Postoperative Pain Management Market Size & Industry Outlook

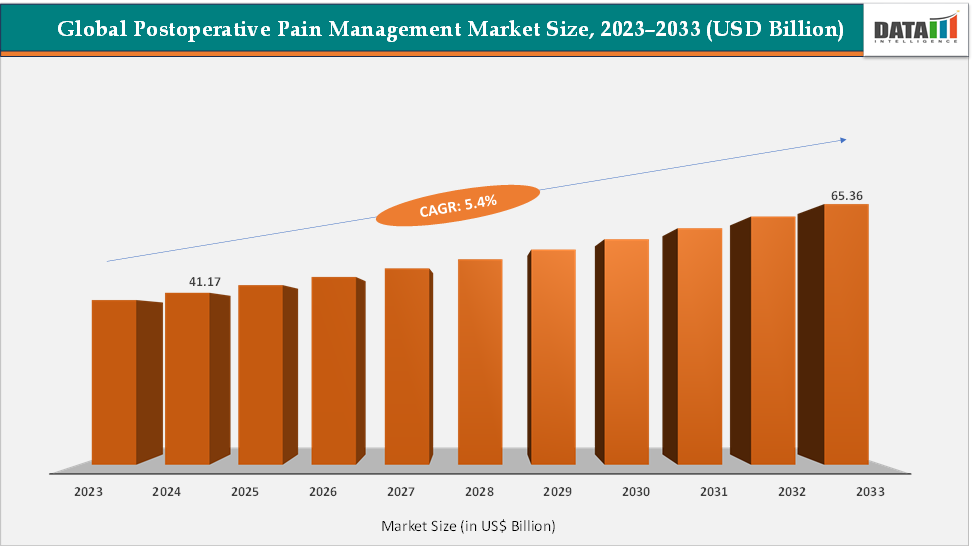

The global postoperative pain management market size reached US$ 41.17 Billion in 2024 from US$ 39.26 Billion in 2023 and is expected to reach US$ 65.36 Billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033. The market is expanding steadily driven by rising surgical volumes and an aging population. Innovation such as Pacira’s EXPAREL, a long-acting liposomal bupivacaine that reduces opioid reliance, and Heron’s ZYNRELEF, which combines bupivacaine with meloxicam for extended postsurgical pain relief. At the same time, regulatory and clinical pressure to curb opioid prescriptions is accelerating the shift toward multimodal analgesia and non-opioid regimens, reflecting both patient safety concerns and payer priorities.

Key Market Highlights

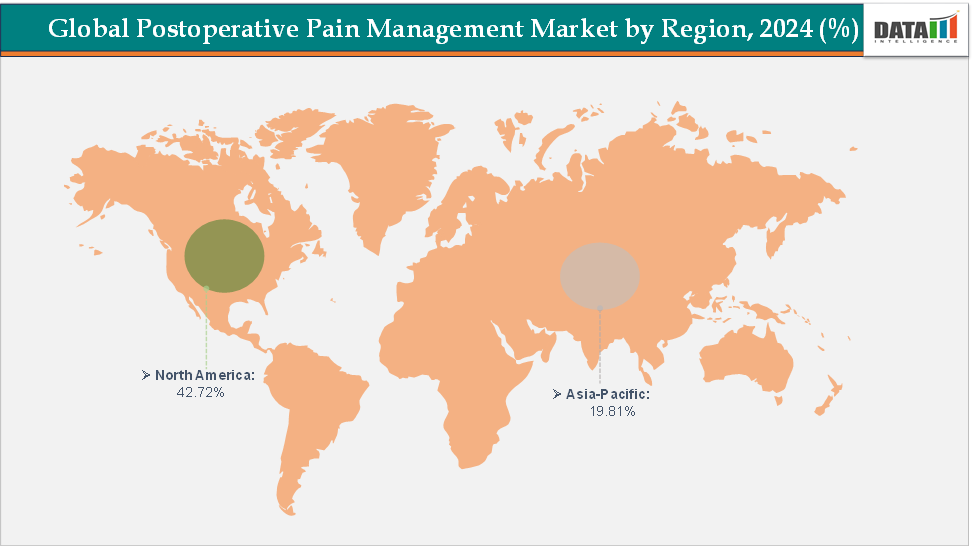

- North America dominates the postoperative pain management market with the largest revenue share of 42.72% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.7% over the forecast period.

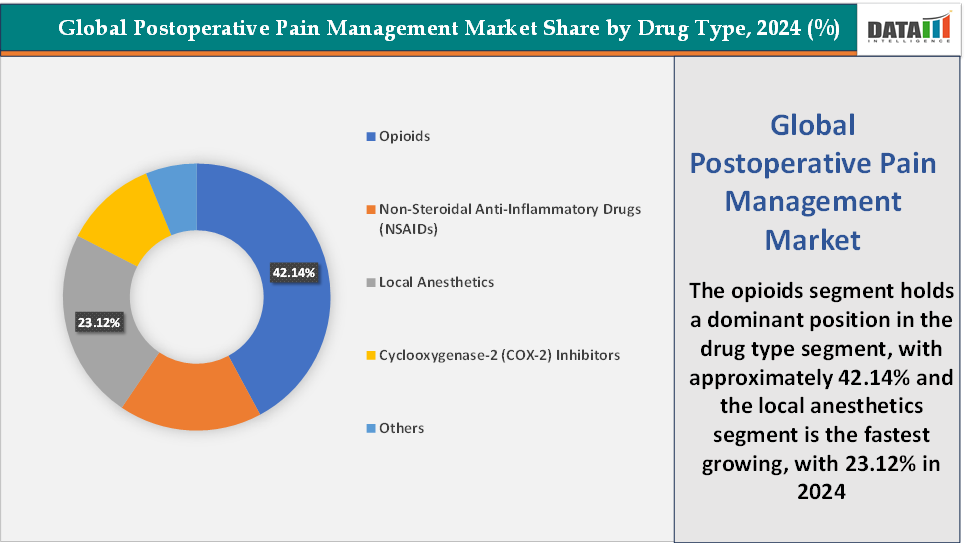

- Based on drug type, the opioids segment led the market with the largest revenue share of 42.14% in 2024.

- The major market players in the postoperative pain management market are Pacira Pharmaceuticals, Inc., Heron Therapeutics, Inc., Mallinckrodt Pharmaceuticals, Johnson & Johnson, Vertex Pharmaceuticals Incorporated, Virpax Pharmaceuticals, Grünenthal, and Oakwood Labs, among others

Market Dynamics

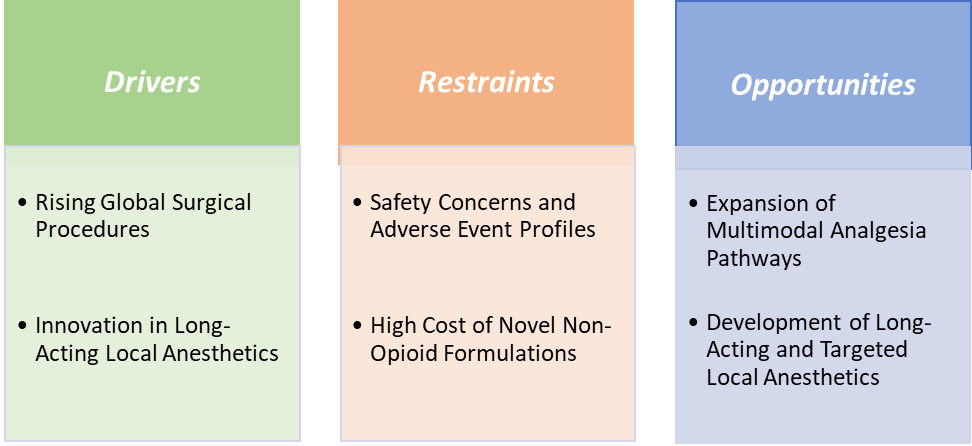

Drivers: Rising global surgical procedures are significantly driving the postoperative pain management market growth

The rapid rise in global surgical procedures is a major driver of the postoperative pain management market, as the surgeries create a vast and consistent need for effective analgesics. For instance, according to the National Institutes of Health (NIH), globally, over 310 million major surgeries are performed each year, with over 40 to 50 million in the USA and 20 million in Europe. It is estimated that 1–4% of these patients will die, up to 15% will have serious postoperative morbidity, and 5–15% will be readmitted within 30 days. With growing access to healthcare in emerging economies and an increasing number of elective and minimally invasive surgeries, the demand for advanced pain control solutions continues to escalate.

This trend has fueled the adoption of innovative, opioid-sparing products, such as the FDA-approved Pacira’s EXPAREL (liposomal bupivacaine) for expanded use in adductor canal and sciatic nerve blocks, covering more than 3 million lower extremity orthopedic procedures annually, and also for shoulder nerve blocks to improve recovery outcomes. As hospitals and ambulatory surgical centers prioritize faster discharges and reduced opioid reliance, the surge in surgical volume not only increases the absolute market but also accelerates the shift toward long-acting local anesthetics, multimodal regimens, and novel drug-device combinations designed to improve both patient safety and cost-effectiveness.

Restraints:Safety concerns and adverse event profiles are hampering the growth of the market

Safety concerns and adverse event profiles remain a major barrier to the growth of the postoperative pain management market, as commonly used drug classes carry significant risks that limit their adoption and increase healthcare costs. Opioids, while effective, are associated with respiratory depression, sedation, delirium, and dependence, with opioid-related adverse events adding more cost in extra hospital costs and extending stays by over a day. NSAIDs pose risks of gastrointestinal bleeding, renal impairment, and cardiovascular complications, which discourage their use in vulnerable post-surgical patients, while COX-2 inhibitors remain under scrutiny for cardiac safety.

Even local anesthetics, considered safer alternatives, can cause rare but severe systemic toxicities such as seizures or cardiovascular collapse when absorbed in excess or accidentally injected intravascularly. These risks trigger stricter regulatory demands, restricted label claims, and cautious prescribing behaviors among surgeons and anesthesiologists, especially in high-risk populations like pediatrics and geriatrics. Combined with negative public perception around opioid misuse and litigation against manufacturers, safety concerns not only suppress demand for certain analgesics but also slow the uptake of innovative formulations, ultimately hampering overall market expansion.

For more details on this report – Request for Sample

Postoperative Pain Management Market, Segment Analysis

The global postoperative pain management market is segmented based on drug type, route of administration, distribution channel, and region.

Drug Type:The opioids segment is dominating the postoperative pain management market with a 42.14% share in 2024

The opioids segment continues to dominate the postoperative pain management market due to their unmatched efficacy in controlling moderate to severe acute pain following surgery. Despite growing concerns about addiction and adverse events, opioids remain the first-line therapy in most hospital settings because of their rapid onset of action, broad availability, and cost-effectiveness compared to newer alternatives. Widely used agents such as morphine, hydromorphone, fentanyl, and oxycodone are routinely administered via intravenous, oral, or patient-controlled analgesia pumps, making them highly adaptable across surgical procedures.

Hospitals favor opioids because of familiarity, extensive clinical evidence, and inclusion in standard perioperative pain management guidelines, ensuring consistent demand. Furthermore, in regions with limited access to advanced non-opioid options, opioids dominate by default due to lower cost and broader reimbursement coverage. Although opioid-sparing protocols and products like liposomal bupivacaine and bupivacaine/meloxicam ER are gaining traction, they are mostly adjuncts rather than replacements. As a result, opioids maintain the largest share of the market, reflecting their entrenched role in surgical pain management despite the global push to curb dependence.

The local anesthetics segment is the fastest-growing in the postoperative pain management market, with a 23.12% share in 2024

The local anesthetics segment is emerging as the fastest-growing area in the postoperative pain management market, driven by the need for safer, opioid-sparing alternatives and the availability of innovative long-acting formulations. Unlike opioids and NSAIDs, local anesthetics offer targeted pain relief with fewer systemic side effects, making them central to multimodal and ERAS (Enhanced Recovery After Surgery) protocols. A key growth driver is the approval of novel formulations such as Pacira’s EXPAREL (liposomal bupivacaine), which provides up to 72 hours of analgesia and has recently been approved for adductor canal and sciatic nerve blocks in lower extremity surgeries, expanding its utility to over 3 million procedures annually.

Similarly, Heron Therapeutics’ ZYNRELEF (extended-release bupivacaine + meloxicam), approved in 2021 and later expanded for joint arthroplasty and abdominal surgeries, has demonstrated the ability to significantly reduce pain and opioid requirements for up to 72 hours post-surgery. With growing adoption in outpatient and ambulatory surgical centers, where long-lasting localized pain relief enables early discharge and faster recovery, these products are setting new benchmarks. The rising clinical preference for prolonged pain control, alongside regulatory and payer support for opioid reduction, positions local anesthetics as the most dynamic growth engine within the postoperative pain management market.

Geographical Analysis

North America is expected to dominate the global postoperative pain management market with a 42.72% in 2024

North America stands as the dominant region in the global postoperative pain management market, accounting for the largest revenue share due to its high surgical volumes and rapid adoption of innovative FDA-approved therapies. The unique ecosystem of high surgical demand, regulatory agility, payer support, and innovation leadership solidifies North America’s position as the most dominant region in the global postoperative pain management market.

US Postoperative Pain Management Market Trends

The US alone performs millions of elective and complex surgeries annually, including orthopedic joint replacements, cardiac interventions, and laparoscopic procedures, all of which demand effective postoperative pain control. The US strong regulatory environment further supports this dominance, as the FDA actively approves new and advanced analgesics such as Olinvyk (oliceridine) received approval in 2020 for intravenous use in hospitals and controlled clinical settings to treat moderate to severe acute pain, while Exparel (liposomal bupivacaine), approved for nerve blocks and surgical infiltration, continues to expand its indications, further strengthening regional market growth.

Similarly, in January 2024, Heron Therapeutics, Inc. announced that the U.S. Food and Drug Administration approved its supplemental New Drug Application for ZYNRELEF (bupivacaine and meloxicam) extended-release solution to expand the indication for soft tissue and orthopedic surgical procedures, including foot and ankle, and other procedures in which direct exposure to articular cartilage is avoided. ZYNRELEF was previously approved for foot and ankle, small-to-medium open abdominal, and lower extremity total joint arthroplasty surgical procedures in adults.

More recently, in January 2025, Vertex Pharmaceuticals Incorporated announced that the U.S. Food and Drug Administration (FDA) approved JOURNAVX (suzetrigine), an oral, non-opioid, highly selective NaV1.8 pain signal inhibitor for the treatment of adults with moderate-to-severe acute pain. JOURNAVX is an effective, well-tolerated medicine without evidence of addictive potential, indicated for use across all types of moderate-to-severe acute pain. Additionally, the presence of leading pharmaceutical companies, robust hospital networks, and a high level of clinician expertise ensures rapid diffusion of new products across both hospital and ambulatory surgical center settings.

The Asia Pacific region is the fastest-growing region in the global postoperative pain management market, with a CAGR of 5.7% in 2024

The Asia Pacific region is emerging as the fastest-growing market for postoperative pain management, fueled by rapid demographic shifts, expanding healthcare infrastructure, and rising surgical volumes across key countries such as China, India, Japan, and South Korea. This growth is strongly tied to the region’s aging population, which is set to more than double from around 630 million in 2020 to over 1.3 billion by 2050, driving higher rates of orthopedic, cardiac, oncological, and gastrointestinal surgeries. The growing burden of chronic illnesses such as diabetes, obesity, and cancer is also contributing to higher surgical procedure counts, particularly for joint replacements, bariatric surgeries, and tumor resections, all of which require effective pain control.

Moreover, the Asia Pacific is witnessing a notable rise in minimally invasive and day-care surgeries, where patients demand longer-lasting pain relief to enable faster discharge and recovery, fueling the adoption of local anesthetics and non-opioid alternatives. While traditional opioids remain widely used due to their low cost and availability, there is increasing awareness of opioid-related adverse effects, pushing clinicians to incorporate multimodal analgesia and safer, long-acting formulations. Combined with evolving regulatory frameworks, growing patient expectations, and rising medical tourism in hubs like India, Thailand, and Singapore, the Asia Pacific region offers the strongest growth trajectory for the global postoperative pain management market, making it the focal point for both multinational players and regional manufacturers.

Europe Postoperative Pain Management Market Trends

The European postoperative pain management market is witnessing steady growth, driven by strong regulatory support and a shift toward safer, non-opioid pain management options. A key driver is the widespread adoption of multimodal analgesia and Enhanced Recovery After Surgery (ERAS) protocols, which emphasize non-opioid therapies to improve outcomes and reduce opioid-related side effects. Innovative FDA- and EMA-approved products are fueling this trend, such as Zynrelef (bupivacaine + meloxicam), which provides up to 72 hours of postoperative analgesia, and Maxigesic IV (paracetamol + ibuprofen), a non-addictive injectable alternative.

Countries like Germany are major contributors, reflecting strong adoption of advanced analgesics and hospital protocols. European regulatory standards, coupled with supportive reimbursement frameworks, facilitate the uptake of premium and safer pain management therapies. Combined with growing patient awareness and a focus on reducing opioid dependence, these factors position Europe as a key and steadily expanding market in the global postoperative pain management landscape.

Competitive Landscape

Top companies in the postoperative pain management market include Pacira Pharmaceuticals, Inc., Heron Therapeutics, Inc., Mallinckrodt Pharmaceuticals, Johnson & Johnson, Vertex Pharmaceuticals Incorporated, Virpax Pharmaceuticals, Grünenthal, and Oakwood Labs, among others.

Market Scope

| Metrics | Details | |

| CAGR | 5.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Type | Opioids, Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Local Anesthetics, Cyclooxygenase-2 (COX-2) Inhibitors, and Others |

| Route of Administration | Injectable, Oral, Topical, and Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global postoperative pain management market report delivers a detailed analysis with 56 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here