Global Surgical Tables and Chairs Market: Industry Outlook

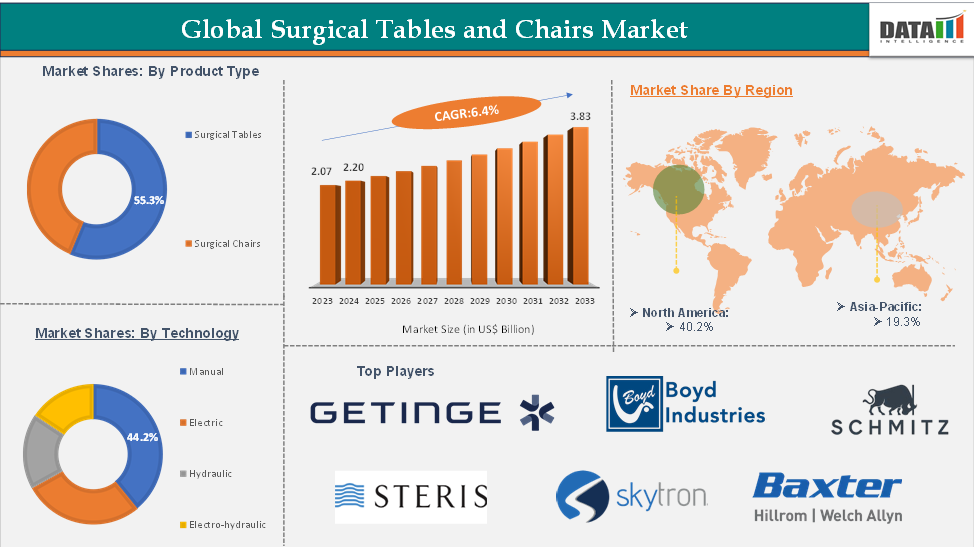

The global surgical tables and chairs market reached US$ 2.07 billion in 2023, with a rise of US$ 2.20 billion in 2024, and is expected to reach US$ 3.83 billion by 2033, growing at a CAGR of 6.4% during the forecast period 2025-2033.

The surgical tables and chairs market is evolving rapidly, fueled by technological innovations that are reshaping modern operating rooms. Advanced surgical tables now feature motorized movements, precise positioning controls, and integration with imaging systems, allowing for greater surgical precision and workflow efficiency. Smart tables equipped with sensors and connectivity features are enabling real-time adjustments based on patient data and procedural needs.

Surgical chairs designed for specialty procedures, such as ophthalmology or ENT, are becoming more ergonomic and adaptable to improve both patient comfort and clinician access. These innovations are not only enhancing surgeon performance but also contributing to reduced procedure times and improved patient outcomes. As hospitals move toward digitally integrated surgical suites, surgical tables and chairs are becoming more intelligent, responsive, and central to delivering high-quality, patient-centric care.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Increasing Surgical Procedures

The growing number of surgical procedures worldwide is a key driver of the surgical tables and chairs market. Rising prevalence of chronic diseases, an aging population, and increasing demand for elective surgeries have significantly increased the volume of surgeries performed globally. NHS carries out 2,400 major elective surgical procedures per 100,000 people each year. As hospitals and surgical centers expand their capacities to meet this demand, there is a parallel need for advanced, ergonomic, and procedure-specific surgical tables and chairs that support both patient safety and surgical efficiency.

For instance, minimally invasive and robotic surgeries require highly adjustable and precision-engineered tables to facilitate complex procedures. This trend is pushing manufacturers to innovate with features like motorized adjustments, imaging compatibility, and enhanced mobility, thereby propelling market growth.

Restraint: High Equipment Cost

Despite growing demand, the high cost of surgical tables and chairs remains a significant barrier to market expansion, particularly in low- and middle-income regions. Advanced surgical tables equipped with motorized controls, imaging compatibility, and multi-specialty functionality often come at a premium price, making them less accessible to smaller hospitals, outpatient clinics, and rural healthcare facilities.

For more details on this report, Request for Sample

Segmentation Analysis

The global surgical tables and chairs market is segmented based on product type, technology, application, end-user, and region.

Product Type:

The surgical tables segment is estimated to have 55.3% of the surgical tables and chairs market share.

The surgical tables segment is expected to dominate the surgical tables and chairs market, owing to its essential role across a broad range of surgical procedures and specialties. Surgical tables are indispensable in operating rooms, providing the necessary support, positioning, and stability required for safe and effective surgeries.

With the rising volume of inpatient and outpatient surgeries there is increasing demand for technologically advanced tables that offer features such as motorized adjustments, radiolucent surfaces for imaging compatibility, and modular designs for multi-specialty use. With this rising demand, the manufacturers are increasingly introducing the equipment. For instance, In March 2024, Getinge has announced the launch of its Corin OR table and Ezea surgical light at the AORN (Association of periOperative Registered Nurses) Conference. These new innovations are engineered to enhance surgical department workflows while prioritizing both patient safety and clinical efficiency for healthcare professionals.

Additionally, hospitals and surgical centers are prioritizing investments in high-performance surgical tables to enhance procedural efficiency and patient outcomes, further driving the segment’s dominance.

Geographical Share Analysis

The North America surgical tables and chairs market was valued at 40.2% market share in 2024

North America is anticipated to dominate the surgical tables and chairs market, driven by well-established healthcare infrastructure, high surgical procedure volumes, and strong investment in advanced medical technologies. The region benefits from a growing elderly population, a high prevalence of chronic and lifestyle-related diseases, and increasing demand for elective and minimally invasive surgeries.

According to the CDC, over 51.4 million surgical and diagnostic procedures are performed annually in the United States, highlighting the immense pressure on surgical infrastructure. Among these, 2.4 million arteriography and angiocardiography procedures, 1 million cardiac catheterizations, and over 1.1 million endoscopies of the small intestine are conducted, along with nearly 500,000 large intestine endoscopies. The growing volume of such specialized and minimally invasive procedures is significantly increasing the demand for advanced surgical tables and chairs that offer precise positioning, imaging compatibility, and ergonomic support. As procedural complexity rises, healthcare facilities are prioritizing equipment upgrades to ensure efficiency, safety, and optimal clinical outcomes.

In addition, healthcare facilities across the U.S. and Canada are consistently upgrading their surgical environments with advanced, ergonomic, and specialty-specific equipment, including motorized surgical tables and procedure-specific chairs. Supportive reimbursement policies, strong presence of key market players, and ongoing R&D efforts further reinforce North America's leadership position in this market.

Major Players

The major players in the surgical tables and chairs market include Getinge, STERIS, Skytron, LLC, Mizuho OSI, Merivaara Corp., Hill-Rom Holdings, Inc., Medifa, Boyd Industries and SCHMITZ medical GmbH, among others.

Key Developments

Report Scope

Metrics | Details | |

CAGR | 6.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Surgical Tables, Surgical Chairs |

Technology | Manual, Electric, Hydraulic, Electro-hydraulic | |

| Application | General Surgery, Orthopedic Surgery, Ophthalmic Surgery, Gynecological Procedures, Dental Procedures, ENT Procedures, Others |

| End-User | Hospitals and Clinics, Ambulatory Surgical Centers, End-User |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global surgical tables and chairs market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more hospital supplies-related reports, please click here