Renewable Feedstock Market Size

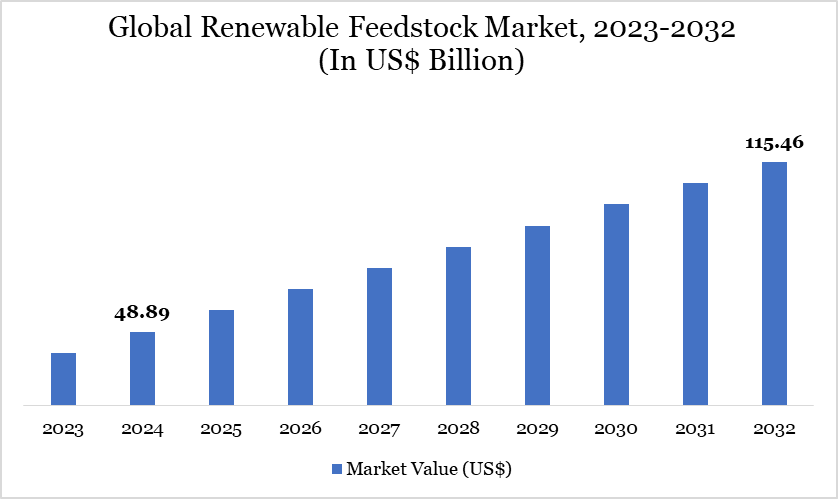

Renewable Feedstock Market Size reached US$ 48.89 billion in 2024 and is expected to reach US$ 115.46 billion by 2032, growing with a CAGR of 11.34% during the forecast period 2025-2032.

The renewable feedstock market is experiencing robust growth, driven by increasing global demand for sustainable and low-carbon alternatives across industries such as biofuels, bioplastics, and specialty chemicals. Key feedstocks include used cooking oil, animal fats, and agricultural residues, offering viable replacements for fossil-based inputs. Regulatory mandates, especially in Europe and North America, are accelerating adoption, while technological advancements in feedstock conversion enhance process efficiency and yield.

Renewable Feedstock Market Trend

Co-processing in refineries is a key trend in the renewable feedstock market as it enables the integration of renewable raw materials, such as used cooking oil, into existing fossil-based refining infrastructure. This approach allows producers to reduce carbon emissions without building entirely new facilities, making it a cost-effective pathway to scale up low-carbon solutions.

Companies are adopting co-processing methods to blend renewable feedstocks with fossil inputs in existing refineries. For instance, in December 2024, Neste expanded its sustainable feedstock portfolio by launching a co-processed renewable version of Neste RE, aimed at the polymers and chemicals industry. Produced at its Porvoo refinery in Finland, the new feedstock is derived from co-processing renewable raw materials like used cooking oil with fossil crude oil. This drop-in solution offers a lower carbon footprint and can replace traditional fossil feedstocks such as naphtha or propane, with sustainability benefits attributed through a mass balance approach.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Source | Agricultural Residues, Forestry Residues, Municipal Waste, Aquatic Biomass, Others | |

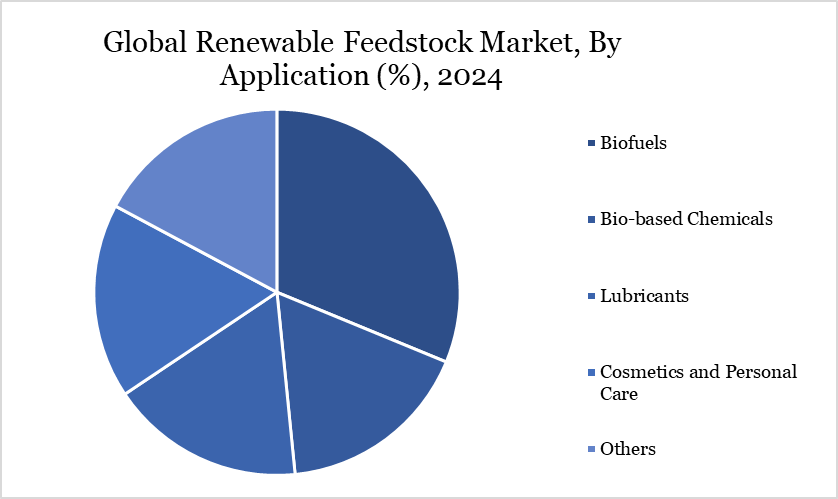

| By Application | Biofuels, Bio-based Chemicals, Lubricants, Cosmetics and Personal Care, Others | |

| By End-User | Residential, Commercial, Industrial, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Renewable Feedstock Market Dynamics

Government Policies and Regulations

Government policies and regulations are a major driver of the renewable feedstock market by creating a favorable framework for sustainable alternatives. Mandates such as the Renewable Fuel Standard (RFS) in the US and the Renewable Energy Directive (RED II) in the EU require blending of biofuels or the use of bio-based materials in energy and industrial applications.

Regulations incentivize the use of waste-derived biofuels through subsidies and tax breaks, helping reduce reliance on crops and fostering circular economies. These policies promote the transition to low-carbon fuels, accelerating the growth of the renewable feedstock market. In 2023, renewable fuel from waste feedstocks reached 2,669 million liters, accounting for 72% of all verified renewable fuel production. Waste feedstocks dominate biodiesel, representing over 90% of its total production. In contrast, bioethanol primarily relies on crop-based sources.

Stringent Regulatory Compliance

Feedstock availability and supply chain issues significantly restrain the renewable feedstock market by creating uncertainty in raw material supply. Many renewable feedstocks are seasonal, geographically limited, or affected by climate conditions, leading to inconsistent availability. Inadequate infrastructure for collection, storage, and transportation further complicates the logistics. This unreliability disrupts production schedules and increases operational costs for manufacturers. As a result, businesses may hesitate to invest in renewable feedstock-based solutions due to supply chain instability.

Renewable Feedstock Market Segment Analysis

The global renewable feedstock market is segmented based on the source, application, end-user and region.

Biofuel Leads as a Major Application Segment in the Renewable Feedstock Market Due to Its Widespread Use in Transportation and Energy Generation.

Biofuel holds a significant share in the renewable feedstock market due to its growing demand as a cleaner alternative to fossil fuels. Derived primarily from biomass sources like corn, sugarcane, and vegetable oils, biofuels are renewable and help reduce greenhouse gas emissions. Governments worldwide are promoting biofuel production through mandates and subsidies, further driving market growth. Total global biofuel production rose from 1,808 to 1,914 thousand boe/d, an increase of 5.8% between 2020 and 2021. This surge in production directly increases demand for renewable feedstocks.

Biofuels are rapidly gaining prominence in the renewable feedstock market, driven by robust growth and significant investments. In August 2024, TotalEnergies delivered its first cargo of 100% biofuel made from used cooking oil in Singapore, capable of reducing greenhouse gas emissions by 80–90% on a life-cycle basis. This type of initiative reflects a global shift towards sustainable energy sources, positioning biofuels as a key player in the transition to a low-carbon economy.

Renewable Feedstock Market Geographical Share

North America Holds a Dominant Share in the Renewable Feedstock Market Due to Robust Policy Support and Expanding Production Capacity

North America holds a significant share in the Renewable Feedstock Market due to its strong focus on sustainability and reducing greenhouse gas emissions. The region has witnessed increased investments in renewable energy sources and bio-based products, making it a key player in the market. The US and Canada are leading in adopting policies supporting the use of renewable feedstocks, particularly in the transportation and chemical sectors. Government incentives and environmental regulations have spurred innovation and commercialization of renewable feedstock technologies.

The industry remains dynamic, with ongoing developments and adjustments to meet the growing demand for renewable fuels. According to the US Energy Information Administration, in 2023, the US increased its biofuel production capacity by 7%, reaching 24 billion gallons per year by early 2024. This growth was largely driven by a 44% surge in renewable diesel and other biofuels. This surge is boosting the renewable feedstock market by increasing the need for raw materials like vegetable oils, animal fats, and waste oils to produce biofuels.

Sustainability Analysis

Environmental sustainability goals are a major driver for the renewable feedstock market, as both companies and governments are increasingly committed to reducing their environmental impact. As part of their efforts to cut greenhouse gas emissions and combat climate change, businesses are shifting from fossil-based materials to bio-based alternatives. Renewable feedstocks, derived from sources like agricultural residues, algae, and waste, help lower carbon footprints and provide a cleaner, more sustainable option for industries.

Furthermore, companies with strong Environmental, Social, and Governance (ESG) commitments are prioritizing renewable feedstocks to align with consumer demand for eco-friendly products. This market growth is supported by global initiatives such as the Paris Agreement, which encourages the use of renewable resources to reduce dependence on fossil fuels. By adopting renewable feedstocks, industries contribute to a circular economy, minimizing waste and promoting resource efficiency.

Renewable Feedstock Market Major Players

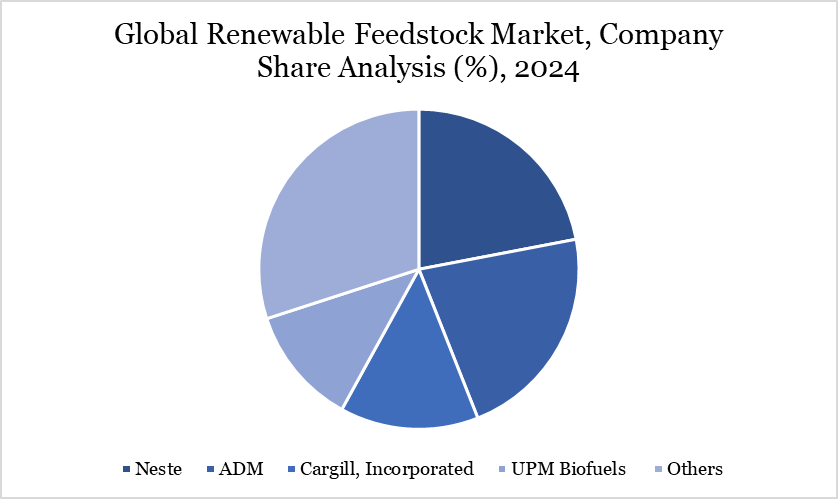

The major global players in the market include Neste, ADM, Cargill, Incorporated, UPM Biofuels, Gevo, Stora Enso, The Scoular Company, Montana Renewables, LLC, TotalEnergies, BASF SE and others.

Key Developments

- In May 2022, Chevron and Bunge launched a joint venture, Bunge Chevron Ag Renewables LLC, to develop renewable fuel feedstocks. This partnership combines Bunge's expertise in oilseed processing and farmer relationships with Chevron's strength in fuel manufacturing and marketing. The new company aims to advance the production of renewable fuel feedstocks, contributing to the growing demand for sustainable energy solutions.

- In January 2025, Bayer and Neste signed a memorandum of understanding (MOU) to jointly scale winter canola as a biomass-based feedstock for renewable fuels, such as sustainable aviation fuel and renewable diesel.

- In March 2024, Repsol and Bunge formed a strategic partnership in Spain to boost the supply of renewable fuels. This collaboration will help Repsol meet its target of producing up to 1.7 million tons of renewable fuels by 2027 by increasing access to low-carbon intensity feedstocks.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies