Market Size

The Global Seeds Market reached USD 57.5 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 95.1 billion by 2031. The market is expected to exhibit a CAGR of 6.5% during the forecast period 2024-2031, according to DataM Intelligence report.

The seeds market is a crucial component of agriculture, supplying seeds for various crops, fruits, vegetables, and plants. It is characterized by fierce competition among major players and regional companies. Genetically modified (GM) seeds have gained widespread adoption, offering traits like pest resistance and increased yield. They have become popular among farmers, improving crop productivity and protecting against pests.

The market also witnesses a rising demand for organic and non-GM seeds driven by consumer preferences. Biotechnology and seed technology advancements contribute to improved seed traits, disease resistance, and drought tolerance. The seeds market continues to evolve, influenced by changing consumer demands, climate conditions, and regulatory frameworks. Staying updated with market reports and research is crucial for understanding the dynamics and opportunities within the seeds market.

Market Summary

| Metrics | Details |

| CAGR | 6.5% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | By Type, Traits, Treatment, Crops, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights -Request Free Sample

Market Dynamics

Growing Global Population Drives Demand for High-Quality Seeds and Fuels Market Expansion

The growing global population is a significant driver of the seeds market, creating a higher demand for food production. According to a recent seeds market analysis, this driver has led to increased investments and innovation in developing high-quality seeds to maximize crop yields and enhance productivity. Major seed market players are actively expanding their market share by introducing advanced seed varieties with improved traits through extensive research and development.

This includes disease resistance, drought tolerance, and enhanced nutritional value. The seeds market analysis indicates that companies with a larger market share are strategically positioned to meet the demands of the growing population and capitalize on the opportunities in the evolving agricultural landscape.

Regulatory Constraints Impact Seeds Market Share and Compliance Costs.

Regulatory constraints impact the seeds market, affecting development, production, and commercialization, as highlighted by the seeds market analysis. Compliance with regulations, including seed certification, intellectual property rights, and biosecurity measures, can be costly and time-consuming, especially for small and medium-sized seed companies. Restrictions on GMOs and biotechnology limit market access and adoption of specific seed varieties.

The diverse regulatory landscapes across countries and regions present challenges for companies, impacting their market share and necessitating navigation through complex regulatory frameworks. According to the seeds market analysis, these constraints require companies to manage compliance and entry to ensure market share growth strategically. For instance, in North America, stringent regulations on GMO labeling affect approximately 70% of the market, influencing consumer choices and market dynamics.

Market Segment Analysis

The Global Seeds Market is segmented based on type, traits, treatment, crops, and region.

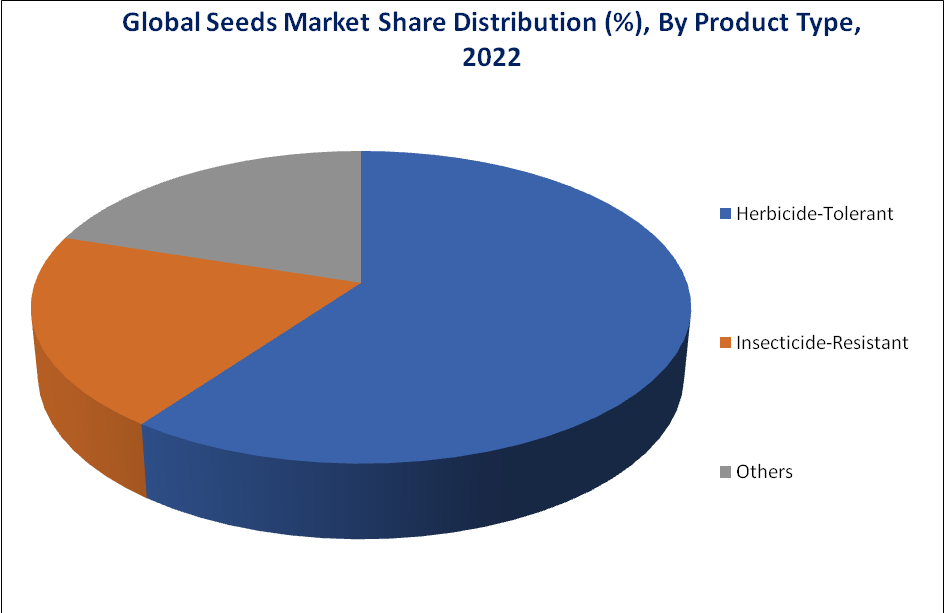

Herbicide-Tolerant Seeds are Expected to Hold the Highest Market Revenue Share in 2022

According to seeds market analysis, the herbicide-tolerant seeds market holds a significant market share, accounting for approximately 60% of the overall genetically modified seeds market. Adoption rates have been substantial, with herbicide-tolerant soybeans capturing around 90% of the soybean market. In the corn market, herbicide-tolerant corn varieties have a market penetration of over 80%. These statistics reflect the strong market demand and the positive impact of herbicide-tolerant seeds on farmers' productivity and profitability.

Source: DataM Intelligence Analysis (2023)

Market Geographical Share

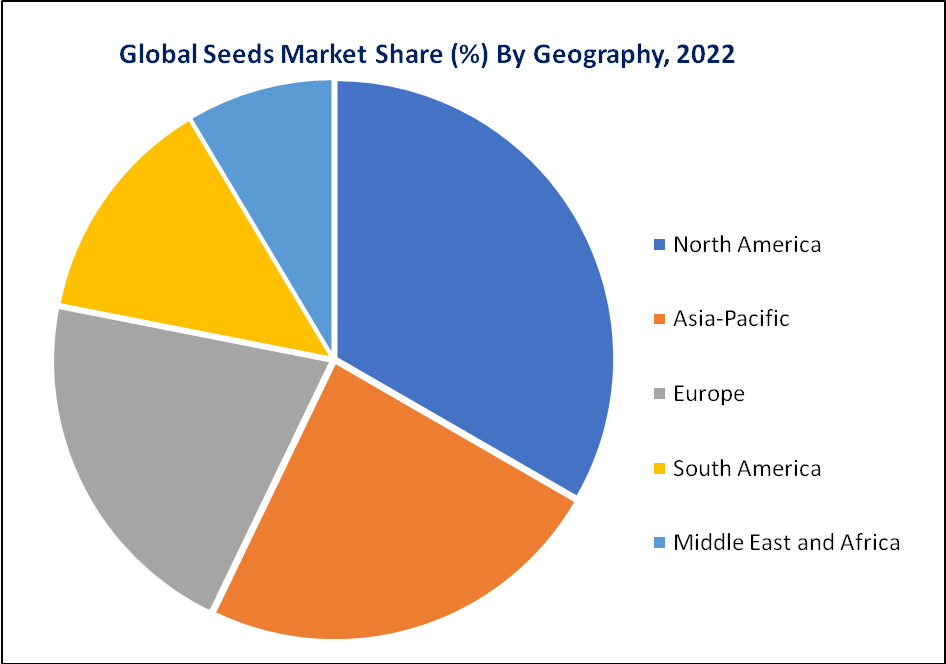

North America Emerges as One of the Largest Markets for Seeds

By region, the global Seeds market is segmented into Asia-Pacific, North America, South America, Europe, the Middle East, and America.

The North American seeds market, as analyzed by market experts, held a significant market share, contributing around 30% of the global market in 2022. Genetically modified (GM) seeds have gained substantial adoption, particularly in corn and soybeans, with GM corn varieties accounting for approximately 80% of the market and GM soybeans reaching a market penetration of about 90%.

The region also witnesses a growing demand for organic and non-GMO seeds, reflecting changing consumer preferences and sustainability concerns. The North American seeds market presents opportunities for companies to cater to diverse needs and capitalize on market dynamics.

Source: DataM Intelligence Analysis (2023)

Market Key Players

The major global players include Bayer CropScience AG, Syngenta AG, BASF SE, Groupe Limagrain, KWS SAAT SE, Land O'Lakes, Sakata Seed Corporation, Rijk Zwaan, Corteva Agriscience and Takii & Co. Ltd.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a mixed impact on the seeds market. While there was an initial disruption in the supply chain due to lockdowns and restrictions, the demand for seeds increased as individuals turned to gardening and agriculture.

The pandemic also highlighted the importance of food security, leading to a surge in home gardening and the cultivation of vegetable and fruit seeds. However, challenges in logistics and trade restrictions have affected global seed distribution and market access, impacting some players in the industry.

Key Developments

- On November 9, 2022, Corteva Agriscience, based in the United States, announced the acquisition of ZNLabs, a diagnostic laboratory specializing in plant and soil health.

- On February 11, 2021, Syngenta announced the acquisition of Sensako, a South African seed company specializing in wheat genetics.

- On March 18, 2021, Limagrain, a France-based company, acquired the vegetable seed business of Clause Group.

Why Purchase the Report?

- To visualize the Global Seeds Market segmentation based on type, traits, treatment, crops and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Seeds-level with all segments.

- The PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key product of all the major players.

The Global Seeds Market Report Would Provide Approximately 69 Tables, 66 Figures And 195 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies