Global AI in Aviation Market: Industry Outlook

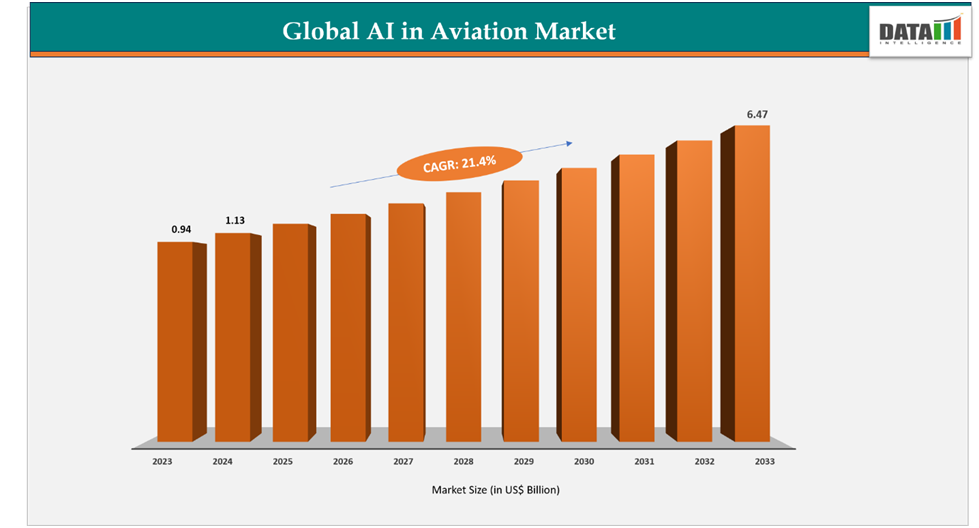

The global AI in aviation market reached US$0.94 billion in 2023, with a rise to US$1.13 billion in 2024, and is expected to reach US$6.47 billion by 2033, growing at a CAGR of 21.4% during the forecast period 2025–2033.

The global AI in aviation market is witnessing steady growth, driven by increasing adoption across commercial airlines, defense applications, and aircraft maintenance. Artificial intelligence is transforming aviation by enabling predictive maintenance, streamlining air traffic management, supporting autonomous flight technologies, and enhancing safety monitoring. This momentum is further strengthened by advances in machine learning, computer vision, and edge AI, as well as rising investments from governments, airlines, and OEMs. In addition, strategic collaborations, defense procurements, and partnerships between aerospace companies and technology providers are reshaping the industry landscape.

The US remains at the forefront of AI adoption in aviation, powered by large-scale investments in both defense and commercial sectors. Leading aerospace companies are embedding AI into core operations to improve efficiency, reduce downtime, and boost safety. In 2025, GE Aerospace deployed its AI-enabled Blade Inspection Tool, which enhances turbine blade inspections critical component for aircraft engine performance. Using AI-guided image analysis, the tool helps technicians detect issues earlier while cutting inspection time nearly in half, enabling faster engine turnaround. With strong R&D capabilities, significant defense budgets, and active collaborations between the US Department of Defense and aerospace OEMs, the US continues to drive global innovation in AI-enabled aviation technologies.

Japan is also emerging as a key contributor to AI in aviation through government-backed investments and international partnerships. In August 2025, Prime Minister Shigeru Ishiba announced a planned investment of US$ 68 billion in India over the next decade to strengthen bilateral ties and boost innovation. The investment will focus on eight strategic sectors, including artificial intelligence (AI), mobility, environment, healthcare, and semiconductors, while fostering startup growth and cross-border technology collaborations. This initiative, alongside Japan’s broader modernization of its aviation and defense sectors, underscores its commitment to integrating AI into flight operations, predictive maintenance, and security systems. These efforts position Japan as a rising force in shaping the future of AI in aviation.

Key Market Trends & Insights

North America accounted for approximately 41.7% of the global AI in aviation market in 2024 and is expected to maintain its dominance during the forecast period. The region’s leadership is fueled by advanced defense programs, robust R&D investments, and early adoption of AI-driven aviation technologies. For instance, Raytheon, an RTX business, successfully completed flight testing on the first-ever AI/ML-powered Radar Warning Receiver (RWR) system for a fourth-generation aircraft, highlighting the role of AI in enhancing situational awareness and defense readiness.

Asia-Pacific is projected to witness the fastest growth, driven by increasing investments in aviation modernization, safety systems, and commercial airline innovation. All Nippon Airways (ANA) has become the first airline in the world to operationally implement an AI-based turbulence prediction system, developed by Tokyo-based BlueWX. This technology leverages over a decade of atmospheric data to improve passenger safety and flight efficiency, showcasing the region’s leadership in commercial aviation AI adoption.

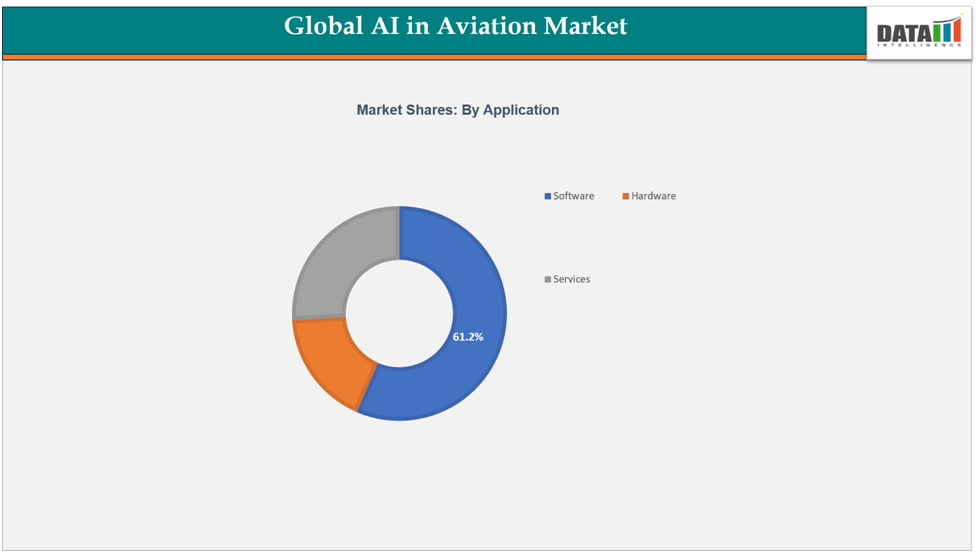

The Software segment continues to dominate the global AI in aviation market, supported by its critical role in enabling predictive maintenance, flight operations optimization, air traffic management, and safety monitoring. Broad adoption across both defense and commercial aviation sectors underscores its importance in driving automation, operational efficiency, and next-generation capabilities.

Market Size & Forecast

2024 Market Size: US$1.13 Billion

2033 Projected Market Size: US$6.47 Billion

CAGR (2025–2033): 21.4%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing market

Drivers & Restraints

Driver: Defense Modernization Programs

The AI in aviation market is being propelled by global defense modernization initiatives, as governments increasingly invest in advanced aerospace technologies to enhance security and mission readiness. AI-powered solutions are streamlining surveillance, mission planning, fleet maintenance, and combat operations, giving armed forces greater precision, efficiency, and adaptability. These advancements are redefining how modern defense fleets are managed and deployed.

For instance, Airbus is testing a smartphone-based artificial intelligence solution known as GenAIR Assistant. This program generates tailored, step-by-step assembly instructions based on user expertise whether beginner, intermediate, or expert improving efficiency, accuracy, and training outcomes. Such developments underscore the role of AI in supporting both defense transformation and workforce optimization in the aviation sector.

Restraint: Data Security & Privacy Concerns

One of the key challenges limiting the growth of the AI in aviation market is the issue of data security and privacy. AI-enabled aviation systems depend heavily on the continuous collection and analysis of sensitive data, including passenger details, flight operations, and defense intelligence. This makes them highly vulnerable to cyberattacks, data breaches, and unauthorized access, which could jeopardize both safety and national security.

For instance, AI-powered predictive maintenance platforms and air traffic management systems require large volumes of critical information to function effectively. Any compromise in these systems could lead to safety hazards or regulatory non-compliance. As a result, the absence of stringent cybersecurity frameworks and standardized safeguards continues to act as a significant barrier to large-scale adoption of AI in aviation.

For more details on this report, Request for Sample

Segmentation Analysis

The global AI in Aviation Market is segmented based on offering, technology, application and region.

Offering: The software segment accounts for an estimated 61.2% of the global AI in aviation market.

The software segment represents an estimated 61.2% share of the global AI in aviation market, solidifying its position as the most critical enabler of AI integration across the industry. Software solutions power applications such as predictive maintenance, air traffic control, flight optimization, crew management, and personalized passenger services making them central to both commercial and defense aviation operations.

Rising demand for real-time analytics, intelligent automation, and decision-support systems continues to propel growth in this segment. Market leaders are increasingly focusing on AI-driven platforms that enhance operational efficiency, improve safety, and deliver more tailored passenger experiences.

For instance, Qatar Airways has partnered with Accenture to launch “AI Skyways”, an initiative designed to embed AI across core airline operations. This collaboration is aimed at transforming customer engagement, optimizing processes, and strengthening Qatar Airways’ position as a pioneer in aviation AI innovation.

Looking forward, the software segment is expected to maintain its dominance in the global AI in aviation market. Emerging technologies such as generative AI, advanced predictive algorithms, and natural language processing will further accelerate adoption. However, challenges around cybersecurity and the high cost of system integration will remain key considerations for stakeholders.

Geographical Analysis

The North America AI in Aviation Market was valued at 41.7%market share in 2024

In 2024, North America held 41.7% of the global AI in aviation market, making it the largest regional contributor. Growth is fueled by strong R&D capabilities, high defense spending, and the early adoption of AI across both military and commercial aviation. A key example is GE Aerospace partnering with Microsoft and Accenture to launch generative AI-powered solutions for the industry. Their first tool, revealed at the 2024 Predictive Aircraft Maintenance Conference in Dublin, enables airlines and lessors to access maintenance records within minutes cutting downtime and boosting efficiency. Carlyle Aviation Partners was the first to test the solution, underscoring the region’s leadership in deploying AI-driven aviation technologies. Robust innovation, coupled with government and industry support, ensures North America’s continued dominance in this market.

The Asia-Pacific AI in Aviation Market was valued at 30.8% market share in 2024

The Asia-Pacific region accounted for 30.8% of the global AI in aviation market in 2024 and is projected to be the fastest-growing region over the coming years. Growth is supported by heavy investments in aviation modernization, AI integration, and expanding commercial aviation activities. A notable development includes Fly Exclusive's acquisition of Jet. AI’s aviation business, positioning Jet.AI as a dedicated AI solutions provider while Fly Exclusive scales its aviation services with AI capabilities. This transaction reflects the region’s growing emphasis on blending aviation operations with cutting-edge AI technologies. Strong government initiatives, strategic partnerships, and rising adoption across airlines are expected to accelerate Asia-Pacific’s share in the global market.

Competitive Landscape

The major players in the AI in Aviation Market include Airbus, Boeing, Lockheed Martin Corporation, Thales, RTX, TAV Technologies, General Electric Company, Amazon Web Services, Inc., SITA, Dedalian

Airbus: Airbus SE, headquartered in Leiden, Netherlands, is a global leader in aerospace and defense, with a strong presence in commercial aircraft, helicopters, space, and defense systems. The company is increasingly integrating artificial intelligence (AI) across its aviation operations to enhance safety, efficiency, and productivity. Airbus is experimenting with its Gen AIR Assistant, a smartphone-based AI program that generates personalized assembly instructions for aircraft manufacturing, adapting guidance for beginner, intermediate, or expert workers. Additionally, Airbus leverages AI for predictive maintenance, flight safety, and optimizing fuel efficiency, positioning itself as a front-runner in advancing AI adoption in aviation.

Market Scope

Metrics | Details | |

CAGR | 21.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Offering | Software, Hardware, Services |

| Technology | Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, Robotics & Automation, Big Data Analytics |

| Application | Predictive Maintenance, Flight Operations, Air Traffic Management, Passenger Experience, Security & Biometrics, Crew Management, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global AI in Aviation Market report delivers a detailed analysis with 54 key tables, more than 47visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more AI in aviation-related reports, please click here