Smart Contact Lenses Market Size

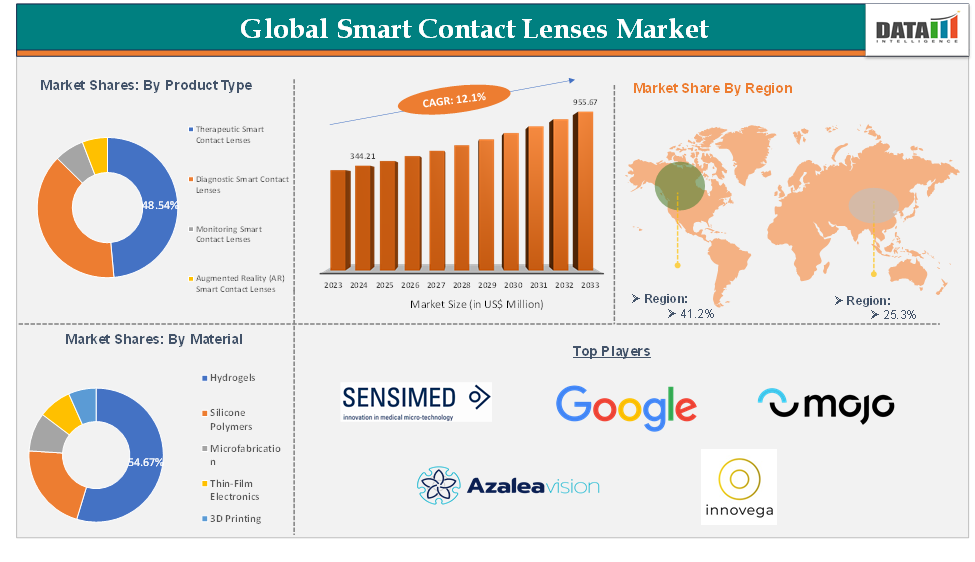

Smart Contact Lenses Market Size reached US$ 344.21 Million in 2024 and is expected to reach US$ 955.67 Million by 2033, growing at a CAGR of 12.1% during the forecast period 2025-2033.

The global smart contact lenses market is experiencing significant growth due to the demand for advanced wearable medical devices, diabetes prevalence, and continuous health monitoring technologies. These lenses, embedded with biosensors and wireless communication systems, are being explored for real-time glucose monitoring, intraocular pressure detection, and augmented reality applications. North America dominates the market due to strong healthcare infrastructure, advanced technologies, and research and development activities by key industry players.

Executive Summary

For more details on this report, Request for Sample

Smart Contact Lenses Market Dynamics

Rise in the Prevalence of Glaucoma is Driving the Market Growth

The increasing prevalence of glaucoma is driving the growth of the smart contact lenses market. This is due to the need for continuous intraocular pressure monitoring for effective disease management. Traditional methods often delay timely interventions. Smart contact lenses with micro-sensors offer real-time, non-invasive monitoring, improving early detection and ongoing management. As the global burden of glaucoma increases, particularly among aging populations, the demand for innovative technologies like smart contact lenses is expected to surge, driving market expansion.

Glaucoma patients must take concentrated eye drops daily, which can cause blindness if missed. However, research indicates that two types of lenses, developed by Leo Lens Technology, can deliver FDA-approved bimatoprost for up to seven days.

For instance, Glaucoma affects 3.54% of the global population aged 40-80, with the highest prevalence in Africa and Asia. The number of people with glaucoma increased from 64.3 Million in 2013 to 111.8 Million in 2040. Men are more likely to have glaucoma (POAG) than women, and people of African ancestry are more likely to have it than those of European ancestry. Urban residents are also more likely to have POAG than those in rural areas. The prevalence of glaucoma has increased significantly since 2013.

Regulatory Challenges

The global smart contact lenses market faces regulatory challenges, particularly in the therapeutic segment, to ensure safety, efficacy, and data security. Obtaining approval is complex and time-consuming, with stringent requirements from the FDA and MDR. The integration of electronic components raises concerns about data privacy and cybersecurity. The lack of standardized regulations across regions also poses a hurdle for global market expansion. Ethical considerations like informed consent are crucial for successful integration and widespread adoption.

Smart Contact Lenses Market Segment Analysis

The global smart contact lenses market is segmented based on product type, application, technology, and region.

Product Type:

The therapeutic smart contact lenses segment holds 48.5% of the segment share in the global smart contact lenses market

Therapeutic smart contact lenses are advanced medical devices that correct vision and deliver therapeutic benefits directly to the eye. They use microelectronic components or drug-eluting materials to monitor, deliver, and manage ocular diseases like glaucoma, diabetic retinopathy, and dry eye syndrome. By maintaining direct contact with the ocular surface, these lenses offer targeted, sustained treatment, improving patient compliance compared to conventional eye drops or systemic medications. This innovative approach enhances ocular therapy precision and efficiency.

The therapeutic smart contact lenses segment is experiencing significant growth in the global market due to the increasing prevalence of chronic eye conditions like glaucoma and diabetic retinopathy. These lenses offer a non-invasive solution by enabling real-time tracking of intraocular pressure and glucose levels through tear fluid analysis, facilitating early detection and improved disease management.

Moreover, advancements in microelectronics and biosensing technologies, such as drug-eluting lenses, demonstrate the potential for direct ocular drug delivery, enhancing treatment efficacy and patient compliance. The growing adoption of wearable health technologies and the integration of smart lenses into IoT platforms has expanded their applications, allowing for seamless data transmission and remote health monitoring.

Smart Contact Lenses Market Geographical Share

North America is expected to hold 41.2% in the global smart contact lenses market

North America's smart contact lenses market is driven by a combination of factors, including leading technology companies and healthcare innovators, high healthcare spending, personalized medicine, and the rising prevalence of chronic conditions like diabetes and glaucoma. The region also benefits from supportive regulatory frameworks and increased wearable health device adoption, accelerating the integration of smart lenses into mainstream healthcare. This combination, combined with heightened consumer awareness and a tech-savvy population, makes North America a pivotal growth engine in the global smart contact lenses market.

For instance, in 2022, an estimated 4.22 Million US adults were living with glaucoma, with a prevalence of 1.62% among those aged 18 and older and 2.56% among those aged 40 and older. Vision-affecting glaucoma had a prevalence of 0.57% among those aged 18 and older and 0.91% among those aged 40 and older. The prevalence of glaucoma varied across states, with Utah having the highest prevalence at 1.11% and Mississippi at 1.95%. Black adults had a higher prevalence at 3.15%, while Hispanic and other racial and ethnic categories had a higher prevalence at 1.56%.

The increasing prevalence of glaucoma in the U.S., particularly among older adults and certain ethnic groups, necessitates advanced eye care solutions like smart contact lenses. These non-invasive devices aid in early glaucoma detection and management, particularly in North America, where chronic eye conditions are a public health priority.

Asia-Pacific is expected to hold a 25.3% share in the global smart contact lenses market

The Asia-Pacific region is experiencing a significant growth in the smart contact lens market, driven by rising healthcare awareness, product launches, a growing diabetic population, and demand for advanced diagnostic tools. Countries like China, Japan, South Korea, and India are adopting these technologies due to expanding healthcare infrastructure, rising disposable incomes, and government initiatives. Research collaborations between tech companies and medical institutions are also driving this market.

For instance, in March 2024, Japanese contact lens maker Menicon plans to use the NanoTerasu synchrotron radiation facility at Tohoku University's Aobayama campus in Sendai to explore next-generation materials and recycling plastic waste. The University of Tokyo will also participate in the research, aiming to explore molecular-level insights.

Smart Contact Lenses Market Key Players & Emerging Players

The major global and emerging players in the smart contact lenses market include Sensimed AG, Google, Innovega Inc., Mojo Vision, Azalea Vision, and others.

Key Developments

- In March 2025, XPANCEO, a deep tech company, showcased three new smart contact lens prototypes at MWC 2025 in Barcelona. The first is a wireless powering companion lens with double the range of previous industry solutions. The company also presented enhanced versions of its AR vision and data-reading prototypes. The prototype is a wireless powering companion.

Scope

| Metrics | Details | |

| CAGR | 12.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Therapeutic Smart Contact Lenses, Diagnostic Smart Contact Lenses, Monitoring Smart Contact Lenses |

| Application | Continuous Glucose Monitoring (CGM), Ocular Diagnostics Drug Delivery Systems, Augmented Reality (AR) Overlays, Remote Patient Monitoring, Others | |

| Technology | Microelectronics, Sensors, Wireless Communication, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, Product Type pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Type Performance & Market Positioning: Analyzes Product Type performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into Product Type development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Product Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance Product Type safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global smart contact lenses market report delivers a detailed analysis with 35 key tables, more than 47 visually impactful figures, and 180 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.