Sickle Cell Disease (SCD) and β-Thalassemia Gene Therapy Market Size & Industry Outlook

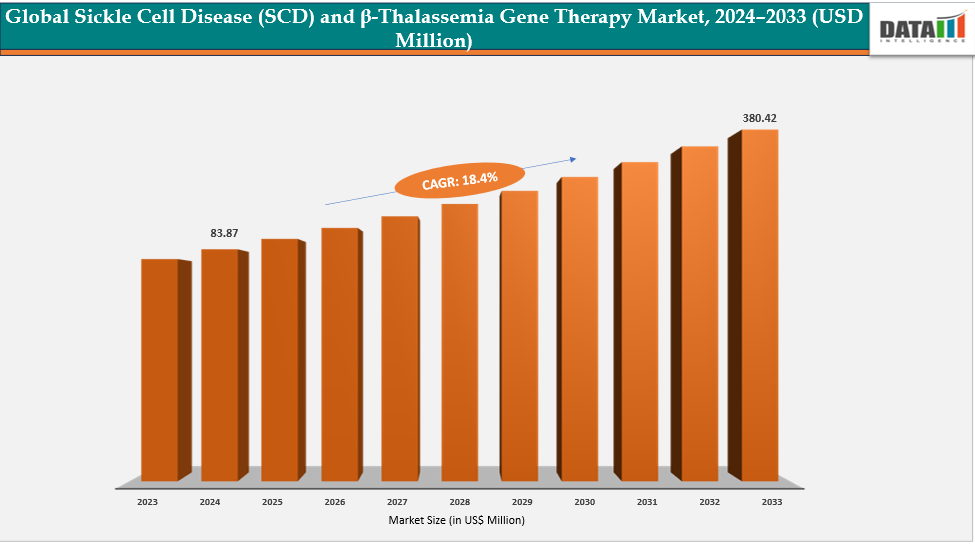

The global sickle cell disease (SCD) and β-thalassemia gene therapy market size was US$ 83.87 Million in 2024 and is expected to reach US$ 380.42 Million by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

The growth of the gene therapy market for sickle cell disease (SCD) and β-thalassemia is being fueled by advancements in gene-editing and gene-therapy technologies. Cutting-edge methods such as CRISPR/Cas9 and base editing allow for accurate correction of genetic defects, presenting potential cures. Therapies that utilize lentiviral gene addition enhance hemoglobin production in patients. Enhanced safety profiles and effectiveness have led to an increase in regulatory approvals. Current clinical trials broaden patient access and provide data on long-term efficacy. Partnerships between biotech firms and pharmaceutical companies expedite the development and commercialization process. Innovations in technology are lowering manufacturing expenses and improving scalability. Programs for early diagnosis and awareness initiatives support the adoption of therapies.

Key Highlights

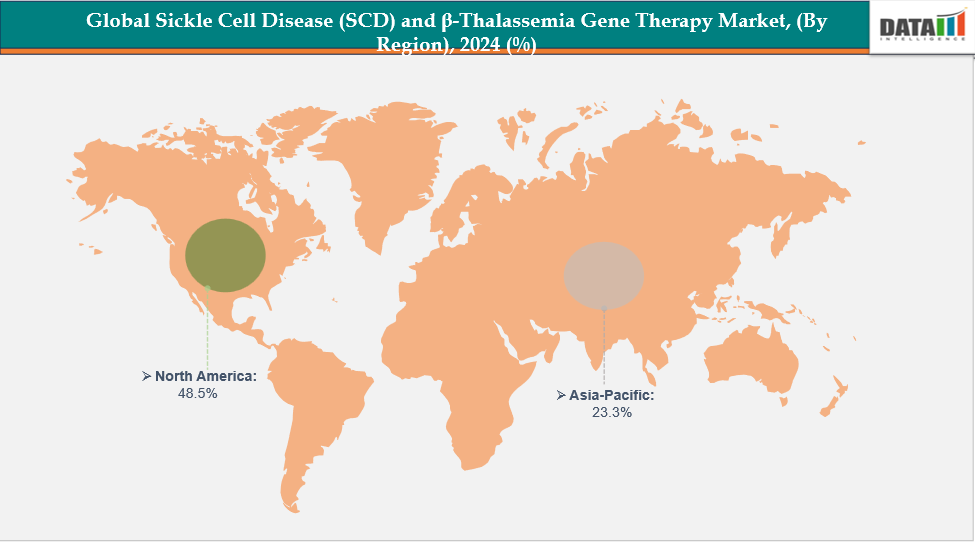

- North America is dominating the global sickle cell disease (SCD) and β-thalassemia gene therapy market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the global sickle cell disease (SCD) and β-thalassemia gene therapy market, with a CAGR of 7.7% in 2024.

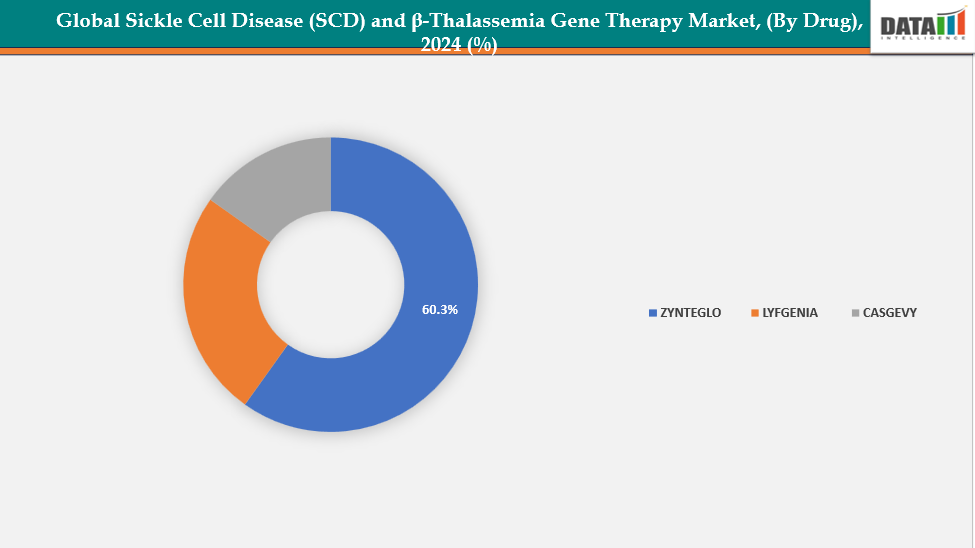

- The ZYNTEGLO drug segment is dominating the sickle cell disease (SCD) and β-thalassemia gene therapy market with a 60.3% share in 2024

- The intravenous segment is dominating the sickle cell disease (SCD) and β-thalassemia gene therapy market with a 100% share in 2024

- Top companies in the sickle cell disease (SCD) and β-thalassemia gene therapy market include CRISPR Therapeutics and bluebird bio, Inc., and emerging players include Sangamo Therapeutics, Inc., Editas Medicine, Beam Therapeutics, Editas Medicine, and CorrectSequence Therapeutics Co., Ltd. among others.

Market Dynamics

Drivers: Rising in clinical trials for gene therapy is accelerating the growth of the sickle cell disease (SCD) and β-thalassemia gene therapy market

The growing number of clinical trials focused on gene therapy is driving expansion in the market for treatments related to sickle cell disease (SCD) and β-thalassemia. An increase in research efforts is enhancing our understanding of genetic mutations and refining treatment accuracy. Clinical research is confirming the long-term safety and effectiveness of gene-editing methods such as CRISPR and lentiviral vectors. Successful outcomes from trials promote regulatory approvals and attract funding from biotech firms and venture capitalists.

For instance, in June 2023, Vertex Pharmaceuticals and CRISPR Therapeutics announced that pivotal trials of exagamglogene autotemcel (exa-cel) for transfusion-dependent beta thalassemia and severe sickle cell disease achieved their primary and key secondary endpoints, as presented at the EHA Congress.

