Biologics Contract Manufacturing Market Overview

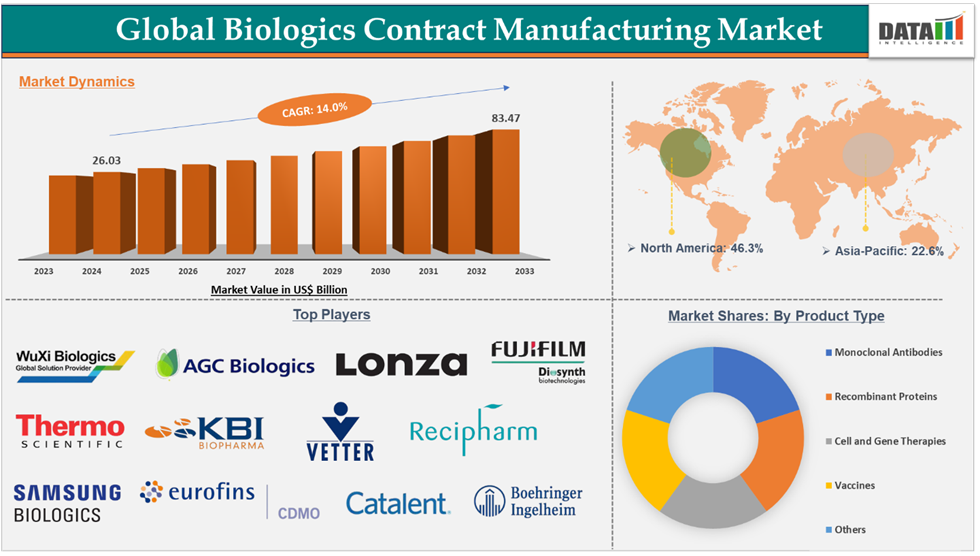

Biologics Contract Manufacturing Market reached US$ 26.03 billion in 2024 and is expected to reach US$ 83.47 billion by 2033, growing at a CAGR of 14.0% during the forecast period 2025-2033.

The biologics contract manufacturing market is experiencing significant growth driven by rising demand for biologics, increasing R&D spending by biopharma and biotech companies on biologic drugs, and strategic partnerships between biopharma/biotech companies and contract manufacturing organizations. The North America region continues to dominate due to the strong presence of key players and their strategic collaborations with biopharma/biotech companies. The Asia-Pacific region is expected to grow with the highest CAGR due to rising investments by biopharmaceutical companies for the development of biologic drugs, and provide access to patients with high unmet needs.

Executive Summary

For more details on this report – Request for Sample

Biologics Contract Manufacturing Market Dynamics: Drivers & Restraints

The rising demand for biologics and the expansion of CDMO facilities are driving the market growth

At present, the global healthcare industry is eying biologics because they have revolutionized the way of treatment. These products have proven themselves as disease-modifying agents in several life-threatening conditions, and provide a complete cure in certain genetic conditions. Biologics are known to have higher efficacy, safety, and treat a condition in a targeted approach. With this many promising features, biologics have evolved as the most trending therapies in recent times. As a result, manufacturers and innovators are increasingly developing biologics to target diseases with high unmet needs. Biotechnology and biopharmaceutical companies are forming strategic collaborations with contract manufacturing organizations, and as a result, CMOs are expanding their global footprint and scaling up their operations.

For instance, in April 2024, FUJIFILM Corporation announced an investment of US$ 1.2 billion in its facility in Holly Springs, North Carolina. This huge investment is aimed at developing a large-scale cell culture CDMO business at the facility. With this investment, FUJIFILM has invested 3.2 billion in this facility to provide end-to-end biomanufacturing services to its customers.

With these rising investments by key players, growing emphasis on biologic drugs, and strategic partnerships between biopharma/biotech firms and CMOs, the market for biologics contract manufacturing is expected to significantly grow in the forecast period.

Stringent regulatory requirements may restrain the market growth

Strict regulations can impose significant challenges and constraints on the biologics contract manufacturing market. While regulations are crucial for ensuring the safety, efficacy, and quality of biologics, they can also create barriers that impact the growth and operation of contract manufacturing organizations.

However, regulatory standards and requirements may vary significantly among different countries and regions. Harmonizing regulatory frameworks globally remains a challenge, and CMOs must adapt to and comply with diverse sets of regulations, adding complexity to their operations.

For instance, regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other health authorities globally have increased scrutiny on biologics manufacturing. This includes strict adherence to Good Manufacturing Practice (GMP) guidelines and other regulatory standards to ensure the safety, efficacy, and quality of biologic products.

Biologics Contract Manufacturing Market Segment Analysis

The global biologics contract manufacturing market is segmented based on product type, platform, application, and region.

Monoclonal antibodies in the product type segment accounted for 44.3% of the market share in 2024 in the global biologics contract manufacturing market

Monoclonal antibodies are the products that are designed to act as antibodies produced by the natural immune system. These products have gained wide popularity due to their targeted approach in various conditions. These are designated as various drug classes, such as immunotherapies, targeted therapies, antibody drug conjugates, etc., indicated for various conditions like cancer, autoimmune diseases, and infectious diseases. The increasing recognition of their efficacy and specificity in targeting specific biomolecules or cells has driven the demand for mAbs in the pharmaceutical industry.

Moreover, monoclonal antibodies are the most widely studied biologics, with a greater number of clinical trials. For instance, according to the World Health Organization, the registered interventional trials using monoclonal antibodies between 2004 to 2013 were 1,207, and in the last decade of 2014-2023, this number has risen to 2,066. This signifies the demand for monoclonal antibodies in the current treatment landscape of various conditions.

With the growing investment by biopharmaceutical companies on development and launch of monoclonal antibodies, the demand for contract manufacturing services is expected to rise in the forecast period, driving the segments growth.

Biologics Contract Manufacturing Market Geographical Analysis

North America dominated the biologics contract manufacturing market with the highest share of 46.3% in 2024

North America, especially the United States, is a global hub for biotechnology and pharmaceutical innovation. The presence of numerous biotech and pharmaceutical companies, research institutions, and academic centers with a focus on biologics has led to a surge in the development of biologic drugs. In the U.S., the top biopharmaceutical industries have a strong presence, and they are investing heavily in research and development activities and scaling up the production of approved biologics to meet the demands of the U.S. patient population. Contract manufacturing services play a crucial role in supporting the manufacturing needs of these entities. The strategic partnerships between the biopharma companies and CDMOs also help to accelerate the region's growth.

For instance, in April 2025, Regeneron Pharmaceuticals, Inc., one of the top pioneering biopharmaceutical companies has announced a strategic partnership with FUJIFILM Diosynth Biotechnologies to manufacture and supply bulk drug product of Regeneron’s commercial biologic medicines. The total investment for this deal is approximately US$ 3 billion.

Biologics Contract Manufacturing Market Major Players

The major players in the Biologics contract manufacturing market are Wuxi Biologics, AGC Biologics, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific Inc., KBI Biopharma, Vetter Pharma, Recipharm AB., Abzena Ltd, Samsung Biologics, Eurofins CDMO, Catalent, Boehringer Ingelheim International GmbH, among others.

Key Development

In April 2025, AGC Biologics announced the launch of a new Cell and Gene business division designated to offer support and scientific ability in cell and gene therapy. The division, based in Milan, Italy, will have a global development and manufacturing network in three regions. The division will focus on enhancing cell therapy and viral vector platforms, such as ProntoLVV and BravoAAV, to increase speed to GMP phases while controlling costs. The division will also include a 140,000-square-foot facility in Longmont, CO, USA, and a new Yokohama facility, set to begin cell therapy operations in July 2025.

Market Scope

Metrics | Details | |

CAGR | 14.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Monoclonal Antibodies, Recombinant Proteins, Cell and Gene Therapies, Vaccines, and Others |

Platform | Mammalian, Microbial, and Others | |

Application | Oncology, Metabolic Diseases, Autoimmune Diseases, Ophthalmology, Infectious Diseases, Cardiovascular Diseases, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |