, Cardinal Health, Becton, Dickinson and Company, Kawasumi Laboratories America, Al Shifa Medical Products Co., Vitaimed Instrument Co., Ltd., McKesson Medical-Surgical Inc., among others.

The global butterfly needle sets market report would provide approximately 55 tables, 58 figures, and 180 pages.