The very high cost of gene therapies and access challenges are hampering the growth of the sickle cell disease (SCD) and β-thalassemia gene therapy market

Restricted availability and logistical difficulties pose significant obstacles to the development of the gene therapy market for sickle cell disease (SCD) and β-thalassemia. These sophisticated treatments necessitate specialized facilities, intricate manufacturing procedures, and trained medical personnel, which are often scarce in numerous areas. The majority of treatment centers are located in developed nations, which results in limited access for patients in low- and middle-income regions.

For instance, in the U.S., ZYNTEGLO is priced at a wholesale acquisition cost of $2.8 million, while LYFGENIA costs $3.1 million per therapy.

For more details on this report, see Request for Sample

Sickle Cell Disease (SCD) and β-Thalassemia Gene Therapy Market, Segment Analysis

The global sickle cell disease (SCD) and β-thalassemia gene therapy market is segmented based on drug, , route of administration, distribution channel and region

By Drug: The ZYNTEGLO drug segment is dominating the sickle cell disease (SCD) and β-thalassemia gene therapy market with a 60.3% share in 2024

The ZYNTEGLO segment is leading the gene therapy market for sickle cell disease (SCD) and β-thalassemia due to its prompt approval and impressive clinical effectiveness. It provides a functional cure for β-thalassemia by allowing patients to become independent from transfusions, which greatly enhances their quality of life. The therapy’s proven safety profile and long-term efficacy data have increased trust among physicians and encouraged patient uptake. Additionally, ZYNTEGLO is supported by robust commercialization strategies and strategic partnerships that improve its market presence.

Furthermore, its presence across major markets, including the U.S. and Europe, further strengthens its leadership. For instance, in August 2022, bluebird bio, Inc. announced that the FDA had approved ZYNTEGLO (betibeglogene autotemcel), the first one-time gene therapy designed to treat the underlying genetic cause of beta-thalassemia in patients dependent on regular red blood cell transfusions.

By Route of Administration: The intravenous segment is dominating the sickle cell disease (SCD) and β-thalassemia gene therapy market with a 100% share in 2024

The intravenous method leads the market for gene therapy in sickle cell disease (SCD) and β-thalassemia, due to its proven clinical efficacy and accuracy in delivering gene-modified cells. Administering autologous hematopoietic stem cells through intravenous infusion after ex vivo gene editing allows for effective engraftment and sustained therapeutic advantages. This approach offers improved dosage control, minimizes off-target effects, and increases treatment safety.

Moreover, most approved gene therapies, including CASGEVY, LYFGENIA, and ZYNTEGLO, are designed for intravenous delivery, reinforcing its dominance. For instance, in December 2023, the FDA approved CASGEVY, a CRISPR/Cas9 genome-edited cell suspension for intravenous infusion, developed by Vertex Pharmaceuticals and CRISPR Therapeutics, for treating sickle cell disease in patients aged 12 and older, offering a durable, one-time therapy with potential for a functional cure.

Sickle Cell Disease (SCD) and β-Thalassemia Gene Therapy Market, Geographical Analysis

North America is dominating the global sickle cell disease (SCD) and β-thalassemia gene therapy market with 48.5% in 2024

North America leads the worldwide market for gene therapy related to sickle cell disease (SCD) and β-thalassemia, due to rising FDA approvals, a well-developed healthcare system, and a significant presence of major companies such as bluebird bio and Vertex. Substantial investments in research and development, favorable reimbursement policies, and a swift embrace of new gene therapies contribute to the region's dominance.

In the U.S., the sickle cell disease (SCD) and β-thalassemia gene therapy market grew with FDA approvals and new product launches, improving patient access, treatment outcomes, and long-term disease management. For instance, in December 2023, bluebird bio, Inc. announced that the FDA approved LYFGENIA (lovotibeglogene autotemcel), a one-time gene therapy for patients aged 12 and older with sickle cell disease, offering potential resolution of vaso-occlusive events by targeting the disease’s root cause.

Europe is the second region after North America, which is expected to dominate the global sickle cell disease (SCD) and β-thalassemia gene therapy market with 34.5% in 2024

In Europe, the market for gene therapy targeting sickle cell disease (SCD) and β-thalassemia has grown due to ongoing clinical trials, strategic partnerships, and collaborative agreements. These efforts improved regional accessibility, fostered technological advancements, and sped up the research, development, and introduction of cutting-edge gene therapies throughout the region.

Owing to the factors like active clinical trials and strategic contracts. For instance, in February 2025, SK pharmteco Cell & Gene Europe, AP-HP, AFM-Téléthon, and Institut Imagine announced a collaboration to produce a 200L CGMP clinical batch of lentiviral vector and provide regulatory support for an innovative sickle cell disease clinical trial, marking significant progress in gene therapy development.

The Asia-Pacific region is the fastest-growing region in the global sickle cell disease (SCD) and β-thalassemia gene therapy market, with a CAGR of 7.7% in 2024

The market for gene therapy targeting sickle cell disease (SCD) and β-thalassemia in the Asia-Pacific region is expanding rapidly, fueled by the increasing occurrence of these diseases, heightened patient awareness, improved access to healthcare, and robust government backing for early detection and focused treatments, especially in countries like China, Japan, South Korea, and India.

China’s sickle cell disease (SCD) and β-thalassemia gene therapy market is expanding, fueled by increasing disease prevalence, active clinical trials, regulatory approvals and government initiatives enhancing patient access and advanced therapy development. Owing to the factors like clinical trials, for instance, in August 2025, CorrectSequence Therapeutics Co., Ltd. successfully treated the first sickle cell disease (SCD) patient using its high-precision base-editing therapy, CS-101, achieving a clinical cure. The milestone was accomplished through an investigator-initiated trial, demonstrating the potential of transformer base editing technology.

Competitive Landscape

Top companies in the sickle cell disease (SCD) and β-thalassemia gene therapy market include CRISPR Therapeutics and bluebird bio, Inc., and emerging players include Sangamo Therapeutics, Inc., Editas Medicine, Beam Therapeutics, Editas Medicine, and CorrectSequence Therapeutics Co., Ltd. among others.

Bluebird bio, Inc.: Bluebird Bio, Inc., a U.S.-based biotechnology company, focuses on developing gene therapies for severe genetic disorders, including Sickle Cell Disease (SCD) and β-Thalassemia. Its therapies, such as Zynteglo and experimental SCD programs, utilize lentiviral gene addition and gene-editing approaches to provide durable, potentially curative treatments, with ongoing clinical trials advancing patient access and therapeutic innovation globally.

Key Developments:

- In September 2025, Vertex Pharmaceuticals secured a reimbursement agreement with the Italian Medicines Agency (AIFA), enabling eligible transfusion-dependent β-thalassemia and severe sickle cell disease patients to access its CRISPR/Cas9 gene-edited therapy, CASGEVY (exagamglogene autotemcel), marking a significant milestone in gene-therapy patient access in Italy.

- In October 2024, Editas Medicine announced progress toward its 2024 goals, achieving in vivo preclinical proof of concept for hematopoietic stem and progenitor cell (HSPC) editing and fetal hemoglobin (HbF) induction in humanized mice. High-level HBG1/2 promoter editing was observed using a proprietary targeted lipid nanoparticle (tLNP) delivery system, alongside strategic updates on reni-cel partnerships.

- In January 2024, Vertex Pharmaceuticals announced that the Saudi Food and Drug Authority (SFDA) approved CASGEVY (exagamglogene autotemcel [exa-cel]), a CRISPR/Cas9 gene-edited therapy, for treating sickle cell disease (SCD) and transfusion-dependent β-thalassemia (TDT) in patients aged 12 and older, addressing a high-prevalence population in Saudi Arabia.

Market Scope

| Metrics | Details | |

| CAGR | 18.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | By Drug | CASGEVY, LYFGENIA, ZYNTEGLO |

| By Route of Administration | Intravenous | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global sickle cell disease (SCD) and β-thalassemia gene therapy market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here