Global Warehouse Robots Market: Industry Outlook

The global warehouse robots market reached US$ 6.2 billion in 2023, with a rise to US$ 6.9 billion in 2024, and is expected to reach US$ 19.5 billion by 2033, growing at a CAGR of 12.2% during the forecast period 2025–2033. The global warehouse robots market is experiencing robust growth, driven by the exponential rise of e-commerce, persistent labor shortages, and the critical need for supply chain optimization. These autonomous machines, including autonomous mobile robots (AMRs), robotic arms, and goods-to-person systems, enhance operational efficiency by automating tasks such as sorting, picking, palletizing, and transportation. The demand is further fueled by advancements in AI, machine learning, and sensor technology, which have improved the capabilities and affordability of robotic solutions. The market experiences a high growth as 80% of warehouses still lack any form of automation, presenting a vast untapped opportunity for adoption.

North America, and particularly the United States, represents a rapidly advancing region within this global landscape. The high concentration of major retailers, third-party logistics (3PL) providers, and tech giants, coupled with intense pressure for faster delivery times, makes the US a primary adopter of warehouse automation. Significant investments are being channeled into modernizing fulfillment centers to stay competitive. Reflecting this trend, the US warehouse robotics market is a significant contributor to the global figures.

Key Market Trends & Insights

- Asia Pacific holds the highest market share, driven by explosive growth in manufacturing automation, fueling demand for robotic arms in warehouses. This is evidenced by China’s installation of over 290,000 industrial robots in 2022, a significant portion dedicated to logistics.

- North America is expected to witness high growth due to the massive integration of autonomous mobile robots (AMRs) for goods-to-person picking to combat high labor costs. This is driven by the need for efficiency, with currently more than 21,000 warehouses operating in the US.

- In Europe, sustainability is a major driver, with a strong trend toward deploying energy-efficient robots and optimizing warehouse layouts to reduce carbon footprints. This aligns with the EU's goal to cut logistics emissions by 90% by 2050.

Market Size & Forecast

- 2024 Market Size: US$ 6.9 billion

- 2033 Projected Market Size: US$ 19.5 billion

- CAGR (2025–2033): 12.2%

- Asia Pacific: Largest market in 2024

- North America: Fastest-growing market

Market Dynamics

Driver: Rising Demand for Faster and Error-Free Order Fulfillment in E-Commerce

A primary driver for the global warehouse robots market is the critical need to enhance order fulfillment speed and accuracy to meet escalating consumer expectations for rapid delivery. The rise of next-day and same-day delivery guarantees has placed immense pressure on logistics networks, making manual processes increasingly untenable. Warehouse robots, particularly autonomous mobile robots (AMRs), excel by navigating facilities autonomously to bring shelves to human pickers, drastically reducing walking time and streamlining the entire picking and packing operation. This directly translates into faster order processing and a significant reduction in errors, which is essential for maintaining customer satisfaction in the competitive e-commerce landscape.

Amazon has deployed over 750,000 robotic drive units in its fulfillment centers worldwide, working in concert with human employees. This massive automation initiative is a core component of its ability to promise and deliver expedited shipping to billions of Prime subscribers. Following its acquisition of Kiva Systems, Amazon's implementation of mobile robotics has been credited with slimming order cycle times by up to 40% and increasing storage capacity by optimizing dense inventory stacking, showcasing a direct correlation between robotic adoption and operational performance.

Warehouses utilizing AMRs for goods-to-person picking can achieve a 200-300% increase in pick rates compared to traditional methods. Furthermore, over 4 billion commercial warehouse robots will be installed by 2025, a figure heavily influenced by the need for speed. This surge is a direct response to the unrelenting growth of e-commerce, where the ability to fulfill orders accurately and swiftly is no longer a luxury but a fundamental requirement for business survival and growth.

Restraint: High Upfront Capital Costs Limiting Adoption among SMEs

A significant restraint on the warehouse robots market is the substantial upfront capital investment required for integration. The costs extend beyond the robots themselves to include necessary warehouse infrastructure modifications, sophisticated software implementation, and ongoing maintenance and specialized operator training. This high initial expenditure creates a formidable barrier to entry, particularly for small and medium-sized enterprises (SMEs) with limited capital. Consequently, many businesses, despite recognizing the long-term benefits in efficiency and cost-saving, are financially unable to adopt this automation technology, slowing overall market penetration outside of large, well-funded corporations.

For more details on this report, Request for Sample

Global Warehouse Robots Market Segment Analysis

The global warehouse robots market is segmented based on robot type, function, payload capacity, end-use industry and region.

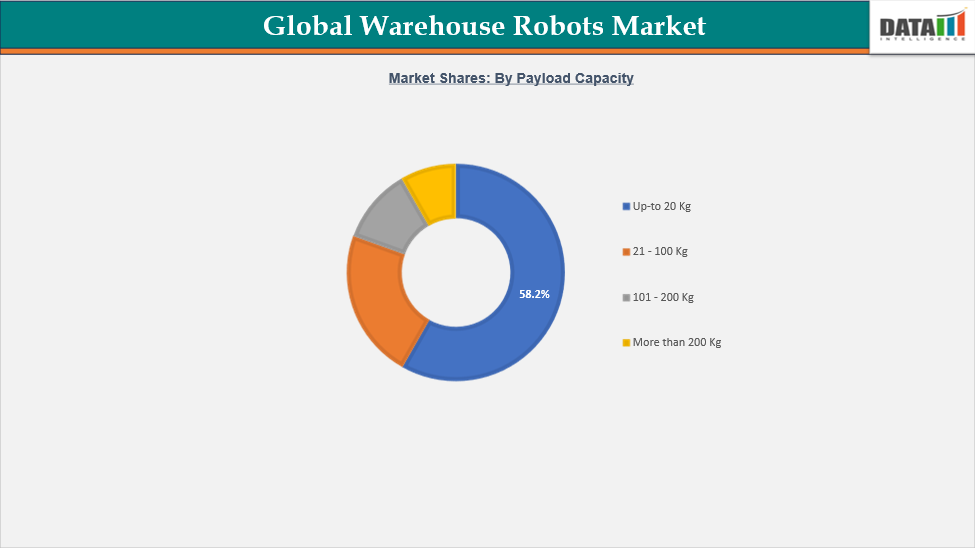

Payload Capacity: The up-to 20 Kg segment is estimated to have 58.2% of the warehouse robots market share.

The up-to-20 kg payload segment is the undisputed growth engine of the global warehouse robotics market, primarily driven by the relentless expansion of e-commerce. This category is perfectly suited for the vast majority of items sold online, including electronics, apparel, and pharmaceuticals, which typically fall within this weight range. The core value proposition lies in automating the most labor-intensive process, that is order picking. By deploying fleets of nimble Autonomous Mobile Robots (AMRs) that bring shelves to stationary pickers, companies achieve dramatic gains in speed and accuracy, directly addressing consumer demands for rapid fulfillment. This goods-to-person methodology is revolutionizing warehouse operations, making it the dominant automation strategy for retailers and third-party logistics providers (3PLs).

PUMA implemented a fleet of AMRs from Geek+ at its distribution center in Germany, where the robots were tasked with transporting picking carts filled with shoes and apparel, all well under the 20 kg limit. This system was designed to support a massive throughput goal of over 80,000 items shipped daily. The results were transformative, enabling a 50% reduction in order processing time while simultaneously doubling the average number of lines picked per hour. This direct correlation between AMR adoption and productivity underscores the segment's critical role in achieving competitive advantage through operational excellence.

The massive adoption is fueled by the segment's versatility, encompassing not just AMRs but also collaborative robotic arms for light assembly and drones for inventory counting. The market for these agile robots is projected to grow at a high CAGR as the continuous growth of online retail makes their value proposition indispensable for modern logistics. Their ability to integrate quickly and deliver a rapid return on investment ensures this segment will remain the focal point of warehouse automation innovation.

