AI in Medical Imaging Market Size

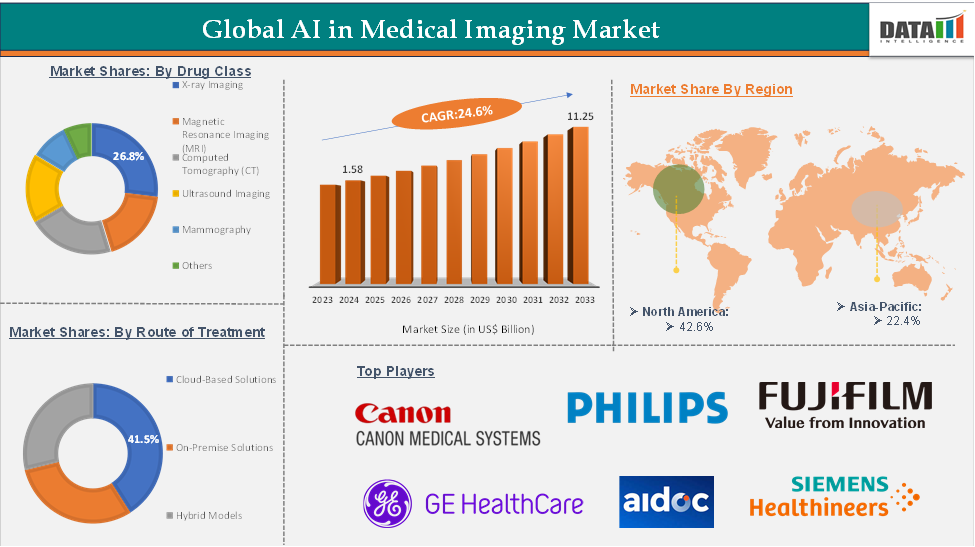

The global AI in medical imaging market was valued at US$ 1.29 Billion in 2023. The market size reached US$ 1.58 Billion in 2024 and is expected to reach US$ 11.25 Billion by 2033, growing at a CAGR of 24.6% during the forecast period 2025-2033.

AI in Medical Imaging Market Overview

The AI in medical imaging market is rapidly advancing, fueled by the integration of deep learning algorithms into radiology workflows, enabling faster, more accurate detection of diseases such as cancer, stroke, and neurological disorders. Key drivers include increasing imaging volumes, radiologist shortages, and strong clinical validation of AI tools for triage, segmentation, and diagnosis across modalities like MRI, CT, and PET.

North America leads the market due to early regulatory approvals, robust healthcare IT infrastructure, and high adoption in hospital networks, while Asia-Pacific is the fastest-growing region, driven by aggressive digital health investments in China, Japan, and South Korea, and rising demand for scalable diagnostic solutions.

Executive Summary

For more details on this report – Request for Sample

AI in Medical Imaging Market Dynamics: Drivers & Restraints

Drivers:

Rising demand for early and accurate diagnosis is significantly driving the AI in medical imaging market growth

The growing need for early and precise diagnosis is playing a crucial role in advancing the medical imaging industry, particularly in 2024 and 2025. Conditions such as cancer, stroke, and neurodegenerative diseases demand timely detection to improve treatment outcomes, pushing healthcare providers to seek faster and more accurate imaging technologies. Diagnostic tools are evolving to help clinicians manage increasing caseloads while enhancing image clarity and interpretation accuracy.

For instance, new imaging suites introduced at ECR 2025, including advanced mammography and multi-organ diagnostic platforms, are designed to streamline workflows and improve diagnostic confidence. Innovations like accelerated MRI scanning and enhanced image resolution are also helping reduce patient wait times and improve clinical decision-making.

These developments underscore the healthcare sector’s focus on improving diagnostic efficiency and accuracy to support earlier intervention and better patient outcomes.

The increasing technological advancements are expected to boost the AI in medical imaging market

Technological advancements are fueling a transformative wave in the medical imaging market by enabling significantly faster, higher-quality, and more intelligent diagnostic processes. For instance, in early 2025, Subtle Medical unveiled AI-driven MRI enhancements that accelerate scan time, enable ultra–low-dose imaging, and synthesize missing sequences.

Additionally, in May 2025, Philips, in collaboration with NVIDIA, introduced a “foundation model” for MRI at ISMRM to enhance scan planning, denoising, super-resolution, and interactive image optimization directly in clinical workflows. GE HealthCare and NVIDIA also partnered to develop autonomous X-ray and ultrasound systems, using AI-enhanced robotics to reduce operator dependency and expand diagnostic access.

Cardiovascular diagnostics have also been redefined: Avandra Imaging released an AI-powered MRI platform in 2025, delivering cardiac scan results within minutes, and India’s SGPGIMS began using an AI-enabled intravascular OCT system in May 2025, offering live, high-resolution imaging to guide precision angioplasty. Complementing hardware innovation are software breakthroughs like Viz.ai’s FDA-cleared CT-based tool for automated detection of subdural hemorrhages (June 2025). Together, these advances are reshaping medical imaging to support earlier and more precise diagnoses.

Restraint:

Data privacy and security concerns are hampering the growth of the AI in medical imaging market

Concerns around data privacy and security are anticipated to pose significant challenges to the growth of the medical imaging market, largely due to the sensitive nature of patient health information and the rising vulnerabilities within digital healthcare systems.

Modern imaging technologies often rely on vast amounts of clinical and diagnostic data for analysis, interpretation, and storage. This creates substantial risks related to compliance with strict data protection regulations such as HIPAA in the United States, GDPR in the European Union, and similar laws in other regions. The need to safeguard this information against unauthorized access, breaches, and misuse places a heavy burden on healthcare providers and technology vendors, potentially slowing down the adoption of new imaging solutions and increasing operational costs.

Opportunity:

The expansion into emerging regions is expected to create a lucrative opportunity for the AI in medical imaging market

The development of multimodal AI solutions presents a significant opportunity for the AI in medical imaging market, as it enables a more comprehensive and accurate understanding of patient health by integrating data from multiple sources. Unlike traditional imaging tools that rely solely on visual data, multimodal systems combine various types of inputs to deliver deeper diagnostic insights and personalized care recommendations.

This integrated approach improves diagnostic precision, particularly for complex conditions like cancer, cardiovascular disease, and neurological disorders, where visual findings alone may not be sufficient. For example, combining imaging with blood biomarkers and patient history can help differentiate between benign and malignant tumors more effectively or predict disease progression with higher accuracy.

AI in Medical Imaging Market Segment Analysis

The global AI in medical imaging market is segmented based on modality, deployment mode, component, and region.

The X-ray imaging from the type segment is expected to hold 26.8% of the market share in 2024 in the AI in medical imaging market

X-ray imaging is expected to dominate the AI in medical imaging market due to its widespread use, affordability, and recent technological advancements that have significantly enhanced diagnostic efficiency. As the most commonly performed imaging modality globally, X-rays provide an ideal platform for AI integration, particularly for high-volume screenings such as chest, trauma, and musculoskeletal assessments. Recent developments underscore this trend, including Gleamer’s FDA-cleared ChestView now enables automated detection of lung conditions.

In May 2025, Milvue's TechCare Trauma received FDA clearance for musculoskeletal analysis, and United Imaging’s robotic uAngio AVIVA system introduced AI-enhanced interventional imaging. These advancements, coupled with increasing regulatory approvals and clinical demand, position X-ray imaging as the leading segment driving AI adoption in the medical imaging market.

AI in Medical Imaging Market Geographical Analysis

North America is expected to dominate the global AI in medical imaging market with a 42.6% share in 2024

North America is expected to lead the global AI in medical imaging market in 2025, largely due to early clinical adoption, advanced digital infrastructure, and strong industry-regulatory collaboration. Over 66% of radiology departments in the U.S. are integrating AI tools to streamline workflows, improve diagnostic accuracy, and manage increasing imaging volumes, placing the region well ahead.

This leadership is reinforced by recent launches such as GE HealthCare’s Sonic DL MRI and Philips’ CT 5300, both unveiled at RSNA 2024, which incorporate AI for faster and more precise imaging.

The FDA’s fast-track approvals, alongside initiatives like CIVIE’s RadPod for on-demand diagnostics and Subtle Medical’s AI MRI tools, further highlight the region’s pioneering role. As the chart above illustrates, North America’s aggressive adoption pace positions it as the global benchmark for AI-driven transformation in medical imaging.

Asia-Pacific is growing at the fastest pace in the AI in medical imaging market holding 22.4% of the market share

Asia-Pacific is emerging as the fastest-growing region in the AI-powered medical imaging market, driven by urgent healthcare needs and rapid digital transformation. Robust growth is fueled by a surge in chronic disease prevalence, governmental investment in infrastructure, and supportive state policies, particularly in China and India, which are scaling AI deployments across rural and urban centers.

Innovations such as India’s Telangana-led pilot of AI in cancer screenings and regional generative-AI challenges in ophthalmology underscore a boom in multimodal imaging and screening solutions across Asia-Pacific. These concerted efforts position APAC at the forefront of next-gen, AI-driven diagnostic expansion.

AI in Medical Imaging Market Top Companies

Top companies in the AI in medical imaging market include GE HealthCare, FUJIFILM Corporation, Koninklijke Philips NV, Aidoc, Blackford Analysis, Siemens Healthineers AG, Canon Medical Systems GmbH, Qure.ai, NVIDIA Corporation, SARC MedIQ, among others.

AI in Medical Imaging Market, Key Developments

On January 27, 2025, Royal Philips unveiled its AI-enabled CT 5300 system at the 23rd Asian Oceanian Congress of Radiology (AOCR) 2025. Alongside this launch, Philips marked a major milestone by surpassing 1,500 global installations of its helium-free 1.5T wide-bore (70 cm) MRI systems, underscoring its continued innovation and leadership in sustainable, advanced imaging solutions.

In May 2025, Avandra Imaging released an AI-powered MRI platform, delivering cardiac scan results within minutes, and India’s SGPGIMS began using an AI-enabled intravascular OCT system.

AI in Medical Imaging Market Scope

Metrics | Details | |

CAGR | 5.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Modality | X-ray Imaging, Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Ultrasound Imaging, Mammography, Others |

Deployment Mode | Cloud-Based Solutions, On-Premise Solutions, Hybrid Models | |

Component | Software, Hardware, Services | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global AI in medical imaging market report delivers a detailed analysis with 60+ key tables, more than 50+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.