Smart Medical Devices Market Size & Industry Outlook

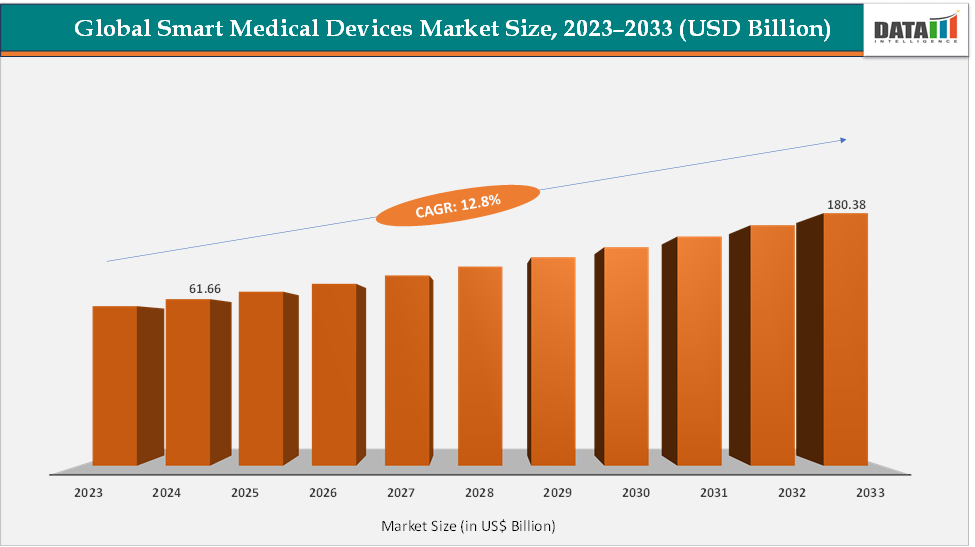

The global smart medical devices market size reached US$ 61.66 Billion in 2024 from US$ 55.12 Billion in 2023 and is expected to reach US$ 180.38 Billion by 2033, growing at a CAGR of 12.8% during the forecast period 2025-2033. The market is expanding rapidly, driven by rising chronic disease prevalence, aging populations, and the integration of AI, IoT, and wearable technologies into healthcare.

Devices such as Abbott’s FreeStyle Libre, a continuous glucose monitoring system, Dexcom G7 CGM, Medtronic’s MiniMed insulin pumps, Masimo’s SET pulse oximeters, and Philips’ connected sleep therapy devices exemplify regulatory-approved innovations already in use. These products support real-time monitoring, remote patient management, and personalized care, reducing hospital visits and enabling better clinical outcomes. The market’s growth trajectory is reinforced by strong adoption in home care settings, hospitals, and telehealth platforms, positioning it as a cornerstone of next-generation healthcare delivery.

Key Market Highlights

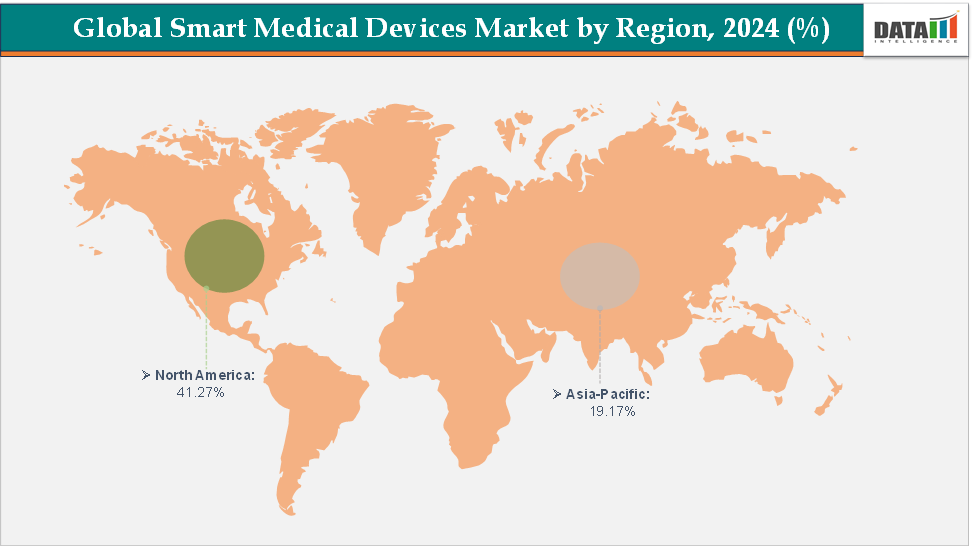

North America dominates the smart medical devices market with the largest revenue share of 41.27% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 12.7% over the forecast period.

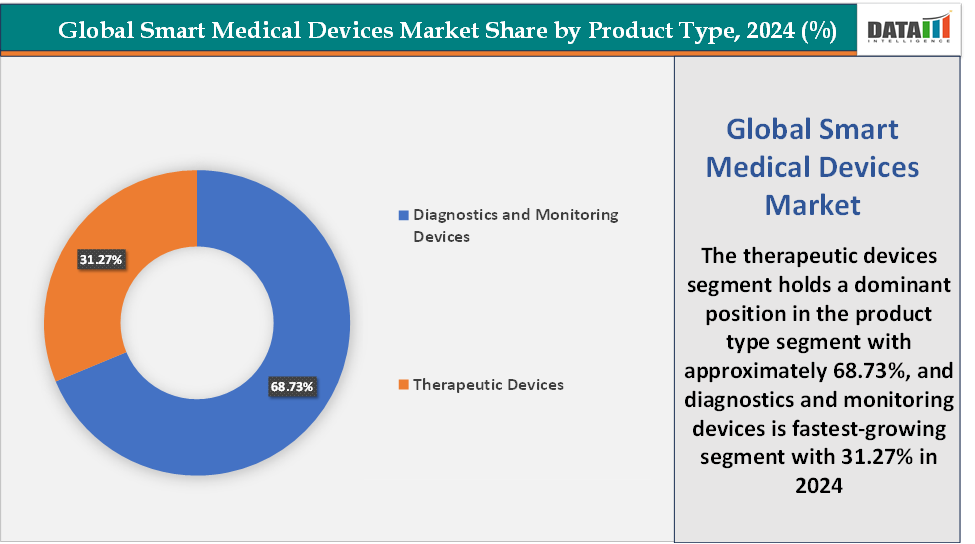

Based on product type, the therapeutic devices segment led the market with the largest revenue share of 68.73% in 2024.

The major market players in the smart medical devices market are Abbott, Medtronic, F. Hoffmann-La Roche Ltd, Koninklijke Philips N.V., Dexcom, Inc., Masimo, NIPRO, Apple Inc., Samsung Healthcare, and GE HealthCare, among others

Market Dynamics

Drivers:Rising prevalence of chronic diseases is significantly driving the smart medical devices market growth

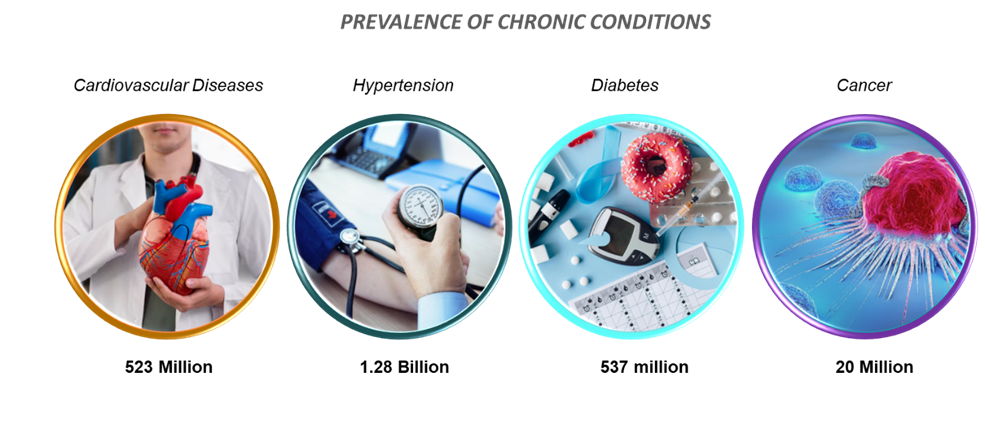

The rising prevalence of chronic diseases is one of the most powerful drivers fueling the growth of the smart medical devices market, as these conditions demand continuous monitoring, long-term management, and personalized care. According to the World Health Organization (WHO), chronic diseases such as cardiovascular disorders, diabetes, cancer, and respiratory illnesses account for nearly 74% of all global deaths annually, with diabetes alone affecting over 540 million adults in 2021, a number expected to reach 783 million by 2045 (IDF Diabetes Atlas).

Such alarming statistics highlight the urgent need for advanced medical technologies that can both track disease progression and deliver therapeutic interventions outside hospital settings. Smart devices like Abbott’s FreeStyle Libre and Dexcom G7 continuous glucose monitoring (CGM) systems, Medtronic’s MiniMed insulin pumps, and Insulet’s Omnipod insulin management system have been FDA-approved to help diabetic patients manage glucose levels more effectively, reducing complications and hospital visits.

In cardiovascular care, approved devices like the Apple Watch ECG feature and AliveCor KardiaMobile provide real-time arrhythmia detection, empowering patients and clinicians with actionable insights. Similarly, Masimo’s SET pulse oximeters and Philips’ connected CPAP devices support respiratory and sleep disorder management. By providing remote monitoring, early detection, and integrated therapeutic capabilities, smart medical devices directly address the needs of chronic disease patients, while simultaneously reducing healthcare costs and easing the burden on hospitals. As chronic disease cases continue to rise globally, the demand for wearable, implantable, and connected therapeutic devices is expected to accelerate, driving the market growth.

Restraints: Data privacy & cybersecurity risks are hampering the growth of the market

Data privacy and cybersecurity risks are major restraints hampering the growth of the smart medical devices market, as these devices depend heavily on connectivity and data sharing. Smart medical devices continuously collect and transmit sensitive health information through cloud platforms, mobile apps, and hospital networks, making them attractive targets for cyberattacks. Beyond implantable devices, connected wearables and monitoring tools are also vulnerable to breaches, as seen in reported ransomware attacks on healthcare IoT ecosystems where patient data was leaked or held hostage.

For instance, according to the HIPAA Journal, in August 2023, 23 million breached healthcare records are noticed. Over the past 12 months, an average of 9,989,003 healthcare records were breached each month. In the year to August 31, 2024, there have been 491 data breaches of 500 or more records, and at least 58,668,002 records are known to have been breached. The average breach size in 2024 is currently 119,487 records and the median breach size is 4,109 records.

Such incidents not only compromise patient trust but also create legal and regulatory compliance challenges under laws like HIPAA (U.S.) and GDPR (Europe). Hospitals and insurers remain cautious about integrating smart devices into broader healthcare systems due to the high cost of implementing cybersecurity safeguards. These risks slow adoption, especially in regions with underdeveloped data protection frameworks, thereby restraining overall market growth despite the clinical value these devices provide.

For more details on this report – Request for Sample

Segmentation Analysis

The global smart medical devices market is segmented based on product type, application, end-user, and region.

Product Type: The therapeutic devices segment is dominating the smart medical devices market with a 68.73% share in 2024

The therapeutic devices segment is dominating the smart medical devices Market, primarily because these products not only monitor health conditions but also provide direct and life-sustaining interventions, making them indispensable for patients with chronic diseases. Unlike diagnostic and monitoring devices, which mainly track health data, therapeutic devices deliver active treatment and thus carry higher clinical importance, adoption, and cost contribution to the market. For instance, in respiratory care, the demand for portable oxygen concentrators and ventilators surged during the COVID-19 pandemic, with FDA-cleared devices like Philips Respironics SimplyGo Mini and ResMed Astral ventilators becoming critical in home and hospital settings.

In diabetes management, therapeutic devices dominate with FDA-approved Medtronic MiniMed insulin pumps, Insulet Omnipod DASH system, and Tandem t:slim X2 with Control-IQ technology, all of which automate insulin delivery and reduce patient burden. Similarly, hearing aids have evolved into smart therapeutic devices, with FDA-approved Phonak Marvel and Oticon More integrating Bluetooth, AI-based sound processing, and remote adjustments. In neurology, Boston Scientific’s Vercise Genus DBS system and Medtronic’s Percept PC neurostimulator exemplify advanced neurostimulation devices that provide real-time sensing for Parkinson’s disease and epilepsy management.

Respiratory and asthma patients benefit from FDA-cleared Propeller Health smart inhalers, which track medication use and adherence through mobile platforms. Collectively, these therapeutic solutions are essential in reducing hospitalizations, improving treatment compliance, and extending care into home and outpatient settings, which aligns with healthcare’s shift toward cost-effective, patient-centric models. Their critical role in disease management, higher reimbursement coverage, and technological advances in connectivity and automation ensure that the therapeutic devices segment continues to command the largest share of the smart medical devices market worldwide.

The diagnostics and monitoring devices segment are fastest-growing in the smart medical devices market with a 31.27% share in 2024

The diagnostics and monitoring devices segment are the fastest-growing area of the smart medical devices market, driven by rising demand for real-time health tracking, preventive care, and patient self-management. Diagnostics and monitoring tools are increasingly being adopted by both patients and healthy consumers, fueling rapid growth. For instance, in diabetes care, Abbott’s FreeStyle Libre 3 and Dexcom G7 continuous glucose monitoring (CGM) systems have gained FDA approval and widespread adoption due to their convenience, needle-free monitoring, and integration with smartphones.

In cardiovascular health, the Apple Watch (FDA-cleared ECG feature) have transformed how atrial fibrillation and arrhythmias are detected outside clinical settings. Similarly, Omron’s HeartGuide smart blood pressure monitor and Masimo’s SET pulse oximeters exemplify innovations that allow continuous, at-home monitoring of vital signs. The growing popularity of wearable devices in preventive healthcare and fitness tracking has blurred the line between consumer electronics and clinical-grade devices, further accelerating adoption. These factors collectively position diagnostics and monitoring devices as the fastest-growing segment, offering massive opportunities in both clinical and consumer markets.

Geographical Analysis

North America is expected to dominate the global smart medical devices market with a 41.27% in 2024

North America stands as the dominant region in the smart medical devices market, primarily due to its presence of major market players, strong regulatory framework, high adoption of digital health technologies, and a large base of patients suffering from chronic diseases. Coupled with rising advancements in AI, IoT-enabled devices, and telehealth integration, the region continues to set the benchmark for smart medical device adoption globally, making it the clear leader in innovation, adoption, and revenue generation.

US Smart Medical Devices Market Trends

The US FDA’s proactive role in approving and fast-tracking innovative devices, ensuring patient access to cutting-edge technologies such as in diabetes management, the FDA approved Abbott’s FreeStyle Libre 3 and Dexcom G7 continuous glucose monitoring (CGM) systems, which are widely used across the US. Similarly, Medtronic’s MiniMed 780G insulin pump and Tandem’s t:slim X2 with Control-IQ technology has become standard tools in insulin delivery, highlighting the region’s focus on advanced therapeutic solutions.

In cardiovascular care, the Apple Watch (ECG feature cleared by the FDA in 2018) and AliveCor’s KardiaMobile 6L, the first FDA-cleared six-lead personal ECG, have revolutionized at-home monitoring of atrial fibrillation and arrhythmias. The US also leads in respiratory and sleep care, with Philips’ DreamStation CPAP devices and ResMed’s connected ventilators playing a critical role during the COVID-19 pandemic. High consumer awareness, a culture of preventive healthcare, and the presence of major market players such as Medtronic, Abbott, and GE HealthCare further strengthen US dominance.

The Asia Pacific region is the fastest-growing region in the global smart medical devices market, with a CAGR of 12.7% in 2024

The Asia Pacific region is the fastest-growing market for smart medical devices, fueled by its large population base, rapid urbanization, rising prevalence of chronic diseases, and increasing healthcare investments. The demand for diabetes management solutions is particularly high, with millions of patients in China and India relying on smart glucose monitoring systems like Abbott’s FreeStyle Libre and Dexcom G6/G7, which have gained regulatory approvals and local market entry.

Japan leads in smart therapeutic and monitoring devices, supported by an aging population, with widespread adoption of Medtronic’s insulin pumps and Omron’s HeartGuide smart blood pressure monitor, a Japan-based innovation that also secured approval. Additionally, governments across the region are actively promoting digital health initiatives, such as China’s Healthy China 2030 plan and India’s National Digital Health Mission, creating favorable regulatory pathways for device adoption.

The presence of regional innovators like Samsung (South Korea) and strong partnerships with global and emerging players are further boosting accessibility and affordability. For instance, in February 2025, MediBuddy, announced a strategic partnership with ELECOM, a Japanese electronics company, to jointly develop and introduce smart health IOT devices to the Indian market. With India experiencing a rapid rise in lifestyle-related diseases, causing 6 million fatalities annually, ELECOM aims to safeguard health by merging digital technology with healthcare products to deliver optimal solutions.

Europe Smart Medical Devices Market Trends

In Europe, the smart medical devices market is witnessing steady growth, supported by a strong regulatory framework, government-led digital health initiatives, and rising adoption of connected healthcare technologies. The European Union’s MDR (Medical Device Regulation) has enhanced the focus on patient safety and interoperability, creating a trusted environment for smart device integration. The region’s aging population with over 20% of Europeans are aged over 65 is driving demand for continuous monitoring and therapeutic solutions.

Devices such as Biotronik’s implantable cardiac monitors and pacemakers and Ypsomed’s YpsoPump insulin delivery system exemplify the region’s leadership in smart therapeutics. Additionally, Europe’s emphasis on sustainability and localized innovation is spurring collaborations between medtech startups and healthcare systems. Collectively, these factors coupled with innovations and a focus on preventive care are making Europe one of the most progressive and innovation-driven regions for smart medical device adoption.

Competitive Landscape

Top companies in the smart medical devices market include Abbott, Medtronic, F. Hoffmann-La Roche Ltd, Koninklijke Philips N.V., Dexcom, Inc., Masimo, NIPRO, Apple Inc., Samsung Healthcare, and GE HealthCare, among others.

Market Scope

Metrics | Details | |

CAGR | 12.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Diagnostics and Monitoring Devices and Therapeutic Devices |

Application | Cardiology, Neurology, Diabetes Management, Sleep Disorders, Pain Management, and Others | |

End-User | Hospitals, Specialty Clinics, Homecare Settings, Ambulatory Surgical Centers, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global smart medical devices market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here