Specialty Oilfield Chemicals Market Overview

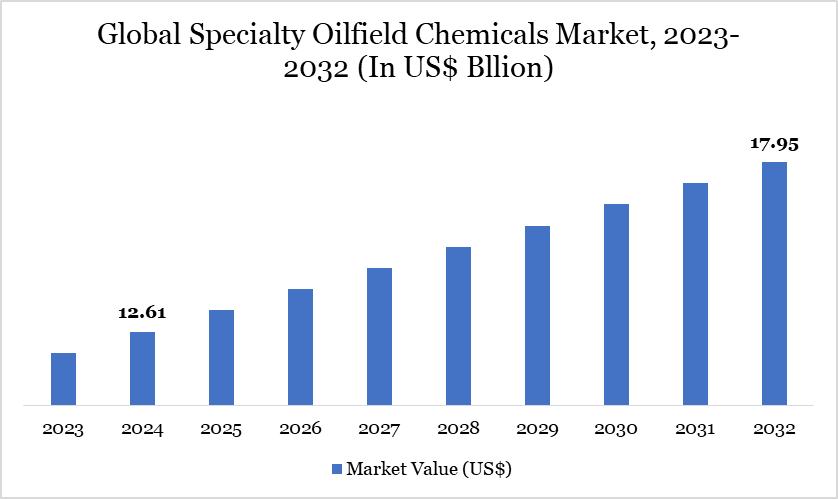

Specialty Oilfield Chemicals Market reached US$12.61 billion in 2024 and is expected to reach US$17.95 billion by 2032, growing at a CAGR of 4.52% from 2025 to 2032.

The specialty oilfield chemical market has evolved significantly in recent years, driven by advancements in technology and changing industry demands. Specialty chemicals are crucial for enhancing the efficiency and safety of oil and gas extraction processes. The market includes a wide range of products such as drilling fluids, production chemicals and enhanced oil recovery (EOR) agents, each tailored to specific functions and challenges in the oilfield.

The specialty oilfield chemical market is witnessing a shift towards regional production to enhance supply chain resilience, increased demand for high-performance and sustainable chemicals and a focus on technological innovation. A prime example is Halliburton's recent opening of its Chemical Reaction Plant in Saudi Arabia.

North America holds the largest share which is, driven primarily by US and Canada. For instance, US is one of the world's largest consumers and exporters of oil and gas. According to U.S. Energy Information Administration (EIA), Crude oil production in US is expected to average 12.9 million barrels per day (b/d) in 2023, up 0.7 million b/d from 2021. Also, the output will exceed 12.8 million b/d in 2023, breaking the previous annual average record of 12.3 million b/d set in 2019. Despite a focus on transitioning to renewable energy, the region continues to be a major consumer of oilfield chemicals due to ongoing operations in the North Sea and other offshore areas.

Specialty Oilfield Chemicals Market Trend

The specialty oilfield chemicals market is witnessing a significant transformation driven by the integration of digital technologies such as IoT, AI, cloud computing and real-time data analytics. These innovations are enabling the development of smart chemicals and digital oilfield solutions that allow real-time monitoring, precise chemical dosing and predictive maintenance. By leveraging data-driven insights, companies can optimize well performance, reduce operational downtime and improve the efficiency of chemical applications, all while lowering costs and minimizing environmental impact.

Companies such as Petrolink are leading this digital revolution with platforms such as PetroVue and PetroVault, which offer real-time data acquisition, operational optimization and advanced analytics. These tools enable enhanced decision-making, remote monitoring and management-by-exception capabilities, supporting safer, more efficient and cost-effective operations. As the oil and gas sector continues to embrace digitalization, the adoption of smart oilfield chemical solutions is expected to accelerate, driving sustainable growth and competitive advantage in a data-centric future.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

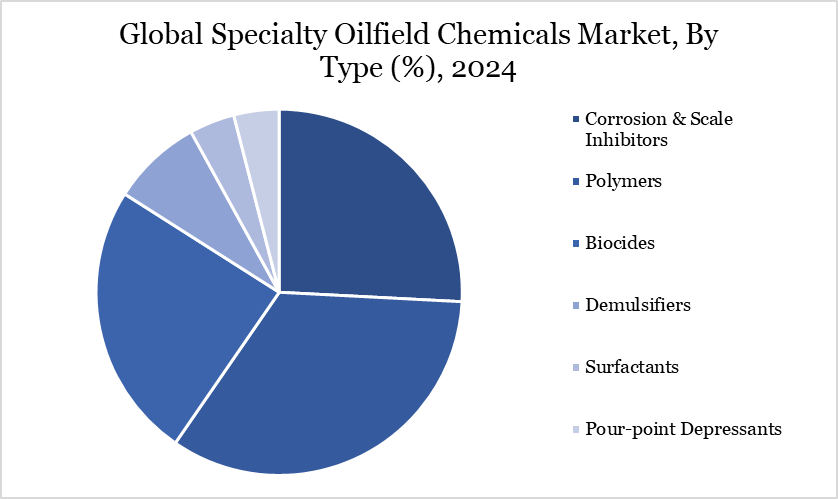

By Type | Corrosion & Scale Inhibitors, Polymers, Biocides, Demulsifiers, Surfactants and Pour-point Depressants |

By Function | Cementing Chemicals, Stimulation and Drilling Fluids |

By Location | Onshore and Offshore |

By Application | Production, Drilling fluids, Oil Recovery, Cementing and Other Applications |

By Region | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Specialty Oilfield Chemicals Market Dynamics

Rising Global Oil Demand and Efficiency Optimization

The IEA predicts that global oil consumption will hit 104.1 million barrels per day by 2026. Oil and gas companies will face greater pressure to improve operations due to the expected increase in demand for ethane, naphtha and LPG. Companies are depending more on specialty chemicals to improve efficiency, reduce downtime and prolong the lifespan of oilfields.

The industry's increasing focus on creative and sustainable chemical products is also fueling the need for specialty chemicals. This change is driven by the necessity to increase production capacity and comply with strict environmental regulations, which will also help drive the expected growth in the specialty chemicals industry.

Government Investments in Oil Refining Capacity Expansion

The growth of the refining sector is creating new opportunities for specialty chemical suppliers and service providers to meet the evolving needs of the industry. A key example is India's investment of over US$ 60 billion under the National Infrastructure Pipeline (NIP) to expand and modernize its oil refining capacity by 2025. This major infrastructure push is set to significantly boost refining output across the country.

As India's refining capacity grows, the demand for specialty oilfield chemicals is expected to rise accordingly. This increasing demand will benefit major industry players, such as Reliance Industries and Indian Oil Corporation, as they scale up their production capabilities to meet the country's growing energy requirements.

Heavy Reliance on Oil Importers

The instability of global oil prices and geopolitics leads to considerable uncertainties in the market, affecting the availability and cost of specialty oilfield chemicals. Countries such as Japan, which rely heavily on oil imports, are especially at risk. According to the IEA, Japan depends on Middle Eastern oil to provide 80% to 90% of its supply. Japan faces challenges in managing costs effectively and maintaining a stable supply chain due to heavy dependence on oil, declining domestic demand and lack of local production.

The interaction between changing worldwide oil prices and political conflicts worsens these problems, making it harder to guarantee steady availability of specialized oilfield chemicals. Japan's situation is made worse by its restricted capacity to produce oil within the country, which leaves it more vulnerable to supply chain disruptions and rising costs.

Specialty Oilfield Chemicals Market Segment Analysis

The global specialty oilfield chemicals market is segmented based on type, function, location, application and region.

High-Quality Demulsifiers Enhancing Oil and Gas Production Efficiency

The demulsifiers segment of the global specialty oilfield chemicals market is divided into non-ionic, anionic, cationic and zwitterionic types, each catering to specific emulsification challenges in various oilfield environments. Non-ionic demulsifiers offer broad stability, anionic ones address high water content, cationic types handle high salinity and zwitterionic demulsifiers provide flexibility for complex conditions.

Regional demands vary such as North America seeking advanced formulations for complex emulsions, Middle East & Africa requiring robust solutions for high salinity, Asia-Pacific needs diverse options for growing exploration activities and Europe focusing on environmentally friendly choices. Innovations are aimed at improving efficiency, reducing dosages and aligning with sustainability goals.

Specialty Oilfield Chemicals Market Geographical Share

Extensive Oil & Gas Activities in North America

The demand for specialty oilfield chemicals in North America is substantial, driven by the region's extensive oil and gas industry activities. The market of this region is robust due to high oil production levels in the US and Canada. In 2022, North America accounted for a noteworthy of the global demand for oilfield chemicals, reflecting the region's significant role in the global oil and gas sector.

The US, a major country in this market, has seen considerable investment in advanced oilfield chemicals, especially in key areas such as the Permian Basin and the Bakken Formation. Companies in North America are increasingly investing in research and development to create advanced oilfield chemicals. For example, the report published by IEA Bioenergy indicates that the production of bio-based products, in addition to biofuels, could generate US$ 10 billion in revenue for the global chemical industry.

Sustainability Analysis

Sustainability is becoming a critical focus in the global specialty oilfield chemicals market, with companies increasingly developing and adopting eco-friendly solutions to reduce environmental impacts and enhance operational efficiency. A notable example of this trend is Clariant Oil Services' launch of the D3 PROGRAM, which exemplifies industry's shift towards sustainability. The D3 PROGRAM consists of three key components like Decarb, Densify and Detox.

The D3 PROGRAM highlights the growing emphasis on sustainability within the specialty oilfield chemicals market. Companies are increasingly investing in innovative technologies and environmentally conscious solutions to reduce their environmental impact while maintaining operational efficiency. As the industry continues to evolve, the adoption of such sustainable practices will be crucial in addressing environmental challenges and meeting regulatory requirements, ultimately contributing to a more sustainable future for the global oil and gas sector.

Specialty Oilfield Chemicals Market Major Players

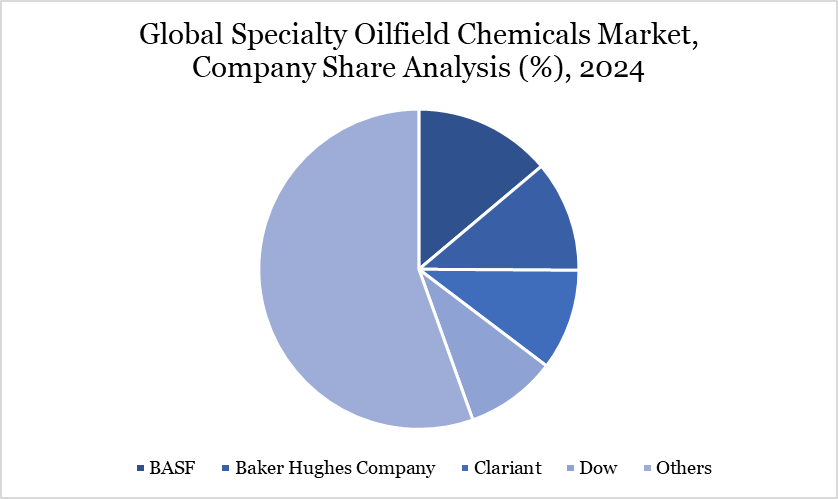

The major global players in the market include Arkema, BASF, Baker Hughes Company, Clariant, Dow, DuPont, Ecolab, Global Drilling Fluids & Chemicals Ltd., Halliburton and Syensqo.

Key Developments

In 2024, BASF's launch of the new "BASF Oilfield Solutions" platform, which focuses on advanced chemical solutions designed to enhance oil recovery and reduce operational costs. This platform introduces innovative products such as the "SULFOTREAT" series, aimed at improving the efficiency of sulfur removal in oilfield operations and "FLOPRO" additives that enhance fluid performance and stability.

In 2023, SLB completed the acquisition of Gyrodata Incorporated, a move poised to enhance its capabilities in the global specialty oilfield chemicals market. This acquisition integrates Gyrodata's advanced directional drilling technologies and precision measurement services into SLB's portfolio, strengthening its offerings in high-precision drilling solutions and expanding its market reach.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies