AI in Oncology Market Size

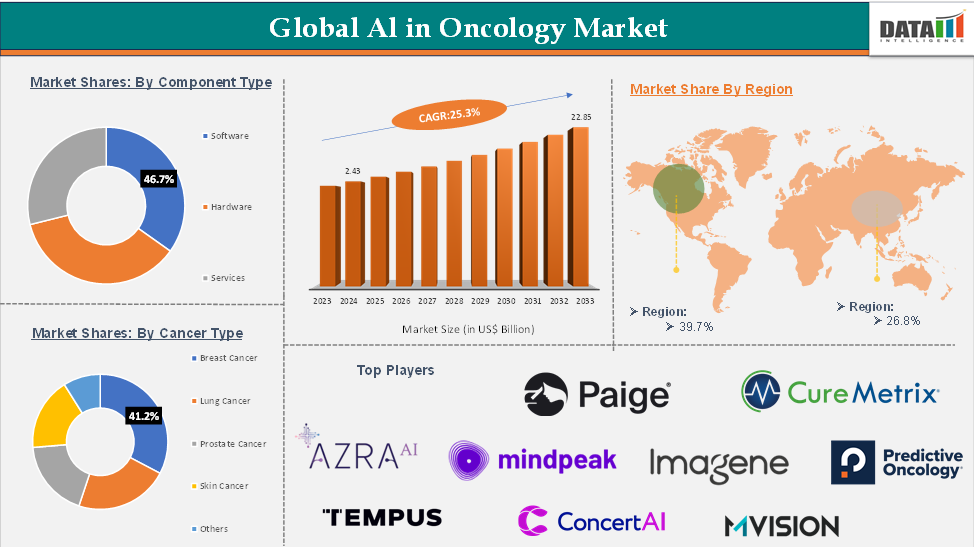

The global AI in oncology market size reached US$ 2.43 Billion in 2024 and is expected to reach US$ 22.85 Billion by 2033, growing at a CAGR of 25.3% during the forecast period 2025-2033.

The global AI in oncology market is witnessing rapid growth, fueled by advancements in artificial intelligence technologies, increased cancer prevalence, and a rising emphasis on personalized medicine. Pharmaceutical and healthcare companies invest heavily in AI-driven diagnostic tools, treatment planning systems, and drug discovery platforms. Regulatory bodies also support this shift, with approvals for AI-based cancer detection devices becoming more common.

Collaboration between medical institutions, technology providers, and research organizations is accelerating the integration of AI into clinical practice. Public awareness about early cancer detection is contributing to higher screening rates, while AI enhances the accuracy and speed of diagnosis.

North America currently dominates the global AI in oncology market, driven by its advanced healthcare infrastructure, strong regulatory support, and high adoption of AI technologies in clinical settings. The presence of leading technology firms and frequent collaborations between healthcare providers and AI developers have further accelerated market growth in the region.

Executive Summary

For more details on this report – Request for Sample

AI in Oncology Market Scope

| Metrics | Details | |

| CAGR | 25.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Component Type | Software, Hardware, Services |

| Cancer Type | Breast Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Others | |

| Application | Cancer Detection, Drug Discovery, Drug Development, Others | |

| End User | Hospitals, Pharmaceutical Companies, Research Institutes, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

AI in Oncology Market Dynamics: Drivers & Restraints

Advancements in Artificial Intelligence and Machine Learning are Expected to Drive the AI in Oncology Market

Advancements in artificial intelligence (AI) and machine learning are playing a pivotal role in the growth of the oncology market by boosting diagnostic precision, enabling more personalized treatment strategies, and speeding up the drug discovery process. For example, in September 2024, Immunai Inc. entered into a multi-year partnership with global pharmaceutical leader AstraZeneca. The collaboration will use Immunai’s proprietary AI platform, known as IDE, to support clinical decision-making and increase the chances of success in drug development efforts.

Similarly, Onc.AI is harnessing a leading real-world oncology dataset to build a robust pipeline of AI models aimed at realizing the full potential of precision oncology.

Meanwhile, companies are collaborating to advance their research in incorporating AI in the early diagnosis of various cancers. For instance, in April 2025, Optellum signed an agreement with Bristol Myers Squibb to use AI for early detection and precision lung cancer care. According to the agreement, Optellum will use its AI-powered imaging and clinical decision support platform to assess the real-world impact on patient outcomes.

Data Privacy and Security Concerns are Expected to Hinder the AI in Oncology Market

Data privacy and security concerns are expected to significantly hamper the growth of the AI in oncology market, as the field heavily relies on large volumes of sensitive patient data for effective algorithm training and deployment. The use of such data raises critical challenges around compliance with regulations like HIPAA in the U.S. and GDPR in Europe, which strictly govern how personal health information can be collected, processed, stored, and shared. Any breach or misuse of this data can lead to legal liabilities, loss of patient trust, and reputational damage for healthcare providers and AI developers.

AI in Oncology Market Segment Analysis

The global AI in oncology market is segmented based on component type, cancer type, application, end user and region.

Component Type:

The software segment is expected to hold 46.7% of the global AI in Oncology Market

The software segment is expected to dominate the AI in oncology market due to its pivotal role in enabling accurate diagnostics, personalized treatment planning, and efficient clinical workflows. This dominance is reflected in its substantial market share, driven by growing adoption across hospitals and research institutions. Recent innovations further validate this trend.

For instance, in October 2023, Philips’ AI-powered MR imaging technology, combined with Quibim’s AI-driven image analysis software, is designed to support clinicians in providing quicker and more efficient prostate cancer care, addressing workforce shortages, and helping to reduce overall healthcare costs.

Similarly, in August 2023, MVision AI announced the release of version 1.2.4 of its guideline-based automatic segmentation software, now rebranded as Contour+. This updated version introduces new contouring models and enhanced Region-Of-Interest (ROI) operations, expanding its clinical applications. With this release, MVision AI aims to further improve the accuracy and consistency of medical contouring, offering a more advanced and standardized solution for clinicians. The model also allows for standardized contouring required in clinical trials and cancer research.

Such advancements demonstrate how AI software solutions are becoming integral to oncology workflows, making the segment the core driver of technological transformation in cancer care.

AI in Oncology Market Geographical Analysis

North America was valued at US$ 0.96 billion in 2024 and is estimated to reach US$ 9.07 billion by 2033, growing at a CAGR of 31.3%

North America is expected to dominate the AI in oncology market due to its advanced healthcare infrastructure, strong research ecosystem, and a high burden of cancer cases. This leadership is reinforced by recent innovations that are rapidly transforming cancer care. For instance, in January 2024, DermaSensor Inc. received FDA clearance for its innovative AI-powered medical device, marking a significant advancement in skin cancer detection. This handheld, non-invasive device utilizes elastic scattering spectroscopy to analyze suspicious skin lesions, providing real-time, objective results to primary care physicians.

Companies are launching advanced AI systems to enhance oncology care. These AI-driven technologies are transforming radiation therapy and personalized treatment pathways, offering more precise and efficient care for both clinicians and patients.

For instance, in May 2024, GE HealthCare unveiled Revolution RT, a cutting-edge radiation therapy CT solution designed to improve imaging accuracy and streamline simulation workflows for a more personalized oncology care experience. The new system, showcased at the ESTRO 2024 Congress in Glasgow, also includes an updated, AI-enhanced version of the Intelligent Radiation Therapy (iRT) platform, which integrates with the Spectronic MRI Planner.

Asia-Pacific is expected to hold 26.8% of the global AI in oncology market.

The Asia-Pacific region is experiencing the fastest growth in the AI in oncology market, fueled by rising cancer rates, advancements in healthcare digitalization, and substantial investments in AI research and technology. Countries such as China, Japan, and India are at the forefront of this growth, driven by expanding healthcare infrastructures and government initiatives that support the integration of AI in cancer care. These countries are also making significant progress in developing AI-powered diagnostic tools and personalized treatment solutions, creating ample opportunities for stakeholders and driving innovation across the region.

Japan, in particular, is playing a key role in advancing AI in oncology. The country is leveraging its technological expertise to integrate AI into cancer care, with notable developments such as Fujifilm's AI-based imaging technology, which helps detect early-stage lung cancer through chest X-rays.

AI in Oncology Market Top Companies

The top companies in the AI in oncology market include Azra Al, CureMetrix, Inc., ConcertAI, Immunai, MVision AI Inc., Paige AI, Inc., Mindpeak GmbH, Imagene AI Ltd., Predictive Oncology, Tempus, among others.

Key Developments

- In February 2025, Avitia announced its business launch and $5M seed investment from PacBridge Capital Partners (“PacBridge”). With Avitia’s platform, laboratories and clinicians now have access to advanced molecular testing directly on-site. This technology will allow a healthcare team to accurately obtain cancer insights and begin treating patients faster, all at reduced costs compared to existing send-out alternatives.