Smart Insulin Management Devices Market Size

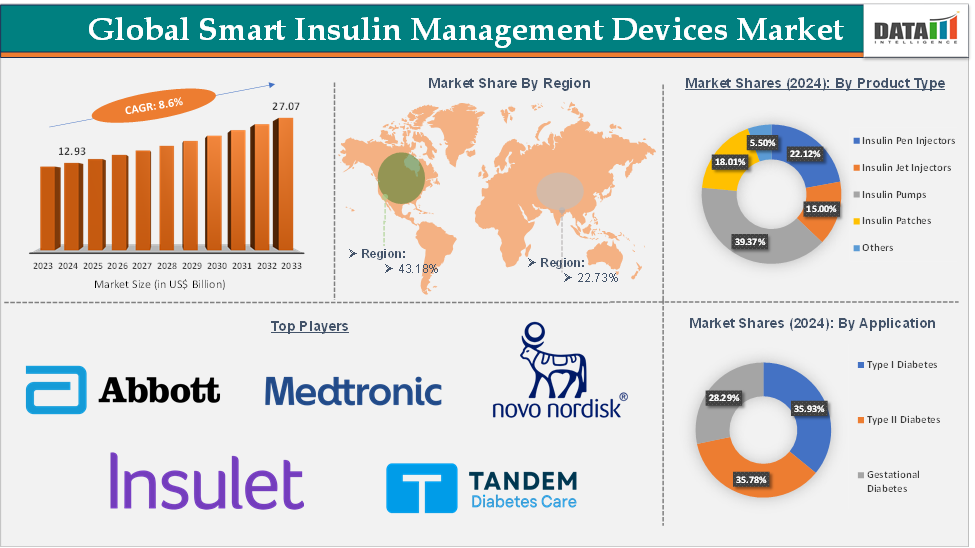

Smart Insulin Management Devices Market Size reached US$ 12.93 Billion in 2024 and is expected to reach US$ 27.07 Billion by 2033, growing at a CAGR of 8.6% during the forecast period 2025-2033.

Smart Insulin Management Devices Market Overview

The smart insulin management devices market is experiencing rapid growth, driven by the global rise in diabetes, increasing adoption of connected health technologies, and the demand for improved glycemic control. Key innovations include smart insulin pens, patch pumps, and automated insulin delivery (AID) systems integrated with CGMs and AI-based dosing algorithms. North America leads the market, while Asia-Pacific emerges as the fastest-growing region. Challenges such as high device costs and integration issues persist, but growing reimbursement support and advancements in digital therapeutics are expected to accelerate adoption globally.

Executive Summary

For more details on this report – Request for Sample

Smart Insulin Management Devices Market Dynamics: Drivers & Restraints

The rising prevalence of diabetes is significantly driving the smart insulin management devices market growth

According to the International Diabetes Federation, by 2050, IDF projections show that 1 in 8 adults, approximately 853 million, will be living with diabetes, an increase of 46%. This surge necessitates scalable, automated management tools, fueling demand for smart insulin pens and pumps that improve adherence and reduce complications. Smart devices like the NovoPen 6 and Medtronic MiniMed 780G help patients manage dosing accurately, track data, and prevent hypoglycemia/hyperglycemia, critical in populations with long-term diabetes.

Traditional insulin methods often lead to poor adherence and suboptimal control. Smart devices like Medtronic’s MiniMed 780G and Insulet’s Omnipod 5 automate insulin delivery based on real-time CGM data, helping patients maintain target glucose levels more consistently. With Type 1 diabetes increasing among children and adolescents, user-friendly and discreet smart insulin pens are becoming more popular, supporting long-term management without complex procedures.

As diabetes-related complications lead to increased hospital visits and costs, smart insulin devices help reduce emergency cases through proactive monitoring and data-driven dosing adjustments. Overall, as diabetes cases rise globally, the demand for smarter, more integrated insulin management solutions grows in parallel, making these technologies critical to both individual patient outcomes and broader public health strategies.

Complications associated with the devices are hampering the smart insulin management devices market's growth

Technical failures can lead to incorrect insulin dosing, which may cause hypoglycemia or hyperglycemia. For instance, Medtronic recalled over 300,000 MiniMed insulin pumps due to a faulty retainer ring that could lead to under- or overdosing, raising safety concerns and affecting brand reputation. Devices like patch pumps and CGMs often require adhesive contact with the skin. Many users report skin irritation, infections, or allergic reactions at the site of application, discouraging long-term use, especially in sensitive populations such as children and elderly patients.

Smart insulin systems often involve a steep learning curve. Elderly patients or those with limited tech literacy may find it difficult to operate apps, interpret CGM data, or troubleshoot devices, reducing overall adoption rates. Not all devices are compatible across platforms. For instance, a Dexcom CGM may not seamlessly integrate with certain insulin pumps or digital health apps, leading to fragmented care experiences. This lack of interoperability complicates device management and discourages multi-device usage.

Smart Insulin Management Devices Market Segment Analysis

The global smart insulin management devices market is segmented based on product type, application, end-user, and region.

The insulin pumps from the product type segment are expected to hold 39.37% of the market share in 2024 in the smart insulin management devices market

Insulin pumps, especially hybrid closed-loop systems, deliver insulin continuously and adjust doses based on real-time glucose data. Devices like the Medtronic MiniMed 780G and Insulet Omnipod 5 have revolutionized diabetes care by minimizing user input and reducing hypo-/hyperglycemia events. Pumps paired with CGMs (e.g., Dexcom G6) allow for automated dose adjustments. This interoperability has led to significant clinical benefits, such as improved HbA1c levels and time-in-range metrics, making pumps more attractive to both patients and clinicians.

Newer models like software in insulin pumps eliminate complications, further driving user preference for convenience and comfort. For instance, in March 2025, Tandem Diabetes Care, Inc. launched Control-IQ+ technology, the latest generation of the company’s advanced hybrid closed-loop algorithm. Control-IQ+, compatible with both the t:slim X2 insulin pump and Tandem Mobi System, is available for people with type 1 diabetes ages 2 years and older and adults with type 2 diabetes. Pumps pre-loaded with the updated software are shipping to new customers, and all eligible, in-warranty Tandem customers will have access to the new features via remote software update free of charge. With these continuous innovations, insulin pumps remain the leading segment within the smart insulin management devices market.

Smart Insulin Management Devices Market Geographical Analysis

North America is expected to dominate the global smart insulin management devices market with a 43.18% share in 2024

North America is a leader in adopting advanced insulin devices. Major manufacturers like Medtronic, Insulet, Dexcom, and Tandem Diabetes Care are headquartered in North America, particularly in the United States and Canada, contributing to faster innovation cycles, FDA approvals, and local market penetration.

For instance, in April 2025, Insulet Corporation, the global leader in tubeless insulin pump technology with its Omnipod brand of products, announced that Omnipod 5 is now commercially available in Canada. Omnipod 5 is the first tubeless, waterproof Automated Insulin Delivery (AID) System approved for use in Canada for people with type 1 diabetes aged two years and above.

The region is at the forefront of integrating diabetes devices with telehealth and smartphone platforms. Apps like Dexcom Clarity and Tandem’s t:connect allow remote monitoring, which became especially critical during the COVID-19 pandemic. For instance, in November 2024, the US Food and Drug Administration (FDA) granted clearance to Medtronic’s new InPen app, setting the stage for the launch of the company’s Smart MDI system integrated with the Simplera continuous glucose monitor (CGM). The InPen app, a smart insulin pen companion, can improve type 1 diabetes care by increasing insulin dosing accuracy and providing real-time data.

Smart Insulin Management Devices Market Top Companies

Top companies in the smart insulin management devices market include Abbott, Medtronic, Tandem Diabetes Care, Inc., Insulet Corporation, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Novo Nordisk A/S, Ypsomed AG, i-SENS, Inc., and Diabeloop SA, among others.

Market Scope

Metrics | Details | |

CAGR | 8.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Insulin Pen Injectors, Insulin Jet Injectors, Insulin Pumps, Insulin Patches, and Others |

Application | Type I Diabetes, Type II Diabetes, and Gestational Diabetes | |

End-User | Hospitals, Home Care settings, Specialty Clinics, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global smart insulin management devices market report delivers a detailed analysis with 62 key tables, more than 55 visually impactful figures, and 157 pages of expert insights, providing a complete view of the market landscape.