Overview

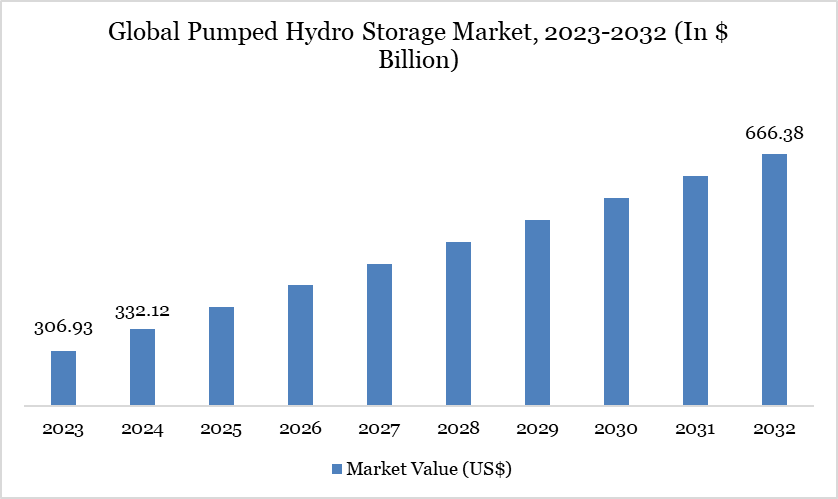

The global pumped hydro storage market reached US$ 332.12 billion in 2024 and is expected to reach US$ 666.38 billion by 2032, growing with a CAGR of 9.20% during the forecast period 2025-2032.

Pumped Hydro Storage remains the foundational technology for grid-scale energy storage worldwide, representing over 90% of installed capacity, which stood at approximately 160 GW by 2020 and has grown to 182 GW by 2023. In 2022 alone, hydropower experienced a substantial boost with 34 GW of new capacity added, including 10 GW of new pumped storage plants.

The global hydropower project pipeline includes around 214 GW of PHS at various stages of development, highlighting massive expansion potential. As of 2023, global additions of pumped storage reached 6.5 GW, even as growth rate slows compared to prior years. Moreover, over 600,000 off-river sections suitable for closed-loop PHS have been identified globally, underscoring the immense untapped resource.

Pumped Hydro Storage Market Trend

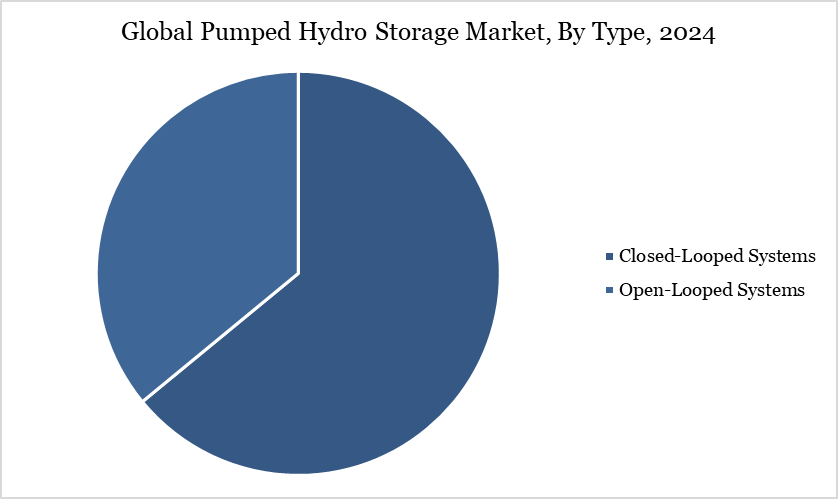

A prominent trend shaping the PHS market is the modernization and repurposing of existing infrastructure. Between 2001 and 2021, global hydropower capacity increased by 70%, driven largely by retrofitting aging plants for storage capabilities. Meanwhile, countries are exploring closed-loop, off-stream PHS, which now represents about 67% of the market due to lower environmental impacts and higher permitting success rates.

With the global renewable generation forecast to nearly double by 2030, adding around 935 GW annually—95% from wind and solar—PHS adoption is poised to grow as a clean, long-duration storage enabler. Technology upgrades like variable-speed turbines are also becoming more common, enhancing grid services and flexibility.

Market Scope

Metrics | Details |

By Type | Open-Loop Systems, Closed-Loop Systems |

By Plant Type | Pure Pumped Storage Plants, Mixed Pumped Storage Plants |

By Storage Capacity | <100MW, 100-500 MW, >500 MW |

By Application | Grid Stabilization & Frequency Regulation, Load Shifting, Renewable Energy Integration, Energy Arbitrage, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Expansion of Grid-Scale Renewable Integration Demands Long-Duration Energy Storage Solutions

The global shift toward large-scale renewable energy deployment has accelerated the demand for long-duration energy storage, with pumped hydro storage (PHS) emerging as a key solution. According to the International Energy Agency, PHS currently represents over 90% of global electricity storage capacity, supporting renewable integration by balancing load and stabilizing supply.

The International Renewable Energy Agency (IRENA) highlights that global PHS potential exceeds 8,000 GW, far surpassing current installed capacity of around 160 GW, reflecting significant scalability. As variable renewable energy grows worldwide, particularly in Asia and Europe, PHS provides essential grid flexibility by storing excess energy and supplying it during demand peaks, enabling a stable and resilient clean energy transition.

High Upfront Capital Investment and Long Project Lead Times

The pumped hydro storage market is constrained by high upfront capital costs and lengthy development timelines. Projects require large investments, with capital expenditures reaching into the billions, and spending several years just to get through permitting, environmental reviews, and construction. These factors significantly slow down deployment and deter new investment in the sector.

Segment Analysis

The global pumped hydro storage market is segmented based on type, plant type, storage capacity, application and region.

Closed-Loop Systems Segment Driving Pumped Hydro Storage Market

Closed-loop systems are significantly driving the growth of the global pumped hydro storage (PHS) market due to their environmental and site flexibility advantages. Unlike open-loop systems, closed-loop designs do not rely on natural water bodies, reducing ecological impact. In the US, over 95% of new PHS projects in the Federal Energy Regulatory Commission’s (FERC) queue are closed-loop configurations.

The DOE (Department of Energy) estimates that more than 35 GW of technically feasible closed-loop PHS capacity could be developed nationwide. A notable example includes the proposed Goldendale Energy Storage Project in Washington, a 1.2 GW closed-loop system with an estimated cost of US$ 2 billion. These systems also offer faster permitting and community acceptance. Their scalability and minimal water dependency make them ideal for arid or mountainous regions. Growing renewable energy demands are further reinforcing this segment’s dominance.

Geographical Penetration

North America Drives the Global Pumped Hydro Storage Market

Demand for pumped hydro storage (PHS) in North America is rising due to the urgent need for grid reliability and renewable energy integration. The US has around 43 operational PHS plants with a combined capacity of approximately 553 GWh. In the past decade, about 1.4 GW of new PHS capacity has been added through upgrades. The US Department of Energy has identified potential for over 36 GW of additional capacity nationwide.

In Canada, a 1 GW PHS project in Ontario has received approval with an investment of about US$ 208 million. Canada is also investing over US$ 3.3 billion into energy storage technologies, including PHS. Increasing renewable adoption and fossil plant retirements are driving this shift. PHS offers long-duration storage essential for clean energy transition.

Sustainability Analysis

The global pumped hydro storage (PHS) market supports renewable energy integration and grid stability. According to the IEA, over 90% of global grid-scale energy storage—about 165 GW—is from PHS. The US DOE reports 22 GW of installed PHS capacity, accounting for 93% of US utility-scale storage. Japan’s METI cites over 25 GW of PHS capacity for peak load balancing.

The European Commission supports PHS expansion in mountainous regions for energy security. Voith Hydro has upgraded existing plants, improving turbine efficiency by up to 20%. These developments position PHS as a key sustainable solution in the global energy transition.

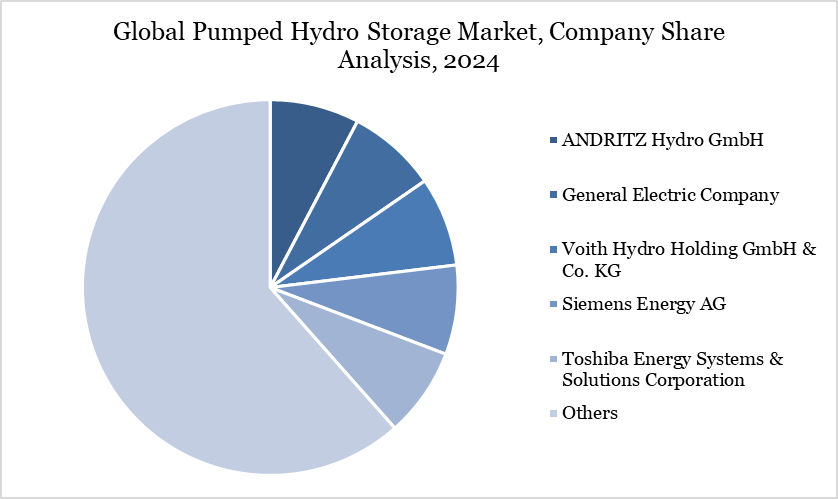

Competitive Landscape

The major global players in the market include ANDRITZ Hydro GmbH, General Electric Company, Voith Hydro Holding GmbH & Co. KG, Siemens Energy AG, Toshiba Energy Systems & Solutions Corporation, Hitachi Energy Ltd., Mitsubishi Power Ltd., Dongfang Electric Corporation, Harbin Electric Machinery Company Limited, and Bharat Heavy Electricals Limited.

Key Developments

In January 2025, The International Hydropower Association (IHA) has today launched a toolkit for pumped storage hydropower (PS) development. This toolkit details the barriers for delivering policy solutions to PS development and the appropriate mechanisms needed to drive this growth. PS is the largest form of renewable energy storage, with nearly 200 GW installed capacity, providing more than 90% of all long duration energy storage across the world with more than 400 projects in operation.

In February 2024, Energiasalv has published an invitation to tender on the international platform Mercell. The tender is for constructing and designing a 500-megawatt underground pumped hydro energy storage plant in Paldiski. Interested parties worldwide, including large-scale underground mining, underground infrastructure, pumped storage, design, and engineering companies, are invited to collaborate and form an alliance to design and construct this water storage facility. The project includes the development of the plan, execution of civil works, and electromechanical works.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report