Global Supply Chain Cybersecurity Market: Industry Outlook

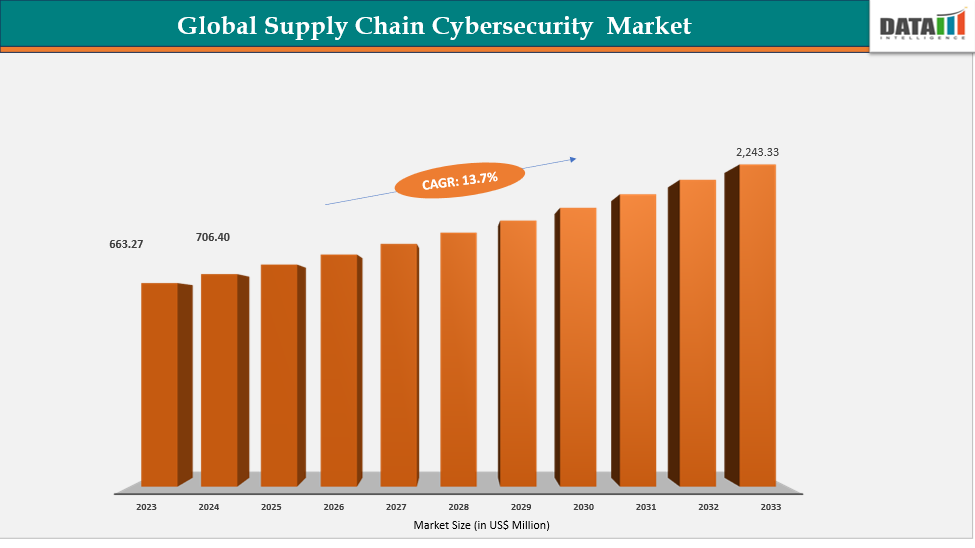

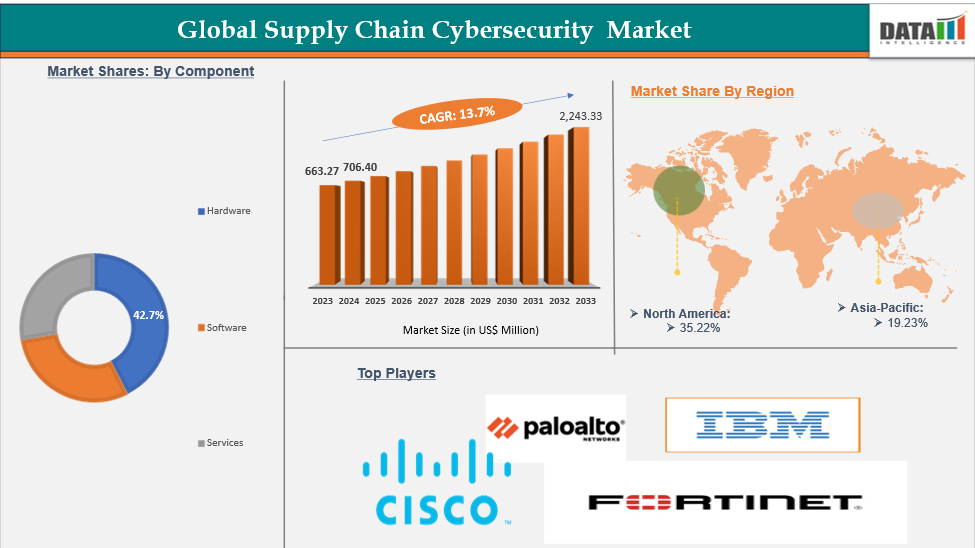

The global supply chain cybersecurity market reached US$ 663.27 million in 2023, with a rise to US$ 706.40 million in 2024, and is expected to reach US$ 2,243.33 million by 2033, growing at a CAGR of 13.7% during the forecast period 2025–2033. The global supply chain cybersecurity market is being shaped by the rising number of cyber incidents targeting critical infrastructure and vendor networks. In the U.S., the Cybersecurity and Infrastructure Security Agency (CISA) has issued supply chain risk management guidance, emphasizing that over 90% of reported critical infrastructure breaches in 2022 involved third-party vendors. This has forced large enterprises and government agencies to embed security requirements deeper into procurement and vendor management frameworks.

In Asia, countries like Japan and South Korea are enforcing supply chain cybersecurity standards through government-led initiatives. Japan’s Ministry of Economy, Trade and Industry (METI) announced the rollout of a Supply Chain Cybersecurity Evaluation System by 2026, requiring manufacturers and suppliers to demonstrate compliance with national security protocols. South Korea’s National Cybersecurity Strategy also mandates risk assessments across 14 critical infrastructure sectors, accelerating demand for secure digital and hardware components across industrial supply chains.

A unique trend in the global supply chain cybersecurity market is the integration of zero-trust frameworks across multi-tier vendor ecosystems. The U.S. Office of Management and Budget (OMB) mandated zero-trust adoption across all federal agencies by 2024, setting a precedent for suppliers and contractors to follow suit. The European Union Agency for Cybersecurity (ENISA) has reported that two-thirds of EU suppliers lack adequate controls, driving the shift toward zero-trust to close visibility gaps. Companies like IBM and Cisco have embedded zero-trust principles into their supply chain security offerings, enabling continuous verification of devices, users, and applications across distributed networks.

Key Market Trends & Insights

North America is the largest market: Driven by U.S. federal mandates such as CMMC and zero-trust adoption, impacting over 300,000 defense contractors in the vendor ecosystem.

Asia-Pacific is the fastest-growing region: With Japan’s METI cybersecurity evaluation rollout and Singapore’s CSA licensing framework for service providers driving accelerated compliance.

The complexity of multi-tier vendor networks is forcing governments and enterprises to standardize cybersecurity expectations; ENISA reports that 66% of suppliers in EU multi-tier chains lack standardized cyber protocols, making harmonization a critical market driver.

Market Size & Forecast

2024 Market Size: US$ 706.40 million

2033 Projected Market Size: US$ 2,243.33 million

CAGR (2025–2033): 13.7%

Asia Pacific: Fastest-growing market

North America: Largest market in 2024

Market Dynamics

Driver: Growing Adoption of Zero-Trust Architectures Across Global Supply Chains

The growing adoption of zero-trust architectures is driving demand in the global supply chain cybersecurity market, as enterprises move away from perimeter-based models. The U.S. Office of Management and Budget (OMB) mandated all federal agencies to implement zero-trust strategies by fiscal year 2024, pushing vendors and contractors in the supply chain to align with these requirements. Likewise, Japan’s National Center of Incident Readiness and Strategy for Cybersecurity (NISC) has incorporated zero-trust into its national cybersecurity strategy, requiring supply chain participants to enforce continuous verification and least-privilege access across interconnected networks.

Restraint: High Cost and Complexity of Securing Multi-Tier Vendor Networks

The high cost and complexity of securing multi-tier vendor networks is a significant restraint in the global supply chain cybersecurity market. The U.S. Department of Defense (DoD) noted that compliance with the Cybersecurity Maturity Model Certification (CMMC) could cost small contractors between USD 1,000 and USD 50,000, depending on network size, creating barriers for lower-tier suppliers. Similarly, the European Union Agency for Cybersecurity (ENISA) has highlighted that over 66% of suppliers in multi-tier chains lack standardized cyber controls, making uniform implementation both expensive and operationally complex.

For more details on this report, Request for Sample

Segmentation Analysis

The global supply chain cybersecurity market is segmented based on organization size, deployment, component, application, end-user, and region.

Component: The hardware component segment is estimated to have 42.7% of the supply chain cybersecurity market share.

In the U.S., the demand for hardware-based supply chain cybersecurity solutions is strongly linked to federal initiatives and enterprise adoption of physical security devices. The Cybersecurity and Infrastructure Security Agency (CISA) has emphasized that hardware vulnerabilities, particularly in IoT devices and RFID systems, represent a major entry point for attackers into supply chains. To mitigate this, the Department of Defense (DoD) requires strict compliance under its Cybersecurity Maturity Model Certification (CMMC), affecting more than 300,000 contractors who must secure both digital and physical assets. This is driving investment in tamper-proof hardware modules, GPS-enabled tracking devices, and authentication systems as foundational components of supply chain resilience.

Globally, manufacturers and logistics companies are increasingly adopting hardware solutions to ensure traceability and security of goods in transit. For example, Honeywell has expanded its portfolio with IoT-enabled Real-Time Visibility devices that integrate sensors directly into supply chain operations to monitor cargo conditions and detect tampering.

Similarly, IBM has partnered with hardware vendors to embed secure cryptographic chips into supply chain tracking systems, reducing risks of counterfeit components entering critical infrastructure. In Japan, the Ministry of Economy, Trade and Industry (METI) has stressed the importance of securing “factory floor” hardware under its Physical/Cyber Guidelines for Factory Systems, recognizing that traditionally isolated machinery is now being networked and requires built-in hardware safeguards.

Geographical Analysis

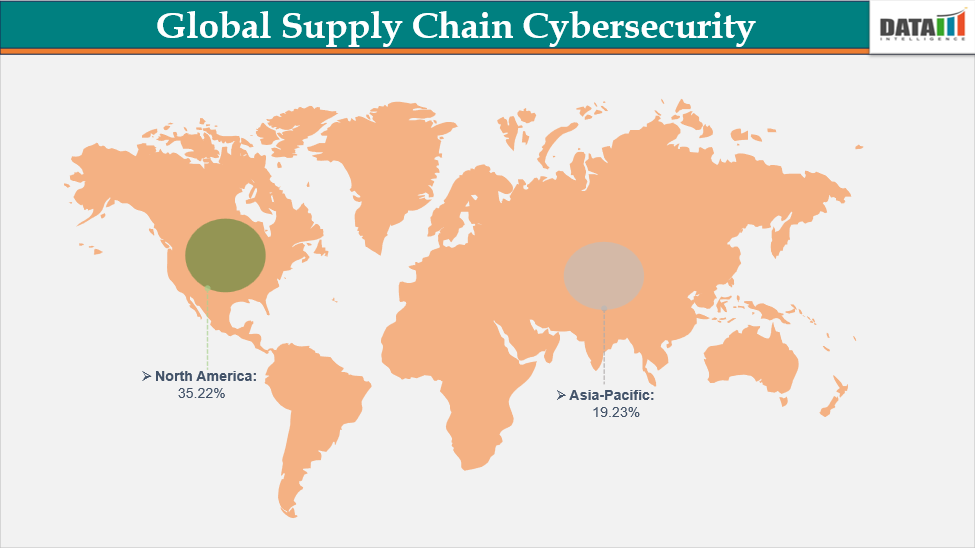

The North America supply chain cybersecurity market was valued at 35.22% market share in 2024

In the United States, supply chain cybersecurity demand is being accelerated by federal mandates and real-world breaches across critical sectors. The Cybersecurity and Infrastructure Security Agency (CISA) has highlighted that many small and medium-sized businesses lack dedicated risk management experts, despite making up over 99% of all U.S. businesses and employing nearly half of the private sector workforce. This has created significant vulnerabilities in digital and physical supply chains.

In response, CISA and the National Institute of Standards and Technology (NIST) have published tailored ICT supply chain risk management guidance and fact sheets for SMEs, encouraging adoption of standardized frameworks like NIST SP 800-161. Additionally, the U.S. Department of Defense (DoD) has advanced the Cybersecurity Maturity Model Certification (CMMC) to enforce supply chain protection across more than 300,000 contractors, directly fueling investment in supply chain cybersecurity platforms.

The Asia-Pacific Supply Chain Cybersecurity market was valued at 19.23% market share in 2024

Asia-Pacific is witnessing rapid uptake of supply chain cybersecurity solutions due to industrial IoT growth and strong government regulations. In Japan, the Ministry of Economy, Trade and Industry (METI) has issued “Physical/Cyber Security Guidelines for Factory Systems,” updated with an appendix on “Smartification,” to tackle vulnerabilities in connected factory machinery.

Furthermore, METI announced plans to introduce a Cybersecurity Measures Evaluation System for Supply Chains by fiscal year 2026, aimed at visualizing and enforcing compliance across manufacturers and suppliers. In South Korea, the government has mandated that companies operating in 14 critical infrastructure sectors, including manufacturing and logistics, comply with strengthened supply chain cybersecurity protocols under the National Cybersecurity Strategy.

Meanwhile, Singapore’s Cyber Security Agency (CSA) has introduced a licensing framework for managed security service providers to increase accountability in securing digital supply chains. These regulatory steps, alongside the expansion of 5G and smart manufacturing, are creating one of the fastest-growing regional markets for supply chain cybersecurity solutions.

Competitive Landscape

The global supply chain cybersecurity market features several prominent players, including International Business Machines Corporation (IBM), Cisco Systems, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., Trellix Corporation, CrowdStrike Holdings, Inc., Broadcom Inc. (Symantec Enterprise Division), Trend Micro Incorporated, and Kaspersky Lab JSC., among others.

IBM Corporation: IBM is a global leader in cybersecurity solutions, offering advanced platforms to secure digital supply chains. Its IBM Security Verify and QRadar SIEM solutions help enterprises detect, monitor, and mitigate threats across vendor ecosystems. The company also partners with governments and industry leaders to strengthen cybersecurity compliance frameworks. With its AI-driven threat intelligence and hybrid cloud expertise, IBM plays a pivotal role in protecting global supply chain networks from evolving risks.

Market Scope

Metrics | Details | |

CAGR | 13.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Deployment | Cloud, On-premises, Battery Charge/Discharge Testers, Environmental Chambers, Battery Life Testers and Others |

Organization Size | SMEs (Small & Medium Enterprises), Large Organizations, Environmental Testing, Life Cycle Testing and Others | |

Component | Hardware, Software, Services | |

Application | Data Protection, Data Visibility and Governance and Others | |

| End-User | Automotive, FMCG, Healthcare, Manufacturing, Retail & E-Commerce, Transportation & Logistics, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global supply chain cybersecurity market report delivers a detailed analysis with 78 key tables, more than 74 visually impactful figures, and 239 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here