Botanical Extracts Market Size

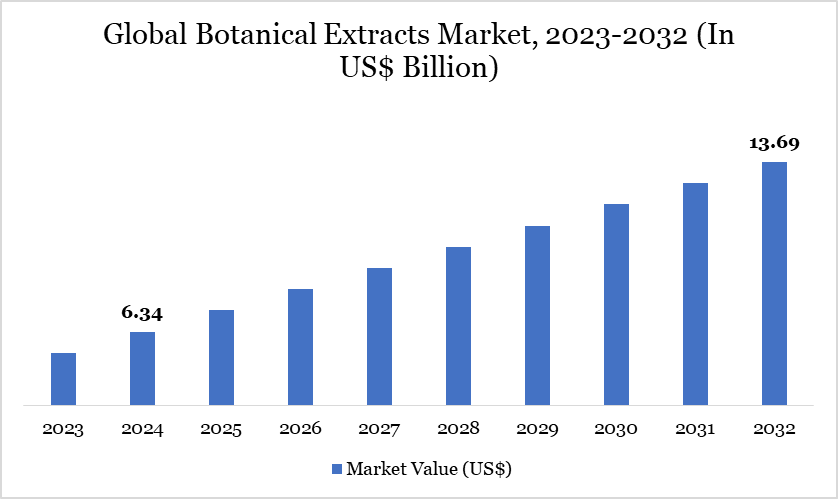

Botanical Extracts Market Size reached US$ 6.34 billion in 2024 and is expected to reach US$ 13.69 billion by 2032, growing with a CAGR of 10.10% during the forecast period 2025-2032

The demand for botanical extracts has surged significantly, driven by recognized health benefits, particularly in combating oxidative stress, reducing free radicals and lowering the risk of various degenerative diseases, including cardiovascular conditions, certain cancers, obesity and type 2 diabetes.

Additionally, botanical extracts in the personal care industry, particularly in anti-aging products, have seen a significant increase, with a clear preference for ingredients with DNA-protecting properties. Key botanical species such as Vitis vinifera (grape), Butyrospermum parkii (shea butter) and Glycine soja (soybean) have remained top choices due to their strong scientific backing for efficacy. Flavonoids, including flavan-3-ols, proanthocyanidins and anthocyanins, are particularly prominent for their antioxidant and anti-inflammatory benefits.

Botanical Extracts Market Trend

The surge in demand for natural and organic products is a key trend in the botanical extracts market as consumers increasingly prioritize health, wellness, and clean-label ingredients. People are moving away from synthetic additives and chemicals, driving preference for plant-based alternatives. Botanical extracts offer a natural solution for flavoring, coloring, and enhancing the nutritional profile of products.

This trend is especially strong in the food, beverage, cosmetics, and personal care sectors. As a result, manufacturers are reformulating products and investing in botanical-based innovation to meet consumer expectations. For instance, in August 2022, ANGUS Chemical Company expanded its personal care portfolio with natural botanical extracts, including green tea, white tea and chamomile, produced using sustainable, traceable methods. The move aligns with the growing consumer demand for naturally derived ingredients in personal care. Additional extracts including hibiscus, rosemary and licorice are in development. ANGUS also offers multifunctional ULTRA PC-grade amino alcohols for broad application in personal care products.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

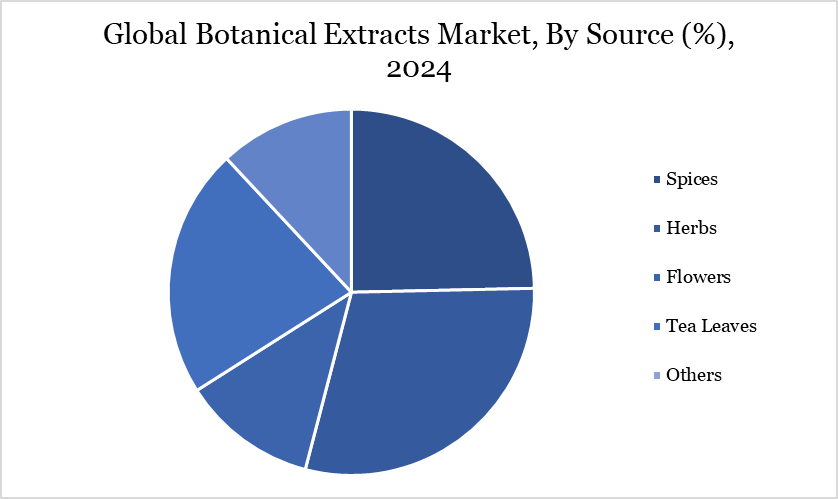

By Source | Spices, Herbs, Flowers, Tea Leaves, Others |

By Form | Powder, Liquid, Others |

By Technology | CO2 Extraction, Solvent Extraction, Steam Distillation, Enfleurage, Others |

By Application | Food & Beverages, Pharmaceuticals & Nutraceuticals, Animal Feed, Cosmetics & Personal Care, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Botanical Extracts Market Dynamics

Demand for Natural and Organic Products

This growing demand for natural and organic products is driving significant expansion in the botanical extracts market. According to the article published on Nutraceuticals World in April 2024, the natural and organic products market reached over US$ 300 billion in 2023, driven by strong consumer demand for health-conscious, sustainable options. Consumers increasingly prefer plant-based, minimally processed ingredients, which aligns perfectly with the rise of botanical extracts in wellness-focused foods, beverages, and supplements. Organic categories notably outperform conventional products, with e-commerce experiencing a resurgence despite mass-market dominance.

Botanical extracts are favored for their clean-label appeal and functional benefits, especially in natural and organic cosmetics, which are experiencing 7% annual growth in Europe, reaching approximately US$5.5 billion in 2023. The popularity of botanical extracts is further supported by their anti-aging and antioxidant properties, alongside rising consumer trust in certifications such as COSMOS and Fairtrade that promote sustainable sourcing.

Expanding Applications in the Food & Beverage Industry

Botanical extracts are transforming the food and beverage industry by meeting the demand for natural, clean-label products with unique flavors and functional health benefits. These plant-derived ingredients support wellness goals, offering alternatives to artificial additives while enhancing taste. With the global natural extracts market projected to grow significantly, companies can leverage botanical extracts to innovate and capture the health-conscious consumer segment.

For example, with 79% of Generation X Brazilians prioritizing health and 31% seeking natural ingredients, the demand for functional beverages is on the rise. Duas Rodas is tapping into this shift by offering botanical extracts, including Yuzu and Guayusa, in their product range, aligning with consumer preferences for natural, reduced-sugar options. The company innovations at Softdrinks Tech 2024, such as Jabuticaba energy drinks, cater to this health-driven trend.

High Production Costs

The high production costs of botanical extracts pose a key challenge in sectors such as natural supplements and cosmetics. Sourcing raw materials, often through specialized cultivation or wild harvesting, drives up input costs. Additionally, extraction processes require advanced technology and energy, further escalating production expenses. Rigorous quality control and regulatory compliance add to the overall cost structure.

The rising demand for sustainable, organic and ethically sourced botanicals adds to the financial burden. Certification processes, such as organic or fair trade, increase production time and costs, limiting accessibility for price-sensitive consumers. As competition for rare botanicals intensifies, these elevated costs could constrain market growth in cost-conscious regions.

Botanical Extracts Market Segment Analysis

The global botanical extracts market is segmented based on source, form, technology, application and region.

The Surging Demand for Herb-Sourced Botanical Extracts

The demand for herb-sourced botanical extracts has surged significantly in recent years, driven by increasing consumer interest in natural products, heightened awareness of health and wellness and the rise of clean-label and sustainable ingredient trends across various industries, particularly in food, beverages, dietary supplements and cosmetics. Manufacturers are actively adapting to the surging demand for herb-sourced botanical extracts by investing in sustainable and transparent sourcing practices to ensure quality and traceability.

For instance, in May 2024, Mibelle Biochemistry launched MonaJuventa Nu, a herbal extract derived from scarlet beebalm (Monarda didyma), designed to slow epigenetic aging. The extract, rich in bioflavonoids like didymium and isosakuranetin, targets key aging processes, including telomere shortening and mitochondrial ATP production. Lemon balm (Melissa officinalis) is used as a stabilizer in the formulation. The herbal solution represents a significant advancement in the anti-aging sector for nutraceutical applications.

Botanical Extracts Market Geographical Share

Rising Demand for Botanical Extracts in Asia Pacific

The Asia-Pacific region is witnessing a strong surge in demand for botanical extracts, driven by increased consumer interest in natural health products, clean-label transparency and plant-based wellness solutions. With an expanding middle class and rising disposable incomes, there is a clear shift toward premium, health-focused products, where botanical ingredients like ginseng, turmeric and green tea are in high demand across nutraceuticals, functional foods and personal care sectors.

Moreover, companies in the region are investing in large-scale herbal extract manufacturing facilities and transforming them into emerging industrial hubs for botanical innovation. For instance, in January 2023, Botanic Healthcare expanded its operations by launching a new branch in Bangalore, India. This move aims to enhance the company's offerings in herbal extracts and strengthen its position as a leading manufacturer and supplier to the pharmaceutical industry.

Sustainability Analysis

The sustainability analysis of the botanical extracts market highlights a growing alignment with eco-conscious consumer trends and green supply chain practices. As demand rises for natural ingredients in food, cosmetics, and supplements, companies are adopting sustainable sourcing methods such as organic farming and wildcrafting under ethical guidelines.

Sustainable certifications (e.g., FairWild, USDA Organic) are gaining prominence to ensure traceability and environmental responsibility. Advances in green extraction technologies, like CO₂ and water-based methods, reduce solvent use and energy consumption. Packaging innovations and carbon footprint reduction efforts are increasingly integrated across the value chain. Regulatory pressures and ESG expectations are pushing manufacturers to improve transparency and adopt circular economy principles.

Botanical Extracts Market Major Players

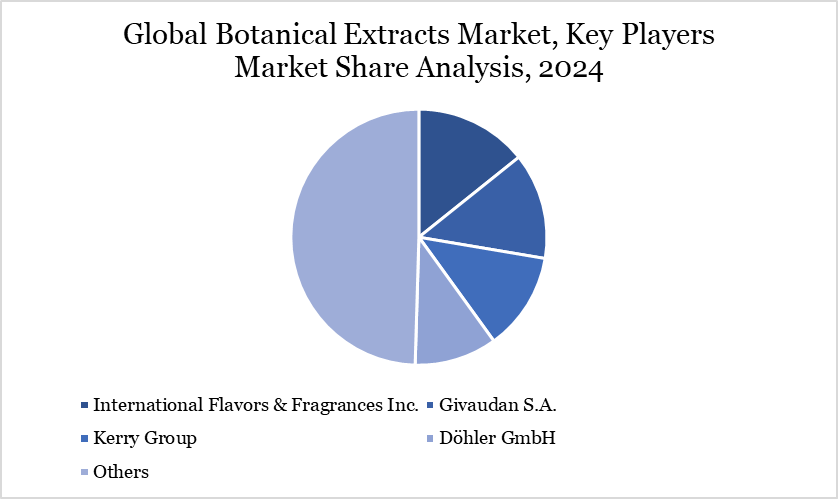

The major global players in the market include International Flavors & Fragrances Inc., Givaudan S.A., Kerry Group, Döhler GmbH, Synergy, Kalsec Inc., Synthite Industries Ltd., Ransom Naturals Ltd, Alchemy Chemicals, Blue Sky Botanics, MartinBauer, Indesso, ADM and others.

Key Developments

On September 4, 2024, Groupe Berkem launched its Global Plant Exploration initiative to advance botanical extract development for the health, beauty, and nutrition sectors. This program emphasizes direct field sourcing, community engagement, and sustainable practices, while ensuring full traceability and strict quality control from raw material to finished product.

In July 2023, Mayaa Veda Herbal launched a new direct-to-consumer (D2C) skincare and haircare brand, offering seven Ayurvedic products free from parabens and sulfates. The range, including botanical shampoos and serums, is designed for individuals with an active lifestyle, promoting simplicity and self-care. The products are cruelty-free, vegan and suitable for all skin and hair types.

In April 2024, Nektium launched a botanical extract sourced from Aframomum melegueta. The extract targets stress and mood support by modulating the endocannabinoid system. Nektium’s proprietary technology ensures the stability of its key bioactive compound, total vanilloid, throughout extraction and encapsulation.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies