US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market – Industry Trends & Outlook

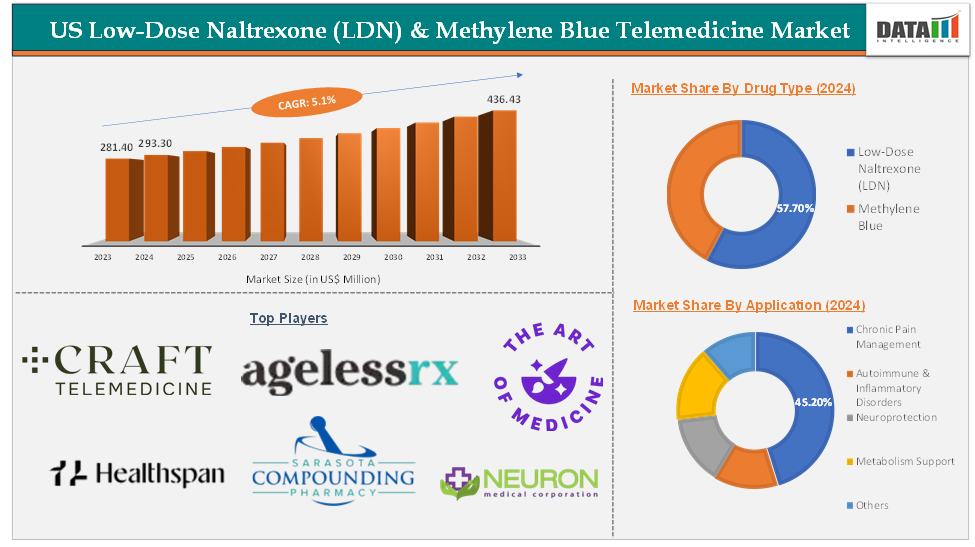

The US low-dose naltrexone (LDN) & methylene blue telemedicine market was valued at US$ 281.40 Million in 2023. The market size reached US$ 293.30 Million in 2024 and is expected to reach US$ 436.43 Million by 2033, growing at a CAGR of 5.1% during the forecast period 2025-2033.

The primary driver is the rising demand for LDN in managing chronic pain, autoimmune disorders, and emerging conditions like Long COVID, due to its anti-inflammatory and immune-modulating properties. Concurrently, methylene blue's applications in treating methemoglobinemia, neurological disorders, and industrial uses are accelerating market growth.

Telemedicine adoption, fueled by advanced US healthcare infrastructure and regulatory support, enhances accessibility to these therapies, particularly for remote or mobility-limited patients. A major trend in the US low-dose naltrexone and methylene blue telemedicine market is the increasing adoption of personalized, compounded therapies delivered directly to patients via digital health platforms.

The opportunity lies in expanding these virtual care models to reach underserved populations, developing integrated digital tools for remote monitoring and adherence, and capitalizing on ongoing clinical research that could validate new uses for both LDN and methylene blue, opening up additional therapeutic markets and revenue streams.

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market – Executive Summary

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market Dynamics: Drivers

Growing acceptance of off-label and alternative therapies

The growing acceptance of off-label and alternative therapies is a major driver for the US low-dose naltrexone (LDN) & methylene blue telemedicine market. This trend reflects a shift in both patient and provider attitudes, where there is increased openness to using medications beyond their original FDA-approved indications, especially when conventional treatments have failed or offer limited benefit.

For LDN, its off-label use has expanded significantly since the 1980s to address conditions such as chronic pain, autoimmune diseases, and neurological disorders. Patients with complex or poorly understood illnesses (like chronic fatigue syndrome, fibromyalgia, and long COVID) are often underserved by standard therapies, prompting them and their clinicians to explore alternatives like LDN, which has shown promise in observational studies and patient-reported outcomes.

Similarly, methylene blue is being investigated and adopted for its neuroprotective and anti-inflammatory properties, even though it is not broadly approved for these uses. This acceptance is further fueled by the rise of online communities, patient advocacy, and telemedicine platforms that make it easier to access information, share experiences, and connect with providers willing to prescribe these therapies.

For instance, according to the Journal of Drugs in Dermatology research data in December 2024, low-dose naltrexone (LDN) is gaining recognition in dermatology for its off-label use in treating a variety of inflammatory and autoimmune skin conditions.

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market Dynamics: Restraints

Regulatory and reimbursement challenges

LDN and methylene blue are most often prescribed "off-label," meaning they are used for conditions not specifically approved by the FDA. For LDN, the FDA only approves naltrexone for opioid and alcohol use disorders at much higher doses, not for chronic pain, autoimmune, or neurological conditions. Methylene blue is similarly limited in its approved uses. This lack of FDA indication for most telemedicine-prescribed uses means that providers and pharmacies must navigate a complex regulatory landscape, often relying on clinical judgment and patient demand rather than formal guidelines.

Because LDN and methylene blue are not FDA-approved for most off-label uses, health insurance plans rarely cover their cost. Patients must pay out-of-pocket, which can be a significant barrier, especially for those with chronic conditions requiring long-term therapy. This lack of coverage also discourages some providers from offering these therapies, further limiting access.

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market Dynamics: Opportunities

Expansion into new indications

Expansion into new therapeutic indications represents a significant opportunity for the US low-dose naltrexone (LDN) and methylene blue telemedicine market, leveraging existing clinical research and telemedicine infrastructure to address unmet medical needs. For LDN, emerging applications include rheumatoid arthritis, where studies demonstrate reductions in disease activity scores and pain markers, and neurological conditions like Parkinson’s and Alzheimer’s disease, supported by its glial-modulating and anti-inflammatory mechanisms.

Additionally, LDN shows promise for complex regional pain syndrome and fibromyalgia, with trials indicating symptom severity reduction. Methylene blue offers expansion potential in Lyme disease, neurodegenerative disorders, and long COVID symptom management through mitochondrial support. Telemedicine platforms enable efficient scaling for these indications by facilitating remote patient monitoring, personalized dosing via compounding pharmacies, and broader clinical trial recruitment. This diversification reduces market reliance on established uses, taps into growing patient populations, and aligns with trends toward drug repurposing and individualized therapies.

For more details on this report, Request for Sample.

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market - Segment Analysis

The US low-dose naltrexone (LDN) & methylene blue telemedicine market is segmented based on drug type, form, application, and prescription channel.

Drug Type:

The low-dose naltrexone (LDN) drug type segment in the US low-dose naltrexone (LDN) & methylene blue telemedicine market was valued at US$ 169.24 Million in 2024

Low-dose naltrexone (LDN) refers to the use of naltrexone, an opioid receptor antagonist originally approved for treating opioid and alcohol dependence, at much lower doses, typically 1–4.5 mg per day, compared to the standard 50 mg or higher. LDN is offered as a daily oral therapy, often compounded into capsules or tablets by specialized pharmacies. The LDN segment specifically targets patients seeking alternative or adjunct therapies for chronic and inflammatory conditions.

LDN’s unique mechanism involves modulating the immune system, reducing inflammation via microglial cell inhibition, and promoting endorphin production, which supports mood and pain relief. Telemedicine platforms facilitate access to LDN by enabling remote consultations, prescription management, and delivery from compounding pharmacies, making it especially valuable for patients in underserved or remote areas.

This segment is driven by factors such as the growing demand for alternative and off-label therapies, the expansion of telemedicine, and improved patient convenience and engagement. For instance, in February 2024, The Compounding Center, a pharmacy specializing in custom-made medications, launched a new product: low-dose Naltrexone (LDN) Flex dose tablets. This product is designed to make LDN therapy safer, more convenient, and more customizable for both patients and healthcare providers.

“Flex dose” means that the tablets are formulated to allow easy adjustment of the dose. Healthcare providers can guide patients to slowly increase (“taper up”) or decrease (“taper down”) their LDN dose in small, precise increments. This is important because the optimal dose of LDN can vary from person to person, and finding the right dose often requires gradual adjustments to maximize benefits and minimize side effects. These factors have solidified the segment's position in the US low-dose naltrexone (LDN) & methylene blue telemedicine market.

Application:

The chronic pain management application segment in the US low-dose naltrexone (LDN) & methylene blue telemedicine market was valued at US$ 132.57 Million in 2024

Chronic pain is defined as pain lasting longer than three months and includes disorders such as fibromyalgia, complex regional pain syndrome (CRPS), neuropathic pain, migraines, and autoimmune-related pain syndromes. LDN is typically prescribed at off-label, low doses (1–5 mg) and is compounded to suit individual patient needs, often delivered through telemedicine platforms for greater accessibility.

These actions help decrease pain, improve sleep and mood, and enhance overall quality of life for patients suffering from chronic pain conditions. Methylene Blue, while less commonly used for pain, is sometimes explored for its neuroprotective and mitochondrial-supporting properties, which may be relevant in certain chronic pain syndromes.

Key drivers for this segment include the growing demand for non-opioid, non-addictive pain management options, especially as opioid-related risks and regulations increase. LDN’s favorable safety profile, low cost, and minimal side effects make it attractive for long-term use, while telemedicine expands access to specialized care and compounded medications for patients who may otherwise face barriers to treatment. Additionally, increased awareness among clinicians and patients, ongoing research into new indications, and the integration of telehealth platforms further propel growth in this segment.

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market – Competitive Landscape

The major players in the US low-dose naltrexone (LDN) & methylene blue telemedicine market include Craft Telemed, AgelessRx, Healthspan, The Art of Medicine, Shed, Sarasota Compounding Pharmacy, Neuron Medical Corporation, Welltopia Pharmacy, Webster Pharmacy, and The Aesthetic Retreat, among others.

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market – Key Developments

In May 2025, AgelessRx, a leader in longevity and telehealth, introduced Methylene Blue capsules as its newest offering. This move taps into growing scientific interest in Methylene Blue’s potential to support brain health, focus, and cellular energy, all delivered in a convenient, mess-free capsule format.

In March 2025, Shed, a telehealth company known for its weight-loss and wellness programs, announced the addition of Low-Dose Naltrexone (LDN) to its range of treatment offerings. This move is designed to provide patients with more comprehensive solutions for chronic pain, autoimmune conditions, and metabolic health factors that can significantly impact weight management.

US Low-Dose Naltrexone (LDN) & Methylene Blue Telemedicine Market – Scope

Metrics | Details | |

CAGR | 5.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Drug Type | Low-Dose Naltrexone (LDN), Methylene Blue |

Form | Capsule, Liquid, Others | |

Application | Chronic Pain Management, Autoimmune & Inflammatory Disorders, Neuroprotection, Metabolism Support, Others | |

Prescription Channel | Direct-to-Consumer (DTC) Telehealth Platforms, Specialist Telemedicine Clinics, Retail/Compounding Pharmacy-Supported Telehealth, Others | |

DMI Insights:

According to DMI analysis, the US low-dose naltrexone (LDN) & methylene blue telemedicine market was valued at US$ 281.40 Million in 2023. The market size reached US$ 293.30 Million in 2024 and is expected to reach US$ 436.43 Million by 2033, growing at a CAGR of 5.1% during the forecast period 2025-2033. The US low-dose naltrexone (LDN) & methylene blue telemedicine market is driven by increased demand for specialized, compounded therapies for chronic and complex conditions, such as autoimmune disorders, chronic pain, and neurological diseases.

Additionally, the synergy between LDN and methylene blue is being explored for complex health conditions, and compounding pharmacies are increasingly tailoring individualized dosing protocols to maximize safety and efficacy. These trends reflect a broader movement toward personalized, flexible, and transparent healthcare delivery. The outlook for the US LDN & methylene blue telemedicine market is robust, with platforms like Craft Telemedicine planning nationwide expansion to all 50 states by 2026, further democratizing access to specialized therapies.

The ongoing digital transformation in healthcare, coupled with rising consumer expectations for convenience and individualized care, is expected to sustain high growth rates. As clinical research continues to validate new therapeutic uses for LDN and Methylene Blue, and as telemedicine becomes further integrated into mainstream healthcare, the market is poised for continued innovation, broader adoption, and the emergence of new patient segments seeking advanced, personalized treatment solutions.

The US low-dose naltrexone (LDN) & methylene blue telemedicine market report delivers a detailed analysis with 42 key tables, more than 33 visually impactful figures, and 156 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare IT-related reports, please click here