Smart Hospitals Market Size & Industry Outlook

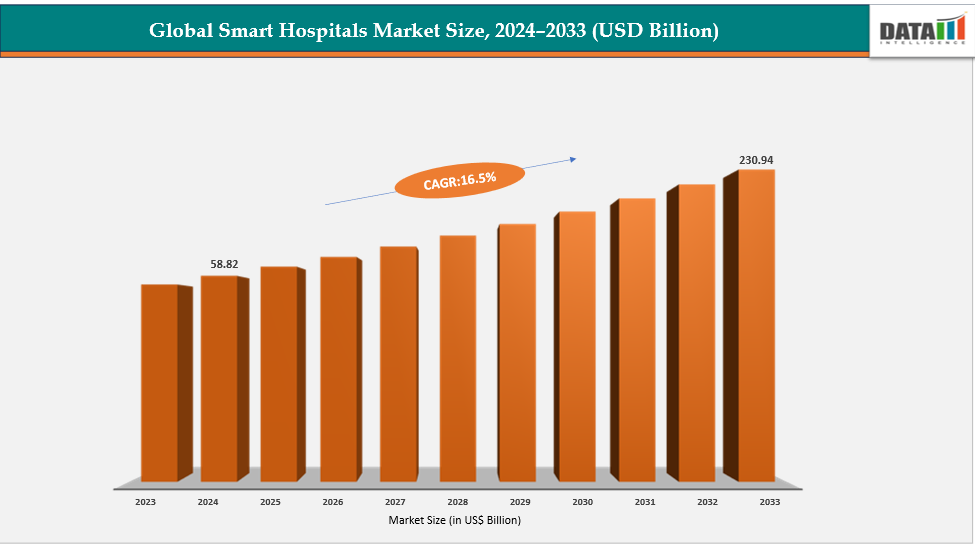

The global smart hospitals market size reached US$ 58.82 billion in 2024 is expected to reach US$ 230.94 billion by 2033, growing at a CAGR of 16.5% during the forecast period 2025-2033. In recent years, hospitals have increasingly recognized that clinical excellence alone is no longer sufficient to ensure patient loyalty and trust experience, engagement, and personalization have become equally critical to healthcare delivery. This shift toward patient-centric care is a key driver behind the rapid growth of the smart hospitals market. Smart hospitals integrate advanced technologies such as artificial intelligence (AI), IoT-enabled devices, digital engagement platforms, and connected room systems to deliver seamless, customized, and proactive patient experiences.

Moreover, personalized patient experiences contribute directly to better clinical outcomes. Digital platforms help identify individual needs and preferences, leading to improved adherence to treatment plans and faster recovery times. Hospitals implementing these technologies often see measurable gains in patient satisfaction scores, lower readmission rates, and enhanced operational efficiency.

Key Highlights

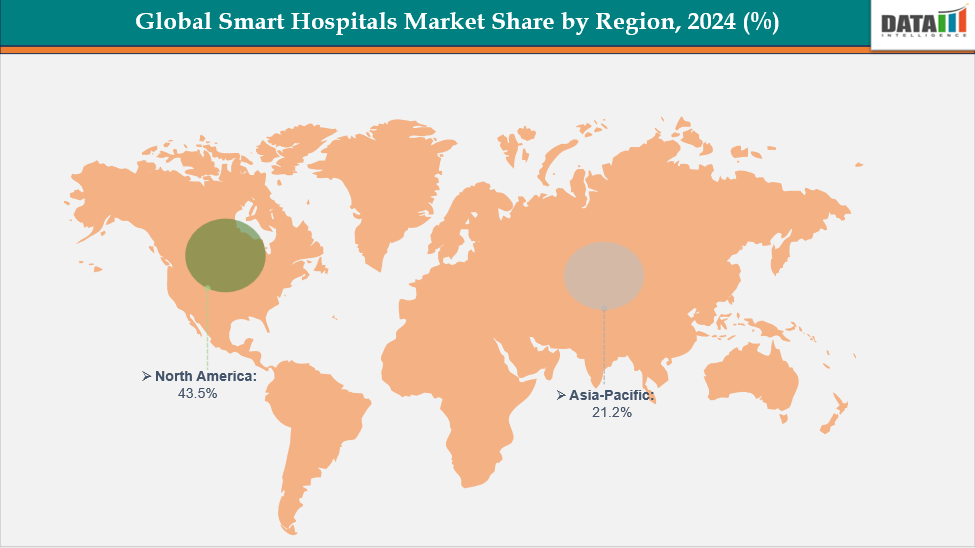

- North America dominates the smart hospitals market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

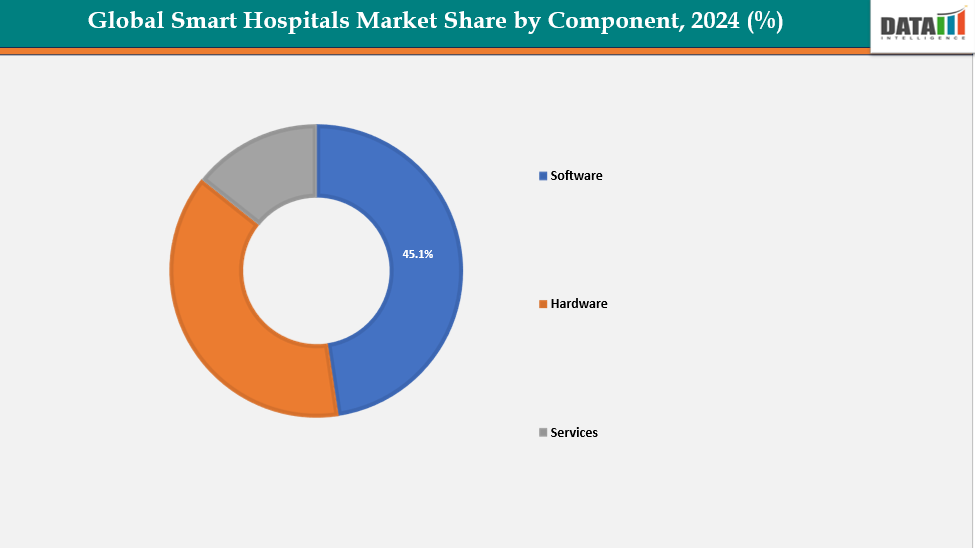

- Based on component, software segment led the market with the largest revenue share of 45.1% in 2024.

- The major market players in the Smart Hospitals market includes eVideon, Artisight, Uniguest, Oneview Healthcare, Diligent Robotics, Andor Health and among others.

Market Dynamics

Drivers: Rising adoption of IoT, AI, and automation in healthcare driving the smart hospitals market growth

The integration of Internet of Things (IoT), Artificial Intelligence (AI), and automation technologies is one of the most transformative drivers of the global smart hospitals market. These technologies enable hospitals to move beyond traditional, reactive models of care toward predictive, data-driven, and highly efficient systems. By connecting medical devices, sensors, and hospital infrastructure, IoT creates an intelligent network that continuously gathers and analyzes patient data in real time. This helps clinicians make faster, more accurate decisions, reduces human error, and streamlines workflows across departments.

| IoT Application | Benefits | Implementation Cost |

| Patient Monitoring | 24/7 vital tracking, early warning systems | Medium |

| Asset Tracking | Equipment location, utilization analytics | Low |

| Environmental Control | Energy savings, optimal patient comfort | High |

| Security Systems | Access control, patient safety | Medium |

Restraints: High implementation and integration costs are hampering the growth of the smart hospitals market

One of the most significant barriers limiting the widespread adoption of smart hospital solutions is the high cost of implementation and system integration. Building a smart hospital requires substantial investment in digital infrastructure, including IoT sensors, connected medical devices, data management platforms, cybersecurity systems, and AI-powered software. For many healthcare providers—especially mid-sized and public hospitals—the financial burden of transitioning from legacy systems to fully digital environments remain prohibitive.

On average, the initial setup cost for a mid-sized smart hospital can range between USD 10 million and USD 50 million, depending on the scale of automation, interoperability requirements, and the complexity of existing hospital IT systems. Beyond hardware and software procurement, a large portion of expenditure goes toward system integration and staff training, which can account for up to 30–40% of total project costs.

For more details on this report – Request for Sample

Smart Hospitals Market, Segment Analysis

The global smart hospitals market is segmented based on component, technology, application, connectivity, end user and region.

Component: The software segment from component segment to dominate the smart hospitals market with a 45.1% share in 2024

The software segment is a key growth driver in the smart hospitals market, enabling integration of clinical, operational, and patient engagement systems. Hospitals are increasingly adopting AI-based analytics, workflow automation, EHRs, and virtual engagement platforms to enhance efficiency and decision-making. Platforms like Artisight’s Smart Hospital, ThinkAndor, and Vibe Health by eVideon demonstrate how intelligent software optimizes workflows and improves patient experiences.

The rise of cloud-based and interoperable solutions further supports scalability and cost efficiency. As healthcare shifts toward digital-first models, software platforms form the core infrastructure powering automation, connectivity, and real-time data intelligence in modern hospitals.

For instance, in June 2025, King Faisal Specialist Hospital & Research Centre (KFSHRC) is setting new benchmarks in global healthcare through its Smart Hospital initiative, which integrates AI, simulation, and immersive technologies across multiple departments. This digital transformation is enabling KFSHRC to advance clinical excellence, strengthen workforce training, and boost operational efficiency, reinforcing its position as a leader in next-generation healthcare delivery.

Technology: The artificial intelligence (AI) segment is estimated to have a 41.1% of the smart hospitals market share in 2024

The AI segment significantly drives the global smart hospitals market by transforming healthcare systems in patient care delivery, monitoring, and management. It empowers hospitals to analyze extensive clinical data in real time, automate decision-making processes, and predict health outcomes with improved accuracy. The integration of AI into diagnostics, workflow management, and patient engagement leads to marked improvements in clinical efficiency, error reduction, and enhanced patient safety.

For instance, in March 2025, The International Institute of Information Technology Hyderabad (IIITH) has partnered with AIG Hospitals to create the Centre for Digital Technologies in Healthcare (CDiTH). This collaboration enhances AIG Hospitals' status as a premier AI-driven medical facility, focused on the incorporation of artificial intelligence (AI) and digital technologies to advance patient care, optimize operational efficiency, and support medical research.

Smart Hospitals Market, Geographical Analysis

North America dominates the global Smart Hospitals market with a 43.5% in 2024

North America, particularly the United States, is leading in the adoption of smart hospitals due to its robust healthcare infrastructure, significant digital readiness, and substantial investments in artificial intelligence (AI) and Internet of Things (IoT) technologies. Hospitals in this region are increasingly using connected devices, electronic health records (EHRs), and automation tools aimed at enhancing patient outcomes and improving operational efficiency.

Notable healthcare providers like Mayo Clinic and Cleveland Clinic have been quick to adopt AI-driven workflow optimization and remote monitoring systems. Additionally, the shift towards value-based care, supported by government initiatives promoting health IT innovation, is further driving market expansion in North America.

For instance, in August 2025, Artisight is a pioneering Smart Hospital platform that autonomously documents operating room activities into a patient's electronic health record (EHR). Utilizing advanced AI and computer vision, it removes the necessity for clinicians and healthcare staff to manually record critical milestones during surgical procedures. This innovation not only enhances real-time updates that bolster patient satisfaction but also promotes a more efficient use of resources in high-demand settings.

Europe is the second region after North America which is expected to dominate the global smart hospitals market with a 34.5% in 2024

Europe's growth in smart hospitals is significantly influenced by government-led digitalization initiatives and robust regulatory frameworks that encourage healthcare innovation. Germany stands out as a leading center for smart hospital implementation, notably through the Hospital Future Act (KHZG), which allocates funding for digital infrastructure and AI-driven clinical applications.

German healthcare facilities are making considerable investments in interoperable health IT systems, enhancing cybersecurity, and utilizing AI for diagnostics to optimize workflows and increase patient safety. Additionally, the collaboration among established tech companies, hospitals, research entities, and digital health startups propels the widespread adoption of smart healthcare solutions throughout Europe.

The Asia Pacific region is the fastest-growing region in the global smart hospitals market, with a CAGR of 8.1% in 2024

The Asia Pacific region is rapidly growing in smart hospitals due to rising healthcare spending, urbanization, and government modernization initiatives. Countries like India, China, South Korea, and Singapore are investing in digital health ecosystems to address population demands and chronic diseases, adopting IoT devices, AI diagnostics, and telehealth platforms. Strategic partnerships, including collaborations with companies like Samsung and Fujitsu, are enhancing this digital transformation.

In Japan, an aging population drives the development of smart hospitals, supported by the government's push for Society 5.0, integrating robotics, IoT, and virtual care to address workforce shortages and improve patient management. Collaborations with firms such as Fujifilm and Hitachi are fostering innovation and positioning Japan as a key player in advanced smart hospital solutions in Asia.

Competitive Landscape

Top companies in the smart hospitals market include eVideon, Artisight, Uniguest, Oneview Healthcare, Diligent Robotics, Andor Health and among others.

Artisight:- Artisight plays a pivotal role in advancing the global smart hospitals market through its AI-powered Smart Hospital Platform, which combines computer vision, machine learning, and IoT connectivity to transform hospital operations and patient care. The platform enables real-time monitoring of patient rooms, automates routine clinical workflows, and enhances communication between care teams—all while ensuring data security and compliance.

Market Scope

| Metrics | Details | |

| CAGR | 16.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Component | Software, Hardware, Services |

| Technology | Artificial Intelligence (AI), Internet of Things (IoT), Cloud Computing, Big Data | |

| Application | Electronic Health Records (EHR) / Clinical Workflow, Medical Connected Imaging, Remote Medicine / Remote Patient Management, Medical Assistance | |

| Connectivity | Wired, Wireless | |

| End User | Hospitals, Home-care / Remote settings, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global smart hospitals market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggested Reports

For more healthcare it-related reports, please click here