Protein Expression & Purification Services Market Size and Trends

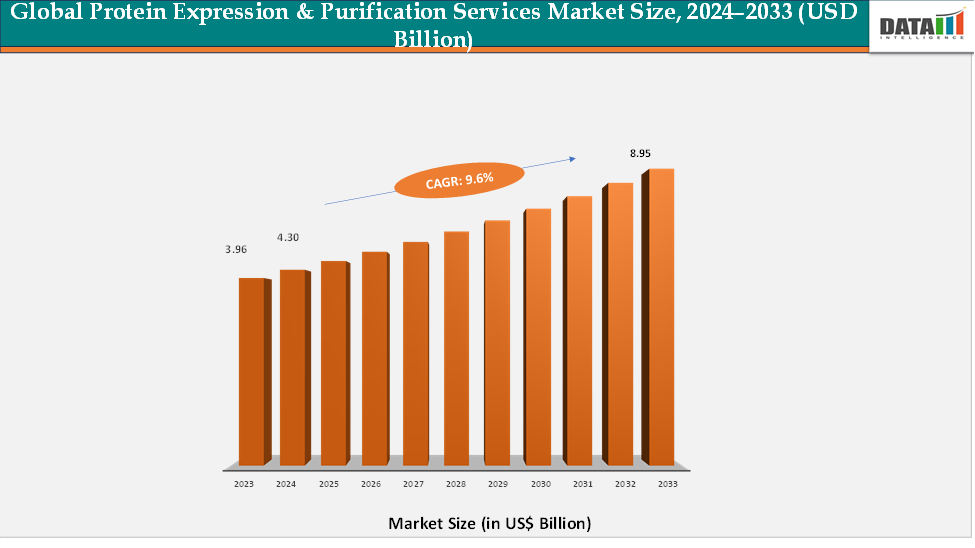

The global protein expression & purification services market reached US$ 3.96 billion in 2023, with a rise to US$ 4.30 billion in 2024, and is expected to reach US$ 8.95 billion by 2033, growing at a CAGR of 9.6% during the forecast period 2025–2033. The protein expression & purification services market is witnessing robust growth, driven by the rising demand for precision medicine, targeted therapies, and immunotherapies that require reliable and scalable protein production. With the increasing focus on developing monoclonal antibodies, recombinant proteins, enzymes, and antibody-drug conjugates (ADCs), biopharmaceutical companies are heavily relying on specialized service providers to accelerate drug discovery and development pipelines. Moreover, advancements in immune checkpoint inhibitors and combination therapies are further boosting the need for high-quality protein expression and purification platforms to ensure efficacy, safety, and regulatory compliance.

Key Market highlights

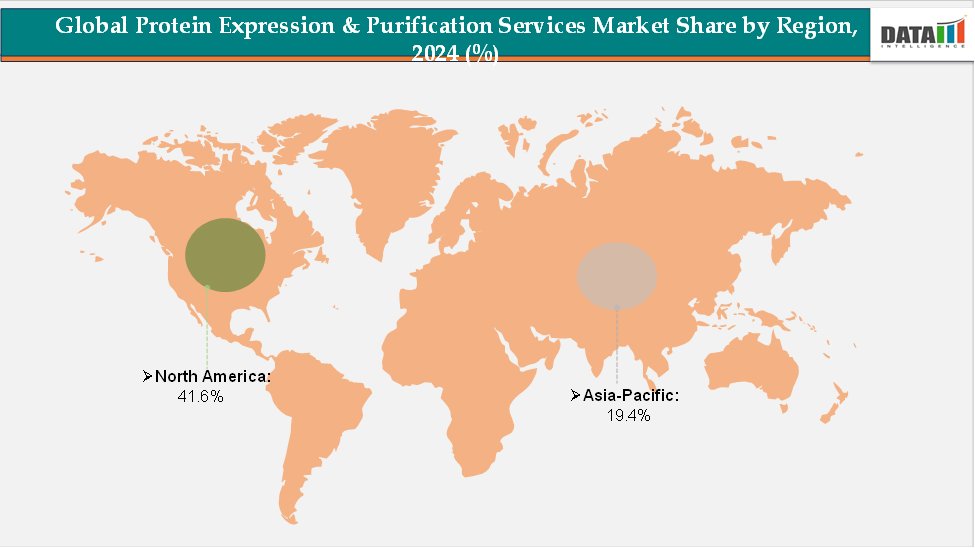

- North America dominates the protein expression & purification services market, accounting for around 41.6% of the global revenue, supported by the strong presence of leading pharmaceutical and biotechnology companies, advanced research infrastructure, and significant R&D investments.

- Asia-Pacific is emerging as the fastest-growing market, representing nearly 19.4% of the global share, fueled by increasing government funding for life sciences research, the expansion of biopharma manufacturing facilities, and the rising adoption of contract research and manufacturing services.

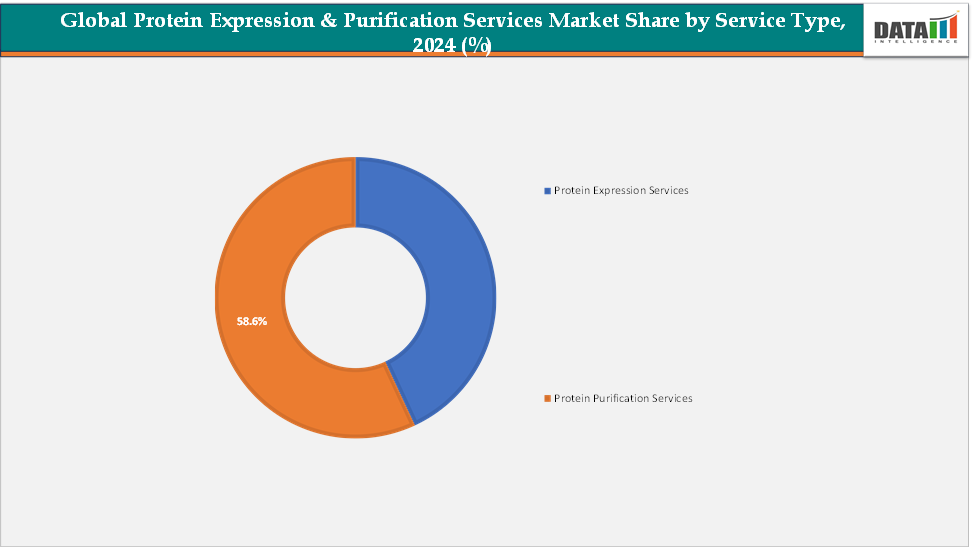

- Protein Purification Services lead the market with 58.6% revenue share, reflecting their critical role in ensuring the quality, safety, and efficacy of proteins used in drug discovery, development, and clinical applications. With the rising complexity of biologics and the demand for high-purity therapeutic proteins, purification services remain the most sought-after segment, driving significant growth and technological advancements in chromatography, filtration, and automated purification platforms.

Market Size & Forecast

- 2024 Market Size: US$ 4.30 Billion

- 2033 Projected Market Size: US$ 8.95 Billion

- CAGR (2025–2033): 9.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Demand for Biologics and Therapeutic Proteins

The rising demand for biologics and therapeutic proteins is significantly driving the growth of the protein expression & purification services market. Biologics, including monoclonal antibodies, recombinant proteins, vaccines, and biosimilars, are increasingly used for the treatment of cancer, autoimmune disorders, infectious diseases, and rare genetic conditions. These complex molecules require advanced expression systems and highly precise purification processes to ensure safety, stability, and therapeutic efficacy.

Since establishing in-house infrastructure for large-scale biologic production is costly and technically demanding, many pharmaceutical and biotechnology companies are turning to specialized service providers. The steady increase in the number of biologic approvals, alongside the growing adoption of targeted and personalized therapies, continues to boost demand for reliable protein expression and purification services globally.

Restraint: High Initial Investment and Maintenance Costs

The high cost and complexity of protein expression and purification services present a major restraint that could hamper market growth. Producing recombinant proteins and purifying them to clinical or research-grade standards requires advanced infrastructure, specialized equipment, and highly skilled personnel. The processes often involve multiple expression systems, optimization steps, and sophisticated purification methods such as chromatography, which add to overall expenses. Small biotech firms, academic institutions, and research labs may find these costs prohibitive, limiting their ability to access large-scale or customized services.

For more details on this report, Request for Sample

Global Protein Expression & Purification Services Market Segment Analysis

The global protein expression & purification services market is segmented by service type, protein type, application, and end-user, and region.

Service Type:The protein purification services segment is estimated to have 58.6% of the protein expression & purification services market share.

Protein purification services currently hold the dominant position in the protein expression & purification services market. This is because purification is a crucial step in ensuring protein quality, stability, and safety for downstream applications such as drug development, diagnostics, and research. Reports indicate that purification accounts for a larger share of the market, contributing to nearly 60% of total revenues. Chromatography-based purification, especially affinity and ion-exchange methods, continues to be widely used due to its effectiveness in producing highly pure proteins. The growing demand for monoclonal antibodies, recombinant proteins, and therapeutic biologics further reinforces the need for advanced purification services, keeping this segment at the forefront.

The protein expression services segment is estimated to have 26.4% of the Protein Expression & Purification Services market share.

Protein expression services are emerging as the fastest-growing segment in this market. Outsourcing of protein expression is expanding rapidly, driven by increasing R&D in biologics, vaccines, and precision medicine, where custom recombinant proteins are required in both small and large scales. Pharmaceutical and biotech companies increasingly rely on service providers for efficient, cost-effective, and scalable expression platforms such as mammalian cells, yeast, and cell-free systems. Additionally, rising demand in the Asia-Pacific is accelerating the expansion of this segment. As a result, expression services are expected to register the highest CAGR in the coming years.

Geographical Analysis

The North America protein expression & purification services market was valued at 41.6% market share in 2024

North America dominates the protein expression & purification services market, largely due to the region’s well-established pharmaceutical and biotechnology ecosystem, advanced research infrastructure, and high investment in drug discovery and development. The United States, in particular, accounts for the largest share of the market, supported by the presence of leading pharmaceutical companies, contract research organizations (CROs), and contract development and manufacturing organizations (CDMOs) that increasingly outsource protein expression and purification activities. The growing pipeline of biologics, including monoclonal antibodies, recombinant proteins, vaccines, and cell and gene therapies, has created sustained demand for high-quality expression and purification services.

Additionally, the regulatory environment in North America is highly supportive of biologics development, with the FDA providing streamlined pathways for approval and commercialization. The strong presence of key market players, coupled with technological advancements in expression systems such as mammalian and cell-free platforms, has reinforced North America’s dominant position. Rising R&D expenditure by both the public and private sectors, along with significant investment in personalized medicine, ensures that the region will continue to lead the global market in the years ahead.

The Europe protein expression & purification services market was valued at 22.8% market share in 2024

Europe maintains a significant position in the protein expression & purification services market, underpinned by its strong biotechnology sector, world-class academic and research institutions, and a well-regulated pharmaceutical landscape. Countries such as Germany, the UK, France, and Switzerland are leading contributors, with a focus on innovation, high-quality biologics development, and advanced protein research. The region is characterized by strong collaborations between academia, biotech firms, and pharmaceutical companies, which have fostered a robust ecosystem for protein-based therapeutics. Europe also places strong emphasis on regulatory compliance and quality standards, which drives demand for specialized purification services that meet stringent requirements for clinical and commercial applications.

Europe’s expertise in biologics manufacturing, its focus on personalized medicine, and its investment in cutting-edge technologies such as next-generation expression systems and high-throughput purification techniques ensure its continued significance. The presence of globally recognized pharmaceutical giants and innovative biotech startups further solidifies Europe’s role as a critical market in the global protein expression and purification services market.

The Asia-Pacific protein expression & purification services market was valued at 19.4% market share in 2024

Asia-Pacific is experiencing the fastest growth in the protein expression & purification services market, fueled by rapid expansion of the biotechnology and pharmaceutical industries across countries such as China, India, Japan, and South Korea. Governments in these nations are heavily investing in life sciences research and infrastructure, while also providing favorable policies to attract foreign pharmaceutical and biotech companies. The rise of contract research and manufacturing organizations (CROs/CDMOs) in the region has made Asia-Pacific an outsourcing hub, offering cost-effective yet high-quality protein expression and purification services.

China and India, in particular, are emerging as hotspots for protein services due to their rapidly growing biotech ecosystems and increasing collaborations with multinational companies. These trends, combined with rising healthcare investments and expanding biopharma manufacturing capabilities, firmly position Asia-Pacific as the fastest-growing regional market.

Competitive Landscape

The major players in the protein expression & purification services market include Thermo Fisher Scientific Inc., GenScript, Merck KGaA, Creative Biolabs, Bhat Bio-tech India Private Limited, Charles River Laboratories, Agilent Technologies, Inc., Aragen Life Sciences Ltd., Sino Biological, Inc., Domainex, among others.

Key Developments:

- In November 2023, Cytiva launched its Protein Select technology, featuring a self-cleaving traceless tag and affinity chromatography resin that standardizes recombinant protein purification, eliminating the need for protein-specific affinity partners and streamlining the process.

- In December 2022, AGC Biologics partnered with W.L. Gore & Associates to integrate Gore’s Protein A affinity purification technology into its CDMO services, enhancing downstream purification with a full single-use process that reduces bioburden, manufacturing footprint, and costs for clinical and select commercial production.

Market Scope

| Metrics | Details | |

| CAGR | 9.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Service Type | Protein Expression Services, Protein Purification Services |

| Protein Type | Natural Proteins, Synthetic Proteins | |

| Application | Research and Development, Diagnostics, Biotechnological Product Manufacturing, Agriculture, Others | |

| End-User | Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations (CDMOs), Diagnostic Laboratories & Clinical Research Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global protein expression & purification services market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here