Global Space Robotics Market Size

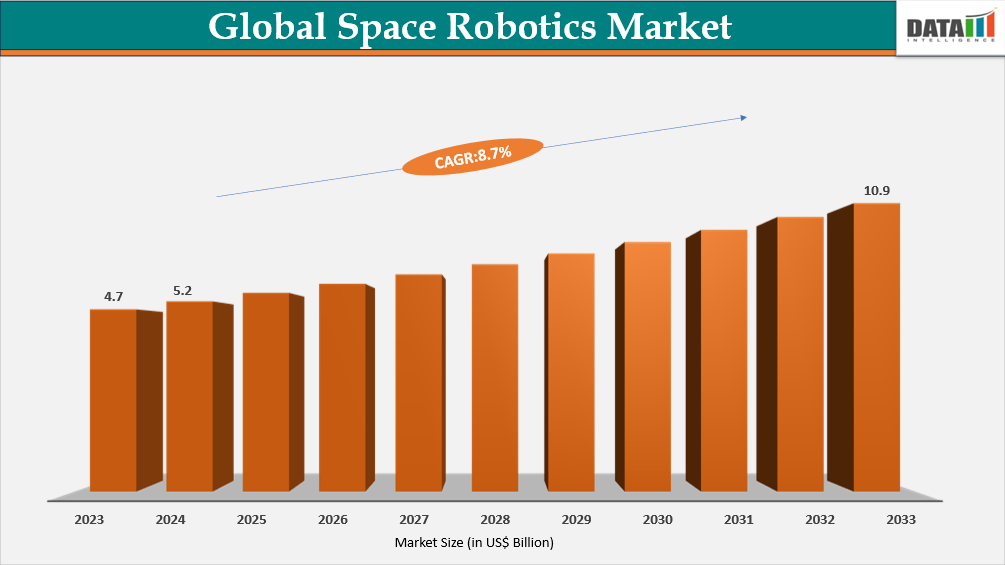

Global Space Robotics Market reached US$ 5.2 billion in 2024 and is expected to reach US$ 10.1 billion by 2032, growing with a CAGR of 8.7% during the forecast period 2025-2032. Space project complexity and ambition drive deep space robotics industry demand. Governments and private companies heavily invest in missions to the Moon, Mars and beyond, which demand robots to perform planetary surface exploration, sample gathering and infrastructure building. Robots need to function autonomously in hostile, uncontrolled environments, driving innovation in AI, machine learning and robotic mobility.

For example, NASA's Artemis mission and ESA's lunar missions rely on robots to land on the moon and erect habitats. Furthermore, growing interest in asteroid mining and space resource exploitation fuels the demand for specialist robotics. As exploration missions reach further into space, the dependence on robots to accomplish the too dangerous or too impractical for human endeavors will continue to increase, solidifying the role of robotics in deep space exploration.

Space Robotics Industry Trends and Strategic Insights

North America dominates the market in the market, capturing the largest revenue share of 39.3% in 2024.

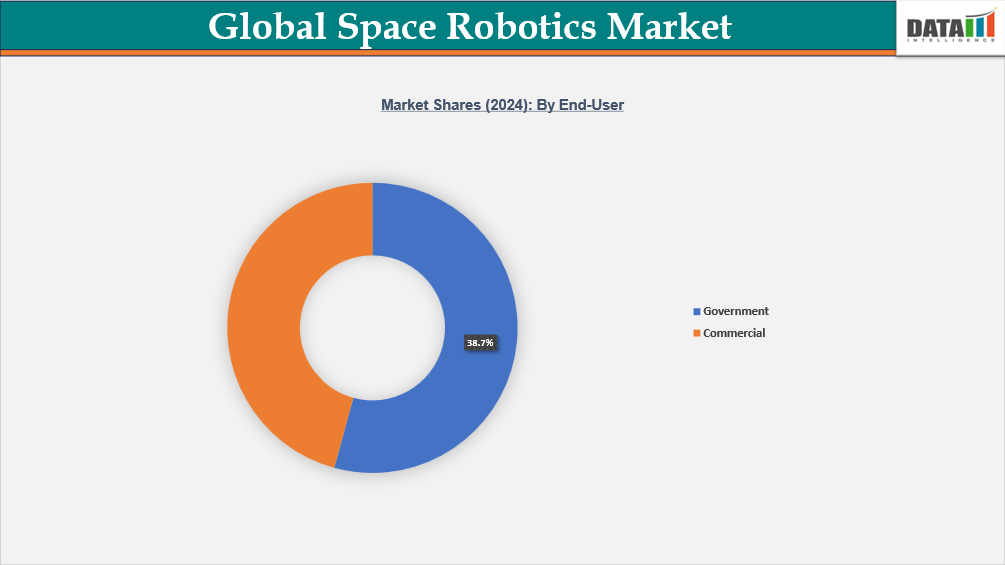

By end-user, the government segment is projected to experience the largest market, registering a significant 28.7% in 2024.

Market Size and Future Outlook

2024 Market Size: US$ 5.2 Billion

2032 Projected Market Size: US$ 10.1 Billion

CAGR (2025-2032): 8.7%

Largest Market: North America

Fastest Market: Asia-Pacific

Source: Datam Intelligence Email: [email protected]

Market Scope

Metrics | Details |

By Solution | Remotely Operated Vehicles, Remote Manipulator System, Software, Services |

By Application | Space Exploration, Satellite Servicing, Space Infrastructure Assembly |

By End-User | Government, Commercial |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Diver-Rising Adoption of Advanced Technologies

New technologies, like Artificial Intelligence (AI) and Deep Learning (DL), are being extensively implemented in the field of robotics. Some organizations are designing AI-enabled deep space robots that offer improved exploration advantages and increased mobility within space. Robots are able to work with minimum human intervention and carry out very intricate tasks for a longer time.

For example, in June 2023, the International Space Station (ISS) began to use a new device called Int-Ball, which was created by the Japan Aerospace Exploration Agency and operated & managed by a crew of JAXA ground controllers. The major aim of Int-Ball is to minimize photographing time; JAXA has created the JEM Internal Ball Camera ("Int-Ball") which autonomously travels to the target spatial position and takes videos/pictures of the target, with the goal of achieving zero photographing time by the crew.

Restraints-High Cost of Development and Deployment

One of the main constraints in the international deep space robotics industry is the excessive cost involved in the development, testing and deployment of space-grade robotic systems. Designing robots that are capable of withstanding hostile extraterrestrial environments—severe temperatures, radiation and delayed communications—calls for customized materials, high-precision engineering and stringent testing procedures.

The expenses are further augmented by launch costs, which can cost tens of millions of dollars per mission. The high capital costs restrict participation to well-funded government agencies and a handful of private companies, resulting in high barriers to entry for startups and new entrants. The financial burden tends to retard innovation cycles and limit wider adoption among international or commercial players.

Segmentation Analysis

The global space robotics market is segmented based on solution, application, end-user and region.

Rising Investments in Government Sector to Drive the Segment Growth

Government end-user is expected to hold about 38.7% of the global market in 2024. Government remains at the forefront of the industry as it is national space agencies such as NASA, ESA, Roscosmos, CNSA and ISRO that are the biggest spenders on space missions into the universe. Governments allocate large sums of money to interplanetary research; space station upkeep and planetary exploration and they demand the use of cutting-edge robotic technologies. Government investment in deep space robotics is further established by the growing focus on Mars exploration and asteroid mining due to growing interest in space security.

Additionally, governments are funding research and development in the fields of robotics and space. For example, in February 2023, India's union budget for 2023-2024 provisioned US$ 151.48 million for the Department of Space (DoS). It will aid the development of India's space program by initiating projects from launch vehicles and satellites to other development and operational ones.

Commercial Sector Has a Significant Growth Rate Due to the Expanding Private Companies

The commercial space robotics sector is quickly growing as private companies look for robotic solutions to cut costs, extend satellite lifecycles and enable new business models in space. One of the most obvious applications is satellite servicing, which employs robotic equipment for in-orbit inspection, refueling and repositioning. For example, Northrop Grumman's Mission Extension Vehicle (MEV-1 and MEV-2) successfully docked with Intelsat satellites, extending their operational lifetimes by more than 5 years and saving operators the expense of launching totally new spacecraft. This commercial proof-of-concept opens the door to service-based contracts in GEO and LEO, establishing recurrent income streams for robotic service providers.

