Protein Therapeutics Market Size & Industry Outlook

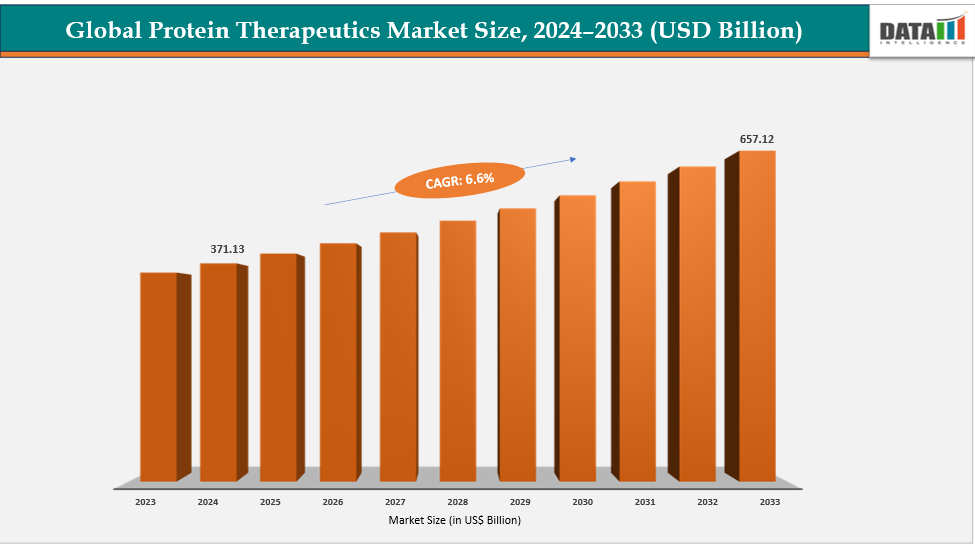

The global protein therapeutics market size reached US$ 349.83 billion with rise of US$ 371.13 billion in 2024 is expected to reach US$ 657.12 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033. The integration of AI and machine learning with protein science enables a comprehensive understanding of cellular and proteome homeostasis. Leveraging these technologies allows for accurate prediction of protein structures and identification of processes such as protein modifications, fitness, and self-organization. This, in turn, facilitates the discovery and development of new protein therapeutics, protein networks, novel proteins, and artificial metabolic pathways. Advanced models predicting protein stability and interactions are also emerging. Additionally, by analyzing lifestyle, genomic data, and medical history, personalized medicines can be formulated. AI algorithms further help reduce the cost and time involved in the development process.

Key Highlights

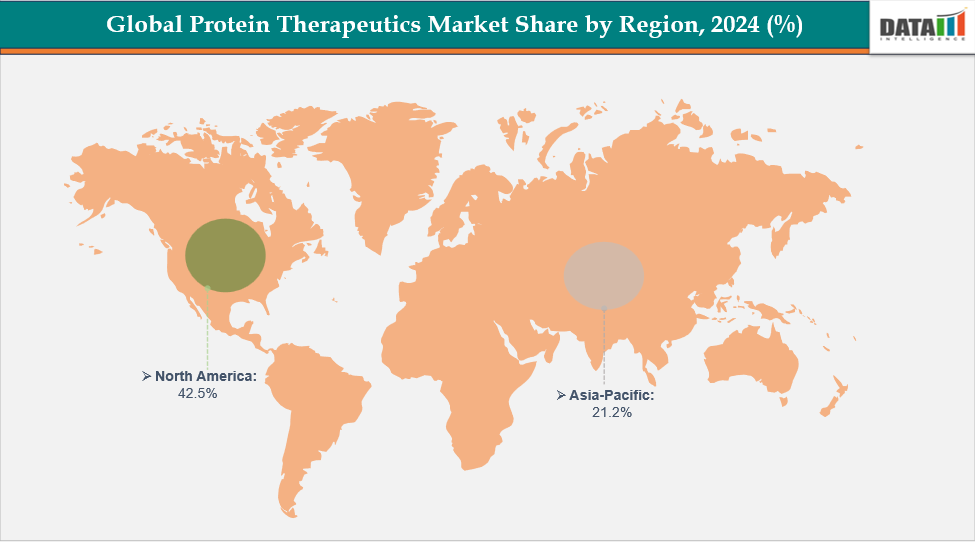

- North America dominates the protein therapeutics market with the largest revenue share of 42.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

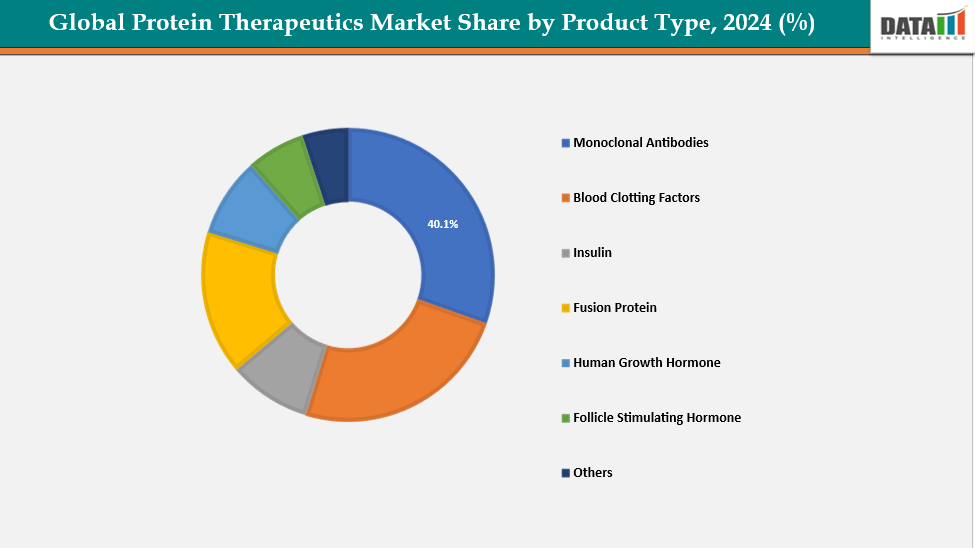

- Based on product type, monoclonal antibodies segment led the market with the largest revenue share of 40.1% in 2024.

- The major market players in the Abbott Laboratories, Amgen Inc., Baxter International Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Merck & Co, Inc, Novo Nordisk A/S, Pfizer Inc., Sanofi and among others.

Market Dynamics

Drivers: Rising prevalence of chronic diseases is significantly driving the protein therapeutics market growth

The growing global prevalence of chronic diseases such as cancer, diabetes, cardiovascular disorders, and autoimmune conditions is a key driver of the protein therapeutics market. As populations age and lifestyle-related risk factors increase, the number of patients requiring long-term, targeted treatments is rising rapidly. This expanding patient base fuels the need for innovative therapies that offer higher specificity, better efficacy, and fewer side effects than conventional drugs. Protein therapeutics address these needs effectively by enabling precision treatment of complex diseases. The steady increase in chronic disease prevalence worldwide therefore directly accelerates research, development, and adoption of novel protein-based medicines, strengthening the market’s growth trajectory.

For instance, in 2024, chronic diseases (NCDs) remain the leading global health challenge, driven by aging populations, lifestyle changes, and improved diagnostics. Conditions such as cardiovascular disease, cancer, chronic respiratory illnesses, and diabetes continue to rise worldwide. Diabetes alone affects roughly 589 million adults, with a significant portion in low- and middle-income countries. In the Americas, NCDs account for about 65% of all health burdens. These trends emphasize the growing need for effective, targeted protein therapeutics and other innovative treatments.

Restraints: High development and manufacturing costs are hampering the growth of the Protein Therapeutics market

The development and manufacturing of protein therapeutics involve substantial financial investments. In 2024, the average cost for a pharmaceutical company to develop a new drug was approximately $2.23 billion, reflecting a slight increase from the previous year. This figure encompasses expenses related to research, clinical trials, regulatory approvals, and market launch. Additionally, the manufacturing costs for protein-based therapies can be significant. For instance, the production cost of monoclonal antibodies typically exceeds $50 per gram of purified antibody or drug substance, which is considerably higher than the target cost of $10 per gram required to make these therapies affordable in low-resource settings.

For more details on this report – Request for Sample

Segmentation Analysis

The global protein therapeutics market is segmented based on product type, application, end user, and region.

Product Type: The monoclonal antibodies from product type segment to dominate the protein therapeutics market with a 40.1% share in 2024

The monoclonal antibodies (mAbs) segment is a key growth driver in the protein therapeutics market due to their high specificity, targeted action, and ability to treat complex diseases such as cancer, autoimmune disorders, and infectious diseases. Advances in recombinant DNA technology and antibody engineering have improved the efficacy, stability, and safety profiles of mAbs, making them increasingly preferred over conventional therapies. Additionally, the rising prevalence of chronic and immunological diseases, along with an expanding aging population, is fueling demand for mAb-based therapies. Strategic collaborations, licensing agreements, and increasing approvals of novel monoclonal antibodies further accelerate innovation and adoption in this segment, strengthening its contribution to the overall protein therapeutics market.

For instance, in July 2025, Invivyd, Inc has announced the formation of the SPEAR Study Group, a leading clinical and translational research team focused on understanding the biology and clinical effects of chronic exposure to SARS-CoV-2 or mRNA vaccine-derived spike protein. The group will design and guide upcoming clinical trials to assess the efficacy of broadly neutralizing anti-SARS-CoV-2 spike protein monoclonal antibody (mAb) therapies in individuals experiencing Long COVID or Post-Vaccination Syndrome (PVS), conditions thought to result from persistent viral reservoirs or circulating spike protein.

Application: The oncology segment is estimated to have a 41.2% of the protein therapeutics market share in 2024

The oncology segment is a major driver of the protein therapeutics market due to the growing global incidence of various cancers and the urgent need for effective, targeted therapies. Protein-based therapeutics, including monoclonal antibodies, immune checkpoint inhibitors, and recombinant proteins, offer high specificity and improved safety profiles compared with traditional chemotherapy. Advances in biotechnology, such as antibody-drug conjugates and engineered cytokines, are enhancing treatment efficacy and patient outcomes.

Additionally, increasing investments in oncology research, favorable regulatory approvals, and rising awareness of personalized medicine are further accelerating the adoption of protein therapeutics in cancer care, positioning oncology as a leading growth segment in the market.

Geographical Analysis

North America dominates the global Protein Therapeutics market with a 42.5% in 2024

North America leads the protein therapeutics market, driven by advanced healthcare infrastructure, high R&D investments, and the presence of major biopharmaceutical companies. Rapid adoption of novel therapies, strong regulatory support, and a high prevalence of chronic and rare diseases further boost market growth.

The U.S. market specifically benefits from robust clinical trial networks, significant government and private funding for biotech research, and early adoption of innovative protein-based therapies. Increasing awareness of personalized medicine and the prevalence of conditions like cancer and autoimmune disorders continue to fuel demand.

For instance, in May 2025, Dallas-based biotechnology company Signify Bio has launched with an oversubscribed $15 million initial financing round, aimed at advancing a novel protein therapeutics approach that leverages the human body’s own cellular machinery. The funding round was led by Actium Group, with participation from the Gates Foundation Strategic Investment Fund, Danaher Ventures LLC, Eli Lilly and Company, BrightEdge, and the venture capital arm of the American Cancer Society.

Europe is the second region after North America which is expected to dominate the global Protein Therapeutics market with a 34.5% in 2024

Europe’s growth is supported by well-established healthcare systems, supportive regulatory frameworks, and increasing collaborations between biotech companies and academic institutions. Rising prevalence of chronic diseases and government initiatives promoting advanced therapeutics also contribute to market expansion. Germany, as a leading European market, benefits from strong pharmaceutical manufacturing capabilities, high healthcare expenditure, and strategic investments in biotechnology. The country’s focus on innovation and clinical research drives adoption of protein therapeutics.

The Asia Pacific region is the fastest-growing region in the global Protein Therapeutics market, with a CAGR of 8.1% in 2024

The Asia-Pacific market is witnessing rapid growth due to increasing healthcare access, expanding biotechnology sectors, and rising prevalence of chronic and infectious diseases. Emerging economies such as China and India are investing heavily in biopharmaceutical R&D, enhancing regional market potential.

Japan’s market growth is fueled by an aging population with high demand for protein therapeutics, advanced healthcare infrastructure, and supportive government policies for innovative biologics. Strong clinical research capabilities and early adoption of novel therapies also play a key role.

For instance, in September 2025, Akeso Inc. has announced that the first patient has been dosed in its registrational Phase II study (AK130-202). The trial is evaluating AK130, a fully independently developed TIGIT/TGF-β bifunctional antibody fusion protein, in combination with ivonescimab (a PD-1/VEGF bispecific antibody), for the treatment of locally advanced or metastatic pancreatic cancer in patients who have received up to two prior lines of systemic therapy.

Competitive Landscape

Top companies in the Protein Therapeutics market include Abbott Laboratories, Amgen Inc., Baxter International Inc, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Johnson & Johnson, Merck & Co, Inc, Novo Nordisk A/S, Pfizer Inc, Sanofi and among others.

Amgen Inc: Amgen Inc. is a global leader in the protein therapeutics market, leveraging decades of expertise in biologics research, development, and commercialization. The company focuses on innovative therapies across oncology, cardiovascular, inflammation, and bone health, with a strong portfolio of monoclonal antibodies and other protein-based treatments. Amgen’s robust R&D pipeline, strategic acquisitions, and collaborations with biotech firms and academic institutions enable it to continuously develop novel protein therapeutics. Its global manufacturing capabilities and extensive market presence, particularly in North America, Europe, and Asia-Pacific, further strengthen its role as a key player driving growth and innovation in the protein therapeutics sector.

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Monoclonal Antibodies, Blood Clotting Factors, Insulin Fusion Protein, Human Growth Hormone, Follicle Stimulating Hormone, Others |

| Application | Oncology, Hormonal Disorders, Genetic Disorders, Metabolic Disorders, Immunologic Disorders, Hematological Disorders, Others | |

| End User | Pharmaceutical Companies, Research Organizations, Academic Institutes, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global protein therapeutics market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here