Vascular Patches Market Size& Industry Outlook

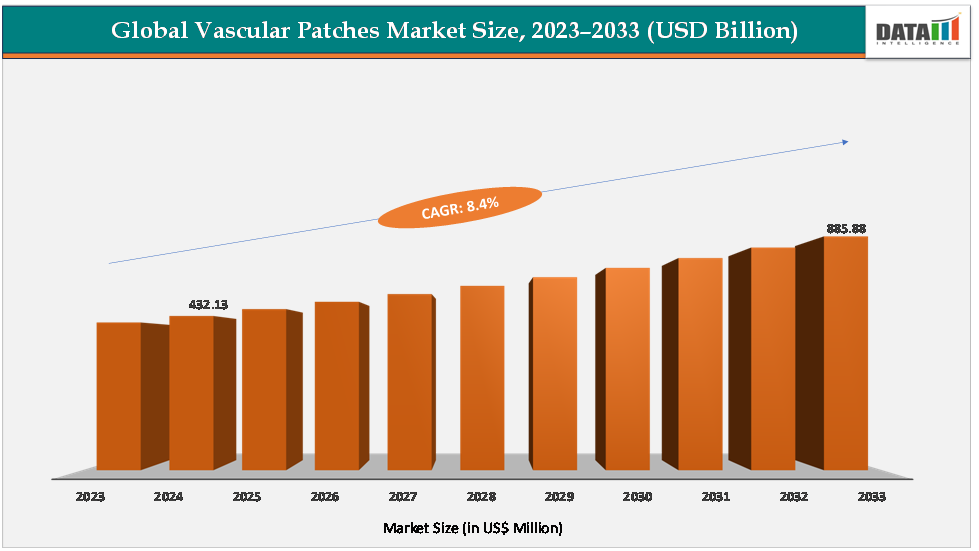

The global vascular patches market size reached US$432.13Million in 2024 from US$401.13Millionin 2023 and is expected to reach US$ 885.88Million by 2033, growing at a CAGR of 8.4%during the forecast period 2025-2033.

The market is driving growth by addressing the rising burden of cardiovascular diseases and the increasing preference for safe, durable surgical closure methods in procedures like carotid endarterectomy, aortic repair, and peripheral bypass. Surgeons increasingly choose biologic patches such as LeMaitre’s XenoSure bovine pericardium patch, Edwards Lifesciences’ pericardial patches, due to superior biocompatibility and reduced restenosis, while synthetic options like W. L. Gore’s GORE-TEX vascular patch and Bard’s Dacron/ePTFE patches remain widely used for cost-effectiveness and durability. The FDA and CE approvals of these products, coupled with clinical evidence of lower complication rates, are accelerating the growth of the market.

Key Market Highlights

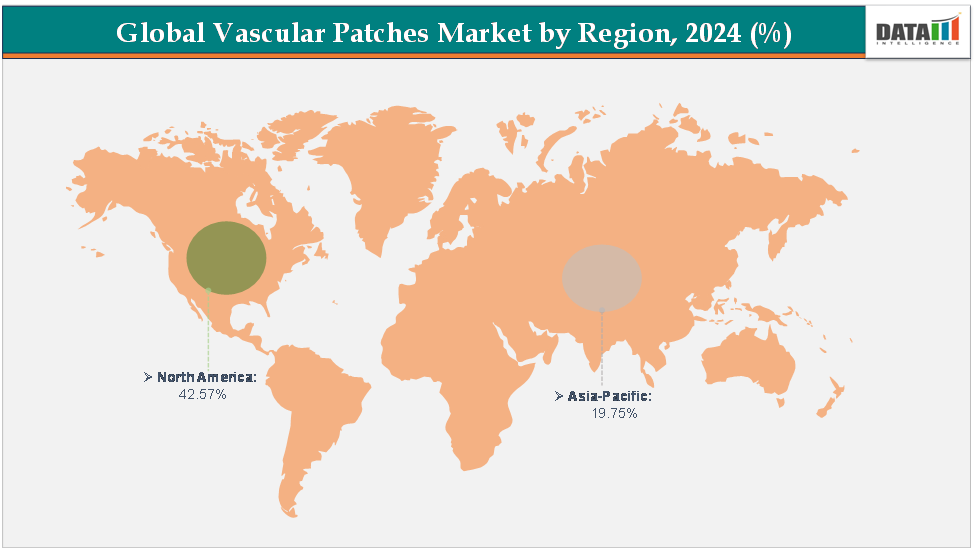

- North America dominates the vascular Patches Market with the largest revenue share of 42.57% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.7% over the forecast period.

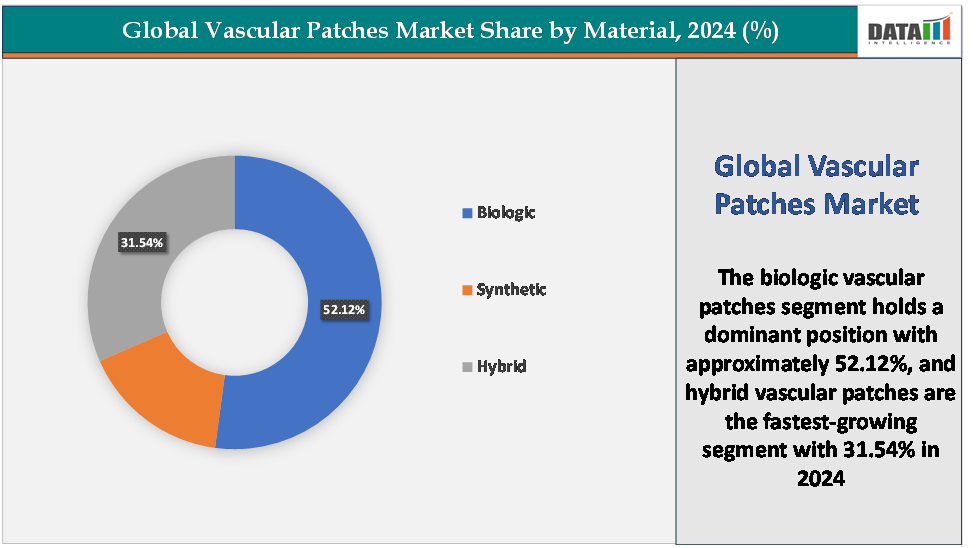

- Based on material, the biologic vascular patch segment led the market with the largest revenue share of 52.12% in 2024.

- The major market players in the vascular patches market are Baxter, B. Braun SE, BD, W. L. Gore & Associates, Inc., Edwards Lifesciences Corporation, LeMaitre Vascular, Inc., Getinge, and Labcor Laboratories Ltda, among others

Market Dynamics

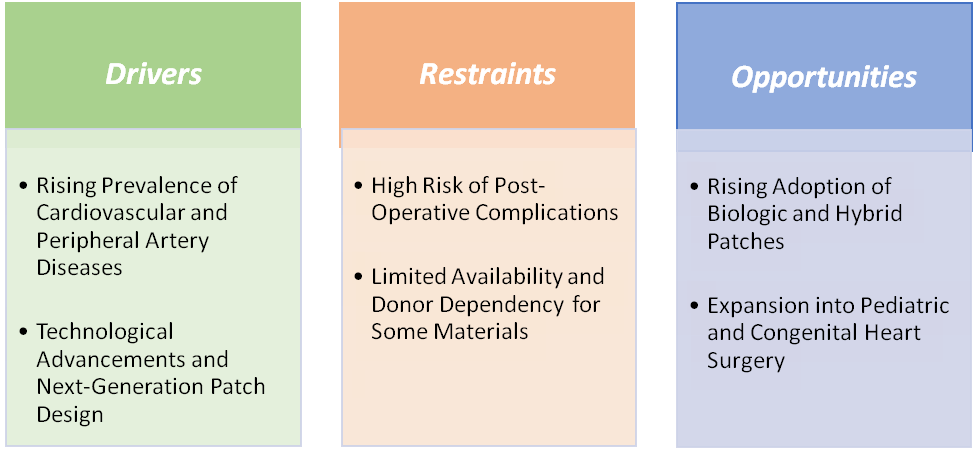

Drivers:

The rising prevalence of cardiovascular and peripheral artery diseases is significantly driving the vascular patches market growth

The rising prevalence of cardiovascular and peripheral artery diseases is driving the vascular patches market growth, as the increasing global burden of these conditions directly translates into higher surgical procedure volumes where patches are an integral part of treatment. According to the World Health Organization, cardiovascular diseases account for nearly 19.8 million deaths annually, representing about 33% of all global deaths, with strokes and heart attacks making up the majority, while the number of people living with cardiovascular disease has almost doubled due to aging populations, urbanization, and rising lifestyle-related risk factors such as diabetes, hypertension, and obesity.

Surgical interventions like carotid endarterectomy (CEA) for carotid artery stenosis are performed in an estimated 150,000 cases globally per year, according to the National Institutes of Health. They routinely employ vascular patches because patch angioplasty closure is associated with lower restenosis and complication rates compared with primary closure. The same applies to procedures for abdominal aortic aneurysm repair, peripheral bypasses, and arteriovenous (AV) access creation in dialysis patients, all of which increasingly rely on patches for vessel reconstruction.

