US Soy Protein Market Size

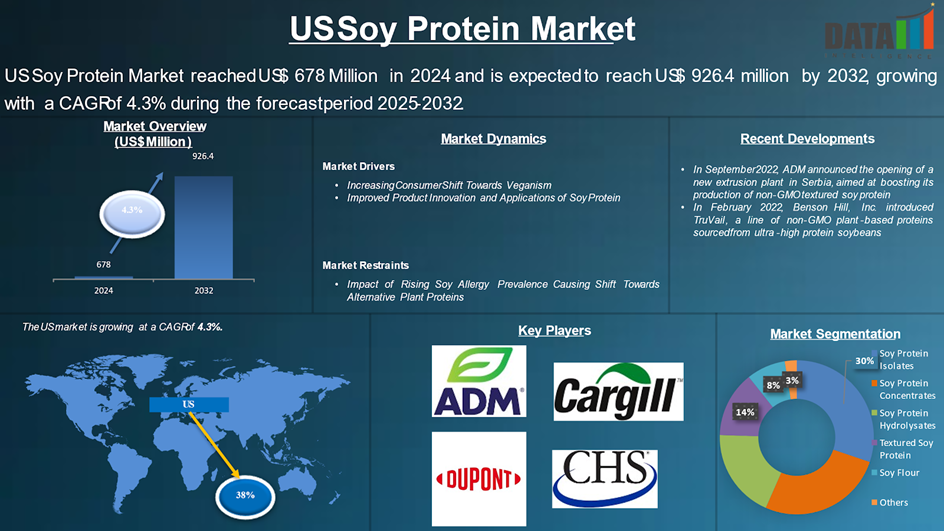

US Soy Protein Market reached US$ 678 Million in 2024 and is expected to reach US$ 926.4 million by 2032, growing with a CAGR of 4.3% during the forecast period 2025-2032.

US soybean protein market is a pivotal component of the global plant-based protein industry, driven by a rising demand for sustainable and plant-derived food sources. As consumer preferences shift towards healthier, eco-friendly alternatives to animal protein, the market for soybean-derived products has seen significant growth.Soy protein is used in a variety of applications, including food products, animal feed and industrial uses, making it an essential part of both the domestic and global agricultural landscape.

In the 2023/2024 production season, US is projected to contribute 29% of the world’s soybean production, amounting to approximately 113.34 million metric tons, according to the USDA. This positions the US as a major supplier of soybeans, with exports accounting for 52% of the total production. This export strength is critical in meeting global demand for soy protein products, particularly as plant-based proteins gain traction worldwide.

Executive Summary

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| CAGR | 4.3% |

| Size Available for Years | 2023-2032 |

| Forecast Period | 2025-2032 |

| Data Availability | Value (US$) |

| Segments Covered | Product Type, Form, Nature, Flavor and Application |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Market Dynamics

Increasing Consumer Shift Towards Veganism

The growing population of vegans in US is a significant driver for the expansion of US soy protein market. In 2023, according to a survey by USDA, more than 5% of Americans identified as following a vegan or vegetarian diet, a trend that continues to accelerate, particularly among younger generations who are more health-conscious and environmentally aware. This demographic shift has led to a surge in demand for plant-based food products, with soy protein emerging as a key ingredient due to its nutritional benefits, versatility and sustainability.

With over 15.5 million vegans in US in 2023, as per the World Animal Foundation, the rise in plant-based eating habits is reshaping the food landscape. Consumers are increasingly seeking alternatives to animal-based proteins and soy protein is at the forefront of this transition due to its complete amino acid profile, making it an attractive option for those seeking balanced, plant-based nutrition.

As the demand for vegan and vegetarian products continues to grow, US soy protein market is well-positioned to capitalize on this trend, with companies increasingly incorporating soy protein into a wide variety of food products, from meat alternatives to dairy-free options. This shift toward plant-based diets is expected to be a key growth driver for the soy protein market in the coming years.

Improved Product Innovation and Applications of Soy Protein

As consumer interest in plant-based diets continues to rise, manufacturers are planning expansion to meet the needs of manufacturers and consumers alike. For instance, in December 2022, Bunge, a global leader in agribusiness, food and ingredients, announced plans to invest around US$ 550 million in constructing a fully integrated facility for soy protein concentrate and textured soy protein concentrate. The significant investment drives growth by enhancing production capabilities.

Accordingly, in February 2022, Benson Hill, Inc. introduced TruVail, a line of non-GMO plant-based proteins sourced from ultra-high protein soybeans. The ingredients, including high-protein soy flour and texturized proteins, are less processed than traditional soy protein concentrate, using up to 70% less water and 50% less CO2 emissions. The company emphasizes sustainability through regenerative agriculture practices, ensuring eco-friendly benefits from farm to fork.

Impact of Rising Soy Allergy Prevalence Causing Shift Towards Alternative Plant Proteins

A significant restraint for US soy protein market is the growing prevalence of food allergies, particularly soy allergies, which are more common in infants and young children. Approximately 0.4% of infants in the US are affected by soy allergies, as reported by Food Allergy Research & Education (FARE). This raises concerns regarding allergic reactions, leading to a more cautious approach by consumers, particularly in the food and beverage sector where allergen labeling and safety are crucial.

As allergy concerns continue to rise, consumers are increasingly shifting toward alternative plant-based protein sources that are perceived as safer for individuals with soy sensitivities. Pea protein, rice protein, hemp protein, chickpea protein and pumpkin seed protein are gaining traction due to their hypoallergenic properties and suitability for those with soy, gluten or other food sensitivities. This shift in consumer preference towards allergen-free and clean-label products further limits the market potential.

Market Segment Analysis

The US soy protein market is segmented based on product type, form, nature, flavor and application.

Versatile Applications of Soy Protein Concentrates

The Europe soy protein market is segmented based on product type into soy protein isolates, soy protein concentrates, soy protein hydrolysates, textured soy protein, flour and others. The soy protein isolates dominate the market primarily due to their high protein content, typically around 88.3 g in 100 gr. This makes them an attractive option for health-conscious consumers and athletes seeking to increase their protein intake. As consumer awareness of plant-based diets continues to grow, the demand for soy protein isolates is likely.

The versatility of soy protein isolate allows for various applications, including meat alternatives, dairy substitutes, protein bars and baked goods. They possess excellent functional properties, such as emulsifying, foaming and water-binding capabilities. These characteristics enhance the texture and mouthfeel of food products, making them particularly valuable in the development of plant-based meats and dairy alternatives.

Major US Players

The major US players in the market include Archer Daniels Midland Company, Cargill, Incorporated, DuPont, CHS Inc., Wilmar International, Kerry Group PLC, The Scoular Company, Prinova Group LLC, NOW Foods and Devansoy Inc.

By Product Type

- Soy Protein Isolates

- Soy Protein Concentrates

- Soy Protein Hydrolysates

- Textured Soy Protein

- Soy Flour

- Others

By Form

- Dry

- Powder

- Granules

- Liquid

By Nature

- Organic

- Conventional

By Flavor

- Unflavored

- Flavored

- Vanilla

- Chocolate

- Savory Flavors

- Fruit Flavors

- Others

By Application

- Food & Beverages

- Bakery & Confectionery

- Meat Alternatives & Extenders

- Dairy Alternatives

- Functional Foods

- Infant Formulas

- Others

- Animal Feed

- Pharmaceuticals & Nutraceuticals

- Personal Care & Cosmetics

- Others

Key Developments

- In February 2022, Amfora launched its first-generation ultra-high plant protein products, including ultra-high protein soy flour, texturized vegetable protein and crisps. These products are made from proprietary soybeans that have 25% more protein than conventional soybeans, supporting sustainable nutrition and global wellness.

- In September 2022, ADM announced the opening of a new extrusion plant in Serbia, aimed at boosting its production of non-GMO textured soy protein. This expansion is part of the company’s strategy to support the increasing demand for meat alternatives in US and the Middle East.

- In February 2022, Benson Hill, Inc. introduced TruVail, a line of non-GMO plant-based proteins sourced from ultra-high protein soybeans.

Why Purchase the Report?

- To visualize the US soy protein market segmentation based on product type, form, nature, flavor and application, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the soy protein market with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The US soy protein market report would provide approximately 46 tables, 39 figures and 195 pages.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies