Global Lithium-ion Battery Testing Equipment Market: Industry Outlook

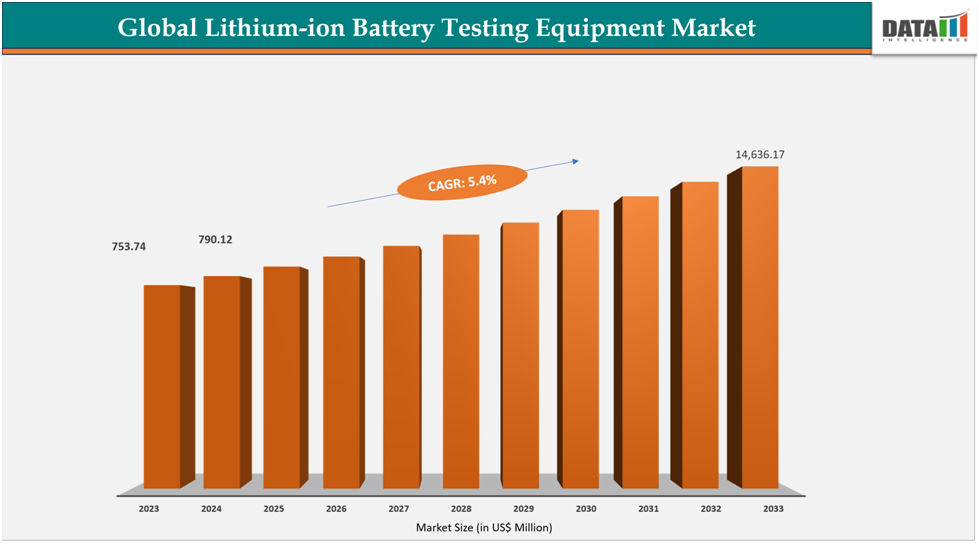

The global lithium-ion battery testing equipment market reached US$ 753.74million in 2023, with a rise to US$790.12 million in 2024, and is expected to reach US$ 14,636.17 million by 2033, growing at a CAGR of 5.4%during the forecast period 2025–2033.

The global lithium-ion battery testing equipment market is expanding rapidly, supported by the surge in electric vehicle (EV) and energy storage manufacturing capacity. According to the International Energy Agency, global EV sales surpassed 14 million units in 2023, doubling battery validation requirements as every cell must pass rigorous safety and performance checks. National programs, such as the US Department of Energy’s Battery500 initiative, are also driving demand for advanced testing hardware to support next-generation chemistries. This alignment of industrial scaling and government-backed R&D funding makes testing infrastructure a cornerstone of global battery competitiveness.

In parallel, stricter regulatory compliance is fueling investment in precision testing systems across regions. The European Union’s Battery Regulation (EU 2023/1542) mandates lifecycle safety validation for cells and packs, while China’s GB/T standards enforce comprehensive cycle and abuse testing for EV batteries. These regulations are compelling manufacturers to deploy high-throughput cyclers, integrated thermal chambers, and pack-level emulation systems. As national safety standards evolve, the demand for testing hardware is expected to remain directly proportional to the expansion of global battery production.

Key Market Trends & Insights

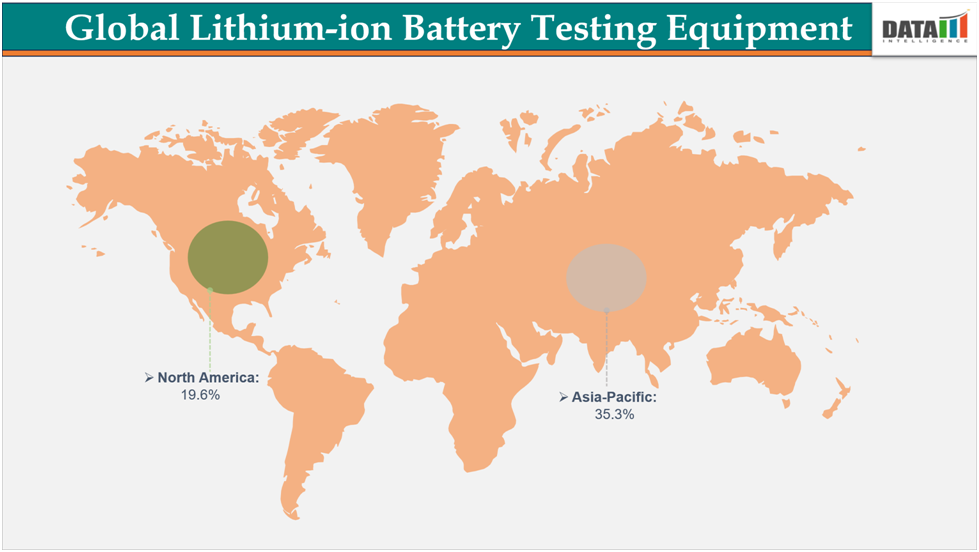

North America is the fastest-growing region, propelled by large-scale US federal investments, such as the US$6 billion allocation under the Bipartisan Infrastructure Law for domestic battery manufacturing and safety testing, accelerating adoption of high-precision test systems.

Asia-Pacific remains the largest region, with China alone commissioning over 1.5 TWh of new cell production capacity by 2030, according to the China Automotive Battery Innovation Alliance, which directly scales the need for cell and pack testing infrastructure.

Europe is emerging as a compliance-driven hub, with the EU’s Battery Regulation requiring traceability, safety validation, and recycling-readiness tests, forcing manufacturers to install multi-stage, integrated validation platforms across gigafactories.

Market Size & Forecast

2024 Market Size: US$790.12million

2033 Projected Market Size: US$14,636.17 million

CAGR (2025–2033): 5.4%

Asia Pacific: Largest market in 2024

North America: Fastest-growing market

Drivers & Restraints

Driver: Expansion of National Safety Standards Mandating Advanced Battery Validation

Expansion of national safety standards is a critical driver for the global lithium-ion battery testing equipment market, as governments mandate rigorous validation to ensure safety in electric vehicles and consumer electronics. The US Department of Transportation enforces UN 38.3 testing requirements for lithium batteries in transport, covering altitude simulation, thermal testing, vibration, and shock, which compels manufacturers to invest in advanced multi-parameter testing hardware.

Similarly, the European Commission under the Battery Regulation (EU 2023/1542) has set stricter testing and safety compliance protocols for cells and packs, further boosting demand for precision test equipment. These evolving regulations push manufacturers to adopt high-throughput, automated systems that can meet compliance efficiently at scale.

In Asia, China’s GB/T 31467 series specifies safety and reliability standards for power batteries used in EVs, requiring robust cycle testing, thermal management validation, and overcharge/short-circuit simulations. Such standards are aligned with national industrial policies that emphasize battery quality as a prerequisite for subsidies and large-scale EV adoption.

Companies supplying test equipment have responded by integrating safety-compliance modules into their platforms, ensuring manufacturers meet these country-specific benchmarks. As more nations align their industrial and transport policies with global sustainability goals, the adoption of standardized testing protocols is expanding, directly driving the growth of advanced lithium-ion battery testing hardware worldwide.

Restraint: High Calibration and Maintenance Costs of Precision Test Hardware

High calibration and maintenance costs are a key restraint in the global lithium-ion battery testing equipment market, as precision instruments require frequent recalibration to meet stringent safety and performance standards. For instance, the US National Institute of Standards and Technology (NIST) highlights that battery measurement equipment operating at ppm-level accuracy must undergo periodic certification, which increases operational expenses for manufacturers and labs. Additionally, company disclosures note that service contracts and calibration cycles can account for 10–15% of annual equipment ownership costs, creating a financial barrier to scaling large fleets of testing systems.

For more details on this report : Request for Sample

Segmentation Analysis

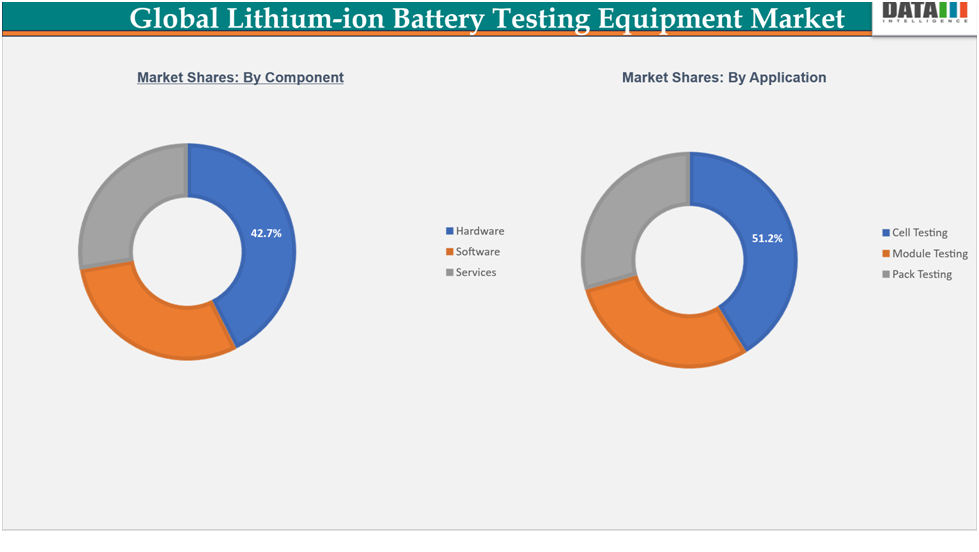

The global lithium-ion battery testing equipment market is segmented based on equipment type, testing type, component, application, end-user ,and region.

Component: The hardware component segment is estimated to have 42.7% of the lithium-ion battery testing equipment market share.

Battery cyclers and cell-level formation/aging rigs are the single biggest hardware drivers because they scale directly with manufacturing output: global battery manufacturing capacity reached about 3 TWh in 2024 and, based on announced giga factory plans, could exceed ~9 TWh by 2030, which multiplies the need for high-throughput cyclers, automated formation benches and production-grade cell testers. The rapid ramp in giga factory capacity (and corresponding rise in production testing volumes) is repeatedly highlighted by intergovernmental and policy reports as the primary demand multiplier for test hardware.

Beyond cyclers, integrated test systems, thermal/environmental chambers, high-precision impedance/EC-analysis instruments, BMS/pack emulators and automated formation/aging lines, are driving equipment spend because manufacturers demand turnkey, calibrated solutions that tie electrical cycling to controlled temperature and safety tests.

Company product disclosures show this trend: Arbin’s turnkey cell-testing systems now ship with integrated temperature chambers and 24-bit, 100-ppm measurement precision to support production and R&D workflows, and Keysight emphasizes complete battery-pack test suites for EV validation. Government strategy documents and federal consortium reports also point to expanding RD&D and manufacturing support, which both increases institutional procurement of advanced test hardware and shortens development cycles.

Geographical Analysis

The Asia-Pacific lithium-ion battery testing equipment market was valued at 35.3%market share in 2024

In Asia-Pacific, demand for lithium-ion battery testing equipment rose sharply in 2024, driven by the region’s leadership in EV production and renewable integration. The Government of China committed more than CNY 200 billion (≈USD 29 billion) in subsidies and tax incentives for EVs and batteries since 2020, alongside the Made in China 2025 plan, which prioritizes advanced testing and quality assurance. In Japan, the Ministry of Economy, Trade and Industry (METI) launched a JPY 2 trillion Green Innovation Fund to accelerate next-generation battery development, requiring extensive validation and safety testing facilities. These state-led programs significantly boosted demand for advanced testing systems across automotive and grid storage projects.

India also contributed to regional momentum with the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) batteries, allocating INR 18,100 crore (≈USD 2.2 billion) to domestic cell manufacturing and testing capacity. Meanwhile, South Korea’s Ministry of Trade, Industry and Energy (MOTIE) invested over KRW 20 trillion (≈USD 15 billion) through 2030 to strengthen its battery ecosystem, explicitly supporting R&D and certification infrastructure. With Asia-Pacific accounting for the majority of global EV and battery output, the region held a dominant share of global lithium-ion battery testing demand in 2024, as national policies across China, Japan, India, and South Korea directly amplified equipment adoption for automotive, electronics, and large-scale storage applications.

The North America Lithium-ion Battery Testing Equipment market was valued at 19.60% market share in 2024

In North America, demand for lithium-ion battery testing equipment accelerated in 2024, supported by rapid EV adoption and federal energy initiatives. The US Department of Energy (DOE) announced over US$7 billion in funding under the Bipartisan Infrastructure Law for domestic battery supply chains, including manufacturing and quality validation. Additionally, the DOE’s Battery Materials Processing and Manufacturing initiative awarded US$480 million to modernize testing and safety infrastructure. These investments created strong pull for advanced testing systems to ensure reliability, performance, and compliance standards in EV and grid storage projects.

The region’s demand was reinforced by government EV targets and clean energy commitments. The US Environmental Protection Agency (EPA) proposed rules aiming for two-thirds of all new cars sold by 2032 to be electric, requiring large-scale battery validation capacity. Similarly, Natural Resources Canada allocated more than CAD 1.5 (US$ 1.09) billion under the Critical Minerals Infrastructure Fund and Strategic Innovation Fund, with a portion dedicated to battery manufacturing and quality assurance. With North America holding 19.6% of global lithium-ion battery testing demand in 2024, federal policies and clean-energy incentives directly drove equipment adoption for automotive, consumer electronics, and energy storage sectors.

Competitive Landscape

The global lithium-ion battery testing equipment market features several prominent players, including Arbin Instruments, Inc., Chroma ATE Inc., Bio-Logic Science Instruments SAS, Digatron Power Electronics GmbH, Gamry Instruments, Inc., Hioki E.E. Corporation, Neware Technology Limited, PEC NV, Megger Group Limited, and Keysight Technologies, Inc., among others.

Keysight Technologies, Inc: Keysight Technologies, Inc. stands out as a global leading player in electronic measurement solutions, with a strong presence in battery testing systems. The company provides advanced platforms that enable precise characterization of lithium-ion batteries under various load, temperature, and charge/discharge conditions. Keysight’s solutions are widely used in EVs, energy storage, and consumer electronics, ensuring performance, safety, and compliance. With its strong R&D capabilities and partnerships with leading automotive and energy companies, Keysight is shaping the future of next-generation battery testing.

Market Scope

Metrics | Details | |

CAGR | 5.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Mn) | |

Segments Covered | Equipment Type | Battery Cyclers, Battery Analyzers, Battery Charge/Discharge Testers, Environmental Chambers, Battery Life Testers and Others |

Testing Type | Performance Testing, Safety Testing, Environmental Testing, Life Cycle Testing and Others | |

Component | Hardware, Software, Services | |

Application | Cell Testing, Module Testing and Pack Testing | |

| End-User | Automotive, Consumer Electronics, Aerospace & Defense, Energy Storage Systems (ESS) and Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global lithium-ion battery testing equipment market report delivers a detailed analysis with 78 key tables, more than 79visually impactful figures, and 239 pages of expert insights, providing a complete view of the market landscape.