US Hospitality Service Robots Market Size

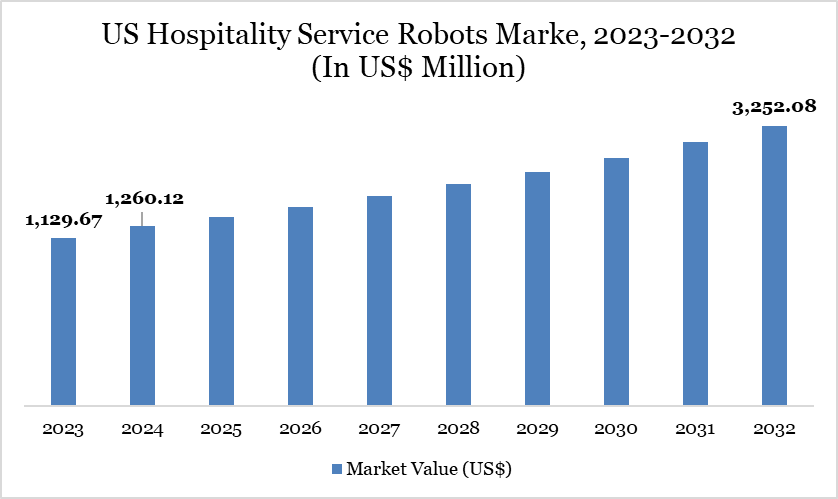

The US hospitality service robots market reached US$1,260.12 million in 2024 and is expected to reach US$3,252.08 million by 2032, growing at a CAGR of 12.70% during the forecast period 2025-2032.

The US hospitality service robots Market is experiencing steady growth, primarily driven by persistent labor shortages in the hotel industry. According to the American Hotel & Lodging Association (AHLA), hotel employment remains nearly 10% below pre-pandemic levels, with 65% of hotels still reporting staffing gaps-especially in housekeeping (38%), front desk (26%), culinary (14%), and maintenance (13%).

This workforce deficit has accelerated the adoption of service robots to fill critical operational roles. Robots are increasingly being used for tasks such as cleaning, room service delivery, concierge assistance, and even kitchen support. While higher pay and broader benefits have helped, they haven’t fully resolved the issue, making automation a strategic necessity. As a result, hotel operators are investing in robotics to enhance efficiency, reduce workload pressure on existing staff, and improve guest satisfaction.

Hospitality Service Robots Market Trend

A key trend in the US Hospitality Service Robots Market is the increasing shift toward multi-functional, autonomous delivery robots that reduce staff workload and enhance operational efficiency. The launch of LG Business Solutions’ next-generation CLOi ServeBot on June 25, 2024, exemplifies this trend. Designed with a four-door compartment and built for autonomous navigation, the robot is tailored for safe and efficient delivery in busy hospitality and healthcare environments. This reflects a broader movement toward integrating smart robotics that can handle repetitive, service-oriented tasks—such as in-room deliveries and amenities distribution, allowing human staff to focus on more complex, guest-facing responsibilities.

Source: DataM Intelligence

Market Scope

Metrics | Details |

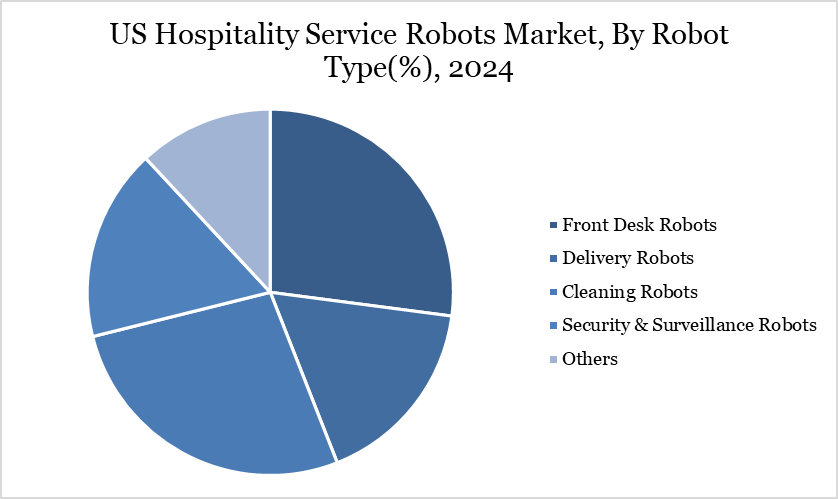

By Robot Type | Front Desk Robots, Delivery Robots, Cleaning Robots, Security & Surveillance Robots, Others |

By Operation Mode | Semi-Autonomous Robots, Fully Autonomous Robots |

By Deployment Mode | Ownership Model, Robotics-as-a-Service |

By End-User | Hotels, Restaurants & Bars, Resorts, Airport, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rise of Collaborative Robots (Cobiots) to Support Frontline Hospitality Staff Amid Labor Gaps

The rise of collaborative robots (cobiots) is emerging as a key driver in the US Hospitality Service Robots Market, especially as the industry grapples with persistent labor shortages and growing service demands. These robots are designed not to replace human workers but to support frontline staff by taking over repetitive, physically demanding tasks.

A prime example is Plato, launched by United Robotics Group on November 7, 2022, in both Europe and the US. Plato is an autonomous mobile platform that helps with food and drink delivery, table bussing, and adapting to real-time service needs in restaurants and catering environments. With its Human-Robot Interface (HRI) and friendly demeanor, it blends industrial performance with the expressivity of social robots like Pepper and NAO. By easing workload and enhancing guest interaction, cobiots like Plato are making robot-human collaboration a scalable solution for operational efficiency in US hospitality. Their deployment is helping businesses maintain service quality despite staffing challenges.

High Initial Investment and Operational Costs

High initial investment and operational costs are significantly restraining the US hospitality service robots market. Many hotels, especially independent or mid-scale ones, find the upfront cost of acquiring and integrating robotic systems prohibitive. Expenses related to infrastructure modification, software integration, staff training, and ongoing maintenance further increase the total cost of ownership. These high costs delay return on investment, making decision-makers hesitant to adopt robots despite long-term efficiency benefits. As a result, adoption remains largely limited to luxury chains or tech-forward establishments with larger capital reserves.

Segmentation Analysis

The US hospitality service robots market is segmented based on robot type, operation mode, deployment model, and end-user.

Source: DataM Intelligence

Cleaning Robots Hold a Significant Share Due to Rising Occupancy and Labor Optimization Needs

Cleaning robots hold a significant share in the US Hospitality Service Robots Market due to the growing emphasis on hygiene, efficiency, and labor optimization. With US hotel occupancy rebounding to around 63.6% in 2024 and over 1.3 billion room nights in 2023 (according to the American Hotel & Lodging Association), hotels face mounting pressure to maintain high cleanliness standards across large, high-traffic properties.

This rise in occupancy directly increases the volume of daily cleaning tasks, making automation a practical necessity. Vacuuming alone accounts for up to 30% of housekeeping time, creating opportunities for robotic floor scrubbers and vacuums to reduce physical workload. These autonomous machines ensure consistent cleaning quality while allowing human staff to shift toward guest-focused roles. Major hotel brands are investing in such technology to meet both guest expectations and staffing challenges.

Technological Analysis

The US hospitality service robots market is witnessing rapid technological advancements, driven by AI, machine learning, and sensor fusion technologies. Robots are becoming more autonomous and reliable in performing tasks such as room service delivery, cleaning, and guest engagement.

For example, Relay Robotics showcased its advanced Relay+ Service Robot at HITEC Orlando in June 2022, underlining its efficiency in addressing labor shortages with cost-effective delivery solutions. Innovations in navigation systems like LiDAR and SLAM allow robots to move seamlessly through complex hotel environments. Voice recognition and multilingual interfaces are also enhancing guest interaction. Integration with hotel management systems further streamlines operations. These advancements are pushing robotic adoption in both luxury and mid-range hospitality segments.

Competitive Landscape

Source: DataM Intelligence

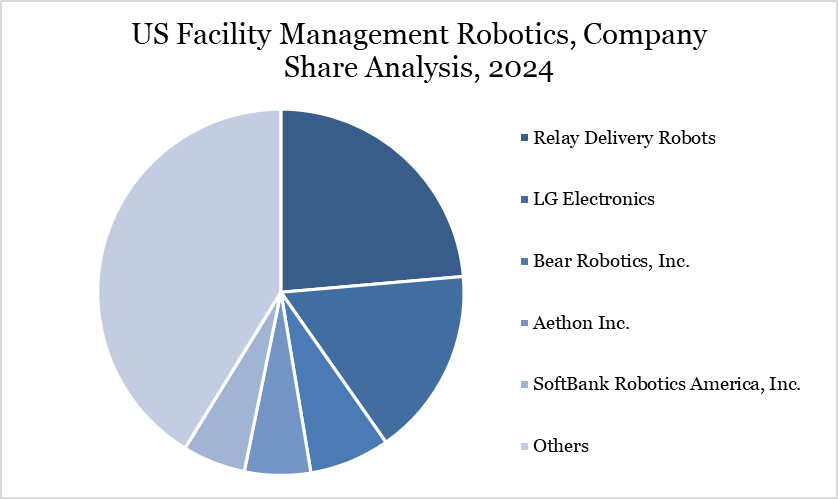

The major players in the market include Relay Delivery Robots, LG Electronics, Bear Robotics, Inc., Aethon Inc., SoftBank Robotics America, Inc., Knightscope, Inc., Richtech Robotics, Pudu Technology Inc., Hyundai Robotics, Travelmate Robotics and others.

Key Developments

In March 2025, RobotLAB announced its partnership with Marriott International and LG to automate room service across select US hotels, beginning with the Renaissance Dallas Hotel. As the only approved system integrator for LG robots in Marriott properties, RobotLAB introduced the first-ever LG room service robot in the US The robot operates 24/7, using elevator integration to deliver food, toiletries, and other essentials directly to guest rooms.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies