Cardiac Catheters and Guidewires Market Size

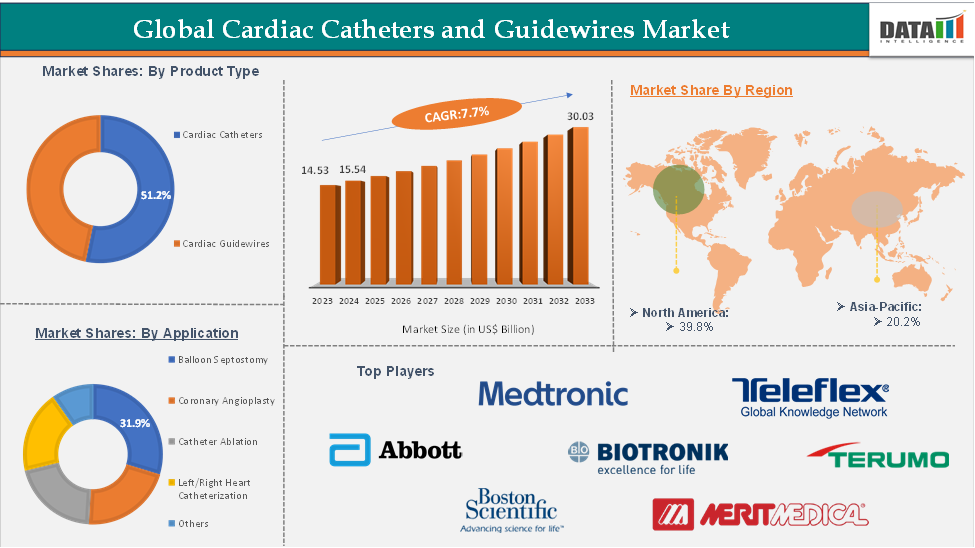

In 2023, the global cardiac catheters and guidewires was valued at US$ 14.53 Billion. The global Cardiac Catheters and Guidewires market size reached US$ 15.54 Billion in 2024 and is expected to reach US$ 64.09 Billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

Cardiac Catheters and Guidewires Market Overview

The global cardiac catheters and guidewires market is witnessing robust growth, driven by the rising prevalence of cardiovascular diseases (CVDs). A growing preference for minimally invasive procedures such as angioplasty and catheter-based diagnostics has significantly boosted market demand, supported by continuous technological advancements in catheter design, guidewire flexibility, and navigation systems.

The market is further propelled by the expansion of healthcare infrastructure in emerging economies, offering lucrative opportunities for manufacturers. Innovations in material science are enhancing performance and patient safety. Additionally, the shift toward outpatient and ambulatory care settings is accelerating the need for efficient, easy-to-use interventional tools. North America currently dominates the market due to its advanced healthcare infrastructure, high procedural volume, and strong reimbursement landscape.

Global Cardiac Catheters and Guidewires Market: Executive Summary

Rising prevalence & improved awareness are significantly driving the cardiac catheters and guidewires market growth

The escalating global burden of cardiovascular diseases (CVDs), including coronary artery disease, myocardial infarction, heart failure, and arrhythmias, has emerged as a significant driver propelling the demand for cardiac catheters and guidewires. More than half a billion people around the world continue to be affected by cardiovascular diseases. It is estimated that by 2050, the burden of stroke among the population aged ≥65 years will increase significantly: by 104.70% for incidence. This persistent rise in CVD prevalence, attributed to risk factors such as sedentary lifestyles, unhealthy dietary habits, tobacco use, diabetes, and hypertension, has amplified the need for timely diagnosis and effective interventional procedures.

Cardiac catheterization procedures are considered the standard approach in diagnosing and treating various heart conditions, including blocked arteries, structural abnormalities, and heart valve diseases. The increased patient pool suffering from CVDs is directly translating into a higher procedural volume of diagnostic and interventional cardiac catheterization, thereby fueling market expansion. Moreover, guidewires play a critical role in facilitating the safe and precise navigation of catheters through complex vascular pathways, further solidifying their indispensable role in cardiovascular interventions.

Healthcare systems across developed and developing regions are increasingly adopting minimally invasive techniques such as percutaneous coronary intervention (PCI), which rely heavily on the use of advanced catheters and guidewires. The growing preference for minimally invasive procedures—owing to their benefits such as reduced hospital stays, quicker recovery, and fewer complications—is further reinforcing the demand.

Furthermore, the aging global population, which is more susceptible to cardiac ailments, along with increasing awareness and early screening initiatives, is anticipated to continue driving the market forward. As a result, the rising prevalence of CVDs remains a cornerstone in the robust growth trajectory of the cardiac catheters and guidewires market, with stakeholders actively investing in R&D to develop more efficient, safer, and patient-friendly products.

Growth of minimally invasive interventions is significantly driving the cardiac catheters and guidewires market growth

The rising adoption of minimally invasive interventions has become a pivotal growth driver for the global cardiac catheters and guidewires market. The shift from traditional open-heart surgeries toward catheter-based procedures is gaining momentum, driven by advantages such as reduced surgical trauma, shorter hospital stays, faster recovery times, and decreased post-operative complications. For instance, according to the data provided by the National Institute of Health, cardiac catheterization ranks among the most commonly performed heart procedures, with over 1 million such procedures carried out each year in the United States alone.

Technological innovations have enabled the development of highly advanced interventional cardiology tools, allowing clinicians to perform complex procedures like percutaneous coronary interventions (PCI), transcatheter aortic valve replacements (TAVR), and electrophysiology studies with increased precision and safety. These procedures depend heavily on the use of specialized catheters and guidewires, making them integral components in modern cardiovascular care.

The increasing preference for minimally invasive approaches is particularly evident in elderly patients and those with comorbidities, who are at greater risk during open-heart surgery. Additionally, favorable reimbursement policies in developed healthcare systems, growing investments in cath lab infrastructure, and the expansion of interventional cardiology training have collectively accelerated the global uptake of such procedures.

Moreover, ongoing advancements in imaging technologies are enhancing procedural success rates, further encouraging the adoption of catheter- and guidewire-based interventions.

Restraint:

The high cost of devices & procedures is hampering the growth of the cardiac catheters and guidewires market

The high cost of cardiac devices and procedures is a significant barrier that could hamper the growth of the cardiac catheters and guidewires market. Advanced catheterization procedures often require the use of specialized, high-precision devices that come with substantial price tags. This, combined with associated hospital costs, imaging technologies, and post-operative care, can make these interventions unaffordable, especially in low- and middle-income regions where reimbursement mechanisms are limited or out-of-pocket expenditure is high.

Opportunity:

Emerging markets expansion is expected to create a lucrative opportunity for the growth of the cardiac catheters and guidewires market

The expansion into emerging markets such as India, China, Brazil, and Southeast Asian nations presents a substantial opportunity for the cardiac catheters and guidewires market. These regions are witnessing a rapid rise in cardiovascular disease prevalence, fueled by urbanization, lifestyle transitions, and an aging population.

Governments and private healthcare providers in these countries are increasingly investing in upgrading healthcare infrastructure, establishing cardiac care units, and expanding access to interventional cardiology. Additionally, the growing penetration of health insurance, along with policy support for non-communicable disease management, is making cardiac procedures more financially accessible to larger segments of the population.

Multinational device manufacturers are recognizing the untapped potential in these markets and are strategically focusing on local partnerships, pricing adjustments, and capacity building initiatives to cater to the needs of cost-sensitive demographics. Furthermore, the increasing availability of skilled cardiologists and the rising adoption of minimally invasive technologies are improving procedural feasibility across secondary and tertiary care centers in these regions.

With favorable demographic trends, improving healthcare expenditure, and an expanding patient base, emerging markets offer a high-growth environment for cardiac catheter and guidewire adoption. Companies that effectively navigate regulatory pathways and address cost challenges will be well-positioned to capitalize on these underserved yet rapidly evolving regions, making emerging markets a key growth pillar for the global market in the coming years..

For more details on this report – Request for Sample

Cardiac Catheters and Guidewires Market, Segment Analysis

The global cardiac catheters and guidewires market is segmented based on product type, application, end-user, and region.

The cardiac catheters from the product type segment are expected to hold 51.2% of the market share in 2024 in the Cardiac Catheters and Guidewires market

The cardiac catheters segment is expected to dominate the cardiac catheters and guidewires market due to its extensive clinical applications, rising cardiovascular disease burden, and continuous technological advancements. Cardiac catheters are vital in both diagnostic and interventional procedures such as coronary angiography, angioplasty, and electrophysiological studies, making them indispensable in cardiac care.

The growing prevalence of heart conditions, particularly in aging populations and regions with increasing lifestyle-related risk factors, is driving higher demand for catheter-based interventions. Furthermore, technological innovations like drug-eluting catheters, steerable designs, and sensor-integrated systems are enhancing procedural safety and precision, encouraging broader adoption. This momentum is further supported by steady product approvals and launches. For instance, in June 2024, Penumbra announced the CE Mark approval and European launch of its BMX81 and BMX96 devices, designed to support neurovascular management in both ischemic and hemorrhagic stroke cases. These represent the company’s most advanced neuro-access solutions to date. The launch further strengthens Penumbra’s neuro portfolio in Europe, building on its earlier expansion in May when the company introduced three new RED reperfusion catheters to the market.

Cardiac Catheters and Guidewires Market, Geographical Analysis

North America is expected to dominate the global cardiac catheters and guidewires market with a 39.8% share in 2024

North America continues to dominate the global cardiac catheters and guidewires market, primarily driven by its well-established healthcare infrastructure, high disease burden, and early adoption of advanced medical technologies. The region reports one of the highest prevalences of cardiovascular diseases, including coronary artery disease and heart failure, thereby generating a consistent demand for interventional procedures.

Furthermore, the presence of leading medical device manufacturers, robust R&D capabilities, and a strong regulatory framework contributes to the region’s leadership position. For instance, in May 2025, Johnson & Johnson MedTech announced the U.S. launch of its SoundStar Crystal ultrasound catheter, designed for use in intracardiac echocardiography (ICE) during cardiac ablation procedures. According to the company, the SoundStar Crystal offers significantly improved and clearer image quality compared to existing ICE catheters. As an advanced 2D ICE catheter, it enhances visualization capabilities during complex cardiac procedures, supporting more accurate and efficient interventions.

Widespread availability of state-of-the-art catheterization labs, coupled with the presence of skilled interventional cardiologists, supports high procedural volumes in both inpatient and outpatient settings. Additionally, favorable reimbursement policies, rising healthcare spending, and increased awareness around minimally invasive cardiac interventions further reinforce market growth. The United States, in particular, acts as a major revenue contributor, with continuous innovation and product launches enhancing the adoption of next-generation catheters and guidewires.

With supportive regulatory pathways, high diagnostic accuracy, and a growing emphasis on early CVD detection and intervention, North America is expected to maintain its dominant position in the global cardiac catheters and guidewires market over the forecast period.

Asia-Pacific is growing at the fastest pace in the cardiac catheters and guidewires market, holding 20.2% of the market share

The Asia-Pacific region is projected to witness the fastest growth in the cardiac catheters and guidewires market during the forecast period, fueled by a combination of epidemiological shifts, healthcare infrastructure development, and rising awareness of cardiovascular health. Countries such as India, China, Japan, and South Korea are experiencing a sharp rise in the incidence of cardiovascular diseases due to aging populations, urban lifestyle changes, and increased prevalence of risk factors such as diabetes, obesity, and hypertension.

Governments across the region are increasingly prioritizing cardiovascular care by investing in hospital infrastructure, launching nationwide screening programs, and strengthening public-private partnerships. In addition, the expansion of private healthcare facilities and the growing availability of trained interventional cardiologists are enabling broader access to catheter-based procedures.

Cardiac Catheters and Guidewires Market Competitive Landscape

Top companies in the cardiac catheters and guidewires market include Abbott, Boston Scientific Corporation, Biotronik, Medtronic, Terumo Medical Corporation, Cordis, Teleflex Incorporated, Nipro, BrosMed Medical Co., Ltd., Merit Medical Sysytem, among others.

Cardiac Catheters and Guidewires Market Key Developments

In July 2024, Intellia Therapeutics, Inc. announced the authorization of its Clinical Trial Application (CTA) by the United Kingdom’s Medicines and Healthcare products Regulatory Agency (MHRA) to initiate a Phase 1/2 study evaluating NTLA-3001 for the treatment of alpha-1 antitrypsin deficiency (AATD)-associated lung disease.

Cardiac Catheters and Guidewires Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Cardiac Catheters, Cardiac Guidewires |

Application | Balloon Septostomy, Coronary Angioplasty, Catheter Ablation, Left/Right Heart Catheterization, Others | |

Distribution Channel | Hospitals, Clinics, Ambulatory Surgical Centers | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cardiac catheters and guidewires market report delivers a detailed analysis with 60+ key tables, more than 50+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here