Smart Implants Market Size & Industry Outlook

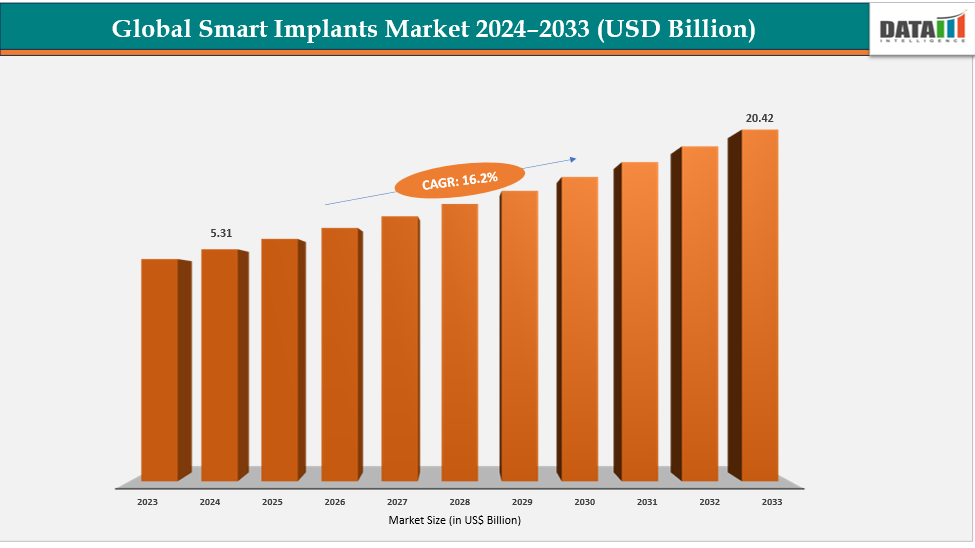

The global smart implants market size reached US$ 4.62 Billion in 2023 with a rise of US$ 5.31 Billion in 2024 and is expected to reach US$ 20.42 Billion by 2033, growing at a CAGR of 16.2% during the forecast period 2025-2033.

The growth of the smart implants market is being accelerated by advances in sensor technology, miniaturization, and low-power electronics. These days, smart implants have extremely sensitive sensors that can track physiological parameters in real time while keeping a small, energy-efficient design. This allows for less intrusive implantation and longer gadget life. These technology advancements improve clinical decision-making, patient comfort, and data accuracy. The demand for cutting-edge medical solutions is also expanding as a result of the aging of the world's population and the increased prevalence of chronic diseases including diabetes, cardiovascular disease, and musculoskeletal disorders.

Key Highlights

- North America is dominating the global smart implants market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global with a CAGR of 7.7% in 2024

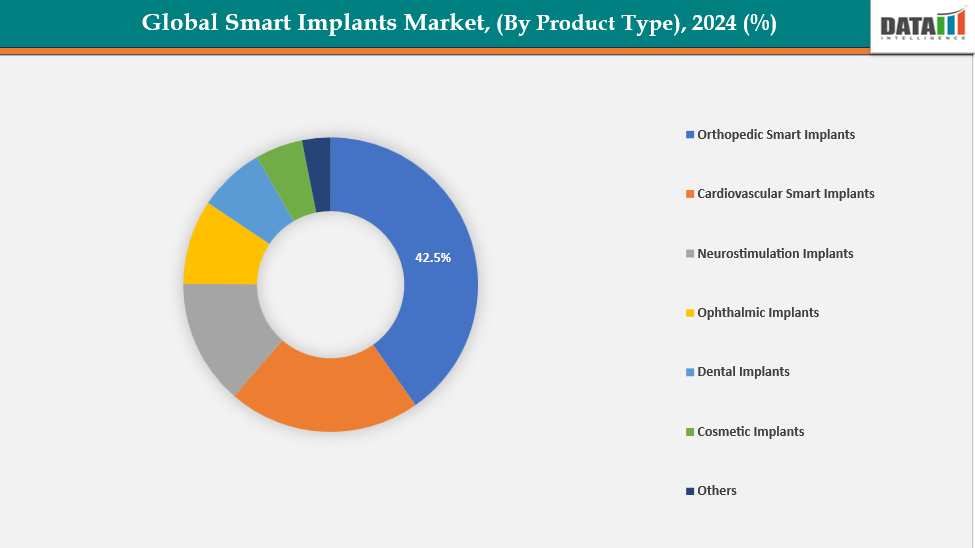

- The orthopedic smart implants segment from product type is dominating the smart implants market with a 42.5% share in 2024

- The metallic implants segment form material is dominating the smart implants market with a 46.5% share in 2024

- Top companies in the smart implants market include Medtronic, Impulse Dynamics, Abbott, NeuroPace, Inc., DSI LTD, Boston Scientific Corporation, Zimmer Biomet, Saluda Medical, Cochlear Ltd, Dexcom, Inc., and Senseonics, Inc., among others.

Market Dynamics

Drivers: Integration with digital health and AI analytics are accelerating the growth of the smart implants market

Integration of smart implants with digital health platforms and AI analytics is driving market growth by transforming raw implant data into actionable insights. Implanted sensors track a patient's health continuously, while artificial intelligence (AI) algorithms look for trends to forecast problems, device malfunctions, or the course of a disease. This lowers hospital visits and makes individualized, preventive care possible. Clinicians can improve clinical outcomes and patient satisfaction by making evidence-based decisions more quickly through remote monitoring and access to electronic health records.

Additionally, the continuous development, regulatory approvals, and upgrades of these implants have reinforced their market dominance. For instance, in July 2025, Cochlear Limited announced that the FDA had approved the Nucleus Nexa System, the world’s first smart cochlear implant. This innovation allowed recipients to access the latest technological advancements directly through the implant, eliminating the need to replace the external sound processor to benefit from new features.

Restraints: Cybersecurity and data privacy risks are hampering the growth of the smart implants market

Cybersecurity and data privacy risks are significantly hampering the growth of the smart implants market. Device operation and patient safety may be jeopardized by hacking and unauthorized access to smart implants, which gather and send private patient data. Vulnerabilities in software, weak encryption, or unsecure communication routes can reveal private medical data, resulting in fines, legal action, and harm to one's reputation. These risks also raise the cost of development and compliance because manufacturers have to put strong security measures in place and submit to thorough audits.

Moreover, concerns over safety and privacy reduce clinician and patient adoption, slowing market penetration. Regulatory authorities impose stricter requirements for networked medical devices, further delaying approvals.

For more details on this report, see Request for Sample

Segment Analysis

The global smart implants market is segmented based on product type, material, end user and region

By Product Type: The orthopedic smart implants segment from product type is dominating the smart implants market with a 42.5% share in 2024

The orthopedic smart implants segment dominates the smart implants market due to several key factors. The need for sophisticated implants that track healing and enhance results is growing as a result of the aging population's increased prevalence of orthopedic conditions such osteoarthritis, fractures, and joint degeneration. These implants can now include sensors that measure load, stress, and bone integration in real time thanks to technological improvements, which promotes optimal rehabilitation and early problem diagnosis. Adoption is also fueled by the rising frequency of orthopedic procedures, including as knee, hip, and spinal replacements.

Moreover, further dominance is reinforced by regulatory approvals and clearance. For instance, in November 2024, CytexOrtho received FDA approval to begin first-in-human trials for its ReNew Hip Implant, a bioabsorbable device designed to mimic healthy cartilage, providing structural support while promoting natural joint regeneration and healing.

By Material: The metallic implants segment form material is dominating the smart implants market with a 46.5% share in 2024

The metallic implants segment dominates the smart implants market due to its superior strength, durability, and proven biocompatibility. Stainless steel, titanium, and cobalt-chromium alloys are among the metals that are perfect for orthopedic, dental, and spinal applications because they can sustain high mechanical stresses. Their extensive track record of safe use guarantees successful osseointegration and minimal rejection rates, boosting surgeon trust.

Additionally, metallic implants can easily integrate sensors and telemetry systems for smart monitoring of load, stress, and rehabilitation progress without compromising structural integrity. High surgical adoption, predictable outcomes, and easier regulatory approvals further reinforce their market dominance.

Geographical Analysis

North America is dominating the global smart implants market with a 48.5% in 2024

North America is projected to lead the global driven by advanced healthcare infrastructure, high prevalence of orthopedic and chronic conditions, and rapid adoption of smart medical technologies. Rising demand for real-time patient monitoring, improved surgical outcomes, and non-invasive, data-driven implant solutions further fuels market growth worldwide.

In the USA, the global smart implants market is growing due to advanced healthcare infrastructure, rising chronic disease prevalence, increasing regulatory approvals, and adoption of innovative imaging, point-of-care, and technology-driven diagnostic and monitoring solutions. For instance, in September 2024, the FDA cleared Senseonics’ Eversense 365 CGM system for adults with Type 1 and Type 2 diabetes. As the world’s first one-year implantable continuous glucose monitor, it provided long-term, integrated glucose tracking, significantly reducing sensor replacements compared to traditional short-term CGM systems.

Europe is the second region after North America, which is expected to dominate the global smart implants market with a 33.5% in 2024

The global smart implants market is expanding due to rising chronic and orthopedic disease prevalence, advanced healthcare infrastructure, and increased access to medical facilities. Technological innovations, regulatory approvals, and strategic collaborations are driving adoption of AI-enabled, point-of-care, and advanced imaging-based smart implant solutions worldwide, boosting market growth. For instance, in February 2025, Senseonics Holdings filed for CE Mark registration for the Eversense 365 CGM system, the world’s longest-lasting continuous glucose monitor, marking a key milestone in expanding its long-term implantable diabetes management technology in Europe.

The global smart implants market is propelled by advanced healthcare infrastructure, robust regulatory support, and rising public awareness. Enhanced access via hospitals, clinics, and digital platforms, along with government initiatives, ongoing research, and continuous technological innovations, is driving worldwide adoption of AI-enabled imaging and point-of-care smart implant solutions.

The Asia Pacific region is the fastest-growing region in the global with a cagr of 7.7% in 2024

The Asia-Pacific covering Japan, China, India, and South Korea, is expanding due to rising disease awareness, urbanization, and enhanced healthcare access. Growth is fueled by increasing chronic and orthopedic conditions, technological advancements in smart implant systems, and rising investments in healthcare infrastructure for improved patient outcomes.

Japan’s smart implants market is driven by an aging population, rising chronic disease prevalence, and advanced healthcare infrastructure. PMDA regulatory approvals, AI integration, digital diagnostics, and adoption of minimally invasive technologies are accelerating nationwide growth and adoption of smart implant solutions. For instance, in March 2025, Medtronic Japan launched the Aurora EV-ICD MRI device and Epsila EV MRI Lead, an extravascular implantable cardioverter-defibrillator system for treating ventricular arrhythmias, including ventricular fibrillation, providing rhythm correction, and improving cardiac function in patients with irregular heartbeats.

Competitive Landscape

Top companies in the smart implants market include Medtronic, Impulse Dynamics, Abbott, NeuroPace, Inc., DSI LTD, Boston Scientific Corporation, Zimmer Biomet, Saluda Medical, Cochlear Ltd, Dexcom, Inc., and Senseonics, Inc., among others.

Medtronic: Medtronic is a global medical technology leader specializing in innovative smart implant solutions. Its portfolio includes advanced implantable devices such as cardiac pacemakers, defibrillators, and neurostimulation systems that monitor and regulate physiological functions in real time. By integrating sensors, AI, and connectivity, Medtronic’s smart implants enhance patient care, improve clinical outcomes, and enable personalized, data-driven therapy worldwide.

Key Developments:

- In October 2025, Medtronic plc announced that its BrainSense Adaptive Deep Brain Stimulation (aDBS), the world’s first closed-loop DBS system for Parkinson’s patients, was recognized on TIME’s annual Best Inventions list, highlighting its innovative contribution to personalized neurological therapy and improved patient outcomes.

- In May 2025, Neuralink received FDA Breakthrough Device Designation for its speech restoration implant, aimed at helping individuals with severe speech impairments caused by conditions such as ALS, stroke, spinal cord injury, cerebral palsy, and multiple sclerosis, enabling improved communication and enhancing quality of life for affected patients.

Market Scope

| Metrics | Details | |

| CAGR | 16.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Orthopedic Smart Implants, Cardiovascular Smart Implants, Neurostimulation Implants, Ophthalmic Implants, Dental Implants, Cosmetic Implants and Others |

| By Material | Metallic Implants, Polymeric Implants, Ceramic Implants, Composite Smart Materials | |

| By End User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global smart implants market report delivers a detailed analysis with 65 key tables, more than 59 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here