Needle Counters Market Size and Trends

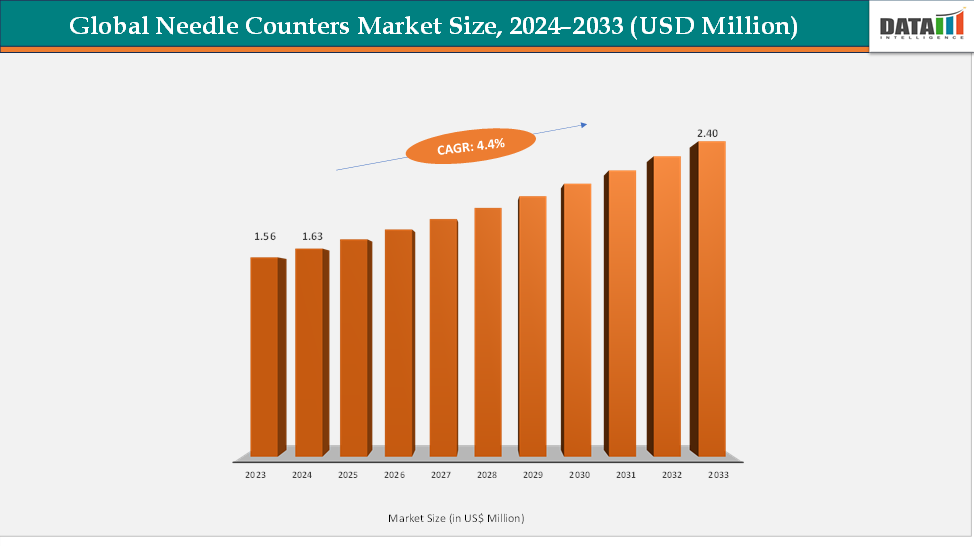

The global needle counters market reached US$ 1.56 billion in 2023, with a rise to US$ 1.63 billion in 2024, and is expected to reach US$ 2.4 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2025–2033. The global needle counters market is experiencing steady growth, driven by the rising number of surgical procedures and increasing focus on patient safety to prevent retained surgical items. Growing awareness of the risks associated with needlestick injuries and surgical errors is boosting demand for effective needle counting solutions.Needle Counters are evolving with improved designs such as magnetic surfaces and ergonomic features to enhance ease of use and accuracy in tracking needles and other sharp instruments during surgeries.

Manufacturers are catering to diverse healthcare settings, from large hospitals with high surgical volumes to outpatient clinics and ambulatory surgical centers, by providing durable, easy-to-use, and cost-effective needle counters. Ongoing adoption of strict surgical safety protocols worldwide is driving market growth. Additionally, expanding healthcare infrastructure in emerging economies is contributing to increased usage of needle counters.

Key Market highlights

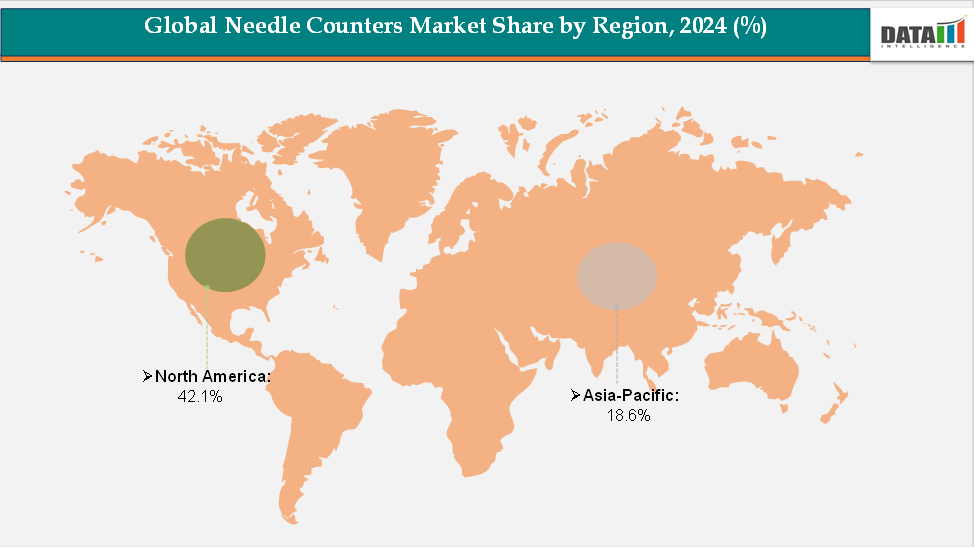

- North America dominates the global needle counters market, accounting for approximately 41.2% of total revenue. The region’s stronghold is attributed to the high volume of surgical procedures performed annually, well-established healthcare infrastructure, and stringent patient safety regulations that mandate the use of counting and verification tools in operating rooms.

- Asia–Pacific represents the fastest-growing regional market, contributing around 18.2% of the global share. The region’s growth is driven by a surge in surgical interventions across emerging economies such as China, India, and Japan, fueled by expanding healthcare infrastructure and increasing awareness about surgical safety standards.

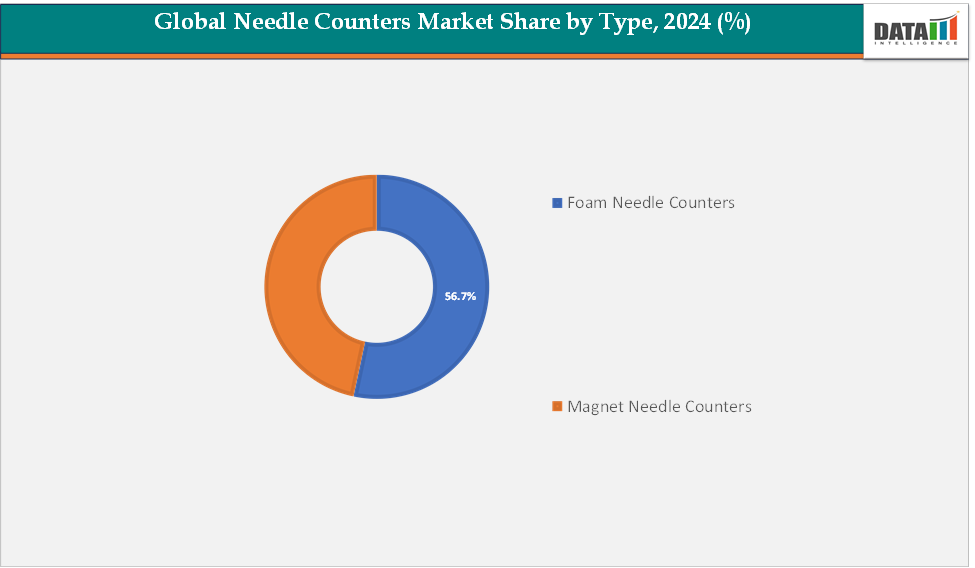

- By product type, foam needle counters remain the dominant segment, accounting for approximately 56.7% of the market. Foam-based designs are preferred due to their lightweight, disposable nature, ease of use, and ability to securely hold needles while reducing the risk of accidental sharp injuries.

Market Size & Forecast

- 2024 Market Size: US$1.63 billion

- 2033 Projected Market Size: US$2.4 billion

- CAGR (2025–2033): 4.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Growing Surgical Volume

The global increase in surgical procedures is a key driver behind the growing demand for needle counters, essential tools used to prevent retained surgical items (RSIs) and improve safety in operating rooms. According to a 2024 article published in ScienceDirect, nearly 250 million surgeries are performed worldwide each year, with countries like the United Kingdom reporting over 8 million surgeries annually, accounting for roughly one-third of all hospital admissions. This trend is projected to intensify, especially in aging populations and regions experiencing rapid expansion in healthcare access.

A significant contributor to the rising surgical volume is the global burden of chronic diseases. Conditions such as cardiovascular disease, cancer, and obesity are increasingly prevalent and often require surgical interventions. As these conditions become more widespread, particularly in middle- and low-income countries, the demand for both elective and emergency surgeries is rising.

As per surgical best practices, sharps counting must be conducted at multiple critical points during procedures, before the surgery begins, before closing any cavity within a cavity, during wound closure at the first layer, and again at skin closure. Each suture needle count must be verified against the package’s labeled quantity upon opening. To ensure safety and accountability, needles are required to be placed in a needle counter, loaded onto a needle holder, or secured in their packaging.

With the global rise in surgical procedures, the frequency of these meticulous counting processes increases, thereby amplifying the demand for reliable, standardized needle counters across operating rooms. These devices not only support compliance with safety protocols but also play a crucial role in reducing the risk of retained surgical items and sharp injuries. Modern designs are becoming standard in operating rooms worldwide.

Restraint: Resistance to Change & Workflow Interruption

Resistance to change among healthcare professionals and concerns about workflow interruption are expected to hinder the growth of the needle counters market. Many hospitals and surgical teams remain accustomed to traditional manual counting methods, perceiving new automated systems as time-consuming or complex to integrate into existing routines.

For more details on this report, Request for Sample

Global Needle Counters Market Segmentation Analysis

The global needle counters market is segmented by type, end-user and region.

Type: The foam needle counters segment is estimated to have 56.7% of the needle counters market share.

Foam needle counters remain the dominant choice in surgical safety solutions, as evidenced by their widespread presence and product versatility showcased on leading supplier sites. For instance, Medline, a prominent medical supplies manufacturer, offers several variations of foam-based needle counters, such as foam block needle counters with adhesive and blade remover, foam block needle counters with double magnet and blade remover, and foam needle counters with magnet and blade guard. These variants demonstrate how foam counters combine key functionalities in a single, cost-effective design.

Such product flexibility drives their adoption across healthcare settings. In fast-paced surgical environments, foam counters deliver ease of use, rapid needle counting, and enhanced safety through features like integrated magnets and blade guards. Additionally, Cardinal Health also lists a foam block needle counter among its offerings, reinforcing that foam-based implementations are well-established and trusted across the industry

Overall, the dominance of foam needle counters is anchored in their proven practicality, broad adaptability, and strong presence among major medical product vendors, making them the go-to solution in operating rooms ranging from high-volume hospitals to outpatient clinics.

The magnet needle counters segment is estimated to have 29.8% of the Needle Counters market share.

The magnet needle counters segment is expected to witness the fastest growth in the global needle counters market, driven by its precision, reliability, and ability to streamline surgical workflows. These counters utilize magnetic technology to accurately detect and count needles, minimizing the risk of human error and improving patient safety in operating rooms. Hospitals and surgical centers are increasingly adopting magnet needle counters due to their efficiency in handling high-volume procedures, ease of integration with existing medical equipment, and compliance with strict safety regulations. Additionally, the growing focus on automating medical processes and reducing surgical complications is further accelerating the adoption of magnet-based needle counters across both developed and emerging markets.

Global Needle Counters Market Geographical Analysis

The North America needle counters market was valued at 41.2% market share in 2024

North America is expected to dominate the needle counters market due to a combination of stringent surgical safety regulations, high surgical procedure volumes, and strong awareness regarding the prevention of retained surgical items (RSIs) and needlestick injuries. According to data published by the National Institutes of Health (NIH) in 2024, approximately 1 in 9 individuals living in U.S. households reported having undergone at least one surgical procedure in the past year. The prevalence was notably higher among adults aged 65 and older and Medicare beneficiaries, with nearly 1 in 5 individuals in both groups reporting at least one surgical intervention.

The region's advanced healthcare infrastructure, widespread implementation of safety protocols like those from AORN and WHO, and strong emphasis on compliance create a favorable environment for consistent adoption of needle counters across hospitals and surgical centers.

Additionally, innovation plays a crucial role in maintaining North America’s leadership in the market. For instance, NewGen Surgical, Inc. launched its NewGen Surgical Needle Counters, the first sustainably designed single-use needle counters made from plant-based materials. These products aim to reduce reliance on non-renewable plastics while maintaining clinical performance.

Such sustainable initiatives are increasingly gaining attention from hospitals and clinics in the region, aligning with broader efforts to reduce medical waste and adopt environmentally responsible practices. The presence of key players driving such innovation further strengthens North America’s position as the leading market for needle counters.

The Europe needle counters market was valued at 20.6% market share in 2024

Europe represents a mature market for needle counters, characterized by steady growth supported by stringent healthcare regulations and high patient safety standards. The adoption of advanced medical technologies and automation in hospitals and surgical centers drives the demand for precise and reliable needle counting solutions. Countries like Germany, the UK, and France are at the forefront, leveraging needle counters to reduce human error, improve surgical efficiency, and comply with occupational safety guidelines. Additionally, increasing hospital investments and the emphasis on healthcare worker protection further bolster the market’s expansion in the region, making Europe a stable and technologically advanced segment for needle counters.

The Asia-Pacific needle counters market was valued at 18.2% market share in 2024

The Asia-Pacific needle counters market is witnessing the fastest growth globally, driven by the rapid expansion of healthcare infrastructure, rising surgical procedures, and increased adoption of automated medical devices. Countries such as China, India, and Japan are investing heavily in modern hospitals and clinics, creating strong demand for safety-focused equipment like needle counters. Additionally, government initiatives promoting patient safety, coupled with growing awareness of needle-stick injuries among healthcare workers, are fueling market adoption. The region’s large population base and rising prevalence of chronic diseases further amplify the need for efficient medical instruments, positioning Asia-Pacific as a key growth hotspot for needle counters in the coming years.

Global Needle Counters Market Competitive Landscape

The major players in the needle counters market include Cardinal Health, Medline Industries, LP, STERIS, DeRoyal Industries, Inc., Boen Healthcare Co., Ltd., NewGen Surgical, Advanced Medical Innovation Inc., Xodus Medical Inc., AUSTRAMEDEX (VIC) PTY LTD, Alleset, among others.

Market Scope

| Metrics | Details | |

| CAGR | 4.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Foam Needle Counters, Magnet Needle Counters |

| End-User | Hospitals, Clinics, Ambulatory Surgical Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global needle counters market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here