SGLT-2 Inhibitors Market Overview

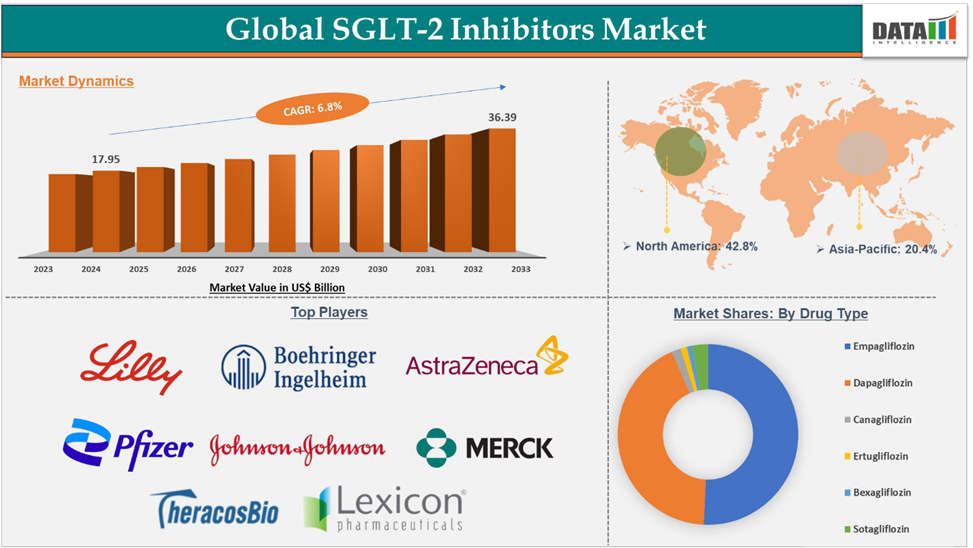

SGLT-2 Inhibitors Market reached US$ 17.95 billion in 2024 and is expected to reach US$ 32.16 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The SGLT-2 Inhibitors market is experiencing growth due to the rising prevalence of type 2 diabetes, rising research and development activities, and new product launches, etc. Moreover, the rising market access for SGLT-2 inhibitors in emerging countries is a significant opportunity for market growth. However, the high cost of treatment can significantly hinder their adoption, resulting in slow market growth.

SGLT-2 Inhibitors Market Definition

SGLT-2 (sodium-glucose cotransporter-2) inhibitors are prescription drugs approved for the treatment of type-2 diabetes, chronic kidney disease, and heart attacks. The drugs in this class include bexagliflozin, canagliflozin, dapagliflozin, empagliflozin, ertugliflozin, and sotagliflozin. These are oral drugs and are available in monotherapy or combination with other drugs such as metformin for the management of diabetes. Some SGLT-2 inhibitors were effective in protecting the kidney and promoting overall kidney health, hence recommended in chronic kidney disease (CKD) patients. These are also effective in reducing the risk of heart stroke, and failure, and preventing heart failure flare-ups.

Executive Summary

For more details on this report – Request for Sample

SGLT-2 Inhibitors Market Dynamics: Drivers & Restraints

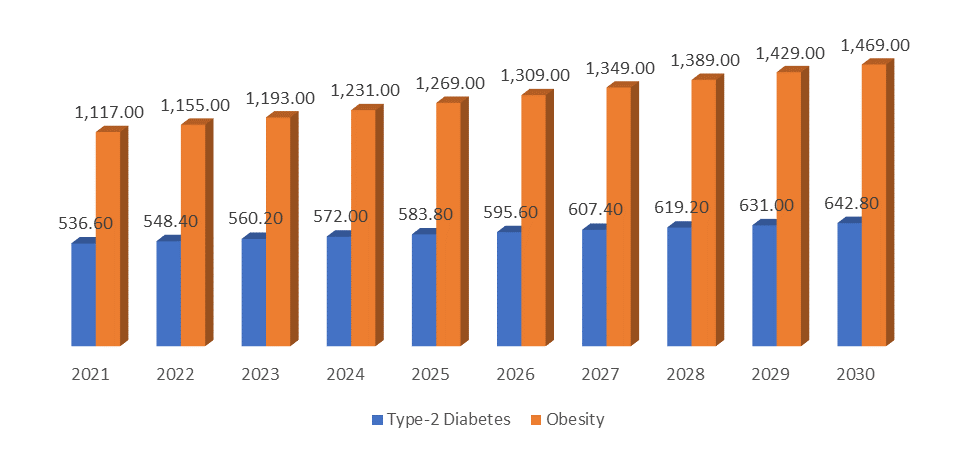

The rising prevalence of diabetes is driving the market growth

The rising prevalence of diabetes is a major driver for the SGLT-2 inhibitors market growth. SGLT-2 inhibitors find their major application in type 2 diabetes patients. These drugs are effective in lowering blood glucose levels when given alone or in combination with metformin. The majority of the SGLT-2 inhibitors are recommended for use as adjunct therapy to diet and exercise. Globally, the number of people with obesity is rising, which is a predominant factor for type 2 diabetes incidence. SGLT-2 inhibitors are found to be effective in lowering body weight in obese individuals, Hence, the adoption of SGLT-2 inhibitors is anticipated to increase in the forecast period.

For instance, according to the International Diabetes Federation (IDF), the prevalent cases of type-2 diabetes are expected to reach 642 million by 2030, from 536 million in 2021. Moreover, as per the World Obesity Federation, the global obese population is expected to reach 1,469 million by 2030 from 1,117 million in 2021.

This alarming rise in patient population increases the total addressable patient size for SGLT-2 inhibitors and creates a huge demand in the forecasted period.

High cost of treatment may restrain the market growth

The high cost of SGLT-2 inhibitors may restrain the market growth in the forecasted period. Since the majority of the SGLT-2 inhibitors are newer agents and are sold under brand names, these drugs are more expensive than other oral antidiabetic medications. This high cost may result in lower adoption among the patient population living in low and middle-income countries.

For instance, in May 2024, a cohort study was published in the BMJ journal, which reported the effectiveness of second-line oral antidiabetic medicine in patients with type 2 diabetes. This cohort study conducted on 75,739 adults who are on sulfonylurea, DPP-4 inhibitor, or SGLT-2 inhibitor has stated the following:

Among all the second-line agents, SGLT-2 inhibitors were costly, as they are newer agents.

The majority of patients prefer sulfonylureas or DPP-4 inhibitors over SGLT-2 inhibitors due to the cost barrier.

SGLT-2 Inhibitors Market Segment Analysis

The global SGLT-2 Inhibitors market is segmented based on drug type, indication, distribution channel, and region.

Drug Type:

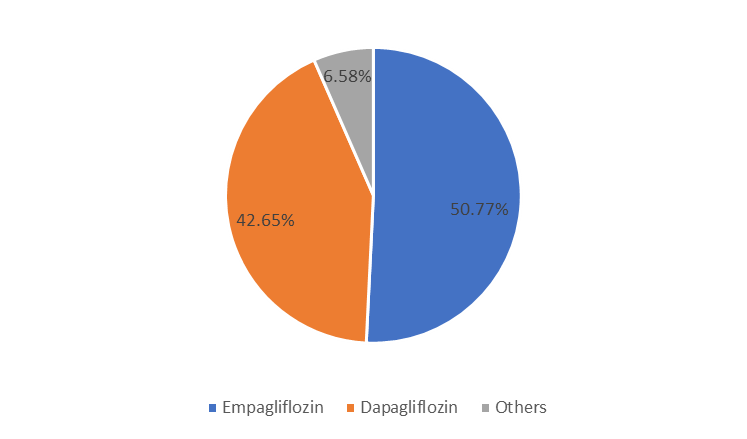

Empagliflozin is dominating the SGLT-2 inhibitors market with the highest share of 50.77% in 2024

Empagliflozin is a novel SGLT-2 inhibitor sold under the brand name Jardiance – co-manufactured by Boehringer Ingelheim Pharmaceuticals, Inc. and Eli Lilly and Company. Both companies share equally the ongoing development and commercialization costs of the Jardiance family of brands. In 2024, the Jardiance family has generated US$ 9.1 billion, which is approximately 50% of the total market share.

Moreover, in Mid-2023, Jardiance received U.S. Food and Drug Administration (FDA) and European Commission (EC) approval for the treatment of adults with chronic kidney disease. With this approval, the product has attained total addressable patients of approximately 850 million worldwide. In addition to approval in CKD patients, both the U.S. FDA and EC approved the drug for use in type-2 diabetes patients 10 years or older. With this approval, Jardiance (Empagliflozin) became the first SGLT-2 inhibitor to be approved in this patient population.

Moreover, Eli Lilly stated that in August 2023, HHS (United States Department of Health and Human Services) selected Jardiance as one of the first ten medicines subject to government-set prices effective in 2026. This can improve patient accessibility to empagliflozin and improve the adoption rate, as the price is anticipated to be reduced.

Indication: Chronic kidney disease (CKD) is the fastest-growing segment in the SGLT-2 Inhibitors market.

Chronic kidney disease (CKD) is the fastest-growing segment in the SGLT-2 inhibitor indications. The highest growth rate is attributable to recent product launches, therapy expansion of novel SGLT-2 inhibitors, and rising clinical evidence on the astounding benefits of SGLT-2 inhibitors in CKD patients.

For instance, a study published in April 2023, in the Journal of Kidney Medicine, has stated that regardless of diabetic status, SGLT-2 inhibitors were proven to be efficacious in proteinuria kidney disease and possess very minimal side effect profile.

Concerning the product launches and therapy expansion, in September 2023, the U.S. Food and Drug Administration (FDA) approved Jardiance (empagliflozin) for the treatment of adults with chronic kidney disease, post its statistically significant results from the EMPA-KIDNEY phase III trial.

SGLT-2 Inhibitors Market Geographical Analysis

North America is expected to hold a significant share of 41.9% of the SGLT-2 Inhibitors market in 2024

North America led the Global SGLT-2 Inhibitors Market in 2022 with a market size of US$ 7.08 billion and reached further to US$ 7.28 billion in 2023.

North America currently holds a significant market share in the SGLT-2 inhibitors market due to various factors, including higher demand for novel therapies, major revenue generated by market players, and higher prevalence of diabetes, chronic kidney diseases, and heart failure. Any emerging drug is expected to first get launched in the U.S. market due to higher demand, and all the SGLT-2 inhibitors in the current market were first launched in the U.S., providing first access to the patients in the country. Due to higher per-capita income and spending on healthcare, the SGLT-2 inhibitors are sold at higher prices in the North America market as compared to other nations. Due to this, manufacturers generate a majority of their revenue from the region.

For instance, Eli Lilly and Company stated that revenue of Jardiance (empagliflozin) increased 34 percent in the U.S., primarily driven by increased demand, and among the total US$ 9.1 billion revenue generated by the drug, a major portion is generated from the U.S.

Asia-Pacific is growing at the fastest pace in the SGLT-2 Inhibitors market, growing at a CAGR of 19.0% between 2025 to 2033.

The Asia-Pacific region in the SGLT-2 inhibitors market is expected to grow with the highest CAGR in the forecast period, mainly due to the rising diabetes population and product launches.

Asia-Pacific holds a significant diabetes patient population in the world, as per the International Diabetes Federation (IDF), type-2 diabetes accounts for 295.84 million cases in 2021, which are expected to reach 351.6 million by 2030. Moreover, the prevalence of CKD in the Asia-Pacific region is rising at an alarming rate. This alarming increase in the diabetes and CKD population provides a significant ground for market players to launch SGLT-2 inhibitors in the region. Several companies have already eyed the region and actively expanding their product reach.

For instance, in February 2024, after a positive nod from the Central Drugs Standard Control Organisation (CDSCO) of India, Boehringer Ingelheim launched Jardiance (empagliflozin) 10 mg tablets in the Indian market for the treatment of adults with chronic kidney disease.

SGLT-2 Inhibitors Market Major Players

The major players in the SGLT-2 Inhibitors market are TheracosBio, LLC, Johnson & Johnson Services, Inc., AstraZeneca, Boehringer Ingelheim International GmbH., Eli Lilly and Company., Pfizer Inc., Merck & Co., Inc., and Lexicon Pharmaceuticals, Inc., among others.

Key Development

In June 2024, AstraZeneca announced that the U.S. Food and Drug Administration (FDA) approved Farxiga (dapagliflozin) to improve glycaemic control in paediatric patients with type-2 diabetes (T2D) aged 10 years and older. The drug was previously approved in the US in adults with T2D as an adjunct to diet and exercise to improve glycaemic control.

Market Scope

Metrics | Details | |

CAGR | 7.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Drug Type | Bexagliflozin, Canagliflozin, Dapagliflozin, Empagliflozin, Ertugliflozin, Sotagliflozin |

Indication | Type-2 Diabetes, Chronic Kidney Disease (CKD), Heart Failure | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |