Advanced Therapies for Blood Purification Market Size

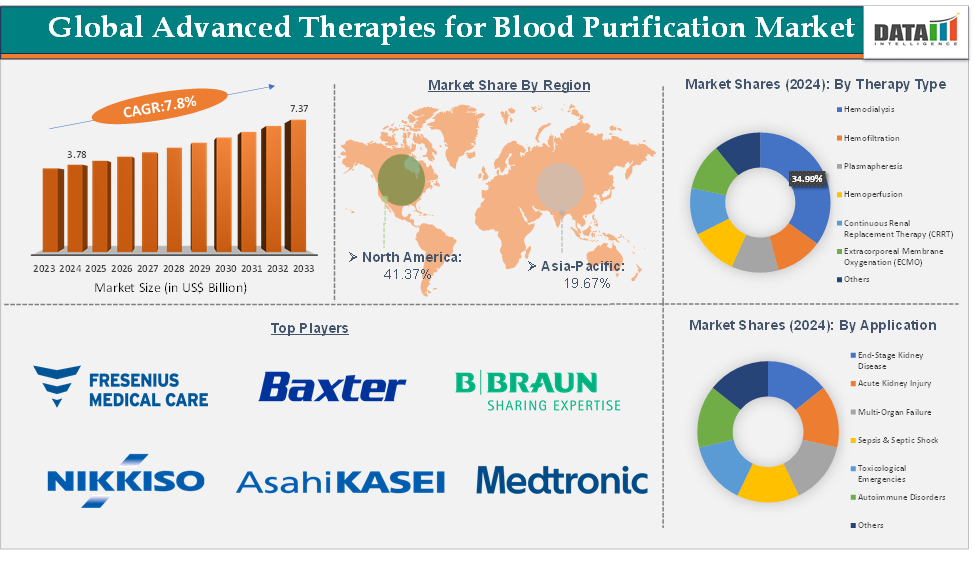

The global advanced therapies for blood purification market size reached US$ 3.78 Billion in 2024 from US$ 3.53 Billion in 2023 and is expected to reach US$ 7.37 Billion by 2033, growing at a CAGR of 7.8% during the forecast period 2025-2033.

Market Overview

The advanced therapies for blood purification market is surging primarily from rising cases of chronic kidney disease (CKD), end-stage renal disease (ESRD), sepsis, and multi-organ failure. Hemodialysis remains the dominant segment, but hemoperfusion is growing the fastest, driven by its expanded use in infections and inflammatory conditions. The rapidly growing portable and home-care device is reshaping the market, supported by technological advancements in miniaturization, AI-enabled monitoring, and telehealth integration.

North America leads in overall market share due to robust healthcare infrastructure and reimbursement systems, while the Asia-Pacific region is the fastest-growing, fueled by expanding healthcare access and rising disease prevalence. Still, challenges persist, such as high equipment costs, regulatory hurdles, and complications, like infection or clotting limit adoption in resource-constrained regions. Emerging opportunities include home-based systems, smart wearable purification technologies, and the exploration of bioartificial kidneys, positioning the market for a transformative decade ahead.

Executive Summary

Market Dynamics

Drivers:

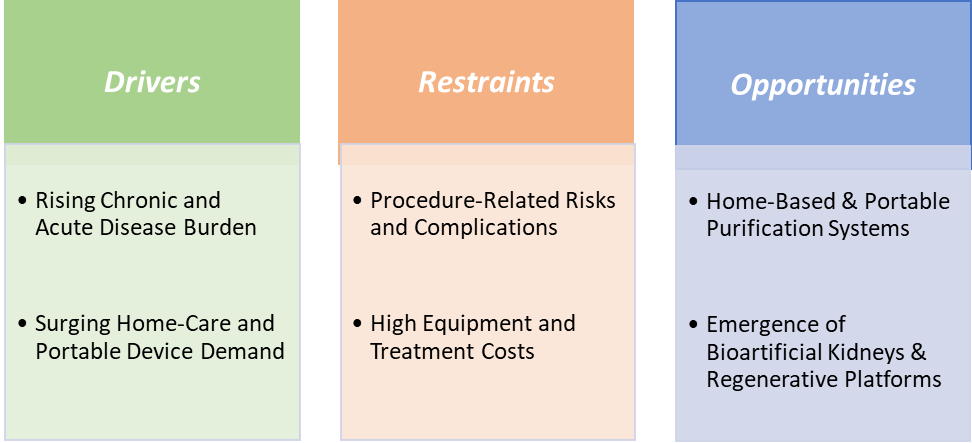

Rising chronic and acute disease burden is significantly driving the advanced therapies for blood purification market growth

The rising burden of chronic and acute diseases is driving the growth of the advanced therapies for blood purification market, as these conditions often require rapid and precise removal of toxins, pathogens, and metabolic waste from the bloodstream. According to the International Society of Nephrology, the prevalence of chronic kidney disease (CKD) worldwide is 10.4% among men and 11.8% among women. acute kidney injury (AKI), experienced by 13.3 million people each year, may resolve or lead to CKD or kidney failure in the future. These rising CKD frequently necessitate long-term dialysis or continuous renal replacement therapy (CRRT), boosting demand for high-efficiency purification systems. Acute kidney injury (AKI), often occurring in critically ill or post-surgical patients, requires advanced modalities like hemofiltration and hemoperfusion to stabilize patients quickly.

Sepsis, a life-threatening inflammatory response, has further fueled the adoption of cytokine adsorption devices such as CytoSorb and Toraymyxin cartridges, which target excessive inflammatory mediators. Liver failure cases are increasingly managed with extracorporeal liver support systems like MARS (Molecular Adsorbent Recirculating System) that combine filtration and adsorption. Even in infectious disease crises, such as COVID-19, extracorporeal blood purification was deployed to manage severe cytokine storm cases. These disease-driven needs, coupled with the shift toward early intervention in ICUs, are pushing hospitals to adopt multi-modality, next-generation purification platforms, thereby accelerating overall market growth.

Restraints:

Procedure-related risks and complications are hampering the growth of the advanced therapies for blood purification market

Procedure-related risks and complications hamper the adoption of advanced blood purification therapies, as they can deter both clinicians and patients from opting for these interventions. Since these procedures involve extracorporeal circulation, there is a heightened risk of bloodstream infections due to catheter use, especially in immunocompromised or ICU patients. Hemodynamic instability, such as sudden drops in blood pressure during continuous renal replacement therapy (CRRT), can endanger critically ill individuals.

Coagulation-related issues, including clotting in the circuit or bleeding complications from anticoagulant use, further increase treatment complexity. In liver failure, treatments like MARS, extended therapy times increase the chance of infection and device-related complications. Additionally, potential electrolyte imbalances or over-removal of essential molecules can lead to metabolic instability. These risks not only increase hospitalization costs and duration but also make regulatory bodies cautious in approving new devices. Consequently, the perception of high clinical risk, especially in resource-limited settings, slows market penetration despite the therapies’ potential benefits.

For more details on this report – Request for Sample

Segmentation Analysis

The global advanced therapies for blood purification market is segmented based on therapy type, application, end-user, and region.

The hemodialysis segment from the therapy type is dominating the advanced therapies for blood purification market with a 34.99% share in 2024

The hemodialysis segment is dominating the advanced therapies for blood purification market due to its widespread adoption, established clinical efficacy, and large patient base requiring long-term treatment. Chronic kidney disease (CKD) affects millions of people globally, with many progressing to end-stage renal disease (ESRD), where hemodialysis remains the gold standard for survival. Its strong market share is reinforced by extensive infrastructure, dialysis centers are widely available across developed regions and increasingly in emerging economies.

Technological innovations, such as high-flux membranes, biocompatible dialyzers, and online hemodiafiltration, have enhanced toxin clearance, patient comfort, and treatment outcomes. For instance, Fresenius Medical Care’s 5008S CorDiax and Baxter’s AK 98 machines offer integrated monitoring and precise fluid management, improving safety and personalization. In acute settings, hemodialysis is also utilized for the rapid removal of toxins in cases like drug overdose or acute kidney injury.

Geographical Share Analysis

North America is expected to dominate the global advanced therapies for blood purification market with a 41.37% in 2024

North America holds a dominant position in the advanced therapies for blood purification market due to its strong healthcare infrastructure, high prevalence of chronic diseases, and early adoption of innovative medical technologies. The region faces a significant burden of conditions such as chronic kidney disease, affecting more than 1 in 7 US adults, about 35.5 million people, or 14%, are estimated to have CKD according to the Centers for Disease Control and Prevention (CDC), acute kidney injury, and sepsis, all of which drive demand for advanced blood purification modalities.

Leading market players like Baxter International and Fresenius Medical Care North America are headquartered or have major operations here, ensuring technological leadership and widespread product availability. Hospitals and specialty clinics in the region are equipped with advanced CRRT systems, cytokine adsorption devices, and extracorporeal liver support technologies, enabling comprehensive treatment capabilities. This combination of disease burden, infrastructure, and industry presence cements North America’s lead in the global market.

Competitive Landscape

Top companies in the advanced therapies for blood purification market include Fresenius Medical Care AG, Baxter, B. Braun SE, Nikkiso Belgium BV, Asahi Kasei Medical Co., Ltd., Medtronic, and Aethlon Medical, Inc., among others.

Market Scope

Metrics | Details | |

CAGR | 7.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Therapy Type | Hemodialysis, Hemofiltration, Plasmapheresis, Hemoperfusion, Continuous Renal Replacement Therapy (CRRT), Extracorporeal Membrane Oxygenation (ECMO) and Others |

Application | End-Stage Kidney Disease, Acute Kidney Injury, Multi-Organ Failure, Sepsis & Septic Shock, Toxicological Emergencies, Autoimmune Disorders and Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Homecare Settings and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global advanced therapies for blood purification market report delivers a detailed analysis with 53 key tables, more than 59 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here