Geographical Analysis

The Asia-Pacific warehouse robots market was valued at 39.1% market share in 2024

The Asia-Pacific (APAC) region is the dominant force and primary growth engine in the global warehouse robots market, far surpassing other regions in both scale and adoption rate. This leadership is fueled by a potent combination of massive government initiatives, rising labor costs, and e-commerce expansion. Countries such as China, South Korea, and Japan are aggressively promoting industrial automation through policies such as "Made in China 2025," directly subsidizing and incentivizing robotic adoption in logistics. The sheer volume of goods moving through APAC's supply chains makes automation a critical necessity for maintaining economic momentum and global competitiveness.

A landmark case study is Japanese logistics giant Yamato Holdings, which faced crippling labor shortages amid rising delivery demand. The company deployed a massive fleet of autonomous mobile robots (AMRs) from a local vendor in a new, highly automated sorting facility. This system handles billions of parcels, with most individual items falling well below 20 kg. The implementation was a success, boosting sorting efficiency by 40% and enabling the facility to operate with a 30% smaller workforce despite handling a significantly higher parcel volume, showcasing automation's role in solving demographic challenges. The growth is further propelled by the dense concentration of global manufacturing and the emergence of massive e-commerce platforms such as Alibaba and JD.com in the region.

The North America warehouse robots market was valued at 27.5% market share in 2024

The North American warehouse robots market is characterized as a mature, high-value arena defined by its rapid adoption of cutting-edge technology to solve acute logistical challenges. Its growth is primarily driven by the relentless pressure of e-commerce giants, severe labor shortages in the warehousing sector, and the intense consumer demand for next-day and same-day delivery. Unlike regions focused on manufacturing automation, North American deployment is concentrated in fulfillment and distribution centers, where speed and scalability are paramount. This environment has made it the global testing ground for sophisticated autonomous mobile robots (AMRs) and complex fleet management software.

A pivotal case study is Walmart Canada, which addressed capacity constraints by implementing a vast system of robotic fulfillment technology from Symbotic across its regional distribution centers. This end-to-end automation system, which includes fleets of robots working in unison, sorts and transports billions of individual items. The results were transformative, increasing the facility’s throughput by up to 40% while achieving nearly 100% inventory accuracy. This demonstrates how major retailers are leveraging automation not for incremental gains but for fundamental, large-scale operational transformation.

The United States accounts for more than 90% of the regional market share, with sustained growth fueled by the need to maximize storage density in expensive real estate markets and to build resilient supply chains capable of weathering future disruptions, cementing automation as a cornerstone of modern North American logistics strategy.

Competitive Landscape

The global warehouse robots market features several prominent players, including ABB Group, KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Honeywell International Inc, Omron Corporation, Toyota Material Handling Solutions, Daifuku Co., Ltd., KION GROUP AG, and Geekplus Technology Co., Ltd., among others.

ABB Group: ABB Group is a global powerhouse in industrial automation and a key player in the warehouse robotics market, primarily through its comprehensive range of robotic arms. Unlike companies focused on mobile robots, ABB excels in automated palletizing, depalletizing, and case-picking solutions. Their robots are engineered for high-speed, heavy-payload applications, integrating advanced vision systems and software to handle complex tasks in distribution and fulfillment centers. A major client such as Walmart utilizes ABB's robotic solutions to automate distribution, highlighting their role in providing robust, precision automation for the demanding logistics sector, particularly for tasks beyond the scope of smaller, mobile units.

Market Scope

| Metrics | Details | |

| CAGR | 12.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Robot Type | Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Collaborative Robots, Articulated Robots, Cylindrical Robots and Others |

| Function | Transportation, Picking & Placing, Palletizing & Depalletizing and Sorting & Packaging | |

| Payload Capacity | Up-to 20 Kg, 21 - 100 Kg, 101 - 200 Kg and More than 200 Kg | |

| End-use Industry | Automotive, Chemicals, Semiconductors & Electronics, Retail & E-Commerce, Food & Beverage, Pharmaceuticals and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global warehouse robots market report delivers a detailed analysis with 70 key tables, more than 71 visually impactful figures, and 234 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here