Geographical Penetration

Rising Investments and Adoption of Technology in Asia-Pacific

Asia-Pacific is the fastest-growing region for space robotics, with strong contributions from China, India, Japan and other regional players. China leads the market, having demonstrated cutting-edge robotics in its Chang’e lunar exploration program, Tianwen-1 Mars rover and robotic arms on the Tiangong space station. China’s roadmap for lunar bases and deep-space exploration ensures long-term investments in autonomous robotics for construction, servicing and planetary mobility.

Beyond the big players, South Korea and Australia are entering the space robotics market. South Korea is using robotics for planned lunar exploration missions and Australia's collaboration with NASA under the Artemis Accords includes the development of a semi-autonomous lunar rover by the mid-2020s. With increasing government financing, regional collaboration and the arrival of commercial entrepreneurs, the Asia-Pacific space robotics market is predicted to become one of the most competitive, contributing not just to national projects but also to global commercial missions.

India Space Robotics Market Outlook

India's space robotics sector is expanding rapidly, fuelled by ISRO's emphasis on lunar and planetary exploration. Robotic technologies were tried in missions such as Chandrayaan-2 and Chandrayaan-3, where autonomous landing and rover systems demonstrated India's expanding capabilities. Looking ahead, ISRO plans to invest in robotic arms and humanoid robots (such as Vyommitra) for the future Gaganyaan human spaceflight mission. The government's effort for commercialization and private sector participation is also projected to create chances for robotics firms meeting satellite servicing and manufacturing needs.

China Space Robotics Market Trends

China's Space Robotics market prognosis remains positive, as it is one of the most advanced countries in space robotics, accounting for more than 40% of the regional market. It has successfully deployed robotic arms on the Tiangong space station, as well as surface rovers on the Moon and Mars. The country's space robotics industry is inextricably connected to its long-term goal of establishing permanent lunar outposts and improving on-orbit servicing capabilities. Chinese enterprises and CASC subsidiaries are developing autonomous satellite servicing and debris removal technologies that are consistent with both national security and commercial purposes. With strong state backing and swift execution, China is poised to be a global leader in robotic applications for human spaceflight, exploration and in-orbit operations.

Presence of Major Companies in North America

North America is expected to be dominant region of the global market holding about 40% of the market in 2024. The region’s strong space exploration programs, sophisticated technological infrastructure and significant R&D expenditures are expected to make it the market leader in the worldwide deep space robotics market. Presence of leading space agencies like NASA and premier private space companies such as SpaceX, Blue Origin and Lockheed Martin gives a competitive advantage in this region. Also, government assistance in policies, financing deep space missions and partnerships with commercial players support North America's market leadership.

Space agencies and companies are building deep space robots that may operate in extreme conditions. An example is NASA, which is currently building its new space-exploring robot, the Shapeshifter. The Shapeshifter is an amphibious aerial robot capable of rolling, flying, floating and swimming. The NASA Innovative Advanced Concepts research program is constructing the robots. When complete, the robots will be able to explore Saturn's moon, Titan, which has liquid (in the form of seas of methane) on its surface.

US Space Robotics Market Insights

US currently dominates the commercial space robotics business, thanks to NASA's legacy and private sector innovation. NASA's contributions include Canadarm2 (on the International Space Station), Mars rovers Curiosity and Perseverance and planned robotic systems for the Artemis lunar program and Lunar Gateway station. Commercially, US businesses are pioneering new uses, including Northrop Grumman's MEV spacecraft for satellite life extension, Redwire's in-space manufacturing robotics and Astrobotic's lunar surface robots for cargo delivery. With billions funded annually through NASA and the Department of Defense, together with a robust commercial sector, US is the largest market and engine of innovation in space robotics globally.

Canada Space Robotics Industry Growth

Canada holds a unique global position as a specialist in space robotics, largely through its legacy of the Canadarm series. The Canadarm and Canadarm2 have been critical to Shuttle missions and ISS operations, while the upcoming Canadarm3 will play a central role on NASA’s Lunar Gateway. Canadian company MDA leads this sector, developing robotic arms, manipulators and autonomous servicing systems for both government and commercial clients. Beyond government contracts, Canada is increasingly targeting the commercial servicing market, leveraging its decades of expertise to expand into robotic satellite repair, inspection and orbital logistics services.

Technology Analysis

Advancements in space robotics are focused on enhanced autonomy, resiliency and accuracy. Artificial Intelligence (AI) and Machine Learning (ML) have been one of the significant advances, which allows robots to make decisions in real-time while on missions with very little human intervention.

For example, NASA's Mars rovers now have autonomous navigation systems that enable them to move across new terrain without repeated Earth-based instructions. This is important due to the communication delay in communication with deep space objects, which varies from 5 to 20 minutes one way.

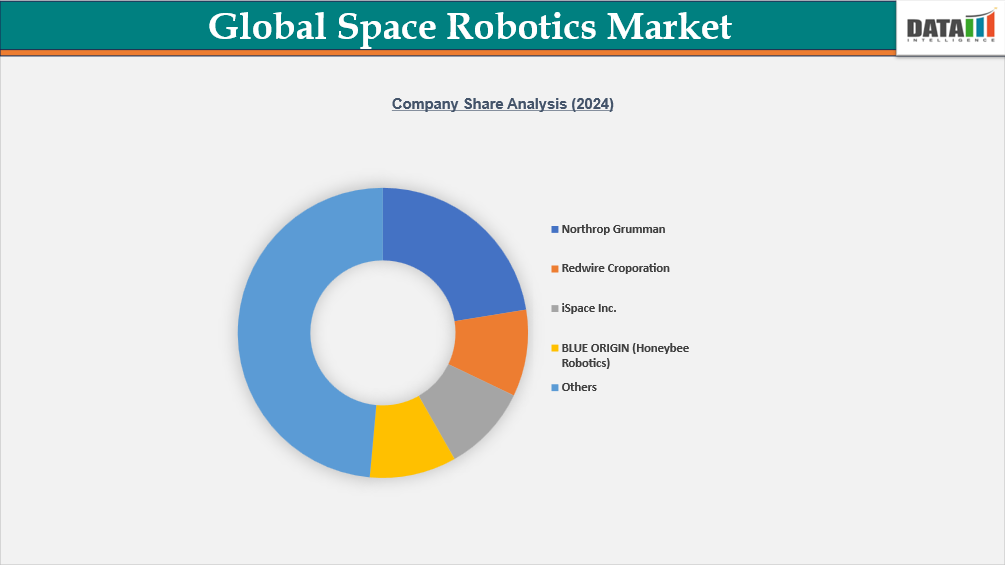

Competitive Landscape

The space robotics market is competitive, driven by a mix of global and regional players striving for technological efficiency and cost leadership.

Key players include Northrop Grumman, Redwire Corporation, iSpace Inc., BLUE ORIGIN (Honeybee Robotics), Motiv Space Systems Inc., Maxar Technologies, Astrobotic Technology, Space Applications Services, Ceres Robotics Inc. and Lunar Resources, Inc.

Players are investing highly in robotics, robotic servicing technologies and seek robotic solutions to reduce costs, extend satellite lifecycles and enable new business models in orbit, to gain an edge.

Key Developments

In 2024, India revealed to send the unmanned 'VyomMitra' mission in the third quarter of 2025. The Indian Space Research Organization (ISRO) created 'VyomMitra', an AI-driven humanoid robot that is shaped with female looks and voice-controlled functionality. This cutting-edge robot is set to be a critical component of India's ambitious manned space program, especially the Gaganyaan mission.

In 2024, NASA made plans to send autonomous space robots out to the moon and Mars to build shelters and solar panels. They called them ARMADAS or "Automated Reconfigurable Mission Adaptive Digital Assembly Systems," and this state-of-the-art technology represents the future of space travel according to NASA.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies