Sports Nutrition Market Size

The Global Sports Nutrition Market reached USD 26,106 million in 2022 and is projected to witness lucrative growth by reaching up to USD 68,231 million by 2031. The market is growing at a CAGR of 12.8% during the forecast period (2025-2032). Products for sports nutrition can help athletes achieve their maximum potential through training, recover more quickly between sessions and competitions, maintain a healthy weight, decrease their risk of injury, and perform consistently.

The market for sports nutrition is being driven by the rising number of health clubs, fitness centres, and gyms as well as the expanding use of various exercise programs in these facilities, where dietitians offer advice on the consumption of sports nutrition.

For instance, the International Health Racquet and Sportsclub Association (IHRSA) estimates that there were 32,270 health clubs in the United States as of 2021 and that 4.5 billion Americans used health clubs at that time. In Germany, there were 9.2 million health club patrons in 2022 which drives the sports nutrition market value.

Market Scope

| Metrics | Details |

| CAGR | 12.8% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Product Type, End User, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To know More Insights: Download Sample

Sports Nutrition Market Dynamics

The Increasing Consumer Involvement In Fitness Clubs Is Expected To Drive The Market Growth

Consumers are more concerned about their health. Products for sports nutrition are becoming more and more well-liked, particularly among athletes and people who engage in strenuous physical activity. The increased emphasis on staying fit and healthy as well as the growth in sports, health clubs, sports clubs, and gyms are some of the factors fueling the expansion of the sports nutrition sector. The United States has the most gyms worldwide, while Brazil is the second-largest country with the most, followed by Mexico.

Fitness club penetration is increasing as a result of consumers' growing concerns about their health. For instance, according to various studies, 18.6% of Americans are members of one or more fitness clubs. On the other hand, on April 3, 2023, EverGrain, AB InBev’s sustainable ingredient business, launched FYTA, a portfolio of high-performance sports nutrition powders made from upcycled barley protein.

The Growing Health, Wellness, And Food Fortification Is Expected To Drive The Market Growth

Consumers are spending a significant portion of their disposable income on fitness and well-being as they become more health conscious. They've come to understand that maintaining a healthy diet in addition to exercise is necessary to become physically fit. The process of adding essential proteins, vitamins and minerals to common foods is known as food fortification. Consumers' poor eating habits and insufficient nutrition intake are a result of a number of factors, including the rise in lifestyle-related diseases and weight management. Foods high in protein support consumer health maintenance.

Sports nutrition products like ready-to-drink (RTD) items, energy bars, and snack foods are gaining in popularity with consumers. For instance, on March 16, 2023, Ready Light Sports Drink launched a “light version of Ready Sports Drink”. It is cutting-edge, scientifically based line of performance goods intended to maximise hydration replenishment and energy production.

Sports Nutrition Market Segment Analysis

The global sports nutrition market is segmented based on product type, end users, distribution channel and region.

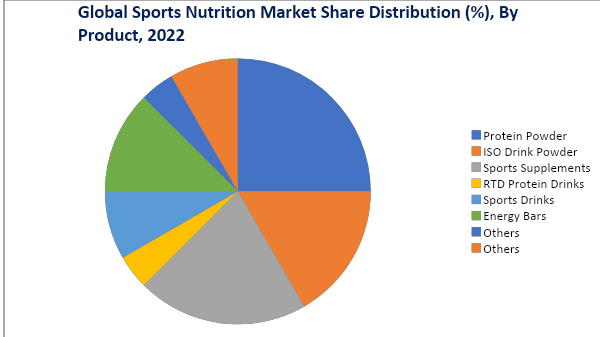

Protein Powder Segment Accounts For The Highest Share In Global Sports Nutrition Market

In 2022, the protein powder segment accounts for the largest share with about 49.2%. The expansion of health and fitness facilities across the region and the rise in sporting events are fostering market expansion. Furthermore, powdered supplements are simple to take, have more stable ingredients, and have a longer shelf life. Adults who want to bulk up and improve their bodies also consume protein powders. To help athletes maintain energy levels for longer by providing concentrated supplements compared to conventional powders, innovations are being introduced in this market, like powders that form thick shakes. For instance, on April 12, 2023, EverPro, the upcycled barley protein ingredient launched first sports nutrition powder made with upcycled barley.

Sports Nutrition Market Geographical Share

North America is the Dominating Region During The Forecast Period.

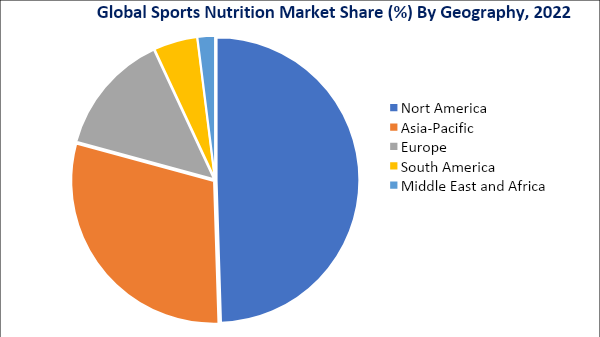

By region, the global sports nutrition market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east and America.

North America had the highest percentage in 2022 more than 45.0%. The increased demand for sports nutrition in this region is being attributed to growing awareness of health and wellbeing. Additionally, the growing number of sports supplement product launches, which point to high demand for these products in the upcoming years, and the local presence of key industry players are some of the key elements anticipated to fuel growth. For instance, on February 15, 2022, The US food innovation lab Chew launched Fastfood, a range of high-performance sports nutrition products to fuel elite and amateur athletes. Another significant element influencing the adoption of these products in this region is the rise in the number of government initiatives promoting sports-related activities.

Sports Nutrition Companies

The major global players include Iovate Health Sciences International Inc., Campo de Lorca. Abbott Laboratories, Quest Nutrition, PepsiCo, Inc., Clif Bar & Company, The Coca-Cola Company, MusclePharm, The Bountiful Company, Post Holdings, Inc., and BA SPORTS NUTRITION, LLC.

Nestlé is a multinational nutrition, health and wellness firm that serves both human and pet populations. The company's products are divided into several areas, including powdered and liquid beverages, pet care, nutrition and health science, prepared dishes and culinary assistance, milk and ice cream, confectionary and water. Nestlé's primary segment is powdered liquid beverages, which account for approximately 26.7% of total revenue. It includes brands like Nescafe, Nesquik, Nespresso, Milo, Blue Bottle Coffee, Nescau and Nestea. The biggest brands in the nutrition and health science area include Nestlé NAN, Ilumina, Gerben, Solgar, Vital Protein, Vitaflo, Pure Encapsulations, Zenpep, Cerelac, BEBA and many more.

Covid Impact on Market

With COVID-19, consumers' attention has shifted away from splurging on luxuries and services and towards preserving and extending the life of essential items. Compared to before, consumers are much more aware of their consumption habits. The World Health Organisation has suggested specific requirements for maintaining food hygiene and food safety regulations in the meantime to reduce Covid-19 transmission through food. These trends will lead to an increase in demand for clean label, legal sports nutrition products. After the global economy recovers, there will be an increase in per capita income and a shift towards healthier lifestyles, which will further increase demand for sports nutrition products.

Key Developments

- On November 24, 2022, the Alkaline Water Company launched sports drink in over 250 Harris Teeter stores.

- On January 16, 2022, Applied Nutrition, a UK-based sports nutrition company, launched L-Carnitine sports drink.

- In February 2021, Clif Bar & Company launched snack bars with prebiotics to support digestive health and broadened Luna Bar's line of products. It can be used to replace a meal or as a nutritious snack.

Why Purchase the Report?

- To visualize the global sports nutrition market segmentation based on product type, end user, distribution channel and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of sports nutrition market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global sports nutrition market report would provide approximately 77 tables, 82 figures and 195 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies