Angiography Devices Market Size & Industry Outlook

Ongoing advancements in technology are driving the growth of the angiography devices market by improving imaging accuracy, operational efficiency, and patient safety. Innovations such as AI-driven software, high-resolution flat-panel detectors, 3D and rotational angiography, and robotic-assisted technologies allow clinicians to visualize blood vessels more effectively, decrease radiation exposure, and conduct minimally invasive procedures with greater precision. The incorporation of intravascular imaging and physiological assessment tools into angiography systems enhances decision-making during intricate procedures. Portable and hybrid systems increase accessibility in both hospitals and outpatient facilities.

Key Highlights

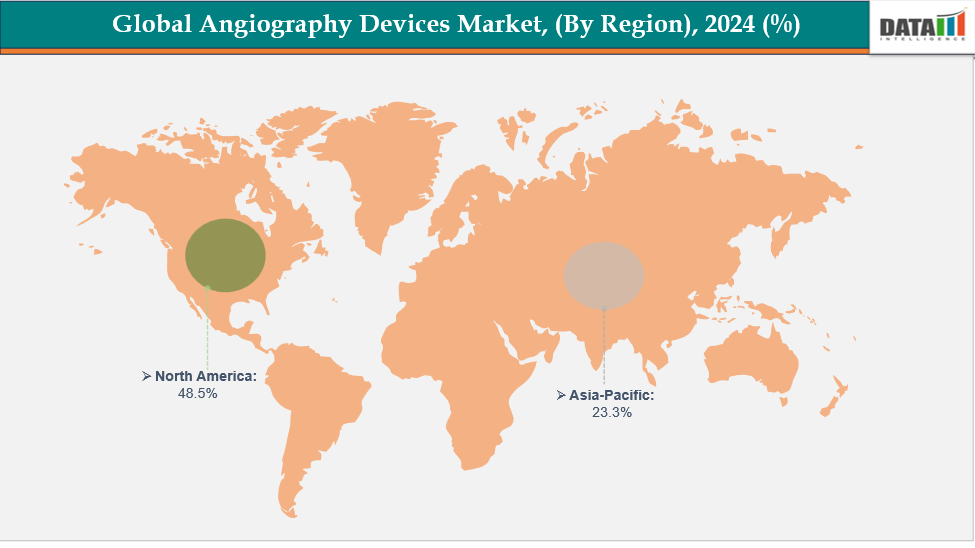

- North America is dominating the global angiography devices market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global angiography devices market, with a CAGR of 7.7% in 2024

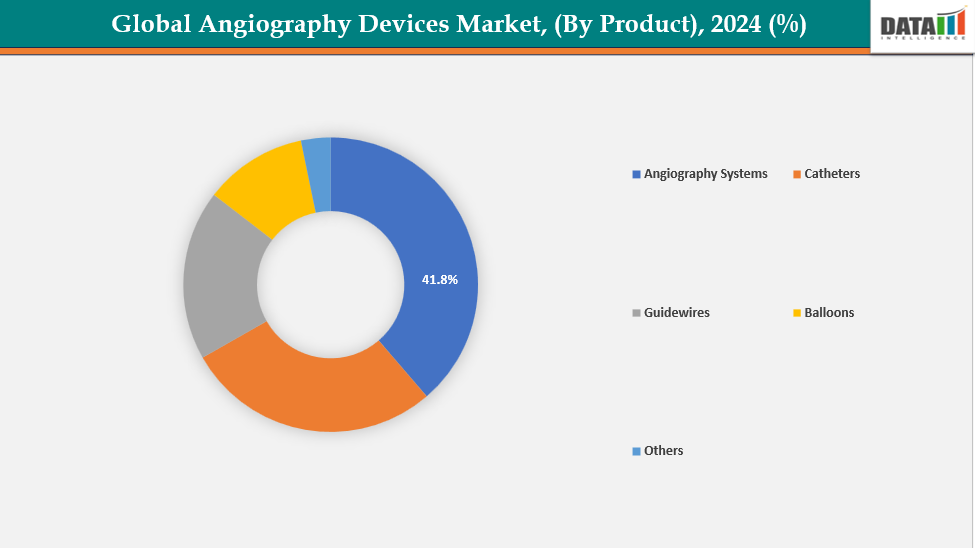

- The angiography systems segment is dominating the angiography devices market with a 41.8% share in 2024

- The x-ray angiography segment is dominating the angiography devices market with a 48.3% share in 2024

- Top companies in the angiography devices market are Siemens Healthcare Private Limited, Medtronic, Abbott, Boston Scientific Corporation, AngioDynamics, Terumo Medical Corporation, GE HealthCare, CANON MEDICAL SYSTEMS CORPORATION, Merit Medical Systems, and Cook, among others.

Market Dynamics

Drivers: Rising prevalence of cardiovascular and vascular diseases is accelerating the growth of the angiography devices market

The increasing global occurrence of cardiovascular and vascular diseases is significantly driving the expansion of the angiography devices market by heightening the need for early, precise, and minimally invasive diagnostic imaging. As health issues like coronary artery disease, stroke, peripheral artery disease, and hypertension continue to rise, fueled by aging populations, inactive lifestyles, obesity, and diabetes, healthcare systems are emphasizing advanced imaging to identify blockages, evaluate vessel integrity, and assist in interventional procedures.

Owing to factors like prevalence. For instance, according to WHO and CDC data, cardiovascular diseases remained the leading global cause of death in 2022, accounting for 19.8 million fatalities, with 85% from heart attacks and strokes. In the U.S., 805,000 heart attacks occurred annually, highlighting the critical need for stronger cardiac care.

Restraints: The high capital cost of angiography suites and advanced imaging systems is hampering the growth of the angiography devices market

The considerable capital expenses linked to angiography suites and advanced imaging technologies are greatly hindering the expansion of the angiography devices market. Setting up a complete angiography suite demands a significant financial commitment for infrastructure, specialized shielding, high-resolution imaging tools, and seamless integration with hospital IT systems.

Additionally, the financial burden is further increased by maintenance expenses, employee training, and recurring system improvements. Small and mid-sized hospitals find it challenging to use the technology because of these costs, particularly in developing nations. Consequently, healthcare providers choose less expensive options or postpone purchases, which slows the growth of the market as a whole.

For more details on this report, see Request for Sample

Angiography Devices Market, Segment Analysis

The global angiography devices market is segmented based on product, technology, procedure, end-user, and region

By Product : The angiography systems segment is dominating the angiography devices market with a 41.8% share in 2024

The angiography systems segment dominates the global angiography devices market mainly due to its important role in the diagnosis and treatment of cardiovascular, neurovascular, and peripheral vascular diseases. Hospitals and heart centers rely heavily on advanced digital angiography systems for real-time imaging, accurate vascular assessment, and minimally invasive procedures such as angioplasty and stenting. The continued adoption of flat panel detector technology, 3D/4D imaging, and hybrid operating room integration is further increasing demand.

Additionally, leading manufacturers are continually investing in updating and improving their workflows using artificial intelligence, thereby strengthening their market leadership. For instance, in May 2024, RapidAI secured FDA 510(k) clearance for its AngioFlow solution, which brought advanced AI-driven perfusion imaging directly into the interventional angiography suite. The technology enhanced clinical confidence, improved workflow efficiency, and supported better decision-making to help improve patient outcomes.

By Technology: The x-ray angiography segment is dominating the angiography devices market with a 48.3% share in 2024

The X-ray angiography segment dominates the angiography equipment market mainly due to its high diagnostic accuracy, wide clinical acceptance, and important role in cardiovascular and peripheral vascular procedures. Hospitals prefer X-ray angiography because it provides real-time, high-resolution vascular imaging, allowing accurate assessment during procedures such as angioplasty, stenting, and catheterization. The installed base of C-arm and fluoroscopic angiography systems is already large, making upgrading easier and more cost-effective than introducing new technology.

Additionally, continuous enhancements in flat-panel detectors, radiation-dose optimization, and workflow automation have strengthened its reliability and efficiency. For instance, in May 2025, United Imaging announced FDA clearance of its first interventional X-ray system, uAngio AVIVA, a ceiling-mounted platform featuring intelligent robotics, voice assist, and advanced imaging, designed to support clinical staff by enhancing precision, workflow efficiency, and focus during interventional procedures.

Angiography Devices Market, Geographical Analysis

North America is dominating the global angiography devices market with 48.5% in 2024

North America leads the angiography devices market due to its mature medical infrastructure, rapid adoption of digital imaging technology, and increasing volume of surgical and critical care procedures. Favorable reimbursement policies, continuous product innovation, skilled medical professionals, and strict regulatory compliance further strengthen the region's market dominance and adoption of angiography solutions.

The angiography devices market in the USA is expanding due to advanced healthcare infrastructure, frequent product launches, innovative imaging technologies, and positive FDA approvals and 510(k) clearances enhancing diagnostic and interventional efficiency. For instance, in October 2025, SpectraWAVE received FDA 510(k) clearance for X1‑FFR, an AI-enabled, wire- and drug-free solution. The software, an add-on to the HyperVue Imaging System, became the first US platform integrating angiogram-derived physiology with intravascular imaging on a single system.

Europe is the second region after North America, which is expected to dominate the global angiography devices market with 34.5% in 2024

The European angiography device market is growing due to the development of medical systems, an increase in the elderly population, and an increase in the number of surgeries. Consistent product launches, favorable reimbursement policies, and EU/CE mark approvals foster innovation, improve patient safety, and support regional market expansion in hospitals and interventional care settings.

Owing to factors like continuous EU and CE mark approvals, for instance, in September 2025, AngioSafe emerged from stealth with FDA 510(k) clearance for its flagship Santreva-ATK Endovascular Revascularization Catheter, leveraging atheroplasty technology. The device had also received CE marking in July 2025 and was successfully employed in its first real-world patient procedures in Italy.

The Asia Pacific region is the fastest-growing region in the global angiography devices market, with a CAGR of 7.7% in 2024

The angiography devices market in the Asia-Pacific region, which includes China, India, Japan, and South Korea, is rapidly expanding due to rising healthcare costs, technological advancements, improved hospital infrastructure, support from government initiatives, and increasing adoption of image-guided interventional procedures in both urban and rural healthcare settings.

In Japan, the angiography device market is growing as companies launch advanced imaging systems, artificial intelligence-based platforms, and interventional solutions backed by Pharmaceuticals and Medical Devices Agency (PMDA) approvals that improve the efficiency of clinical implementation and procedures. For instance, in October 2025, MedHub-AI announced that Japan’s Ministry of Health, Labour and Welfare approved national reimbursement for its AutocathFFR System, following earlier PMDA regulatory clearance, marking a key milestone in expanding access to advanced coronary physiology assessment across the country.

Angiography Devices Market Competitive Landscape

Top companies in the angiography devices market are Siemens Healthcare Private Limited, Medtronic, Abbott, Boston Scientific Corporation, AngioDynamics, Terumo Medical Corporation, GE HealthCare, CANON MEDICAL SYSTEMS CORPORATION, Merit Medical Systems, and Cook, among others.

Siemens Healthcare Private Limited: Siemens Healthcare Private Limited is a leading provider of advanced medical imaging and interventional solutions in India and globally. In the Angiography Devices Market, the company offers high-performance X-ray and hybrid angiography systems, such as the Artis pheno and Artis Q series, combining precision imaging, workflow automation, and AI-enabled features to support diagnostic and interventional cardiovascular procedures efficiently.

Key Developments:

- In April 2025, Terumo Health Outcomes announced that Medis QFR 3.0, an FDA-cleared coronary physiology assessment software, became available in the U.S. through its collaboration with Medis Medical Imaging, enhancing cath lab workflow and patient care while building on their December 2023 partnership.

- In December 2024, Grand Pharma received NMPA approval for its intravascular dual-mode imaging system, NOVASYNC, enabling commercialization in China. This milestone marked the successful technology transfer and full localization of the imported NOVASIGHT HYBRID SYSTEM, expanding the company’s domestic coronary imaging capabilities.

Market Scope

| Metrics | Details | |

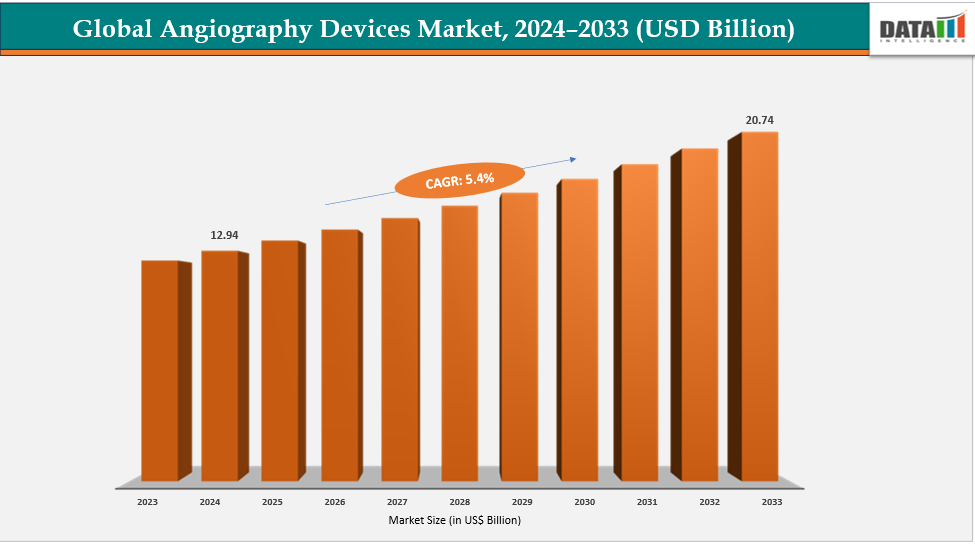

| CAGR | 5.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product | Angiography Systems, Catheters, Guidewires, Balloons, Others |

| By Technology | X-Ray Angiography, Magnetic Resonance Angiography, Computed Tomography Angiography, Others | |

| By Procedure | Coronary Angiography, Endovascular Angiography, Neurovascular Angiography, Onco-Angiography, Others | |

| By End‑User | Hospitals and Clinics, Diagnostic and Imaging Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global angiography devices market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical imaging-related reports, please click here