Positron-Emission Tomography (PET) Market Size & Industry Outlook

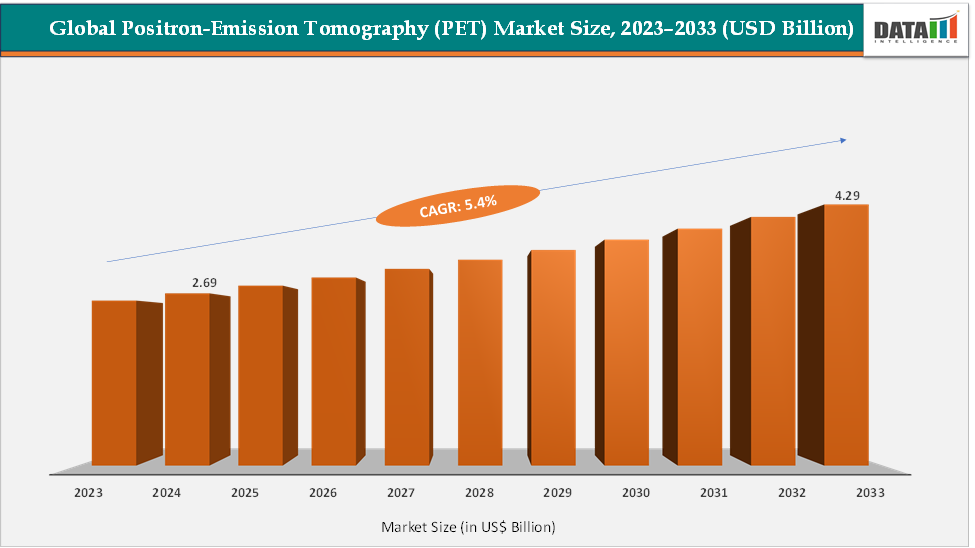

The global positron-emission tomography (PET) market size reached US$ 2.69 Billion in 2024 from US$ 2.56 Billion in 2023 and is expected to reach US$ 4.29 Billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033. The global Positron Emission Tomography (PET) market has been experiencing robust growth, driven by technological advancements, rising prevalence of chronic diseases, and expanding clinical applications. PET imaging has gained widespread adoption across both developed and emerging markets due to its ability to provide detailed functional and metabolic information that complements anatomical imaging.

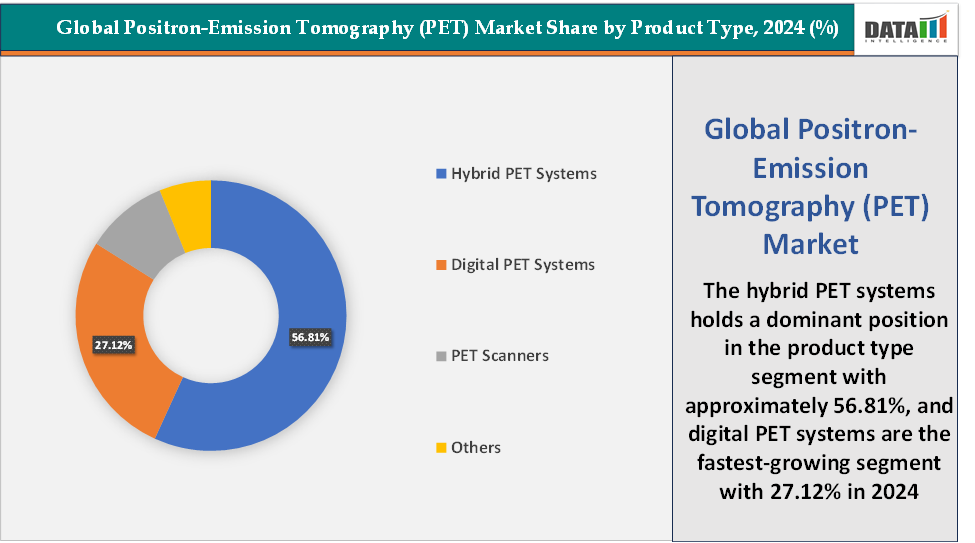

Based on product type, hybrid PET systems dominate the market because they combine functional imaging from PET with anatomical imaging from CT or MRI, providing more precise and comprehensive diagnostic information than standalone PET scanners. This dual capability is especially critical in oncology, where accurate tumor localization and staging directly influence treatment decisions. Additionally, novel product launches further boosting the segment growth.

For instance, in December 2024, United Imaging introduced two new products at RSNA 2024: uMR Ultra, a work-in-progress 3-tesla MRI scanner, and uMI Panvivo, a PET/CT scanner. The uMI Panvivo is a new PET/CT scanner with scalable architecture and an air-cooled compact design. The scanner has 219 per second time-of-flight (TOF) timing resolution, 2.9 mm NEMA spatial resolution, and 181 cps/kBq effective sensitivity, and is designed to provide image clarity and lesion detectability. It has a large boar clearance for patient comfort.

Key Market Highlights

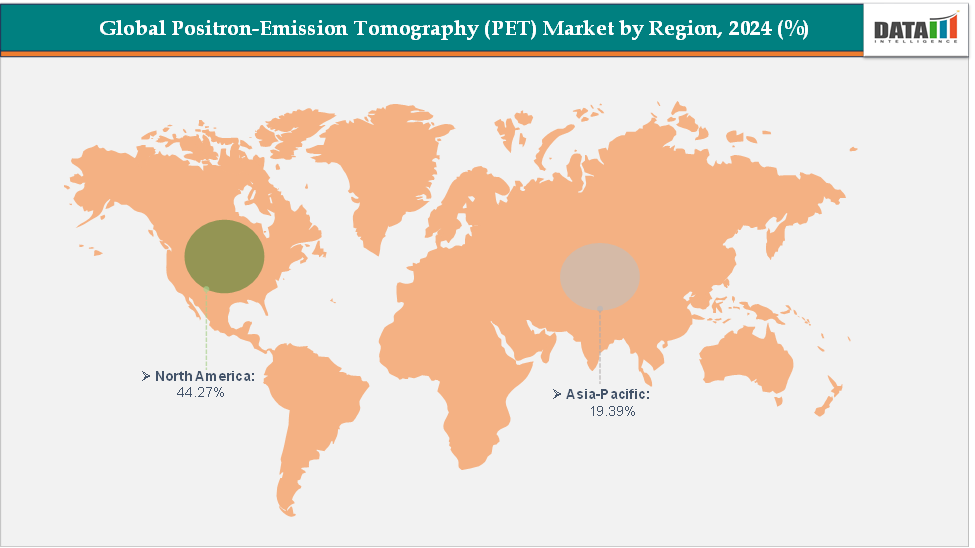

- North America dominates the positron-emission tomography (PET) market with the largest revenue share of 44.27% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.7% over the forecast period.

- Based on product type, the hybrid PET systems segment led the market with the largest revenue share of 56.81% in 2024.

- The major market players in the positron-emission tomography (PET) market are GE HealthCare, Siemens Healthineers, CANON MEDICAL SYSTEMS CORPORATION, Koninklijke Philips N.V., United Imaging Healthcare Co., Ltd., Neusoft Medical Systems Co., Ltd., Shimadzu Corporation, Bruker, Mediso Ltd., and Positrigo AG, among others

Market Dynamics

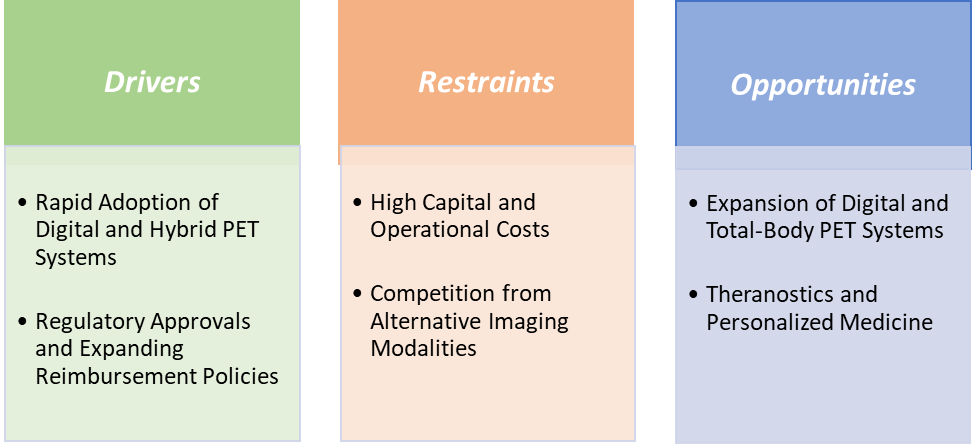

Drivers: Rapid adoption of digital and hybrid PET systems is significantly driving the positron-emission tomography (PET) market growth

The rapid adoption of digital and hybrid PET systems is significantly driving the growth of the PET market by enhancing diagnostic capabilities and expanding clinical applications. Digital PET systems offer improved spatial resolution and sensitivity, enabling more accurate detection of small lesions and reducing radiation exposure. Hybrid PET/CT systems provide comprehensive insights into disease processes. Novel product launches by major market players are driving this trend.

For instance, in June 2024, Siemens Healthineers introduced the Biograph Trinion, a high-performance, energy-efficient positron emission tomography/computed tomography (PET/CT) scanner with a wide range of clinical capabilities and a low lifetime operational cost. The scanner’s high-performance PET/CT platform has a new, scalable, air-cooled, digital detector based on lutetium oxyorthosilicate (LSO) crystal elements. This detector delivers high spatial resolution and an ultrafast time-of-flight performance of 239 ps for small lesion detectability and effective sensitivity up to 128 cps/kBq, enabling fast scans and low patient radiation doses.

Additionally, in May 2025, Mahajan Imaging & Labs unveiled North India’s first 128-Slice Digital PET-CT, Omni Legend by GE HealthCare, along with a modern state-of-the-art pathology lab. Similarly, in June 2025, S.L. Raheja Hospital launched AI-enabled Digital Positron Emission Tomography – Computed Tomography (Digital PET CT) scan and 3 Tesla Magnetic Resonance Imaging (3T-MRI) services. In addition, the hospital introduced advanced Neonatal Intensive Care Unit (NICU) and Pediatric Intensive Care Unit (PICU) services to further enhance critical care for infants and children.

Restraints: Competition from alternative imaging modalities is hampering the growth of the market

Competition from alternative imaging modalities is a significant restraint hampering the growth of the positron emission tomography (PET) market, as healthcare providers often rely on other advanced imaging techniques that are more cost-effective or widely available. Modalities such as Magnetic Resonance Imaging (MRI) and Computed Tomography (CT) remain preferred in many clinical settings due to their lower cost, broader accessibility, and absence of radiotracers. For example, MRI is often favored in neurological and musculoskeletal imaging because of its superior soft-tissue resolution, while CT is widely used in cardiology and emergency diagnostics due to speed and availability.

Similarly, Single Photon Emission Computed Tomography (SPECT) competes directly with PET in nuclear cardiology applications, offering lower operational costs despite PET’s superior image quality. A case in point is cardiac imaging, where SPECT continues to dominate because of lower pricing and greater insurance coverage, limiting PET adoption despite the approval of advanced tracers like GE HealthCare’s Flyrcado (2024) for myocardial perfusion imaging. Additionally, cost barriers and the need for radiopharmaceutical infrastructure make PET less accessible in smaller hospitals and emerging markets, prompting reliance on CT or MRI instead. This strong presence of alternative imaging solutions poses a challenge to PET’s wider adoption, slowing down its growth trajectory.

For more details on this report – Request for Sample

Segmentation Analysis

The global positron-emission tomography (PET) market is segmented based on product type, application, end-user, and region.

Product Type: The hybrid PET systems segment is dominating the positron-emission tomography (PET) market with a 56.81% share in 2024

Hybrid PET systems, particularly PET/CT and PET/MRI combinations, have emerged as the dominant segment in the positron emission tomography (PET) market due to their ability to provide both functional and anatomical imaging in a single scan, significantly enhancing diagnostic accuracy and clinical decision-making. By integrating metabolic information from PET with structural detail from CT or MRI, these systems enable precise tumor localization, staging, and therapy monitoring, which is especially critical in oncology, neurology, and cardiology. The PET/CT segment alone accounted for the largest market share, reflecting its widespread adoption in hospitals and diagnostic imaging centers globally.

Recent product launches further demonstrate the momentum in this segment. For instance, in June 2024, Siemens Healthineers introduced the Biograph Trinion, a high-performance, energy-efficient positron emission tomography/computed tomography (PET/CT) scanner with a wide range of clinical capabilities and a low lifetime operational cost. This new system is designed to be user- and patient-focused as well as a sustainable investment in terms of reduced installation and operational costs and easy, on-site scalability.

Similarly, in July 2024, Positron Corporation presents its new NeuSight PET-CT 3D 64 slice scanner, available for the US and North American Markets. The NeuSight PET-CT advanced technology sets a new standard in imaging and diagnostic precision, patient comfort, and operational efficiency for nuclear cardiology practices and hospitals. With continued technological innovation, such as time-of-flight enhancements, digital detector integration, and AI-driven image reconstruction, hybrid PET systems are expected to maintain their dominance, driving the PET market.

The digital PET systems segment is the fastest-growing in the positron-emission tomography (PET) market, with a 27.12% share in 2024

Digital PET systems are the fastest-growing segment of the PET market because they offer superior imaging accuracy, higher sensitivity, faster scan times, and lower radiation doses compared to traditional analog systems, making them highly attractive for both clinicians and patients. Technologies like silicon photomultiplier (SiPM) detectors allow improved small-lesion detection and quantitative accuracy, which is especially valuable in oncology, neurology, and cardiology.

Products such as Philips’ Vereos (the first fully digital PET/CT), GE HealthCare’s Omni Legend, United Imaging’s uMI 550, and Siemens’ Biograph Vision Quadra and Trinion exemplify this shift, with real-world installations reporting double the imaging speed, up to four-fold dose reductions, and improved diagnostic confidence. Hospitals and diagnostic centers are adopting these systems not only to enhance clinical outcomes but also to improve workflow efficiency and patient throughput, making digital PET systems the most dynamic growth driver in the global PET market.

Geographical Analysis

North America is expected to dominate the global positron-emission tomography (PET) market with a 44.27% in 2024

North America has established itself as the dominant region in the global positron emission tomography (PET) market, driven by a combination of early adoption of innovative imaging technologies, strong presence of major players, novel product launches, along with FDA approvals and strong reimbursement support. The United States, in particular, is a key contributor to the North American PET/CT system market share, reflecting widespread deployment of modern cancer therapies and state-of-the-art medical facilities.

US Positron-Emission Tomography (PET) Market Trends

Major market players in the US include GE HealthCare, Siemens Healthineers, Philips Healthcare, and United Imaging Healthcare, offering a broad spectrum of PET systems such as Siemens’ Biograph Vision PET/CT and United Imaging’s uMI 550 digital PET/CT, which deliver high-resolution imaging, enhanced sensitivity, and efficient workflow.

Recent FDA approvals have reinforced US leadership, including GE HealthCare’s Flyrcado, approved in September 2024 for myocardial perfusion imaging, offering superior image quality and workflow efficiency for complex patient populations, and TLX007-CDx, a PSMA PET imaging agent for prostate cancer approved in March 2025, advancing molecular imaging in oncology.

The Asia Pacific region is the fastest-growing region in the global positron-emission tomography (PET) market, with a CAGR of 5.7% in 2024

The Asia Pacific region is the fastest-growing market for positron emission tomography (PET) due to a convergence of factors including rising healthcare expenditure, a growing burden of chronic diseases such as cancer and cardiovascular disorders, rapid infrastructure development, and favorable regulatory approvals. Countries like China and India are at the forefront of this expansion: China, for instance, saw the National Medical Products Administration (NMPA) approve Florbetaben F-18 in September 2023 as its first amyloid PET radiotracer for Alzheimer’s disease diagnosis, highlighting the country’s push toward advanced molecular imaging solutions.

Moreover, local manufacturers and regional players are expanding production capabilities, making PET scanners and radiopharmaceuticals more affordable and accessible, which reduces dependence on imports and widens adoption in middle-income populations. Reports indicate that China currently dominates the Asia Pacific PET market in installed base and technological adoption, while India ranks as the second-largest contributor with double-digit growth rates, reflecting its increasing demand for advanced imaging in oncology and neurology.

Europe Positron-Emission Tomography (PET) Market Trends

Europe has become a critical growth region for the PET market, underpinned by strong healthcare systems, progressive regulatory approvals, and increasing investment in molecular imaging. Several EU countries are expanding reimbursement for PET/CT imaging and newer tracers (especially in oncology and neurology), which lowers financial barriers for adoption in hospitals and diagnostic centers. Manufacturers like Siemens Healthineers, Philips Healthcare, GE HealthCare, and United Imaging are active in launching or upgrading digital and hybrid PET/CT systems in European markets, encouraging large hospital networks to modernize diagnostic infrastructure.

According to the National Institutes of Health (NIH), total PET volume in 2021 was 154,400 scans (94% PET/CT, 6% PET/MRI) in Germany. PET volume in 2021 normalized to total population, was lower in Germany (1,857 scans per 1 million inhabitants) when compared to public figures from France (10,182 scans), Belgium (9,866 scans), or Italy (4,312 scans). PET volume in Germany demonstrated significant growth 2017 to 2021 (+48%). The top three indication fields were oncological (re)staging (76%), theranostic (13%), and neurology (4%). The top three indications were lung cancer (31%), prostate cancer (16%), and lymphoma/leukemia (12%). The top three radiotracers used were FDG (75%), PSMA radioligands (17%), and somatostatin-receptor radioligands (8%). This rising adoption is boosting the growth of the market in Europe.

Competitive Landscape

Top companies in the positron-emission tomography (PET) market include GE HealthCare, Siemens Healthineers, CANON MEDICAL SYSTEMS CORPORATION, Koninklijke Philips N.V., United Imaging Healthcare Co., Ltd., Neusoft Medical Systems Co., Ltd., Shimadzu Corporation, Bruker, Mediso Ltd., and Positrigo AG, among others.

Market Scope

| Metrics | Details | |

| CAGR | 5.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Hybrid PET Systems, Digital PET Systems, PET Scanners, and Others |

| Application | Oncology, Neurology, Cardiology, Infectious Diseases, and Others | |

| End-User | Hospitals, Specialty Clinics, Diagnostic Imaging Centers, Ambulatory Surgical Centers, and Academic & Research Institutes | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global positron-emission tomography (PET) market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here