Surgical Tubing Market Size& Industry Outlook

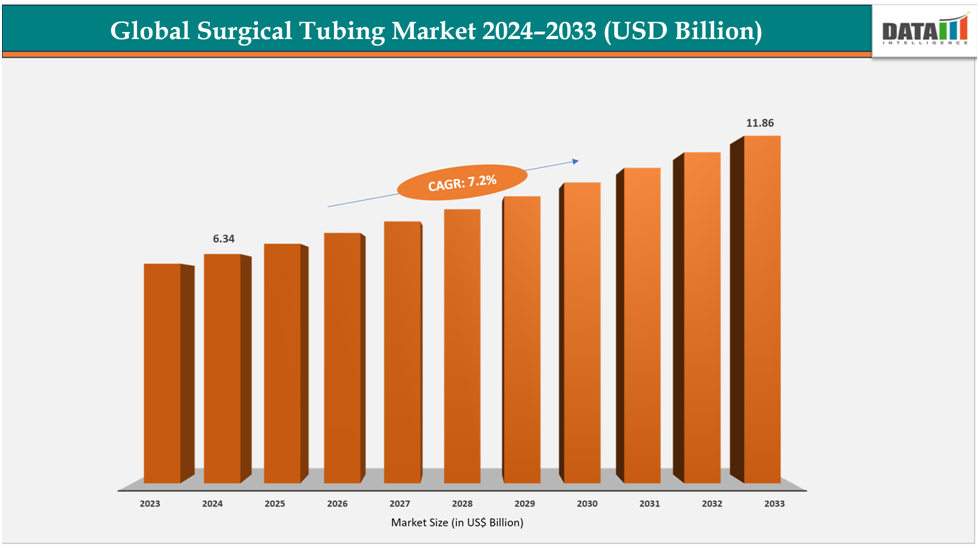

The global surgical tubing market size reached US$ 5.94Billionin 2023 with a rise of US$6.34Billion in 2024 and is expected to reach US$11.86Billion by 2033, growing at a CAGR of7.2%during the forecast period 2025-2033.

The market for surgical tubing is driven by the growing number of surgical procedures and improvements in medical technology. Materials innovations including fluoropolymers, thermoplastic elastomers, and medical-grade silicone improve patient safety, durability, and biocompatibility. Specialized designs, such as ENFit connections and peekable heat-shrink tubing, increase flow efficiency and decrease procedural errors. Demand is further increased by the incorporation of tubing with cutting-edge medical equipment such as dialysis machines, peristaltic pumps, and catheters. Concurrently, aging populations, the proliferation of hospitals and surgical centres, and the increasing incidence of chronic diseases all lead to an increase in surgical procedures, which directly raises tubing consumption and sustains global market growth.

Key Highlights

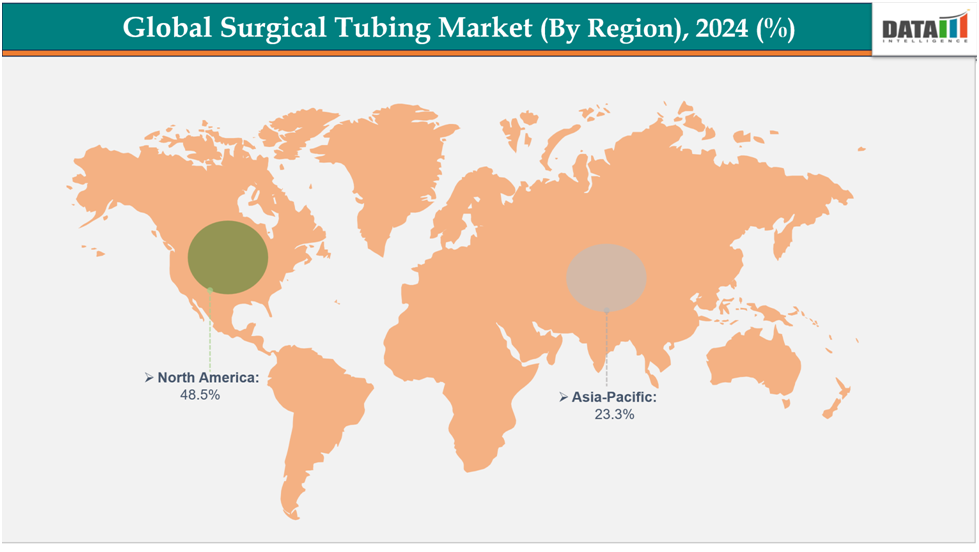

- North America is dominating the global surgical tubing market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global surgical tubing market, with a CAGR of 7.5% in 2024

- The polyvinyl chloride segment from material is dominating the surgical tubing market with a 31.3% share in 2024

- The single-lumen segment from structure is dominating the surgical tubing market with a 43.3% share in 2024

- Top companies in the surgical tubing market include Saint-Gobain, Freudenberg Medical, Zeus Company LLC, RAUMEDIC AG, Teleflex Incorporated, Tekni-Plex, Inc., Kent Elastomer Products, Inc., Trelleborg Group, Nordson Corporation, and Coroplast Corp., among others.

Market Dynamics

Drivers: Rising prevalence of chronic diseases is significantly driving the surgical tubing market growth

The rising prevalence of chronic diseases, such as cardiovascular disorders, diabetes, and kidney failure, is significantly driving the surgical tubing market. There is a greater need for tubing for IVs, catheters, and drainage systems since these illnesses frequently necessitate numerous medical interventions and surgical operations. Chronic disease therapies that are less intrusive increase the demand for specific, biocompatible tubing. Long-term care and repeated hospital stays support ongoing consumption, and delicate patient circumstances spur the creation of cutting-edge materials like silicone and polyurethane.

Owing to the rising prevalence of chronic diseases, for instance, recent data from the WHO and CDC reported that cardiovascular diseases remain a major health concern in the United States. Each year, approximately 805,000 individuals experienced a heart attack, including 605,000 who suffered their first and 200,000 who had a prior heart attack. These figures highlighted the persistent burden of heart disease on the population.

Restraints: The risk of contamination and infection are hampering the growth of the surgical tubing market

The growth of the surgical tubing market is being hampered by risks of contamination and infection because these tubes come into direct contact with blood, fluids, and sterile environments during medical procedures. For instance, in April 2025, Fresenius Medical Care initiated a Class 2 recall of its 5008X Hemodialysis Blood Tubing Sets due to potential blood leaks between the venous chamber and tubing. This issue posed risks of blood exposure and infection, prompting healthcare providers to remove affected units from use and return them to the manufacturer.

Moreover, microbial contamination or improper sterilization can lead to hospital-acquired infections, sepsis, or other complications. This raises safety concerns among healthcare providers, increases regulatory scrutiny, and can limit adoption.

For more details on this report, see Request for Sample

Segmentation Analysis

The global surgical tubing market is segmented based on material structure, application, end user and region

By Material:

The polyvinyl chloride segment from material is dominating the surgical tubing market with a 31.3% share in 2024

Polyvinyl chloride (PVC) dominates surgical tubing because it forms the primary structural backbone of the material. While plasticizers and other additives stay scattered throughout the production process, PVC's lengthy polymer chains form an uninterrupted network that gives it softness and flexibility. Because PVC is biocompatible, chemical resistant, and mechanically strong, it is used for surgical tubing and can come into touch with biological fluids like blood. Additionally, it withstands sterilizing techniques like ethylene oxide and gamma irradiation without suffering greatly.

The dominance of polyvinylchlorides further reinforced by recent investments in research and development. For instance, in August 2025, Alphagram introduced flexible, phthalate-free PVC compounds for medical devices. Plasticizers, essential for flexibility, enabled PVC to bend without cracking, supporting products like oxygen tubing and blood bags. Non-phthalate plasticizers such as DOTP gained popularity due to stricter regulatory requirements under RoHS, REACH, and Prop 65.

Moreover, economically, PVC is cost-effective compared to alternatives such as silicone or polyurethane. It's a combination of durability, flexibility, safety, and affordability.

By Structure: The single-lumen segment from structure is dominating the surgical tubing market with a 43.3% share in 2024

Single-lumen tubing dominates the surgical tubing market due to its simple design, versatility, and cost-effectiveness. Its single hollow channel makes it simple to produce and works well with a variety of medical applications, such as drainage, suction, oxygen delivery, and IV lines. The PVC backbone offers durability, strength, and flexibility, and plasticizers enable bending without breaking. Single-lumen tubes meet regulatory requirements with little modification, are less expensive, and are simpler to sterilize than multi-lumen or braided tubes.

Geographical Analysis

North America is dominating the global surgical tubing market with a 48.5% in 2024

North America leads the global surgical tubing market, fueled by high healthcare spending, a growing number of surgical procedures, and the rising prevalence of chronic diseases like cardiovascular disorders, diabetes, and kidney diseases, which increase demand for quality tubing. For instance, according to a recent report by the American Kidney Fund, in August 2025, an estimated 35.5 million Americans had kidney disease, with approximately 815,000 living with kidney failure. Nearly 555,000 were on dialysis. By 2025, kidney disease affected over 14% of American adults, disproportionately impacting people of color. Despite more than 260,000 living with transplants, demand far exceeded availability, with only a fraction receiving kidneys from living donors.

Moreover, the region’s advanced healthcare infrastructure, well-equipped hospitals, and specialized surgical centers support the adoption of diverse tubing technologies, including single-lumen, multi-lumen, and specialized medical-grade PVC tubing. Favorable reimbursement policies and strong regulatory frameworks, such as FDA approvals, ensure safe and reliable usage.

Europe is the second region after North America which is expected to dominate the global surgical tubing market with a 34.5% in 2024

The global surgical tubing market is driven by rising healthcare expenditure, increasing surgical procedures, and growing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and kidney failure. Expanding hospital infrastructure, technological advancements, and favorable government initiatives further support the demand for high-quality surgical tubing worldwide. For instance, in September 2025, Junkosha expanded its medical tubing portfolio by launching Clear Peelable Heat Shrink Tubing at Medical Technology Ireland. The product offered improved clarity, reduced assembly risk, and streamlined processes for catheter manufacturers. The company also highlighted increased manufacturing capacity and expanded options across its Peelable Heat Shrink Tubing and Etched PTFE Liner ranges.

Germany’s surgical tubing market is propelled by advanced healthcare infrastructure, supportive regulations, and high public awareness. Widespread access through hospitals and clinics, along with government initiatives, public health campaigns, and private sector support, drives demand, ensuring consistent adoption and sustained growth across the country.

The Asia Pacific region is the fastest-growing region in the global surgical tubing market, with a CAGR of 7.5% in 2024

The Asia-Pacific surgical tubing market, including Japan, China, India, and South Korea, is growing due to rising healthcare expenditure, expanding hospital infrastructure, and increasing surgical procedures. Technological advancements, government initiatives, and public health programs are driving demand, enhancing quality standards, and supporting widespread adoption of surgical tubing across the region.

China and India are witnessing rising demand for surgical tubing due to expanding healthcare infrastructure, increasing surgical procedures, and growing healthcare expenditure. Further, the company partnerships and collaboration further drive the growth in the surgical tubing market. For instance, in November 2024, Lubrizol and Polyhose signed an MoU, supported by the Tamil Nadu government, to manufacture medical tubing locally. The agreement established a new facility, enabling a fivefold expansion of Lubrizol’s medical tubing production in the region.

Competitive Landscape

Top companies in the surgical tubing market include Saint-Gobain, Freudenberg Medical, Zeus Company LLC, RAUMEDIC AG, Teleflex Incorporated, Tekni-Plex, Inc., Kent Elastomer Products, Inc., Trelleborg Group, Nordson Corporation, and Coroplast Corp., among others.

Saint Gobain: Saint-Gobain is a global leader in high-performance medical and surgical tubing, offering Tygon and Version products made from thermoplastic elastomers, silicone, and fluoropolymers. Their tubing ensures safety and reliability in medical devices, including dialysis systems, drug delivery, and peristaltic pumps, positioning the company as a key market player.

Key Developments:

- In 2023, Fortune Medical launched two products: a silicone gastrostomy tube and a silicone nasogastric tube featuring ENFit connectors, based on ISO 80369-3 standards. The tubes enhanced patient safety by preventing misconnections and improved comfort through medical-grade silicone, ensuring superior biocompatibility and reduced discomfort during use.

Market Scope

| Metrics | Details | |

| CAGR | 7.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Material | Polyvinyl Chloride, Thermoplastic Elastomer, Thermoplastic Polyurethane, Silicone and Others |

| By Structure | Single-Lumen, Multi-Lumen, Braided Tubing Tubing and Others | |

| By Application | Orthopedic Surgery, Neurosurgery, Trauma Surgery And Others | |

| By End User | Hospitals, Clinics, Ambulatory Surgical Centers and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The Global Surgical Tubing Market report delivers a detailed analysis with 70 key tables, more than 60visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here