Overview

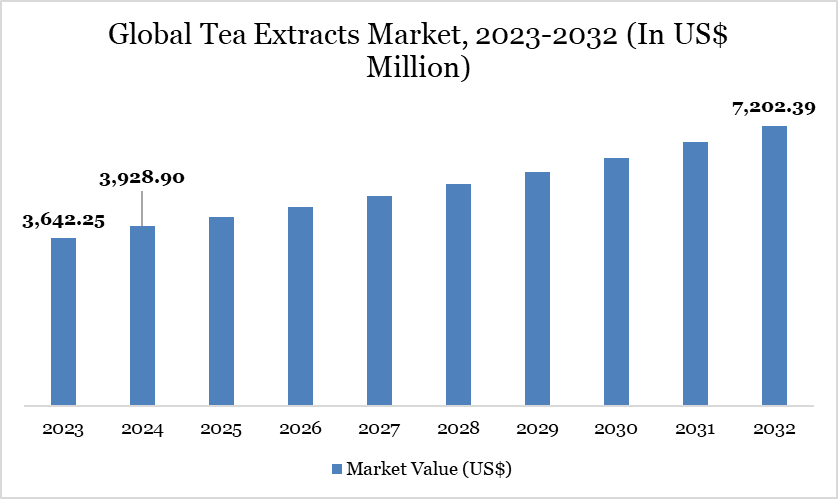

The global Tea Extracts market reached US$3,928.90 million in 2024 and is expected to reach US$7,202.39 million by 2032, growing at a CAGR of 7.87% during the forecast period 2025-2032.

The global tea extracts market is witnessing robust growth, driven by rising consumer awareness of health benefits associated with tea polyphenols and antioxidants, as well as increasing demand for functional beverages and natural ingredients. According to FAO, global black tea production is expected to grow by 2.2% annually, reaching 4.4 million tonnes by 2027, largely fueled by output increases in China, Kenya, and Sri Lanka, with China matching Kenya’s production levels. At the same time, green tea production is projected to grow even faster at 7.5% per year, reaching 3.6 million tonnes by 2027, primarily driven by China’s output, which is set to more than double from 1.5 million tonnes in 2015–2017 to 3.3 million tonnes.

This production growth underpins the availability of raw materials for tea extracts, creating opportunities for beverage manufacturers and nutraceutical companies. For instance, in May 2025, Finlays launched Finlays Solutions. These evolved extracts business offers end-to-end beverage innovation support, combining scientific expertise, advanced technology, and consumer insights to develop market-ready products. The launch highlights the trend toward personalized, innovative, and quality-driven extracts that meet the evolving preferences of foodservice operators, retail brands, and ingredient houses.

Tea Extracts Market Trend

The tea extracts market is witnessing steady growth driven by rising consumer demand for natural, plant-based ingredients in functional beverages, dietary supplements, and cosmetics. Increasing awareness of the health benefits of tea polyphenols, catechins, and antioxidants is fueling adoption across industries. Additionally, the shift toward clean-label products and the popularity of ready-to-drink teas are further boosting market expansion.

Market Scope

Metrics | Details |

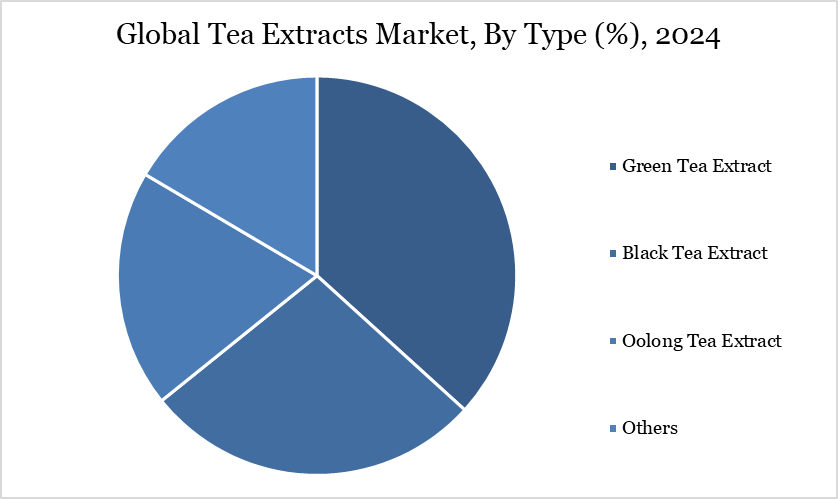

By Type | Green Tea Extract, Black Tea Extract, Oolong Tea Extract, Others |

By Form | Powder, Liquid, Others |

By Nature | Conventional, Organic |

By Application | Food & Beverages, Nutraceuticals, Cosmetics & Personal Care, Pharmaceuticals, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Request For Free Sample: Click Here

Market Dynamics

Rising Demand for Functional Beverages with Natural Antioxidants

Around the world, there are more than 1,000 different varieties of tea, reflecting its rich cultural and botanical diversity. Tea has long been valued not only for its taste but also for its health-promoting properties, making it a natural fit for functional beverages.

Over a lifetime, an average person spends approximately US$16,500 on tea consumption, underlining its central role in daily life. Tea enjoys widespread popularity among younger generations, with over 87% of millennials consuming it, representing 4 out of 5 tea drinkers globally. After water, tea ranks as the second most consumed beverage worldwide, emphasizing its universal appeal. Every day, approximately 3 billion cups of tea are consumed across the globe, showing its role as a staple drink across cultures and continents.

This high level of consumption reflects an underlying trust in tea’s natural antioxidants, which are known to support immunity and overall wellness. Consumers are increasingly seeking functional beverages that combine convenience with health benefits, creating a surge in demand for tea extracts.

Companies are responding by innovating extraction methods that preserve flavor and bioactive compounds, ensuring maximum efficacy in finished products. In November 2022, Layn Natural Ingredients, for instance, launched its Instant Tea Extract Powder line, which retains both flavor and functionality while being soluble in hot and cold water. The line offers caffeinated and decaffeinated versions of black, green, pu-erh, white, and oolong tea extracts, catering to diverse consumer preferences. These extracts are ideal for instant teas, ready-to-drink beverages, gummies, bars, and liquid shots, providing versatile options for functional formulations.

Fluctuating Raw Material Prices

Fluctuating raw material prices are restraining the tea extracts market as variations in tea leaf availability, driven by unpredictable weather conditions, rising labor costs, and supply chain disruptions, increase production expenses. These price instabilities make it challenging for manufacturers to maintain consistent product pricing and profit margins. As a result, many companies face difficulties in scaling production and meeting the growing demand across industries.

Segment Analysis

The global tea extracts market is segmented based on type, form, nature, application and region

Green Tea Extract Holds a Significant Share in the Global Tea Extracts Market Due to Its High Antioxidant Content and Wide Use in Functional Beverages

Green Tea Extract holds a significant share in the global Tea Extracts Market, driven by rising consumer awareness of its health benefits and natural antioxidants. Approximately 600,000 tons of green tea are consumed globally each year, accounting for roughly one-fifth of total tea consumption across all varieties, highlighting its central role in the worldwide tea market.

Consumers increasingly prefer beverages that combine functionality with taste, which has bolstered green tea extract’s popularity in dietary supplements, functional drinks, and ready-to-drink juices. The market has seen a surge in product innovations, including blends that pair green tea with fruits and botanicals, meeting the demand for natural, low-calorie options.

For instance, in June 2022, The Berry Company launched a Green Tea and Blueberry juice blend, enriched with Aronia and Juniper extract, reflecting the trend of using green tea in modern beverage formats. This gluten-free, vegan-friendly drink contains all-natural ingredients with no added sugars, which appeals to health-conscious consumers. Packed with antioxidants from green tea and vitamins from fruit, the beverage supports cardiovascular health and cognitive function, emphasizing green tea extract’s functional benefits.

Geographical Penetration

Asia-Pacific Holds a Significant Share in the Global Tea Extracts Market Due to Its Large-Scale Tea Production, High Domestic Consumption, and Expanding Export Demand

The Asia-Pacific region holds a significant share in the global tea extracts market due to its strong agricultural base and deep-rooted tea culture. Countries like India, China, and Sri Lanka dominate tea cultivation, contributing substantially to the raw material supply for tea extracts. According to IBEF, India cultivated 6.19 lakh hectares of land for tea production in 2022 and remains one of the world’s top tea-consuming nations, with 80% of its production consumed domestically. This high domestic consumption drives the demand for processed and value-added tea products, including extracts. India’s tea production rose from 1,374.97 million kg in FY23 to 1,382.03 million kg in FY24, reflecting steady growth and consistent supply. During FY25 (April–December), production reached 1,186.62 million kg, maintaining India’s position as a key player in the Asia-Pacific tea market.

China, as another major tea producer, continues to invest in high-quality tea cultivation and processing techniques, supporting the growing demand for green, black, and specialty tea extracts. The region’s climatic conditions favor large-scale cultivation, ensuring year-round availability of tea leaves for extract production. Rising health awareness and preference for natural antioxidants have boosted the consumption of functional beverages, where tea extracts serve as a key ingredient.

Sustainability Analysis

The global Tea Extracts Market is increasingly aligning with sustainability and ethical sourcing trends, reflecting growing consumer demand for environmentally responsible products. Organic cultivation practices are gaining prominence, reducing reliance on chemical fertilizers and pesticides, which in turn protects soil and water health. For instance, in June 2024, Organic India advanced this movement by launching its tulsi supplement and herbal tea with the Regenerative Organic Certified (ROC) label, emphasizing soil health, animal welfare, and fair labor practices. This ROC certification complements their existing USDA Organic and Fairtrade credentials, signaling transparency and authenticity in product sourcing. Consumers are showing a strong preference for brands that disclose sustainability certifications directly on packaging, reinforcing trust and brand loyalty. Organic and regenerative practices also support biodiversity by maintaining ecosystem balance and reducing habitat disruption.

In parallel, technological innovations in extraction are improving the environmental footprint of tea extracts, reducing energy and water consumption during processing. For instance, in July 2024, Applied Food Sciences introduced PurTea, an organic green tea extract designed for high bioavailability of antioxidants while minimizing waste and bitterness. PurTea’s water-soluble formulation allows beverage manufacturers to create clean-label, functional drinks with reduced chemical additives. By standardizing caffeine and catechin content, such products enhance consumer health outcomes while maintaining sustainability standards. The market’s growth is also fueled by rising demand for natural energy sources in beverages, favoring ingredients sourced from regenerative and organic agriculture.

Competitive Landscape

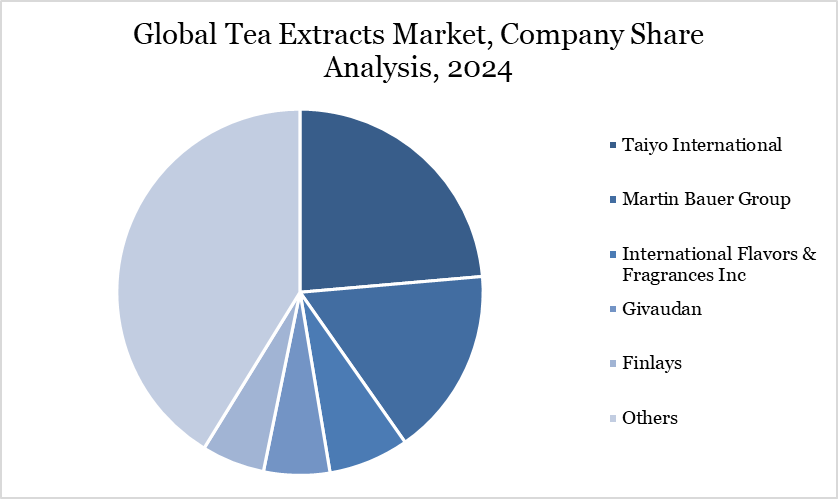

Taiyo International, Martin Bauer Group, International Flavors & Fragrances Inc, Givaudan, Finlays, Kemin Industries, Inc., Synthite Group, Prinova Group LLC, Indena S.p.A., Hunan Sunfull Bio-tech Ltd.

Key Developments

In August 2025, TrimIQ’s launch in the UK and Ireland, featuring Garcinia and Green Tea Probiotic Complex for sustainable weight management. This product demonstrates how tea extracts are increasingly incorporated into functional wellness solutions that target fat reduction, energy enhancement, and appetite control.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies