Microarray Market Size& Industry Outlook

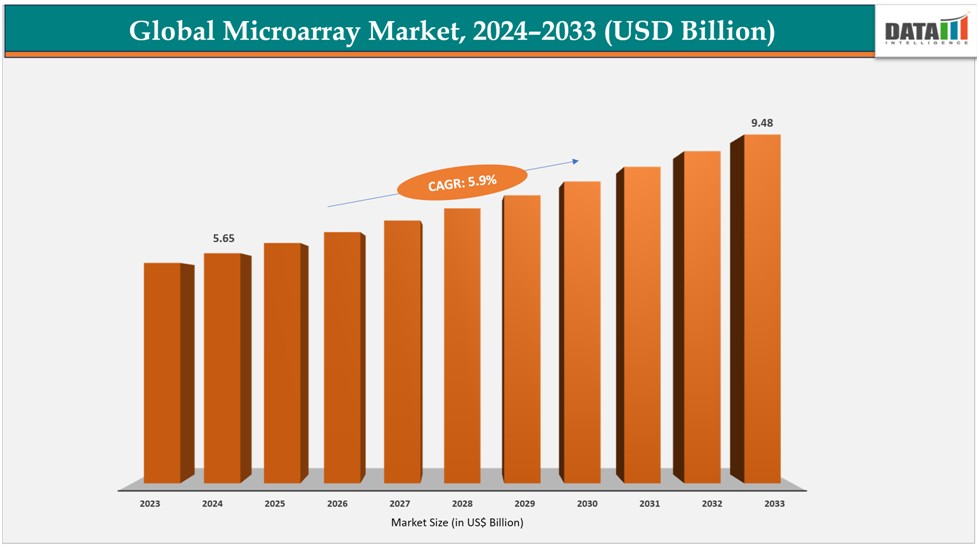

The global microarray market size reached US$ 5.36 Billion with a rise of US$5.65Billion in 2024 and is expected to reach US$ 9.48Billion by 2033, growing at a CAGR of 5.9%during the forecast period 2025-2033.

The global microarray market is expanding rapidly, driven by high-throughput arrays and multiplexing technologies that enable fast, cost-effective analysis of thousands of genetic or protein targets simultaneously. These developments enhance scalability, accuracy, and efficiency in a variety of applications, including environmental monitoring, agriculture, genomics, diagnostics, and personalized medicine. They are even more valuable in clinical and scientific settings when combined with automation and artificial intelligence. Increased investment in biological research, rising illness prevalence, and growing demand for precision medicine are all driving adoption. Microarrays offer crucial instruments for extensive analysis and focused treatment development, making them indispensable to contemporary life sciences as healthcare moves toward data-driven solutions.

Key Highlights

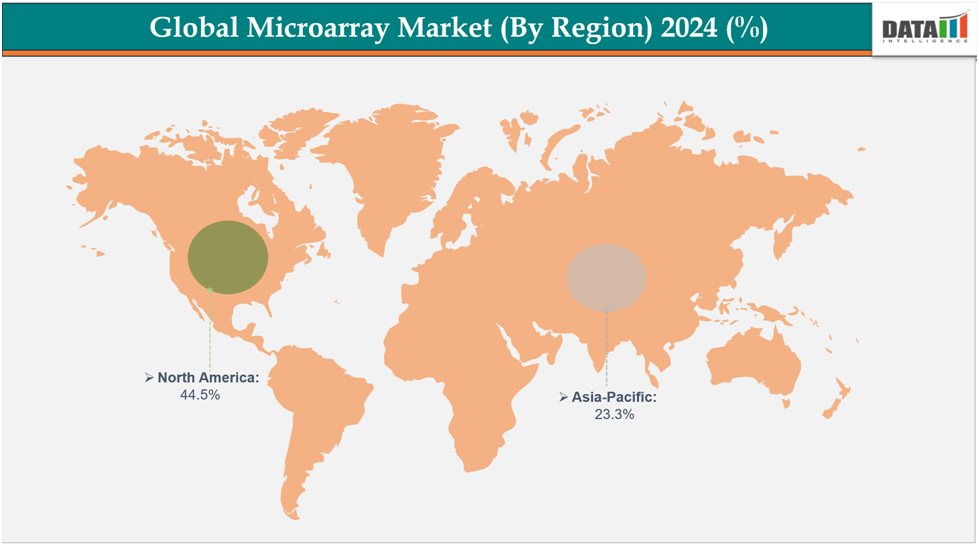

- North America dominatesthe microarray market with the largest revenue share of 44.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of7.6% over the forecast period.

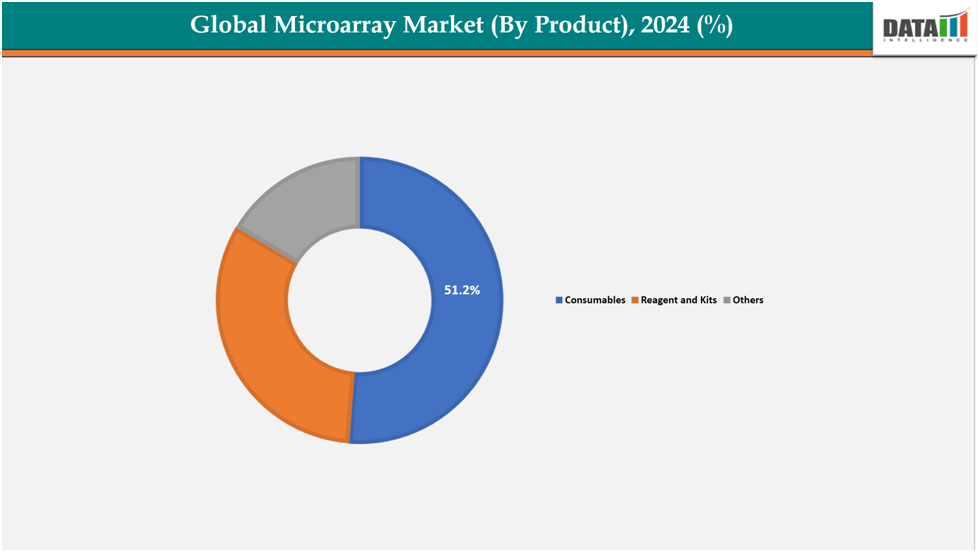

- The consumables from product segment dominating the microarray market with a 51.2% share in 2024.

- The DNA microarrays from type segment dominates the microarray market; it holds a 58.1% of share in 2024

- Top companies in the microarray market include Thermo Fisher Scientific Inc., Akonni Biosystems, Inc., PathogenDx Corporation, AliveDx, AYOXXA Biosystems GmbH, Phalanx Biotech Group, Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Grace Bio-Labs, and Bio-Rad Laboratories, Inc., among others.

Market Dynamics

Drivers: The rise in chronic disease and cancer prevalence are significantly driving the microarray market growth

The growing prevalence of chronic diseases and cancer is significantly driving the microarray market. Microarrays enable high-throughput analysis of genes and proteins, supporting early diagnosis, prognosis, and treatment planning. Microarrays are being utilized more and more to find disease-specific biomarkers and direct focused medicines as healthcare moves toward personalized medicine. The need for effective diagnostic tools is further increased by aging populations and growing healthcare costs. The use of microarray technologies is also being accelerated by government funding and genomics research projects. Microarrays are becoming indispensable tools in the management of complex chronic and oncological illnesses because of their capacity to provide multiplexed, quick, and affordable analysis.

For instance, in 2022, the World Health Organization reported approximately 20 million new cancer cases. Around 53.5 million people survived at least five years post-diagnosis. It was estimated that one in five people developed cancer in their lifetime, with one in nine men and one in twelve women dying from it. By 2050, new cases were projected to rise by 77% to over 35 million. Noncommunicable diseases such as cardiovascular disease, cancer, diabetes, and chronic respiratory diseases caused 74% of global deaths.

Restraints: Cost and capital expenditure barriers are hampering the growth of the microarray market

The microarray market faces slow growth due to high capital and operating costs. A significant upfront investment is needed to purchase scanners, hybridization stations, and data infrastructure; continuing costs are increased by consumables, maintenance, and qualified personnel. Purchases are restricted by grant-based research budgets, and smaller labs, hospitals, and emerging-market facilities sometimes lack funding. Buyers are deterred by a lengthy return on investment, particularly as next-generation sequencing and other genomic methods develop quickly, raising concerns about imminent obsolescence. Low public healthcare budgets in underdeveloped nations exacerbate the problem, and investors are hesitant to make financial commitments. These technological and financial risks limit acceptance, lower sample throughput, and impede the growth of international markets.

For more details on this report, see Request for Sample

Segmentation Analysis

The global microarray market is segmented based on product, type, application, end user, and region.

By-Product:

The consumables from product segment dominating the microarray market with a 51.2% share in 2024

Consumables dominate the microarray market because they generate steady, repeat revenue. Each assay requires new chips, slides, reagents, and labeling kits, creating constant demand far beyond the one-time purchase of instruments. High testing volumes in genomics, oncology, and drug discovery drive frequent replenishment, while many reagents have short shelf lives. Vendors continuously release improved probe designs and chemistries, encouraging regular upgrades. Major suppliers follow a “razor-and-blade” model: selling instruments at competitive prices and profiting mainly from consumable sales. Expanding applications in personalized medicine, agricultural genomics, and infectious-disease research ensure growing sample throughput, keeping consumables the largest and fastest-growing product segment.

By Type:

The DNA microarrays from type segment dominates the microarray market; it holds a 58.1% of share in 2024

DNA microarrays dominate the microarray market because they are well-established, versatile, and cost-effective for large studies. They are crucial to academic research, diagnostics, and medication development because of their extensive use in gene-expression profiling, SNP genotyping, and copy-number analysis. Demand is continuously driven by clinical applications including infectious illness detection and cancer categorization. Reproducible outcomes are guaranteed by the technology's maturity, which includes defined processes, data analysis pipelines, and large reference datasets. When the gene set is known and the lab infrastructure is in place, DNA arrays are still less expensive than next-generation sequencing. Because of these benefits, DNA microarrays continue to dominate the industry.

For instance, in August 2024, Illumina launched the TruSight Oncology Comprehensive, the first FDA-approved DNA microarray assay and distributable comprehensive genomic profiling (CGP) in vitro diagnostic (IVD) kit with pan-cancer companion diagnostic claims. The test analyzed DNA and RNA from tumor tissue, detecting over 500 genes to guide personalized treatments, including therapies for NTRK and RET gene fusions, using FFPE tumor samples.

Geographical Analysis

North America dominates the global microarray market with 44.5% in 2024.

North America dominates the global microarray market due to its strong R&D ecosystem, hosting major companies like Illumina and Thermo Fisher that drive innovation in DNA microarray technologies. High healthcare expenditure allows widespread adoption of expensive diagnostic tools, while early acceptance of genomic diagnostics and FDA-approved assays accelerates clinical use. Supportive government and private funding from agencies like NIH further fuel research and market growth. Additionally, a large patient base with prevalent cancer and genetic disorders increases demand for microarray-based diagnostics. The combination of technological innovation, robust infrastructure, and clinical need makes North America the leading region in the market.

Owing to the factors like product launches, in August 2023, Thermo Fisher Scientific introduced two advanced genomic tools to enhance cytogenetics and population-scale research. The Applied Biosystems CytoScan HD Accel array provided comprehensive analysis of over 5,000 critical genome regions, supporting prenatal, postnatal, and oncology studies. It delivered results in two days, improving laboratory efficiency and enabling up to 100% higher assay productivity with existing equipment.

Europe is the second region after North America, which is expected to dominate the microarray market with34.5% in 2024.

The microarray market in Europe is expected to be the second largest globally, with major contributions from countries such as Germany, the UK, and France. Growth is driven by the region’s advanced healthcare infrastructure, increasing adoption of precision medicine, and rising prevalence of cancer and genetic disorders. Additional factors boosting demand include strong research funding, widespread genomic testing initiatives, and growing emphasis on early disease detection and personalized treatment. Supportive regulatory frameworks, along with initiatives from organizations like the European Society of Human Genetics (ESHG), enhance clinical applications, improve patient outcomes, and strengthen Europe’s position in the microarray market.

Germany leads the European microarray market due to high healthcare investment, advanced research infrastructure, and a strong focus on precision medicine. The rising prevalence of cancer and genetic disorders, supportive regulatory approvals, and increasing demand for genomic diagnostics drive market growth, while early adoption of advanced microarray platforms and integration with next-generation sequencing and bioinformatics accelerate the region’s leadership in the microarray sector.

The Asia Pacific region is the fastest-growing region in the global microarray market, with a CAGR of 7.6% in 2024.

The microarray market in Asia-Pacific is expanding rapidly, driven by rising prevalence of cancer, genetic disorders, and chronic diseases. Countries like China, India, Japan, and South Korea are leading this growth due to advanced research infrastructure, increasing adoption of innovative microarray platforms, and supportive government healthcare and genomics initiatives. Technological advancements, growing awareness of precision medicine, and rising investment in genomic research are further fueling demand, making Asia-Pacific a key focus for microarray market expansion.

The microarray market in China is rapidly expanding due to increasing genomic research, rising prevalence of cancer and genetic disorders, and growing demand for precision medicine. Growth is further supported by a robust private healthcare and research sector, availability of locally manufactured microarray kits and reagents, and increasing awareness of genomic diagnostics among clinicians.

For instance, in September 2024, UltraDx Bio, a Shanghai-based diagnostics company, obtained clinical registration approval from China’s NMPA for its UD-X Fully Automated Single-Molecule Array Fluorescence Immunoassay Analyzer. Utilizing Simoa technology from Quanterix, the device enabled ultra-sensitive detection of protein biomarkers at femtogram levels, supporting early screening, diagnosis, and treatment evaluation of Alzheimer’s disease and other neurological, infectious, immune, cardiovascular, and tumor-related conditions.

Competitive Landscape

Top companies in the microarray market include Thermo Fisher Scientific Inc., Akonni Biosystems, Inc., PathogenDx Corporation, AliveDx, AYOXXA Biosystems GmbH, Phalanx Biotech Group, Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Grace Bio-Labs, andBio-Rad Laboratories, Inc.,among others.

Thermo Fisher Scientific Inc.:Thermo Fisher Scientific Inc. is a global leader in life sciences, providing advanced microarray solutions through its GeneChip and CytoScan platforms. The company offers microarray systems, reagents, and software for genomic research, cytogenetics, and molecular diagnostics, supporting applications in cancer, genetic disorders, and personalized medicine worldwide.

Key Developments:

- In March 2023, Spectrum Solutions acquired Altimetric, Inc., and Microarrays, Inc. This strategic move aimed to expand their laboratory products and testing capabilities, enhancing their portfolio in molecular diagnostics and custom assay development.

Market Scope

| Metrics | Details | |

| CAGR | 5.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By-Product | Consumables, Reagents and Kits, and Others |

| By Type | DNA Microarrays, Protein Microarrays and Others | |

| By Application | Research Applications, Disease Diagnostic | |

| End User | Research and Academic Institutes, Pharmaceutical and Biotechnology Companies, Diagnostic Laboratories | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global microarray market report delivers a detailed analysis with 73 key tables, more than 73visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here