Cardiac Ablation Devices Market Size and Trends

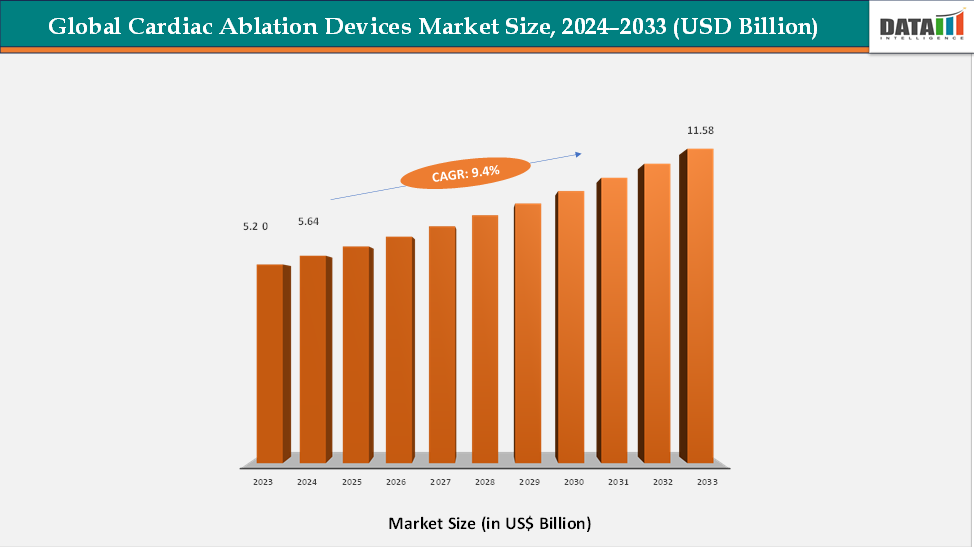

The global cardiac ablation devices market reached US$ 5.20 billion in 2023, with a rise to US$ 5.64 billion in 2024, and is expected to reach US$ 11.58 billion by 2033, growing at a CAGR of 9.4% during the forecast period 2025–2033. The global cardiac ablation devices market is experiencing strong and sustained growth, driven primarily by the rising prevalence of cardiac arrhythmias and the increasing adoption of minimally invasive electrophysiology procedures. Continuous technological advancements, including pulsed-field ablation (PFA), contact-force sensing catheters, and advanced 3D mapping systems, are improving procedural accuracy, reducing complications, and enhancing patient outcomes. Healthcare systems are also shifting toward outpatient and same-day ablation centers, further elevating demand for efficient, high-throughput ablation technologies.

At the same time, growing investments in electrophysiology infrastructure across emerging markets are expanding access to ablation procedures. With rising arrhythmia burdens, ongoing technological improvements, and broadening global adoption, the Cardiac Ablation Devices market is solidifying its role as a critical pillar of modern rhythm-management therapy.

Key Market highlights

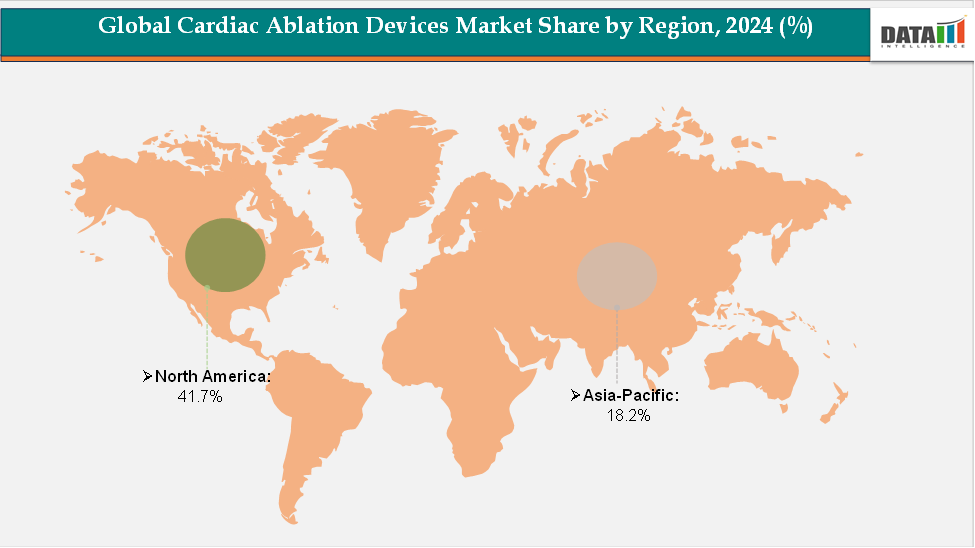

- North America accounted for approximately 41.7% of the global cardiac ablation devices market in 2024, maintaining its position as the leading regional contributor. This dominance is driven by the high prevalence of cardiac arrhythmias, widespread availability of advanced electrophysiology (EP) labs, and strong adoption of minimally invasive ablation procedures in the United States and Canada.

- The Asia-Pacific region held around 18.2% of the global market in 2024 and is expected to be the fastest-growing region in the coming years. Rising healthcare investment, rapidly improving EP infrastructure, and increasing diagnosis rates of arrhythmias in countries such as China, India, Japan, and South Korea are key growth drivers. The region is seeing accelerated adoption of catheter-based ablation due to expanding hospital capacity, government support for cardiac care modernization, and growing availability of specialized electrophysiologists.

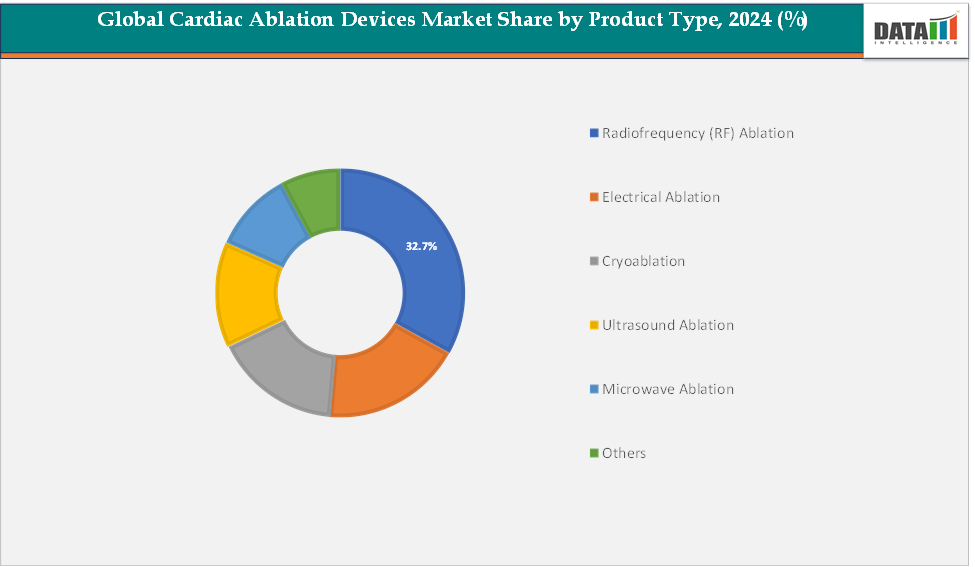

- By product, the radiofrequency (RF) ablation segment dominated the global cardiac ablation devices market, accounting for approximately 32.7% of total revenue in 2024. RF ablation remains the most widely used modality due to its established safety profile, proven clinical outcomes, and compatibility with advanced mapping and navigation systems. Its versatility in treating a wide range of arrhythmias—including atrial fibrillation, supraventricular tachycardia, and ventricular tachycardia—continues to support broad adoption. The segment’s leadership is further strengthened by ongoing innovations such as contact-force sensing catheters and temperature-controlled RF systems, which enhance procedural precision and reduce complication risks.

Market Size & Forecast

- 2024 Market Size: US$5.64 Billion

- 2033 Projected Market Size: US$11.58 Billion

- CAGR (2025–2033): 9.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Cardiac Ablation Devices Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Cardiac Arrhythmias

The rising prevalence of cardiac arrhythmias is a key driver for the cardiac ablation devices market, as it directly expands the pool of patients eligible for interventional treatments. For instance, atrial fibrillation (AF) affects an estimated 33.5 million people globally as of 2023, with projections suggesting continued growth due to aging populations and lifestyle-related cardiovascular risk factors such as hypertension, obesity, and diabetes in countries like the United States. AF affects nearly 6 million adults, many of whom are increasingly opting for catheter-based ablation over long-term antiarrhythmic medication due to better long term outcomes.

Similarly, supraventricular tachycardia (SVT) and ventricular tachycardia (VT) are increasingly being diagnosed in both adults and pediatric populations, leading to higher demand for electrophysiology (EP) procedures. Hospitals and EP labs are reporting rising procedure volumes, for instance, in the U.S. catheter ablation procedures increased by approximately 10-12% annually over the past five years, driven largely by AF and VT cases

These trends highlight that as more patients are diagnosed early and referred for minimally invasive treatments, the need for radiofrequency (RF) ablation catheters, cryoablation devices, and advanced 3D mapping systems grows significantly. Device manufacturers, including Biosense Webster, Abbott Laboratories, and Medtronic, are responding with innovations such as contact-force sensing catheters, pulsed-field ablation (PFA), and Al-enabled navigation platforms, further boosting adoption.

Restraint: High Costs

The high costs associated with cardiac ablation devices, including RF generators, mapping systems, and disposable catheters, are expected to restrain market growth. Many hospitals, particularly in emerging market, face budget constraints that limit adoption, while the overall procedural expenses can be a barrier for patients without adequate insurance coverage. This financial burden may slow the penetration of advanced ablation technologies in cost-sensitive regions.

For more details on this report, Request for Sample

Global Cardiac Ablation Devices Market Segment Analysis

The global cardiac ablation devices market is segmented by product, type, application, end-user and region.

Product Type: The radiofrequency (RF) ablation segment is estimated to have 32.7% of the cardiac ablation devices market share.

Radiofrequency (RF) ablation is the most widely used technology in the cardiac ablation devices market due to its proven efficacy, safety profile, and extensive clinical adoption over the past decades. It works by delivering high-frequency alternating electrical currents through a catheter to generate controlled thermal energy, which creates precise lesions in cardiac tissue to eliminate arrhythmogenic foci. RF ablation has been extensively validated in treating a wide range of arrhythmias, particularly atrial fibrillation and ventricular tachycardia, making it the preferred choice for electrophysiologists.

Its dominance is further supported by well-established procedural protocols, a high success rate, and the availability of advanced tools such as contact-force sensing catheters and 3D mapping systems, which enhance precision and reduce complications. Additionally, widespread physician training, strong clinical evidence, and favorable reimbursement policies in key markets like North America and Europe have reinforced RF ablation as the leading modality in the cardiac ablation devices market. Emerging technologies, while gaining attention, have yet to match the extensive adoption and clinical confidence that RF ablation currently commands.

Global Cardiac Ablation Devices Market - Geographical Analysis

The North America cardiac ablation devices market was valued at 41.7% market share in 2024

North America remains the dominant region in the global cardiac ablation devices market due to a combination of high disease prevalence, advanced healthcare infrastructure, and strong technological innovation. The region experiences a significant burden of cardiac arrhythmias, particularly atrial fibrillation, which drives consistent demand for ablation procedures. The United States, in particular, contributes the largest share of the market, supported by a well-established network of tertiary cardiac centers and highly skilled electrophysiologists. Favorable reimbursement policies make minimally invasive ablation procedures financially accessible for both hospitals and patients, further boosting adoption.

Additionally, North America serves as a hub for major medical device companies, enabling rapid development, commercialization, and early adoption of advanced ablation technologies such as contact-force sensing catheters, sophisticated mapping systems, and emerging modalities like pulsed-field ablation. Heavy investment in research and development, coupled with extensive clinical trial infrastructure and a strong culture of technological adoption, reinforces North America’s leadership position in the cardiac ablation devices market.

The European cardiac ablation devices market was valued at 21.4% market share in 2024

Europe holds a significant and stable position in the global cardiac ablation devices market, driven by well-established healthcare systems, comprehensive reimbursement coverage, and high clinical expertise. Countries such as Germany, the United Kingdom, and France feature specialized electrophysiology centers and hospitals that are leaders in cardiac care. These institutions are actively adopting advanced ablation technologies, including hybrid platforms, contact-force sensing catheters, and sophisticated mapping systems, which strengthens Europe’s competitive edge.

The region’s supportive regulatory framework facilitates the entry of innovative medical devices, while ongoing investments in minimally invasive cardiac interventions ensure steady demand. High patient awareness, expanding electrophysiology lab capacities, and a strong focus on advanced procedural techniques collectively maintain Europe’s influential and prominent position in the global cardiac ablation devices market.

The Asia-Pacific cardiac ablation devices market was valued at 18.2% market share in 2024

The Asia‑Pacific region is emerging as the fastest-growing market for cardiac ablation devices due to rising disease prevalence, expanding healthcare infrastructure, and increasing awareness of advanced treatment options. Countries like China, India, and Japan are witnessing a surge in lifestyle-related cardiovascular conditions driven by urbanization, aging populations, and sedentary lifestyles, which in turn increases demand for arrhythmia treatment. Rapid investments in healthcare facilities, including the establishment of more electrophysiology labs, are making ablation procedures more accessible.

Additionally, growing patient awareness, physician training, and the presence of global medical device companies in the region are accelerating adoption. Cost advantages due to local manufacturing and improved supply chains are also supporting market expansion. With these factors combined, the Asia‑Pacific region is poised for strong and sustained growth, making it the fastest-growing segment in the global cardiac ablation devices market.

Global Cardiac Ablation Devices Market – Competitive Landscape

The major players in the cardiac ablation devices market include Johnson & Johnson, Boston Scientific Corporation, Medtronic, Atricure, Inc., Abbott, Kardium Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 9.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$Bn) | |

| Segments Covered | Product Type | Radiofrequency (RF) Ablation, Electrical Ablation, Cryoablation, Ultrasound Ablation, Microwave Ablation, Others |

| Application | Cardiac Rhythm Management, Open surgery, Others | |

| End-user | Hospitals, Ambulatory Surgical Centers, Clinics, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cardiac ablation devices market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here