Industry Outlook

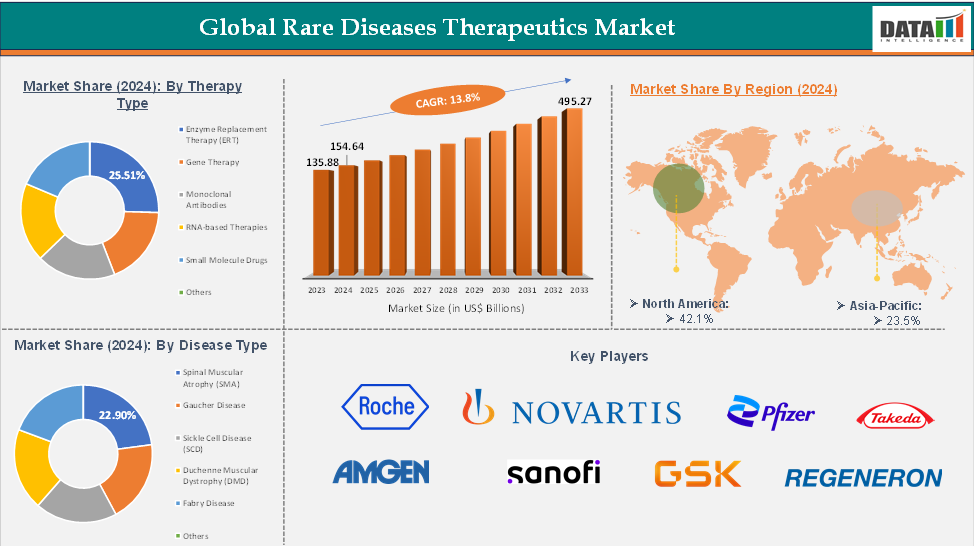

The global rare disease therapeutics market reached US$ 135.88 billion in 2023, with a rise of US$ 154.64 billion in 2024, and is expected to reach US$ 495.27 billion by 2033, growing at a CAGR of 13.8% during the forecast period 2025-2033.

The global rare diseases therapeutics market is expanding due to the growing recognition of rare genetic and chronic conditions and the focus on precision medicine. Advances in molecular diagnostics and genomics are enabling earlier and more accurate identification of rare disorders, driving demand for innovative treatments like enzyme replacement therapies, gene and cell therapies, monoclonal antibodies, and RNA-based drugs. Regulatory bodies are supporting development through orphan drug policies, expedited approvals, and financial incentives. North America is expected to dominate the market leader due to strong healthcare infrastructure and reimbursement pathways, but emerging regions show potential due to rising awareness and healthcare access.

Executive Summary

Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Rare Genetic Disorders Globally

The rise in rare genetic disorders is driving the therapeutics market for conditions like Duchenne muscular dystrophy, spinal muscular atrophy, cystic fibrosis, and lysosomal storage diseases. The identification of previously undiagnosed patient populations and expansion of disease registries are encouraging biopharmaceutical companies to invest in niche therapies like gene therapy, enzyme replacement therapy, and RNA-based drugs. This trend is widening the commercial scope for orphan drugs and accelerating regulatory approvals and premium pricing models, reinforcing the market's growth trajectory.

For instance, in 2024, Rare diseases affected 300 million people globally, affecting 3.5% to 5.9% of the population. 72% are genetic, with over 7000 characterized by diverse disorders. 75% affect children, with 70% onset during childhood.

Restraint: High Treatment Cost and Limited Patient Affordability

Despite advancements in rare disease therapeutics, high treatment costs remain a significant barrier to access and market growth. The lack of generic or biosimilar alternatives further compounds the issue, as many therapies enjoy extended exclusivity under orphan drug legislation. Moreover, complex manufacturing processes for biologics and gene therapies drive up production costs, making it difficult to scale pricing models affordably. This affordability gap creates disparities in diagnosis-to-treatment timelines, limits patient reach, and challenges the long-term sustainability of rare disease care globally.

For instance, Hemgenix, a gene therapy to treat haemophilia B based on an adeno-associated virus vector, costs up to US$3·5 million per case in the USA.

For more details on this report, Request for Sample

Segmentation Analysis

The global rare disease therapeutics market is segmented based on therapy type, disease type, end user, and region.

Therapy Type:

The enzyme replacement therapy (ERT) from the therapy type segment the expected to have 25.51% of the rare disease therapeutics market share.

The enzyme replacement therapy (ERT) segment is experiencing significant growth in the rare diseases therapeutics market due to its clinical effectiveness in treating enzyme-deficient genetic disorders like Gaucher disease, Fabry disease, and Pompe disease. Early diagnostic advancements and newborn screening programs are facilitating timely ERT initiation. Regulatory support, R&D investments, and increased awareness among clinicians and patients are accelerating the market entry of novel enzyme therapies. Expanding reimbursement coverage in developed markets further enhances ERT's role in rare disease management.

For instance, in May 2025, Velaglucerase-beta for injection, the first and only locally developed enzyme replacement therapy for Gaucher disease in China, has successfully advanced from concept to commercialization, marking a significant breakthrough for CANbridge Pharmaceuticals and WuXi Biologics in the R&D of innovative rare disease therapeutics in China.

Geographical Analysis

The North America global rare disease therapeutics market was valued at 42.1% market share in 2024

North America is expected to dominate the global rare disease therapeutics market due to its developed healthcare infrastructure, heavy investment in biomedical R&D, and regulatory frameworks like the U.S. Orphan Drug Act. These incentives lower the financial risk for developing orphan drugs, while advances in genomics and personalized precision medicine accelerate the discovery and delivery of targeted treatments. Patient advocacy groups, increased disease awareness, and expanded access programs contribute to a patient-centric approach, driving demand and research momentum.

For instance, in December 2024, the U.S. Department of Health and Human Services' ARPA-H announced a new funding opportunity for the Rare Disease AI/ML for Precision Integrated Diagnostics (RAPID) program. The program aims to improve rare disease diagnostics by developing and validating AI-enabled diagnostic support systems, enabling more accurate diagnoses in less time.

Furthermore, in July 2024, the US FDA has established a rare disease innovation hub to expedite the development and approval of orphan drugs, addressing challenges in rare disease clinical trials and high development costs that have led to some therapies being dropped by companies.

Moreover, North America's robust pipeline of biologics and emerging gene therapies, supported by specialty pharmacies and cross-sector collaborations, reinforces its leadership in this niche yet high-growth segment.

Major Players

The major players in the rare disease therapeutics market include F. Hoffmann-La Roche Ltd, Novartis AG, Pfizer Inc., Takeda Pharmaceutical Company Limited, Amgen Inc., Sanofi S.A., GlaxoSmithKline plc, Regeneron Pharmaceuticals, Inc., Biogen Inc., and Sarepta Therapeutics, among others.

Key Developments

In February 2025, Arrowhead Pharmaceuticals expanded its We'll Get There Soon campaign, launched in November 2024, to include a dedicated educational website and a white paper on Familial Chylomicronemia Syndrome (FCS), providing essential resources and support for healthcare providers.

Market Scope

Metrics | Details | |

CAGR | 13.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Therapy Type | Enzyme Replacement Therapy (ERT), Gene Therapy, Monoclonal Antibodies, RNA-based Therapies, Small Molecule Drugs, Others |

| Disease Type | Spinal Muscular Atrophy (SMA), Gaucher Disease Sickle Cell Disease (SCD), Duchenne Muscular Dystrophy (DMD), Fabry Disease, Others |

| End User | Hospitals, Specialty Centers, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global rare disease therapeutics market report delivers a detailed analysis with 70 key tables, more than 61 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here