Global Wheel Loader Market: Industry Outlook

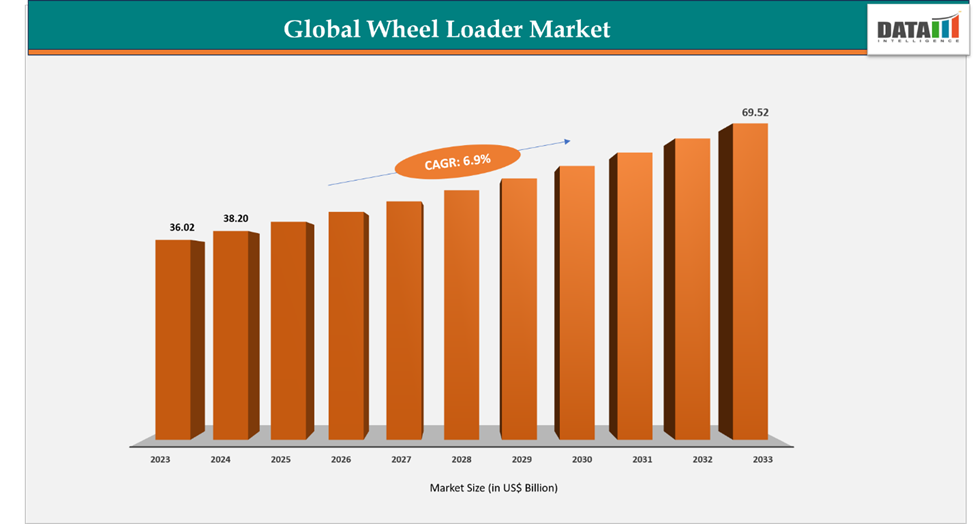

The global wheel loader market reached US$ 36.02 billion in 2023, with a rise to US$ 38.20 billion in 2024, and is expected to reach US$ 69.52 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2025–2033. The global wheel loader market is experiencing steady growth, fueled by rising demand in construction, mining, logistics, and material handling industries. Advancements in automation, AI-driven load management, telematics, and fuel-efficient powertrains are enhancing productivity, safety, and operational efficiency. Increasing investments in large-scale infrastructure, smart construction projects, and industrial modernization are further driving adoption of advanced wheel loaders. Collaborations between OEMs and technology providers are also accelerating innovation in machine performance, maintenance solutions, and operational optimization

The US remains the largest market for wheel loaders, supported by strong demand from construction, mining, and industrial sectors. Major infrastructure initiatives and modernization programs are boosting the need for high-performance wheel loaders with enhanced fuel efficiency, operator comfort, and automation features. Strategic partnerships between US manufacturers and global suppliers, combined with robust R&D capabilities, ensure that enterprises have access to advanced equipment, reinforcing the country’s leadership in the global wheel loader market.

Japan is a key market in the Asia-Pacific region, driven by industrial modernization, urban development, and mining activities. The focus is on energy-efficient and technologically advanced wheel loaders to optimize operational productivity and reduce costs. Collaborations with global OEMs enable Japanese companies to leverage smart fleet management, telematics, and automation technologies, accelerating adoption of next-generation machinery.

Digital Twin technology is transforming the wheel loader market by creating virtual models of physical machines for real-time monitoring, predictive maintenance, and performance optimization. These solutions enable operators to simulate operations, monitor equipment health, optimize load cycles, and minimize downtime. Leading manufacturers, including Caterpillar, Volvo CE, Komatsu, and Hitachi Construction Machinery, are integrating IoT sensors, telematics, and AI-driven analytics to deliver digital twin capabilities that enhance operational efficiency, extend equipment lifespan, and reduce maintenance costs. For instance, Hitachi Construction Machinery has unveiled a real-time digital twin platform for construction sites, supporting progress management and autonomous machinery operation. Through collaboration with technology partners aptpod and Unicast, this platform aims to improve safety and productivity while addressing industry labor shortages. Digital twin wheel loaders are particularly valuable for large-scale construction and mining projects, where predictive analytics and precise operational planning are critical for efficiency and cost optimization.

Key Market Trends & Insights

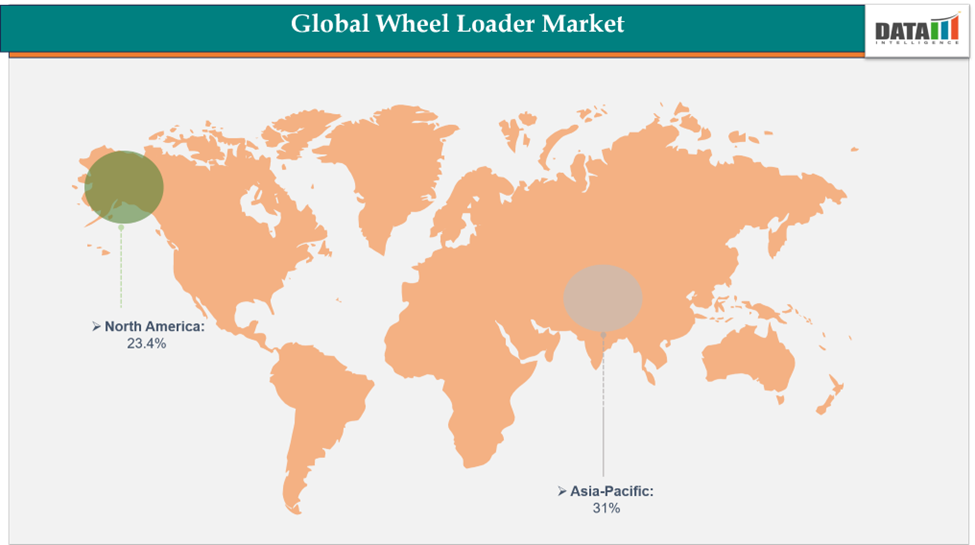

- Asia-Pacific accounted for approximately 31% of the global wheel loader market in 2024 and is expected to maintain its dominance throughout the forecast period. This leadership is supported by rapid urbanization, large-scale infrastructure projects, and growing industrial and mining activities in countries such as China, India, and Japan. Investments in smart construction, energy-efficient machinery, and mechanization are further fueling adoption. For instance, Caterpillar Inc. has signed an investment agreement with the Suzhou Industrial Park Administrative Committee (SIPAC) to build a new wheel loader manufacturing facility in China’s Jiangsu province. The new facility will be wholly owned and operated by Caterpillar, enhancing production capacity and supporting regional demand for advanced wheel loaders.

- North America is projected to be the fastest-growing region, driven by significant investments in infrastructure modernization, industrial expansion, and large-scale construction projects. The US market is supported by strong R&D capabilities and partnerships between OEMs and construction firms, ensuring access to technologically advanced wheel loaders with enhanced fuel efficiency, automation, and operator comfort. Rising demand for efficient material handling in construction, mining, and logistics sectors continues to accelerate regional growth. For example, Volvo has launched a new generation of wheel loaders, featuring upgraded performance, fuel efficiency, and operator-focused innovations to meet evolving industry needs.

- Construction Wheel Loaders remain the dominant product category due to their essential role in earthmoving, material handling, and heavy-duty operations across construction, mining, and industrial projects. Broad adoption in infrastructure development, industrial facilities, and mining operations underscores their importance in driving technological innovations, including automation, telematics, and energy-efficient designs.

Market Size & Forecast

- 2024 Market Size: US$ 38.20 Billion

- 2033 Projected Market Size: US$ 69.52 Billion

- CAGR (2025–2033): 6.9%

- Asia-Pacific: Largest market in 2024

- North America: Fastest-growing market

Market Dynamics

Driver: Rapid Urbanization and Infrastructure Development

The global wheel loader market is witnessing robust growth due to accelerating urbanization and the expansion of infrastructure projects worldwide. Rapidly growing urban centers, industrial hubs, and transportation networks are driving the demand for efficient material-handling and earthmoving equipment. In emerging economies such as India, large-scale initiatives in roads, bridges, airports, and urban development are key contributors to the adoption of wheel loaders. The Indian government’s focus on megaprojects, smart city development, and industrial modernization is creating substantial demand for high-capacity, technologically advanced machinery capable of handling large-scale construction tasks with speed and precision.

Wheel loaders play a vital role in supporting these initiatives, from foundation work and land clearing to bulk material transport and site preparation. Advanced wheel loaders with telematics, automation features, and fuel-efficient engines are increasingly being deployed to maximize productivity and minimize operational costs. Additionally, the integration of digital technologies and operator-assist systems allows construction companies to optimize workflows, track performance in real-time, and reduce downtime, further enhancing the value of wheel loaders in urban and infrastructure development projects. These factors collectively position urbanization and infrastructure expansion as key drivers shaping the long-term growth trajectory of the global wheel loader market.

Restraint: Operational and Maintenance Costs

Despite their critical role in construction and industrial projects, wheel loaders face significant challenges related to operational and maintenance expenses. The total cost of ownership can be high due to fuel consumption, periodic maintenance, spare part replacements, and specialized operator requirements. For small and medium-sized contractors, these costs may limit adoption or lead to reliance on older, less efficient machinery.

Manufacturers are actively addressing these challenges through innovative designs and integrated technologies. For instance, Caterpillar’s medium wheel loaders are engineered for industry-leading fuel efficiency and simplified maintenance, providing multiple size, power, and bucket options to suit diverse worksites. Features such as Cat Payload, a factory-integrated technology, allow operators to work faster and more accurately by measuring load weights in real-time, improving productivity and reducing errors. The combination of enhanced fuel efficiency, easy maintenance, and intelligent load management helps to mitigate high operational costs, extend machine life, and optimize performance across construction projects. By addressing operational and maintenance challenges, OEMs are enabling broader adoption of wheel loaders in both developed and emerging markets, ensuring that the equipment remains a reliable backbone for large-scale infrastructure and urban development initiatives.

For more details on this report, Request for Sample

Global Wheel Loader Market Segment Analysis

The global wheel loader market is segmented based on type, propulsion, application and region.

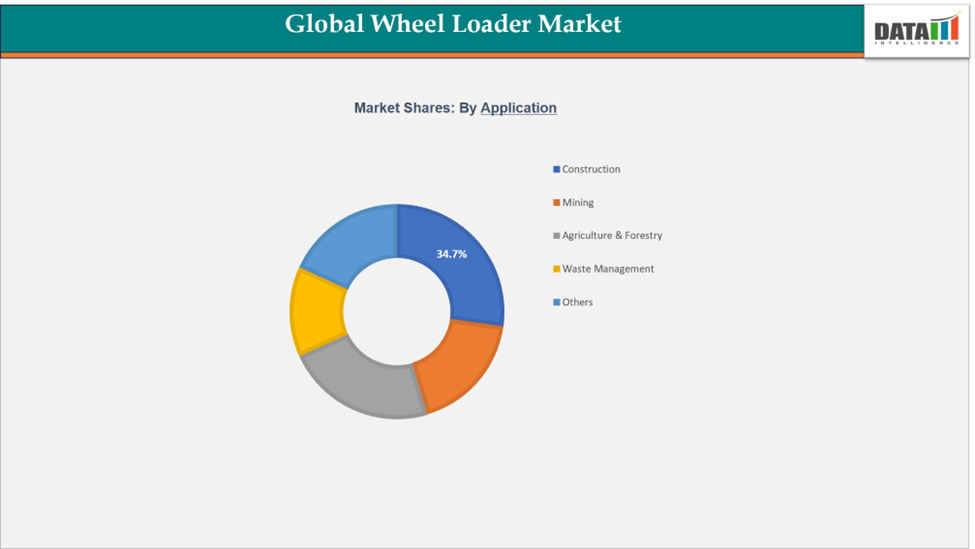

Application: The Construction segment accounts for an estimated 34.7% of the global wheel loader market.

The construction segment remains the largest and most influential category in the global wheel loader market, owing to its essential role in earthmoving, material handling, and large-scale infrastructure development. Wheel loaders are widely used across road construction, commercial buildings, industrial facilities, and urban projects due to their versatility and efficiency. Modern loaders equipped with fuel-efficient engines, telematics, and automation systems are increasingly preferred by contractors seeking higher productivity and operational reliability.

Within this segment, the 100hp category has gained particular attention as manufacturers aim to bridge the gap between compact and medium-size wheel loaders. CASE Construction Equipment’s 421G wheel loader is a prime example, designed to meet this specific market need. Weighing 8,970 kg, the 421G is compatible with a 1.5 m³ standard bucket or a 1.7 m³ light material bucket, providing flexibility for a variety of construction tasks. Its design balances lifting power with maneuverability, making it ideal for urban construction sites where space is limited, yet heavy-duty performance is required.

The 421G also enhances operator efficiency and comfort, featuring ergonomic controls, advanced visibility, and intuitive operation. By filling the gap between smaller compact loaders and larger medium-size machines, CASE enables contractors to optimize their fleets, reduce idle time, and improve project productivity. This launch highlights how innovation within the construction segment focuses on meeting specific operational requirements while maintaining high standards of durability, efficiency, and performance.

Geographical Analysis

The Asia-Pacific wheel loader market was valued at 31% market share in 2024

The Asia-Pacific wheel loader market was valued at approximately 31% of the global market share in 2024 and is expected to maintain its dominance throughout the forecast period. Market growth in the region is driven by rapid urbanization, large-scale infrastructure projects, and increasing industrial development. Countries such as China, Japan, and South Korea are at the forefront, investing heavily in roads, bridges, airports, and urban construction projects. For instance, Caterpillar Inc. signed an investment agreement with the Suzhou Industrial Park Administrative Committee (SIPAC) to establish a new wheel loader manufacturing facility in China’s Jiangsu province, highlighting the region’s focus on strengthening local production capacity and supporting growing demand for construction machinery.

Further reinforcing regional growth, on February 26, 2025, SDLG held a grand dispatch ceremony at its factory for 18 large-scale machines, including L9100H large wheel loaders and E6800H ultra-large excavators, which were delivered to a major client in Asia-Pacific. This milestone underscores SDLG’s global expansion strategy and commitment to providing high-performance equipment to meet the increasing demand in the region. Combined government-backed initiatives, private-sector infrastructure investments, and large-scale deliveries from leading manufacturers continue to accelerate Asia-Pacific’s share of the global wheel loader market.

The North America wheel loader market was valued at 23.4% market share in 2024

The North America wheel loader market held approximately 23.4% of the global market share in 2024, remaining the largest regional contributor. Growth in the region is driven by ongoing infrastructure modernization, urban development projects, and increasing demand for high-performance construction equipment. Strong R&D capabilities, advanced manufacturing technology, and strategic investments by leading OEMs continue to reinforce the region’s market leadership.

In particular, Volvo CE recently debuted two mid-size electric wheel loader machines in North America, offering enhanced operational efficiency, sustainability, and performance for construction and infrastructure projects. These launches reflect the region’s focus on adopting innovative, eco-friendly machinery and advanced technologies to support evolving construction requirements. Coupled with robust industrial activity and government-backed infrastructure programs, these developments ensure North America maintains its dominant position in the global wheel loader market.

Competitive Landscape

The major players in the wheel loader market include Liebherr, Caterpillar, AB Volvo, J C Bamford Excavators Ltd., Komatsu, HD Hyundai Construction Equipment, Hitachi Construction Machinery Co., Ltd, Doosan Infracore, XCMG Group, CNH Industrial America LLC

Liebherr: Liebherr is a global leader in construction machinery, offering a comprehensive range of high-performance wheel loaders designed for efficiency, durability, and versatility. The company focuses on delivering innovative solutions for construction, mining, and infrastructure projects, emphasizing fuel efficiency, advanced hydraulics, and operator comfort. Liebherr’s wheel loaders are widely adopted across North America, Asia-Pacific, and Europe, with models tailored to meet diverse operational requirements. Continuous investments in R&D, automation, and digital technologies enable Liebherr to maintain a competitive edge, addressing the evolving needs of large-scale construction and industrial applications worldwide.

Market Scope

| Metrics | Details | |

| CAGR | 6.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Compact Loaders, Medium Loaders, Large Loaders |

| Propulsion | Diesel, Electric, Hydrogen | |

| Application | Construction, Mining, Agriculture & Forestry, Waste Management, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global wheel loader market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more wheel loader-related reports, please click here