This rising disease burden has created strong demand for both biologic and synthetic patches, as reflected in the adoption of products such as LeMaitre’sXenoSure bovine pericardial patch, known for its suture strength and biocompatibility, Cryolite's CardioCel and VascuCel, designed to resist calcification and promote long-term durability, W. L. Gore’s ACUSEAL cardiovascular patch, offering rapid hemostasis in synthetic form, and Edwards Lifesciences’ Duravessbovine pericardial patch, used in carotid, femoral, and iliac repairs. With cardiovascular and peripheral vascular procedures set to rise further in both developed and emerging markets, vascular patches are positioned as a clinical necessity, and the growing pipeline of FDA- and CE-approved products underscores their role as a key growth engine within the broader cardiovascular device industry.

Restraints:

The high-risk of post-operative complications is hampering the growth of the market

One of the major restraints hampering the growth of the vascular patches market is the high risk of post-operative complications associated with their use, which often makes surgeons cautious and sometimes leads to alternative techniques being preferred. Complications such as patch infection, pseudoaneurysm formation, thrombosis, bleeding, restenosis, and even patch rupture have been reported, particularly with synthetic materials like ePTFE or Dacron that may not integrate as seamlessly with host tissue. For instance, infections following synthetic patch implantation can necessitate revision surgery or patch removal, leading to increased patient morbidity and higher healthcare costs.

W. L. Gore’s ePTFE patches offer durability but have been linked to suture-line bleeding or pseudoaneurysm in rare cases, which raises clinical concerns. These risks drive some surgeons to opt for primary closure techniques or autologous vein grafts, particularly in infection-prone patients, limiting the universal adoption of vascular patches. Moreover, complications in procedures like carotid endarterectomy, where patch angioplasty is otherwise recommended, can impact confidence in patch use and slow market penetration. As a result, while patches are clinically valuable, the lingering fear of post-operative adverse events continues to act as a barrier to broader uptake, particularly in conservative surgical environments and emerging markets with limited infection control resources.

For more details on this report – Request for Sample

Segmentation Analysis

The global vascular patches market is segmented based on material, application, end-user, and region.

Material:

The biologic vascular patches segment is dominating the vascular patches market with a 52.12% share in 2024

The biologic vascular patches segment is dominating the vascular patches market due to its strong clinical advantages, surgeon preference, and proven track record in reducing post-operative complications compared with synthetic alternatives. Biologic patches, typically derived from bovine or porcine pericardium or processed human tissue, offer superior biocompatibility, flexibility, and resistance to infection, which makes them highly suitable for procedures such as carotid endarterectomy, peripheral bypass, and aortic repairs. Clinical studies and surgical guidelines consistently show that patch angioplasty using biologic materials reduces the risk of restenosis and pseudoaneurysm formation, leading to better long-term outcomes.

For instance, Lemaitre's XenoSure bovine pericardial patch, widely approved by the FDA and CE, has become one of the most frequently used biologic patches worldwide because of its ease of handling, strong suture retention, and low thrombogenicity. Similarly, CryoLife’s CardioCel and VascuCel bioscaffold patches, engineered with anti-calcification technology, are gaining traction in both adult and pediatric cardiovascular surgeries, as they integrate well with host tissue and provide durable repair solutions. Edwards Lifesciences’ Duravess bovine pericardial patch is also commonly used in carotid, femoral, and iliac endarterectomies, where its natural collagen structure promotes healing and reduces complication rates.

Additionally, in infection-prone or high-risk patient populations, surgeons often default to biologic patches to minimize post-operative complications, further cementing their market dominance. As cardiovascular and peripheral vascular surgeries continue to rise globally, the biologic segment’s growth is accelerating, driven not only by superior clinical outcomes but also by ongoing innovation in hybrid biologic-synthetic and anti-calcification technologies, ensuring that biologic patches remain the dominant force shaping the vascular patches market landscape.

The hybrid vascular patches are the fastest-growing segment in the vascular patches market, with a 31.54% share in 2024

The hybrid vascular patches segment is emerging as the fastest-growing category in the vascular patches market, largely because it addresses the limitations of both traditional biologic and synthetic materials by combining their strengths. Hybrid patches are engineered to integrate the biocompatibility and infection resistance of biologics with the mechanical strength, durability, and controlled performance of synthetics, making them highly attractive for surgeons tackling complex cardiovascular and peripheral vascular procedures.

For instance, Comatrix ECM patches, derived from extracellular matrix technology, exemplify a hybrid approach by remodeling into living tissue while offering structural support, and they are FDA-cleared for cardiovascular repair, gaining increasing adoption in US hospitals. Similarly, Humacyte’s investigational bioengineered human acellular vessels (HAVs), though still in late-stage trials, are drawing global attention for their ability to act like synthetic grafts initially and then remodel biologically, representing a breakthrough in regenerative medicine. These innovative solutions are being evaluated in applications such as arteriovenous access for dialysis, aortic reconstruction, and congenital heart defect repairs, areas where long-term durability and reduced complication risks are especially valued.

Geographical Analysis

North America is expected to dominate the global vascular patches market with a 42.57% in 2024

North America is the dominant region in the global vascular patches market, driven by a combination of advanced healthcare infrastructure, high disease prevalence, favorable reimbursement policies, and the strong presence of leading market players. The combination of a large aging population, higher surgical volumes, robust healthcare funding, and cutting-edge product availability ensures that North America continues to hold the largest share of the vascular patches market, setting clinical and technological benchmarks for other regions to follow.

US Vascular Patches Market Trends

The US has one of the highest burdens of cardiovascular and peripheral artery diseases, with the CDC estimating that about 20 million Americans live with coronary artery disease and nearly 6.5 million with peripheral artery disease (PAD). This large patient pool generates substantial demand for vascular interventions such as carotid endarterectomy, abdominal aortic aneurysm repair, and peripheral bypass surgery, where vascular patches are a critical component.

The US also benefits from early regulatory approvals and rapid adoption of advanced products, with the US FDA approving widely used biologic patches such as Lemaitre's XenoSure bovine pericardial patch, CryoLife’s CardioCel and VascuCel bioscaffold patches, and Edwards Lifesciences’ Duravess bovine pericardial patch, as well as synthetic options like Gore’s ACUSEAL cardiovascular patch and Bard’s Dacron patches.

Additionally, the presence of leading manufacturers headquartered in the United States, such as W. L. Gore & Associates and CryoLife, ensures steady innovation, distribution, and surgeon training programs that reinforce regional dominance. Academic research centers and hospitals in the US also lead in clinical trials and adoption of next-generation hybrid vascular patches, including products like CorMatrix ECM patches, which leverage regenerative medicine technology and are already in use for select cardiovascular applications.

The Asia Pacific region is the fastest-growing region in the global vascular patches market, with a CAGR of 8.7% in 2024

The Asia Pacific region is the fastest-growing market for vascular patches, fueled by its rapidly expanding patient base, rising healthcare investments, and growing adoption of advanced cardiovascular surgical products. The region faces a significant burden of cardiovascular and peripheral artery diseases, with the World Health Organization reporting that nearly 60% of global cardiovascular deaths occur in Asia, largely driven by aging populations, diabetes, smoking, and hypertension.

Countries like Japan, China and India, home to the largest diabetic populations worldwide, are seeing a surge in vascular surgeries such as carotid endarterectomy, peripheral bypasses, and aortic repairs, all of which create strong demand for vascular patches. Multinational players are actively expanding their footprint in the Asia Pacific, introducing FDA- and CE-approved products such as LeMaitre’s XenoSure bovine pericardial patch, CryoLife’s CardioCel, and W. L. Gore’s ACUSEAL patch into the region through distributor networks and local partnerships.

Europe Vascular Patches Market Trends

Europe represents one of the most important growth drivers of the vascular patches market, supported by its high cardiovascular disease burden, well-established healthcare infrastructure, and early adoption of innovative medical devices. Cardiovascular diseases remain the leading cause of mortality in the region, accounting for over 3.9 million deaths annually, which translates into significant demand for surgical interventions where vascular patches are indispensable.

European surgeons have been early adopters of patch angioplasty in carotid endarterectomy, considered the gold standard to reduce restenosis risk. Alongside widely used biologic and synthetic products, the region has also seen the introduction and adoption of specialized patches such as Baxter’s Peri-Guard bovine pericardial patch and Getinge’s Biosynthetic patches, both of which are commonly used in vascular and cardiac repair across European hospitals. Europe also benefits from the presence of leading device manufacturers, such as Getinge AB, known for its innovations in biosynthetic vascular solutions.

Competitive Landscape

Top companies in the vascular patches market include Baxter, B. Braun SE, BD, W. L. Gore & Associates, Inc., Edwards Lifesciences Corporation, LeMaitre Vascular, Inc., Getinge, and Labcor Laboratórios Ltda, among others.

Market Scope

| Metrics | Details | |

| CAGR | 8.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Material | Biologic, Synthetic, and Hybrid |

| Application | Carotid Endarterectomy, Open Repair of Abdominal Aortic Aneurysm, Aortic Repairs, Vascular Bypass Surgery, Arteriovenous (AV) Procedures, and Others | |

| End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global vascular Patches Market report delivers a detailed analysis with 56 key tables, more than 54visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here