Hybrid Energy Storage Market Overview

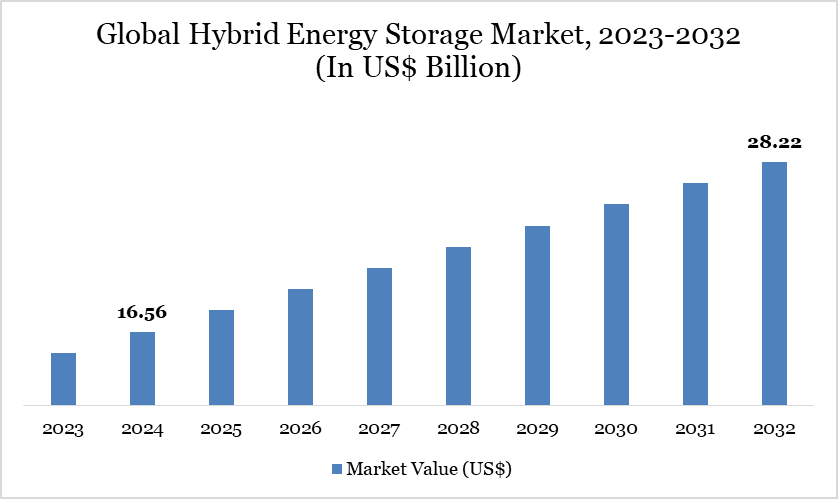

Global Hybrid Energy Storage Market reached US$ 16.56 billion in 2024 and is expected to reach US$ 28.22 billion by 2032, growing with a CAGR of 6.89% during the forecast period 2025-2032.

The global Hybrid Energy Storage System (HESS) market is undergoing substantial expansion driven by the rising need for energy efficiency, grid dependability, and the incorporation of renewable energy sources. HESS integrates multiple energy storage technologies, usually high-energy-density batteries like lithium-ion with high-power-density systems such as flywheels or supercapacitors, to formulate a versatile and adaptive energy solution. This hybrid methodology enhances system efficiency, prolongs component durability, and diminishes operational expenses.

The industry is further strengthened by international sustainability objectives, including the Paris Agreement, and measures such as the US Inflation Reduction Act of 2022, which designated US$370 billion for clean-energy development. Investments in battery energy storage systems (BESS) exceeded US$5 billion in 2022, nearly tripling from the prior year, with the global industry anticipated to attain between US$120 billion and US$150 billion by 2030. The growth trajectory has robust momentum, especially in utility-scale and commercial applications that demand scalable, cost-efficient, and effective energy solutions.

Hybrid Energy Storage Market Trend

A significant trend in the Hybrid Energy Storage System (HESS) market is the swift proliferation of utility-scale battery energy storage systems (BESS), projected to increase at an annual rate of 29% until 2030. Utility-scale installations over 10 MWh are anticipated to yield an annual capacity of 450 to 620 GWh by the decade's conclusion, securing up to 90% of the global market share. The advent of "revenue stacking" models, wherein Battery Energy Storage System (BESS) projects derive income from many sources such as supplementary services, capacity markets, and arbitrage, is influencing business tactics, particularly in dynamic countries like the UK, Italy, and Germany.

The increasing use of electric cars (EVs), projected to represent 45% of worldwide vehicle sales by 2030, is stimulating demand for energy storage at commercial EV charging locations. The incorporation of flywheel technology to manage rapid power fluctuations is increasing, as it enhances battery performance and improves lifetime efficiency, especially in applications requiring frequent cycling.

For more details on this report - Request for Sample

Market Scope

Metrics | Details |

By Configuration | Grid-Connected, Standalone |

By Technology | Solid State Battery, Thermal Energy Storage, Pumped Hydro Storage, Fly-wheel, Supercapacitor, Ultracapacitor, Others |

By Battery Type | Lithium-Ion, Lead-Acid, Nickel-Based |

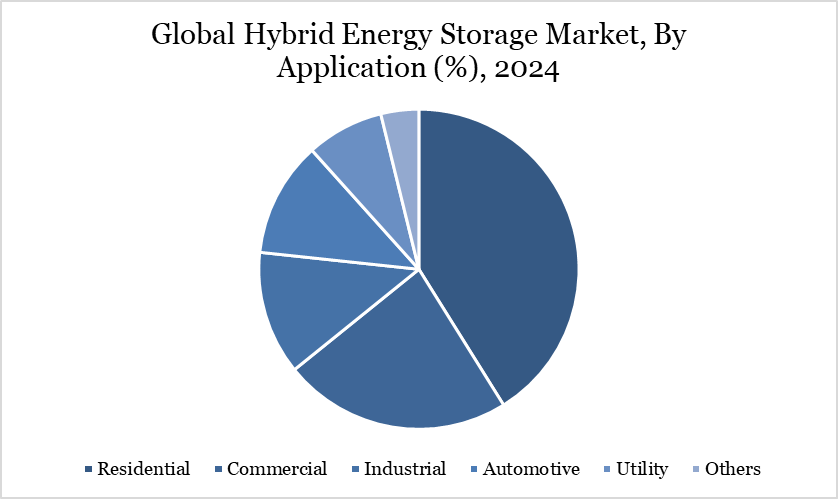

By Application | Residential, Commercial, Industrial, Automotive, Utility, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Hybrid Energy Storage Market Dynamics

Demand for renewable energy surge in spark hybrid integration

The global initiative for renewable energy integration is a key factor propelling the Hybrid Energy Storage System (HESS) market. As countries pledge to diminish carbon emissions and attain net-zero objectives, the utilization of solar and wind energy has escalated. Nonetheless, these sources are intrinsically intermittent, rendering energy storage technologies essential for grid resilience. Hybrid systems facilitate the storage and redistribution of surplus energy produced during peak periods when supply diminishes or demand escalates.

Flywheels can rapidly provide substantial power for brief intervals, mitigating volatility and improving grid frequency regulation. These hybrid systems also diminish the frequency of charge-discharge cycles experienced by batteries, hence extending battery longevity. This versatility is essential for overseeing microgrids, utility operations, energy trading, and event-driven applications. The deployment of Battery Energy Storage Systems (BESS), exemplified by a 6.5 GWh project in the US, is driving the long-term adoption of Hybrid Energy Storage Systems (HESS) throughout the energy sector due to the increasing necessity to stabilize and maximize renewable energy sources.

Challenges of fragmentation and complexity market scalability

The HESS market encounters significant challenges stemming from its complexity and fragmentation. The integration of several technologies, including lithium-ion batteries, flywheels, and supercapacitors into hybrid systems, poses significant challenges in terms of compatibility, operational synergy, and cost-effectiveness. The hybrid characteristics of these systems frequently necessitate bespoke engineering and sophisticated energy management software, hence increasing the initial capital investment.

Regulatory systems vary significantly among countries and regions. For instance, although Italy and the UK provide capacity auctions and supplementary services, respectively, these revenue sources are not generally applicable, complicating consistent scalability for enterprises. Moreover, providers must adhere to local grid specifications and operational standards, frequently developing customized solutions for each market. The absence of standards and the requirement for specialist integration knowledge persist as obstacles to the extensive deployment of HESS, especially for smaller entities lacking large-scale development resources.

Hybrid Energy Storage Market Segment Analysis

The global hybrid energy storage market is segmented based on configuration, technology, battery type, and application, and region.

Industrial sector applications broaden operational scope

Hybrid Energy Storage Systems are increasingly recognized in the industrial sector for their capacity to enhance key energy applications through better efficiency and resilience. A primary application is in grid and microgrid stabilization, where HESS guarantees uninterrupted operations amid variable supply and demand situations.

Industrial facilities also gain from minimizing renewable energy curtailment by storing excess energy and discharging it as required. Furthermore, in sectors involved in energy trading and large-scale utility operations, HESS improves performance through revenue-generating strategies such as frequency regulation and peak shaving. Events and remote industrial locations utilize the rapid discharge capability of flywheels to fulfill short-term high-power demands, alleviating battery stress and prolonging system longevity.

These hybrid setups provide industrial customers enhanced flexibility, cost efficiency, and system durability, rendering them progressively appealing in areas with fluctuating energy costs and carbon reduction requirements. With the rapid advancement of industry electrification, the demand for resilient and scalable HESS systems is anticipated to increase.

Hybrid Energy Storage Market Geographical Share

North America emerges as a key growth hub driven by policy support and grid modernization

North America, especially the US, constitutes one of the most rapidly expanding regions for Hybrid Energy Storage Systems. This impetus is robustly bolstered by federal policy frameworks, notably the Inflation Reduction Act of 2022, which allocated US$370 billion for renewable energy development.

Utility-scale Battery Energy Storage System (BESS) deployments in the US are now experiencing significant growth, with certain systems achieving capacities of up to 6.5 GWh as of 2022. This regional expansion is chiefly propelled by utilities and grid operators seeking to regulate peak demand, stabilize the grid, and incorporate rising levels of renewable energy.

Energy storage devices are essential for frequency control and load balancing, especially in areas such as California and Texas that are at the forefront of the renewable energy transition. The presence of subsidies, grid upgrading efforts, and the rising usage of electric vehicles further solidify North America's preeminence in the HESS market. With the increasing demand for grid flexibility, the region is anticipated to continue being a central hub for HESS research and implementation.

Technological Analysis

Technological advances are fundamental to the evolution of the Hybrid Energy Storage System market. Advancements in battery chemistry have markedly improved energy density and prolonged cycle life, hence augmenting the long-term sustainability of hybrid systems.

Lithium-ion batteries, however effective for continuous energy provision, are increasingly being strategically combined with flywheels, which provide quick, high-power discharges and can endure extended cycling without performance deterioration. This collaboration alleviates battery strain and improves the system's responsiveness.

Contemporary flywheels necessitate minimum upkeep and provide extended longevity, rendering them an optimal component in HESS. The emergence of intelligent energy management systems is crucial, facilitating smooth coordination among components to optimize energy flow, enhance system longevity, and diminish operational expenses. These advancements enable HESS providers to offer modular, scalable, and application-specific solutions that address fluctuating industrial and utility requirements. The ongoing enhancement of hybrid architectures guarantees that the HESS business will lead the energy storage revolution.

Hybrid Energy Storage Market Major Players

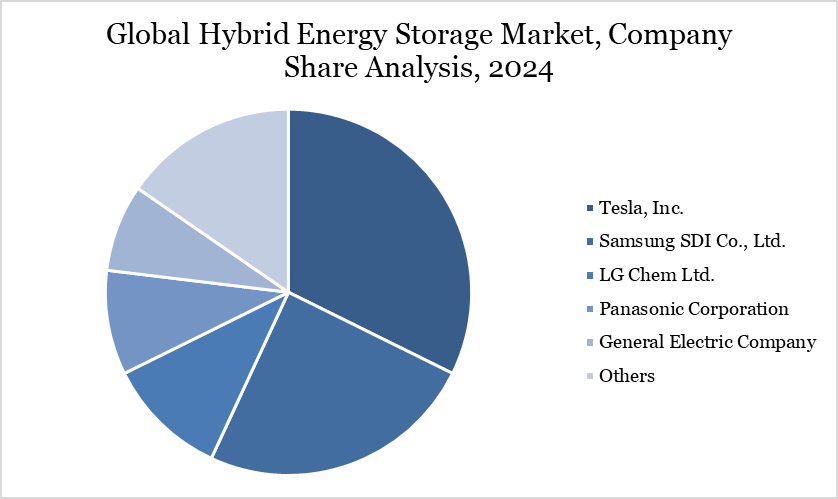

The major global players in the market include Tesla, Inc., Samsung SDI Co., Ltd., LG Chem Ltd., Panasonic Corporation, General Electric Company, Siemens AG, Hitachi Ltd., NEC Corporation, BYD Company Limited, Fluence Energy, LLC.

Key Developments

In February 2025, GridStor a utility-scale battery energy storage systems manufacturer acquired 150 MW battery storage project, Texas from Balanced Rock Power. The acquisition will help company to expand its presence in the state and is estimated to benefit off of upcoming increase in energy demand by 2030.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies